Retirement Topics Required Minimum Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

You cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 70½. However, changes were made by the Setting Every Community Up for Retirement Enhancement Act which was part of the Further Consolidated Appropriations Act, 2020,P.L. 116-94, signed by the President on December 20, 2019. Due to changes made by the SECURE Act, if your 70th birthday is July 1, 2019 or later, you do not have to take withdrawals until you reach age 72. Roth IRAs do not require withdrawals until after the death of the owner.

Your required minimum distribution is the minimum amount you must withdraw from your account each year.

- You can withdraw more than the minimum required amount.

- Your withdrawals will be included in your taxable income except for any part that was taxed before or that can be received tax-free .

Are You A Participant In A Roth 401/roth 403

If yes, you can do in-plan Roth 401 conversion. You should reach out to the recordkeeper of your plan to learn their conversion process. In this case, you can only convert your traditional savings in this 401. Do you have 401 or 403 savings at previous employers? If so, you could rollover those monies into your current 401 which would increase the amount you could convert.

The in-plan Roth 401 conversion does have a downfall. All 401 monies are subject to required minimum distributions. These monies will increase your required minimum withdrawals compared to if they were in a Roth IRA and would not be aggregated with your other contributions. Those dont kick in until age 72, so you may have some time to figure out a different plan to avoid the downfall.

A Roth conversion can be implemented whenever the timing is right. I recommend working with a Certified Financial Planner that will work in concert with your Certified Public Accountant or Enrolled Agent . May the tax savings be with you!

What Taxes Are There If You Leave Your Job Before Repaying Your 401 Loan

Many plans require you to repay your 401 loan in full if you leave your job. Other plans allow you to continue making payments.

If your plan requires you to pay in full when leaving your job, you have until the due date of your tax return to pay off your loan. For example, if you leave your job in February 2022, you have until April 2023 to repay the loan since the distribution would count for 2022 taxes filed by April 15, 2023. If you need even more time to repay the loan, you can request an extension of time to file your tax return and get another six months.

If you cant pay your loan in full, you owe taxes and penalties the same as for missing payments as described above.

You May Like: Who Are The Best 401k Providers For Small Businesses

When Can You Withdraw From A 401k

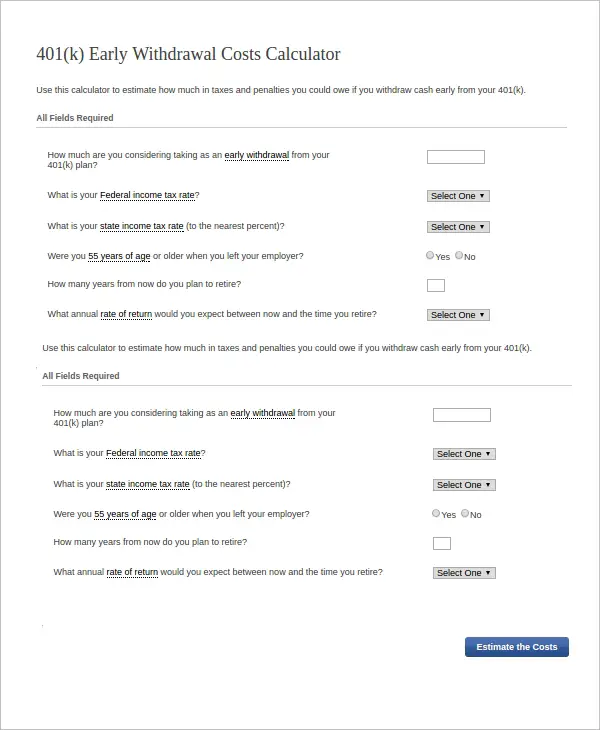

If you are out of cash, you may be wondering when you can withdraw from a 401 plan. Find out when to withdraw retirement money.

Retirement accounts such as 401 help workers invest part of their paycheck for their golden years. The money contributed to a 401 is meant for retirement, and this is why the IRS makes it difficult for retirement savers to access their money before attaining the full retirement age. Usually, the younger you are, the fewer options you have to access your 401 money, but this changes when you reach the required retirement age.

Once you are 59 ½, you can take a 401 withdrawal without paying an early withdrawal penalty. However, you will still be required to pay taxes on the 401 withdrawal. If you are below 59 ½, you may be able to withdraw from your 401, but you may incur an early withdrawal penalty. An exemption to this requirement is if you leave your job when you reach age 55, when you may qualify to make a penalty-free withdrawal.

Taking Required Minimum Distributions After 72

Once you reach age 72, you must start taking the required minimum distributions from the 401 account. You must begin taking RMDs by April 1 of the year after your turn 72 . The amount of distributions depend on your life expectancy.

There is an exemption to the required minimum distributions if you are still in active employment. If you are still working for the employer that manages your 401, you may be exempted from taking the mandatory distributions unless you own more than 5% of the company. You cannot qualify for the exemption if you own the company.

Tags

Read Also: How Fast Can I Get My 401k Money

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

What Is A 401 Rollover

A 401 rollover lets you move cash or investments from one eligible retirement plan to another without penalty. You can roll funds from a 401 or 403 plan into a traditional IRA, Roth IRA or qualified 401 with your new employer. Each of these options has its pros, cons and limitations.

