To Ira Rollover: Everything You Need To Know

If youre moving from the US to Canada or youve already moved, you may be wondering about the implications of a 401 to IRA rollover and whether its something you should do. At SWAN Wealth Management, many of our cross-border clients are concerned about having access to their 401 when they move or retire to Canada. If youve already moved or are planning a move, then this information applies to you.

This article is for educational purposes only. Speak to a qualified tax professional and financial advisor about your particular situation as this can be complicated.

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

Can You Roll A 401 Into An Ira Without A Penalty

Distributions from a 401 are limited before you are 59.5 if you are still working with the company. But once you leave your job, regardless of your age, you will have access to your 401 funds and can decide what to do with them. Remembering if you were to cash out the account and not do a rollover you would pay taxes and a potential penalty.

You may also have an option to do an in-service rollover if you are over the age of 55 and still working with your 401 employer.

INDIRECT ROLLOVER AND 60-DAYS ROLLOVER

It is possible to roll over a 401 to an IRA without penalty. If you are over the age of 59.5 or separated from service, you must deposit the funds from your 401 plan to another retirement account within 60 days if it is an indirect rollover.

However, it is best to move the money directly from one institution to another because there are no 60-day rule or mandatory 20% withholding taxes.

Keep in mind an indirect rollover or 60-day rollover is where the distribution is made payable to you. In comparison, a direct rollover means you, as the account owner, never have access to the funds.

Be aware of the once-per-year rollover rule. Roth conversions are not subject to the once-per-year rollover rule.

Recommended Reading: Can You Roll Over 401k To Roth Ira

Simple Ira Contribution Limits

For 2021, the SIMPLE IRA contribution limits are $13,500 or $16,500 for people who are age 50 and older. For 2022, the SIMPLE IRA contribution limits rise to $14,000 or $17,000 for people 50 or older.

If you want to contribute more than that amount, you can also invest up to an additional $6,000 in a traditional or Roth IRA. You cannot, however, max out both a SIMPLE IRA and another employer-sponsored retirement plan, like a 401.

The annual total for both SIMPLE IRA contributions and 401 contributions cant be more than $19,500 for 2021 . In 2022, this increases to $20,500 . Because an employer cannot offer both a 401 and a SIMPLE IRA, this scenario would only occur if you changed employers during one year, your employer changed your plan mid-year or you had multiple jobs with retirement benefits.

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

Recommended Reading: How To Find My Old 401k

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

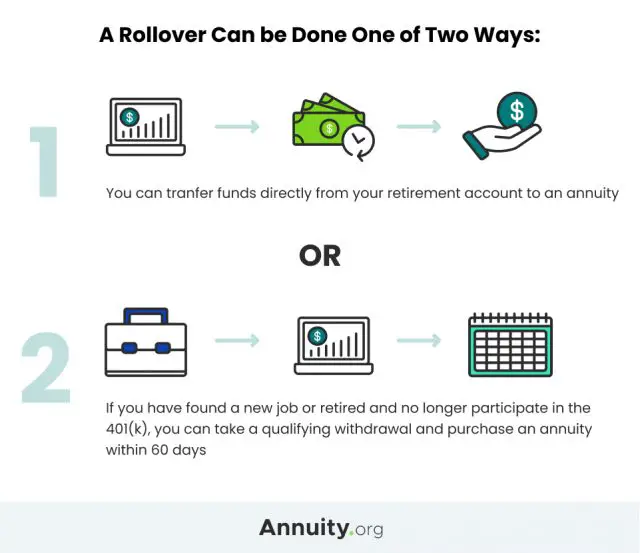

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.

Take Steps To Ensure A Tax

Confirm the date. Once you think it has been two years since your first SIMPLE IRA contribution, confirm with the plans custodian. Be sure that you have met the two-year rule before beginning any transfer paperwork. Keep in mind that some custodians calculate that period with different start dates.

Remember the IRA One-Rollover-per-Year Rule.Per IRS rules, you are limited to one non-taxable IRA rollover per 12-month period. If you make more than one per year, the distribution will count as income. It may be subject to the 10% early withdrawal tax.

Consider waiting until the two years are up.Are you concerned about the timing of your IRA rollover? To keep things simple, you may want to keep the funds where they are until the two years are up. Again, be sure to confirm with your plans custodians that you have met the two-year rule before starting the rollover.

Recommended Reading: Is Fidelity A 401k Plan Administrator

Recommended Reading: How Much Is 401k Taxed

There Are Benefits To Keeping Retirement Funds In Your 401

Although there are some potential benefits of keeping retirement funds in your employer-sponsored retirement plan, the IRA rollover is often the preferred choice for clients. One advantage of keeping your retirement funds in your 401 is that certain 401 plans have exceptions to the 10% early withdrawal penalty. For example, if you have stopped working for the company you may be able to take money out of your plan at age 55 instead of waiting until age 59.5, without paying a 10% penalty. This is specific to various employers so you would need to check with your plan administrator. Some 401s may also provide ERISA creditor protection. ERISA offers very strong creditor protection, and safeguards covered funds from most creditors. IRAs dont receive creditor protection under ERISA but do receive creditor protection under state law. It may be equivalent protection but is not always the case.

