Are Retirement Savers Actually Changing Course

To answer this question, we looked at the behavior of 401 participants during the first half of 2022 from T. Rowe Prices recordkeeping data. Using collective and anonymized data, we analyzed their exchange activity and changes in their deferral rates during this volatile period.

In general, 401 participants have been staying the course. Based on our research, over 95% of 401 participants have not made any investment exchanges during the first half of 2022. But underlying that, there are some noticeable trends.

Apart from exchanges, 401 participants can also change their deferral rates in response to market conditions, but other factors may also be at work. For most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, suggesting that cutting back on contributions is one way workers may be coping with inflation at fourdecade highs. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Average Deferral Rate Has Remained Stable

Weekly average deferral rate during the first and second quarter of 2022

As of July 1, 2022.401 participants of plans with approximate assets> $25m. during the first half of 2022 from T. Rowe Prices record-keeping data.Source: T. Rowe Price.

Look At Other Ways To Protect Your Financial Health

During a period of economic uncertainty, maintaining a good investment strategy is importantbut it’s only one piece of your financial plan. Other ways to prepare your finances for a potential recession include evaluating your budget and cutting back on discretionary spending, paying down debt and building your emergency fund.

It’s also a good idea to monitor your credit and take steps to improve your credit score in case you need to borrow money to get by. While there’s no surefire way to predict the direction of the economy, these steps can help you bolster your financial position and improve your odds of avoiding a personal financial catastrophe.

Understanding The Different Types Of Retirement Plans

With so much information to grasp, planning your retirement can be complicated and daunting. However, we have designed this section to make understanding retirement easier. Continue reading to familiarise with all the different ways that you can build your retirement income.

Although there are many different types of retirement plans, they all typically fall under these 3 schemes:

Also Check: How Do Companies Match 401k

Avoid Panic Selling Stay In The Game

What you don’t want to do after a market free fall is self-sabotage your retirement. “The worst thing todo is to panic and sell,” says Schwab’s Williams.

Still, there are crunch times when you have no choice but to tap your 401 as a last resort. In fact, in a sign of financial strain, an investor survey by Vanguard found that “hardship withdrawals” from employer-sponsored retirement accounts recently reached an all-time high.

Those early withdrawals result in a tax hit and possible 10% penalty. If you’ve taken an emergency distribution, put together a “plan to replenish what you’ve removed,” says Dan Cronin, founder of Lifestyle Wealth Management. Move on from short-term troubles and get back on track as soon as you can.

“Investing and saving for retirement is a long-term game,” Schwab’s Williams stresses. “Stay in it.”

YOU MAY ALSO LIKE:

Be Aware Of The Fees Associated With Your Plan

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

Also Check: How Much Money Can You Put In 401k Per Year

These Strategies Can Help You Use Your 401 To Grow Your Wealth

A 401 makes investing for retirement easy with pre-tax contributions withdrawn directly from your paycheck. However, once you’ve made your contribution, you need to choose the right investments to maximize returns while limiting risk. Most 401 plans usually provide a small selection of funds in which to invest, and you’ll want to pick an appropriate mix of assets for your age and risk tolerance.

This guide will help you develop a strategy to invest in your 401 to make the most of this tax-advantaged retirement account.

Determine How Much To Park In Cash

Assuming the planned withdrawal rate is sustainable, a retiree can then begin staging the portfolio by anticipated spending horizon. Money for the next few years goes into cash not only have yields on cash instruments come up recently but cash wont budge in value, either, meaning the retiree wont be forced to change her plans because shes had a loss of capital. In the Bucket framework that Ive discussed on Morningstar.com, Ive earmarked two years worth of spending needs for cash.

To go back to the Paul and Amy example, they would need a minimum of $16,000 in cash or up to $64,000 in cash.

Read Also: Can The Irs Take My 401k If I Owe Taxes

Why Im Investing 100% Of My 401 Into 5 World

In 2023 Im going to rebalance my portfolio around five world-beater blue-chip assets based on the Dividend Kings ZEUS retirement portfolio strategy.

- 33% blue-chip ETFs

- 33% hedging assets

- 33% individual stocks.

ZEUS = Zen Extraordinary Ultra SWAN and let me show you why it lives up to that name.

In fact, ZEUS is the king of sleep well at night retirement portfolios.

Now there are infinite combinations of the ZEUS portfolio.

Here is our family friend Roses ZEUS High-Yield Ultra-Low Volatility portfolio.

