How Much Should You Contribute To Your 401 Per Year

The amount you should contribute to your 401 each year should reflect your retirement savings goal, how many years you have to save, and your expected annual rate of return.

When deciding how much to save, first consider your budget and how much of your income you can commit to your 401. Next, look at the amount you need to contribute to get the full company match. You can then plug those numbers, along with your salary, into a 401 calculator to get an idea of how likely you are to hit your retirement savings goal.

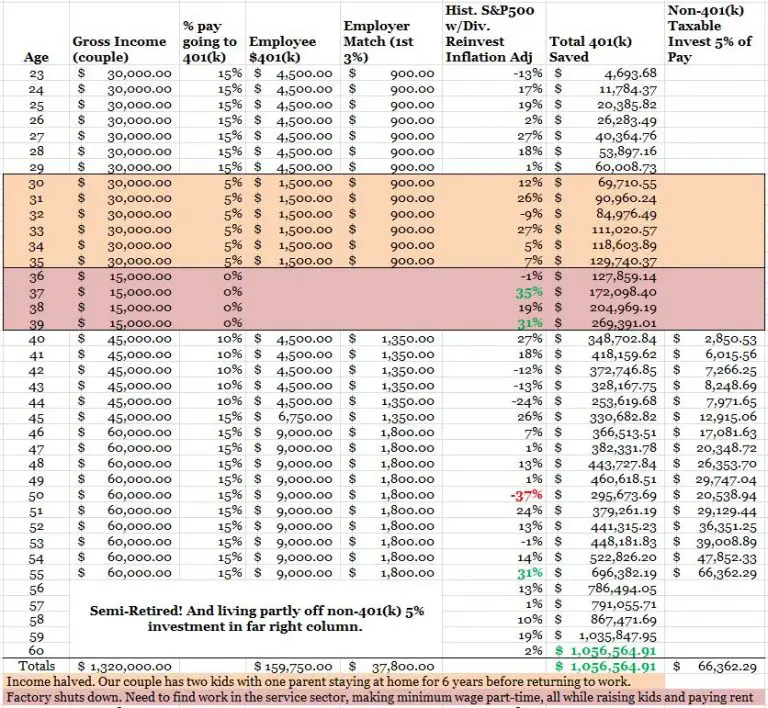

For instance, you might figure out that you need to save 15% of your pay each year. But if youre not making a lot yet, you might only be able to afford saving 8% each year. So what do you do then? A simple solution is to increase your contribution amount each year and work your way up to the 15% threshold gradually.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

What Is A 401 Catch

If youre 50 or older, youre eligible for a catch-up contribution. Catch-up contributions are a way for you to save more for retirement later in your life, which can be helpful if you already had a late start. The limit for 2023 catch-up contributions is $7,500 for a 401 and $1,000 for an IRA. Find out if youre eligible for catch-up contributions here.

If youre feeling behind, portfolio strategist Amy C. Arnott has some ways you can play catch-up with your retirement savings based on your life stage:

- In your 30s: Try saving 15% of your income.

- In your 40s: Try saving 18% of your income or maxing out your contributions every year.

- In your 50s: Increase salary percentage, max out contributions, consider catch-up contributions, or contribute to taxable accounts.

- In your 60s: Delay retirement or work part-time, readjust your spending, or consider a fixed annuity.

We outline how to make the most out of your 401 in our special report Your 401 Plan Guide.

Recommended Reading: Can A Sole Proprietor Have A Solo 401k

Why Contribute To A 401

A 401 is an investment plan sponsored by your employer to help you save for retirement.

If you work for a tax-exempt or non-profit organization, or a state or local municipal government, you may be offered a 403 or 457 plan, respectively which share some common features with 401 plans but there are also differences, so be sure to understand the details before you invest.

The main advantages of 401 plans include:

You May Like: How To Rollover A 401k Into A Self Directed Ira

I Wish I Had Stayed In Touch With My Friends

Often they would not truly realise the full benefits of old friends until their dying weeks and it was not always possible to track them down. Many had become so caught up in their own lives that they had let golden friendships slip by over the years. There were many deep regrets about not giving friendships the time and effort that they deserved. Everyone misses their friends when they are dying.

Don’t Miss: How Much Can An Individual Contribute To A 401k

Shoppers Rush To Buy Must Have Aldi Gadget That Costs Just 7p Per Hour To Run

It also assumes a stock market return of 5% as well as annual management fees of 0.5% and a minimum workplace contribution of 8%.

This might not be achievable for some, for example, you may not be earning enough or you may choose to prioritise saving for a house over paying into your pensions.

But it does show how investing in your retirement pot now can add up, so you can have a more comfortable retirement.

Start out by working out how much you’ll need in retirement to be comfortable and work backwards. You should also assume that your salary will increase and you will be able to stash away more cash as you get older.

Calculators, such as this one from Money Helper, are a good way to work out how much you need to save now.

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Read Also: How To Calculate Employee 401k Match

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

Also Check: Are Employers Required To Offer 401k

Leave Your 401 With The Old Employer

In many cases, employers will permit a departing employee to keep a 401 account in their old plan indefinitely, although the employee cant make any further contributions to it. This generally applies to accounts worth at least $5,000. In the case of smaller accounts, the employer may give the employee no choice but to move the money elsewhere.