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

Compare costs among your retirement plans to find out where youre getting the better deal.

-

Protection against creditors: 401s have protections against creditors that IRAs dont provide, including in bankruptcy and against claims from creditors. IRAs are protected in bankruptcy up to a limit of $1,283,025 dont ask us why the amount is so exact across all plans. IRA protection from creditors may vary by state.

-

You may be able to put off distributions if you work longer: A traditional IRA requires minimum distributions to begin at age 70½. A 401 does, too the IRS wants to get its hands on the taxes you owe when you take those distributions, because theyve been deferred since the contributions were made but if youre still working, you can postpone distributions from a 401 until you retire.

-

401 loans: These are, lets be clear, a last resort. But if youre in dire need of money and you have nowhere else to get it, a 401 might offer you the option to take a loan from your own account, then pay yourself back with interest.

» See how a 401 could improve your retirement: Try our 401 calculator.

You May Like: What Is Better Roth Or 401k

Direct Vs Indirect Rollovers

A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties. Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. In many cases, you can shift assets directly from one custodian to another, without selling anything. This is known as a trustee-to-trustee or in-kind transfer.

Otherwise, the IRS makes your previous employer withhold 20% of your funds if you receive a check made out to you. It’s important to note that if you have the check made out directly to you, taxes will be withheld, and you’ll need to come up with other funds to roll over the full amount of your distribution within 60 days.

To learn more about the safest ways to do IRA rollovers and transfers, download IRS publications 575 and 590-A and 590-B.

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

Recommended Reading: Should I Borrow From My 401k

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Already Have An Ira With Principal

Log in to view account information online or add to your account.

Learn more about rollover IRAs:

This document is intended to be educational in nature and is not intended to be taken as a recommendation.

Investment and insurance products are:

- Not insured by the Federal Deposit Insurance Corporation or any federal government agency.

- Not a deposit, obligation of, or guaranteed by any Bank or Banking affiliate.

- May lose value, including possible loss of the principal amount invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the member of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754,member SIPC. Principal Life and Principal Securities are members of Principal Financial Group® , Des Moines, IA 50392.

Principal, Principal and symbol design, and Principal Financial Group are trademarks and service marks of Principal Financial Services, Inc., a member of the Principal Financial Group®, Des Moines, IA 50392.

You May Like: How Much Do You Need In Your 401k To Retire

Rollover To An Annuity

A guaranteed lifetime income annuity, similar to a pension distribution, will provide a steady stream of income that’s guaranteed to last for the rest of your lifeno matter how long you live.1 With an annuity that offers a guaranteed payout, you wont have to worry about the impact a decline in the market will have on your payments.

What If I Have Both Pretax And After

Generally, pretax assets are rolled into a rollover IRA or traditional IRA. After-tax assets or after-tax savings) are rolled into a Roth IRA.

You can choose to roll pretax savings into a Roth IRA, but doing so would be treated as a taxable event. Similarly, you can roll after-tax savings into a traditional IRA, but this requires careful tracking of your assets for when you start taking distributions. Before deciding, please consult your tax advisor about your personal circumstances.

Don’t Miss: How To Rollover 401k From Previous Employer To New Employer

When Shouldnt I Buy An Annuity With My 401

There may be benefits to leaving your 401 balance in your employer plan if allowed:

- You will continue to benefit from tax deferral.

- There may be investment options unique to your plan.

- Fees and expenses may be lower.

- There is a possibility for loans.

- Distributions are 10% federal tax penalty-free if you terminate service after you turn 55.

Also, if you intend to spend a substantial amount of your savings early, an annuity might not be a good fit. The surrender periods and long-term nature of annuity strategies are best suited for those who leave the majority of their money in an annuity for an extended period. So, if youre planning for immediate major expenses, research your options carefully.

Recommended Reading: How Much Should I Have In My 401k At 25

What Spouses Should Know

If you are the spouse of someone who plans to roll over their 401 balance to an IRA, be aware that you’d lose the right to be the sole heir of that money. With the workplace plan, the beneficiary must be you, the spouse, unless you sign a waiver.

Once the money lands in the rollover IRA, the account owner can name any beneficiary they want without their spouse’s consent.

Here’s another potential misstep: Making a withdrawal from your 401 to give to your ex-spouse as dictated in a divorce agreement. That won’t work the money will be considered a distribution to you, subject to taxation, as well as potentially a penalty if you’re under age 59½.

In a divorce, retirement assets that are awarded to the ex-spouse can only be distributed penalty-free via a qualified domestic relations order, or QDRO. That document is separate from the divorce decree and must be approved by a judge.

Also Check: What Happens To Your 401k If You Get Fired

Tips For Retirement Investing

- Consider finding a financial advisor to steer you in the right direction in terms of savings and investments. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre starting to plan for retirement, you should consider the tax laws of the state you live in. Some have retirement tax laws that are very friendly for retirees, but others dont. Knowing what the laws apply to your state, or to a state you hope to move to, is key to getting ahead on retirement planning.