You can build a ZEUS portfolio to optimize for any goal you want.

- maximum safe yield today

- maximum safe retirement income over time

- maximum long-term returns

You can use anywhere from 1 stock exchange-traded fund to as many as you want .

You can use using hedging ETFs like EDV , DBMF , SHY cash.

And you can buy anywhere from 2 to 20 individual blue chips, which is the key to this strategy.

- the bonds, managed futures, and cash help you sleep well

- the stock ETFs ensure you cant lose all your money

- the individual blue-chips turbocharge your yield, growth, and total returns.

Let me show you how I built my personally optimal ZEUS 401 retirement portfolio.

- my Roth IRA is the same thing, just 1/3rd the size.

Make Your 401 Selections With A Pro

Whether youre just starting to invest in your 401 or youve had one for years, an experienced professional can help you navigate your options and outline a strategy to meet your retirement goals.

Looking for the right investing pro? Try our SmartVestor program! Its a free, easy way to find qualified pros in your area. A SmartVestor Pro will help you understand your investment selections so you can make informed decisions about your future.

Read Also: How To Roll A 401k Into Another 401k

Contribute Enough To Max Out Your Match

Employers often match contributions you make to your own 401 plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company’s matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it’s smart to always max out your match before investing in any other retirement accounts.

More Financial Advising Help

Seeking professional help to manage your 401 is a smart move. In 2014, Financial Engines Inc. published a report that concluded professionally managed assets perform an average of 3.2% better than nonprofessionally-managed assets. However, many professional investment managers could charge up to 3%.

SmartAsset can help you find a profitable solution to finding a safe and affordable way to get professional 401 management.

You May Like: What Happens To My 401k If I Get Fired

‘s Best Mutual Funds In 401 Retirement Plans

A key to smart retirement saving: spreading your portfolio across a few of the best mutual funds in your 401 plan. Here are the 29 top options available.

Checking your 401 balance when the market gets choppy, as it has in recent months, can feel a lot like watching a scary movie: You’re afraid to look, but you want to know what’s happening. And in that context, we decided now was a good time to check in again with the country’s most popular 401 mutual funds.

Every year, with the help of financial data firm BrightScope , a financial data firm that rates workplace retirement savings plans, we analyze the 100 mutual funds with the most assets in 401 and other defined contribution plans, then rate them Buy, Hold or Sell. Our goal: To guide you toward the best mutual funds likely to be available in your plan.

In the end, only a cool 29 funds, which we’ll describe in detail below, won our “Buy” seal of approval. But you’ll want to pay attention to the fine print. Some funds are appropriate for aggressive investors others are geared for moderate savers.

We’ll also point out that we didn’t weigh in on index funds. That’s because choosing a good index fund always rests on three simple questions: 1.) Which index do you want to emulate? 2.) How well has the fund done in matching that index? 3.) How much does the fund charge? Generally speaking, however, we have no issues with any of the index funds listed in the top 100.

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

Read Also: Do I Have To Pay Taxes On 401k Rollover

How Can You Choose Safer Investments For Your 401

Understanding your retirement timeline and your risk tolerance will help guide you during the investment selection process. Many 401 plans have a default investment, which could be a managed account, balanced fund, or lifecycle fund. If you prefer safer investments, you can evaluate each of the options available through your employers plan to find the mix that matches your comfort level.

Nonqualified Deferred Compensation Plans

Unless youre a top executive in the C-suite, you can pretty much forget about being offered an NQDC plan. There are two main types: One looks like a 401 plan with salary deferrals and a company match, and the other is solely funded by the employer.

The catch is that most often the latter one is not really funded. The employer puts in writing a mere promise to pay and may make bookkeeping entries and set aside funds, but those funds are subject to claims by creditors.

Pros: The benefit is you can save money on a tax-deferred basis, but the employer cant take a tax deduction for its contribution until you start paying income tax on withdrawals.

Cons: They dont offer as much security, because the future promise to pay relies on the solvency of the company.

Theres some risk that you wont get your payments if the company has financial problems, says Littell.

What it means to you: For executives with access to an NQDC plan in addition to a 401 plan, Littells advice is to max out the 401 contributions first. Then if the company is financially secure, contribute to the NQDC plan if its set up like a 401 with a match.