Leaving 401 money where it is can make sense if the old employers plan is well managed and you are satisfied with the investment choices it offers. The danger is that employees who change jobs over the course of their careers can leave a trail of old 401 plans and may forget about one or more of them. Their heirs might also be unaware of the existence of the accounts.

Tips To Save For Retirement

Enrolling in your 401 is one of the easiest ways to begin building retirement savings. Your employer may have enrolled you automatically when you were hired. If youre not sure, contact your HR department. You can also check your default contribution rate to see how much youre contributing to the plan.

Its a good idea to contribute at least enough to get the full company match if one is offered. Otherwise, youre leaving free money on the table.

If youre worried youre not saving enough, consider supplementing your 401 with an Individual Retirement Account .

An IRA is another tax-advantaged savings option. You can open a traditional IRA, which offers the benefit of tax-deductible contributions, or a Roth IRA. With a Roth IRA, you cant deduct contributions, but qualified withdrawals are 100% tax-free.

Not sure how to start a retirement fund? Its actually easy to do through an online brokerage. You can create an account, choose which type of IRA you want to open, and set up automatic contributions to start building wealth.

Recommended Reading: How Much Does Fidelity Charge To Withdraw 401k

Do Rolled Over Funds Count Towards My Contribution Limit

It depends. If you made the contribution in the same tax year, then the amount you contributed will count towards your contribution limit, regardless if you rolled them over. If you have rolled over funds from a previous 401, but made the contribution in a previous tax year, that balance does not count towards your annual limit.

For example, lets say you were employed at Company X for 2 years from April 2020 to April 2022, and joined Company Y in May 2022. Any contributions you made from April 2020 until December 31, 2021 would not count towards your 2022 limit, even if you roll it over to your Company Y 401. If you already contributed $5,000 to your 401 with Company X before you departed, your remaining 2022 allowable contribution amount would be $15,500 .¹

Dont Miss: Baileys Grove Retirement Community

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Read Also: When Do You Have To Take Money Out Of 401k

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

You May Like: What Is The Phone Number For 401k

How Much Should I Have In My 401k At 30

Again, the average 401 amount is more than twice as high as the median 401 balance. This indicates that high-wage earners and those who are committed to making the most of their 401 plan have a greater capacity for savings.

If youre falling behind, throughout your 30s you should consider bumping up the amount you contribute by a few percentage points when you have the opportunity. When you schedule the increase with any increases or bonuses you obtain, this becomes an incredibly simple task to do. In this method, you wont see any reduction in your discretionary money. In point of fact, if you live within rather than over your means, it will be easier for you to maintain control over your spending habits.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401 contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older. For 2023, you can contribute $22,500 and those ages 50 and up can contribute an extra $7,500.

Recommended Reading: How To Do A Direct 401k Rollover

Open Simultaneous Retirement Funds

The IRS allows you to contribute to a 401, an IRA and a Roth IRA in the same year. However, there is overlap between the contribution limits for an IRA and a Roth IRA.

If you are already maximizing your contribution limits to your 401 but are still concerned that it isnt enough, consider opening an IRA or a Roth IRA to supplement your savings. Doing so will allow you to put money into multiple retirement accounts at the same time, helping you to boost your savings considerably.

If you already have simultaneous retirement accounts, consider simply opening an earmarked account. Even though it wont see the same tax advantages, theres no reason that you cant save for retirement with an ordinary investment portfolio. You can put as much money into it as you like then just plan on leaving it there for retirement.

How Would Early Withdrawals From Retirement Accounts Be Impacted By The New Law

The SECURE 2.0 Act of 2022 includes several rule changes that would benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress plans to add a basic exception for emergencies. Account holders who are younger than 59 and a half could withdraw up to $1,000 per year for emergencies, and have three years to repay the distribution if they want. No further emergency withdrawals could be made within that three-year period unless repayment occurs.

The bill also specifies that employees would be allowed to self-certify their emergencies, that is, no documentation is required beyond personal testimony. The bill would also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters would also get some relief with the proposed changes. The proposed new rules would allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals wouldnt be penalized and would be treated as gross income over three years. If the bill passes, the rule would apply to all Americans affected by natural disasters after Jan. 26, 2021.

You May Like: Can You Roll A 401k Into An Existing Ira

What Should You Do If Your Fees Are Really High

In most cases, the fees will be under 1%, which is also listed as 100 basis points, Ventre says. If you see a mutual fund expense ratio of 2% or 200 basis points, that to me is a bit of an outlier. In that case, go to your HR department and ask how they manage the plan or when the last time they reviewed it was.

You cant shop around in the case of your 401, since youre captive to what your employer offers. But you can choose to invest in different mutual funds within your retirement account if that would help you save on fees and increase your returns.

Another option if your fees are high is to contribute just enough to your 401 to meet your company match and invest the rest of your money on your own into an IRA or a health savings account . Fees are also a consideration after you leave your employer, when youre deciding whether to leave your 401 where it is or roll it over into a new account.

But know that saving something is still better than saving nothing, and saving through any employer sponsored plan is still one of the best ways to automate this hefty task. When you save through an employer-sponsored plan, youre doing what every investor really should be doing, which is paying yourself first, Moulton says.