Traditional IRA: You can move your 401 funds into a traditional IRA without paying additional taxes or penalties . If you contributed to your 401 with pretax dollars, meaning your contributions were deducted from your gross income, you can roll your funds into a traditional IRA. There they will continue to grow tax-deferred until you withdraw the money in retirement. If you have a designated Roth 401 account, you can’t roll it into a traditional IRA.

Roth IRA: You can roll your funds from a Roth 401 into a Roth IRA, or from a traditional 401 to a Roth IRA. With a Roth, your money grows tax-free and is also tax-free when you withdraw it in retirement. However, converting funds from a traditional 401 to a Roth IRA will generate a tax bill now: The amount of your conversion counts as regular income on your current-year tax return.

401 with your new employer: Some employers allow their employees to roll funds from an old 401 into their new 401 accounts. This allows you to keep all of your retirement funds in one place rather than managing multiple accounts or leaving funds behind with an old employer.

Read Also: How To Take Money Out Of Your 401k Fidelity

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Borrowing Or Withdrawing Money From Your 401 Plan Before You Retire

Borrowing or withdrawing money from your 401 before you retire is a big decision. After all, youve worked hard and saved hard to build up your retirement fund. While taking money out of your 401 plan is possible, it can impact your savings progress and long-term retirement goals so its important to carefully weigh the risks, costs and benefits.

Also Check: How 401k Works After Retirement

You May Like: When Can You Take Out 401k Without Penalty

What Are The Penalties For Not Taking Mandatory Withdrawals

Failing to withdrawal the required amount each year could cost you a pretty penny. Although the IRS has been waiting patiently to get their share of your retirement via income tax, they arenât too patient once you reach 72.

Any mandatory amount that hasnât been withdrawn from a 401 by December 31 of the applicable year will be subject to a 50 percent penalty.

If your calculated mandatory amount is $10,000 and you fail to withdraw it, you could lose $5,000 automatically.

Itâs best to review your mandatory withdrawal amount at the beginning of each year and make a plan to withdraw that amount before the end of the year.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Recommended Reading: What To Do With My 401k When I Change Jobs

Which Employees Are Eligible To Participate In My Sep Plan

Employees must be included in the SEP plan if they have:

- attained age 21

- worked for your business in at least 3 of the last 5 years

- received at least $650 in 2021 and 2022 $600 in compensation from your business for the year.

Your plan may use less restrictive requirements, for example age 18 or three months of service, to determine which employees are eligible.

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Don’t Miss: Should I Convert My 401k To A Roth Ira

Alternatives To Borrowing From Your 401

Before you borrow from a 401 to buy a home, consider whether there are other options available. For example:

- Down payment assistance programs: Down payment assistance programs are designed to help eligible buyers with down payment and closing costs. Some programs offer grants to qualified buyers that dont have to be repaid. Others offer matching savings programs, similar to a 401, that match every dollar you save towards your down payment, up to a certain amount.

- Down payment gifts: If you have family members who want to support your efforts to buy a home, consider asking them to gift money for a down payment. The amount of money that can be gifted and the amount you have to put towards the down payment out of your own funds may vary based on the type of mortgage. The most important thing to remember with down payment gifts is that they must be thoroughly documented. Otherwise, the lender might not allow you to use those funds for your down payment.

- IRA withdrawal: If you have an IRA, you can withdraw up to $10,000 from your account towards a down payment on a home without incurring the 10% early-withdrawal penalty. Be aware that if youre withdrawing from a traditional IRA, youll still owe income tax on the amount you withdraw.

Withdrawing From 401 Between Age 55 And 59

If you take a distribution before attaining age 59 ½, you could be required to pay income taxes and a penalty on the distribution. However, an exemption to this IRS requirement is when you quit your job at 55. This exemption is known as the rule of 55, and it allows participants to avoid paying the 10% penalty tax when they leave their employer at age 55. This rule does not apply if you are still working for the employer managing your 401 account.

You can take a penalty-free distribution if you are laid off, fired, or you resign from your job in the year when you attain age 55. If you quit at age 54 and wait until you are 55 to start taking withdrawals, you will still owe a penalty tax on the withdrawn amount. Additionally, if you rollover your 401 to an IRA, the rule of 55 does not apply. You will have to wait until you are 59 ½ to take a penalty-free withdrawal from an IRA.

Recommended Reading: How Fast Can You Get Your 401k Money Out

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

You May Like: How To Rollover 401k From Previous Employer To New Employer

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Other Alternatives To A 401 Loan

Borrowing from yourself may be a simple option, but its probably not your only option. Here are a few other places to find money.

Use your savings. Your emergency cash or other savings can be crucial right now and why you have emergency savings in the first place. Always try to find the best rate on a high-yield savings account so that youre earning the highest amount on your funds.

Take out a personal loan. Personal loan terms could be easier for you to repay without having to jeopardize your retirement funds. Depending on your lender, you can get your money within a day or so. 401 loans might not be as immediate.

Try a HELOC. A home equity line of credit, or HELOC, is a good option if you own your home and have enough equity to borrow against. You can take out what you need, when you need it, up to the limit youre approved for. As revolving credit, its similar to a credit card and the cash is there when you need it.

Get a home equity loan. This type of loan can usually get you a lower interest rate, but keep in mind that your home is used as collateral. This is an installment loan, not revolving credit like a HELOC, so its good if you know exactly how much you need and what it will be used for. While easier to get, make sure you can pay this loan back or risk going into default on your home.

Don’t Miss: How To Move 401k From One Company To Another

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.