Also Check: How To Convert After Tax 401k To Roth Ira

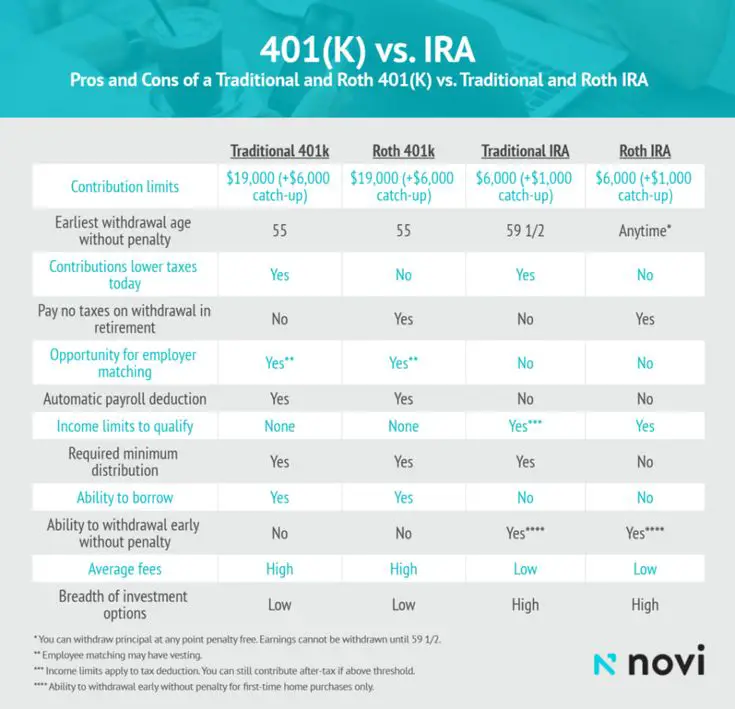

You May Be Settling For Poor Investing Options

One of the drawbacks of a 401 plan is the limited investment options. You can’t make any investment you want. Instead, your plan provider sets the options you can choose from. These usually include your company’s stock if it’s a public company, target-date funds , and market cap-based funds.

The investment options don’t matter for some people, because they’re perfectly content with limited options. For others, the limited options may prevent them from executing their investing strategy. For example, if you wanted to invest in a more industry-specific exchange-traded fund like the First Trust NASDAQ Cybersecurity ETF, many 401 plans wouldn’t let you.

That’s where an IRA comes in handy. Roth and traditional IRAs are retirement accounts that operate like regular brokerage accounts, in that you can invest in any stock you want. Whether it’s individual companies, index funds, or ETFs, there’s no shortage of options.

With a Roth IRA, you contribute after-tax money and can take tax-free withdrawals in retirement. With a traditional IRA, you can deduct your contributions, depending on your income, filing status, and whether you’re covered by a retirement plan at work ). Unlike a Roth IRA, traditional IRA withdrawals are taxable.

Investing With A 401 Vs Index Funds

Index funds are low-cost mutual funds designed to track the performance of groups of stocks, while 401 accounts are tax-advantaged retirement accounts many businesses offer to workers. These two investing vehicles provide different benefits that generally complement each other, and both figure in many investors strategies. If youre trying to decide between the two options to put your money in, here are the keys to understanding the pros and cons of each. Consider working with a financial advisor as you create or periodically modify your investment strategy.

Recommended Reading: What Investments Should I Have In My 401k

Q: Can I Take Out A 401 Loan

A: You can, but we advise against it! A 401 loan is a lump-sum disbursement from funds that you have saved in your retirement account. But, you must repay the loan over a fixed-amount of timewith interest.

If you cant pay this loan back, youll be hit with some serious penalties. The remaining loan balance will be treated as a pre-mature cash withdrawal from your 401. So, itll be subject to at least a 20 percent federal income tax, state tax, and a 10 percent early withdrawal penalty. Thats a lot to lose.

How Do 401 Plans Work For Small Businesses

A 401 is a retirement account that employers provide. Employees can put part of their paycheck into the account, and employers also can deposit money into these accounts to help employees save for retirement. Theyre a good benefit to use to attract and retain talent and offer extra compensation to employees.They also offer a tax deduction to the sponsoring business.

You May Like: How Do I Offer 401k To My Employees

Be Cautious With Crypto Investing

Cryptocurrencies like Bitcoin and Ethereum have been popular investments over the past few years. However, they have since faced considerable losses, especially with the collapse of major industry players, including the epic implosion of crypto exchange FTX.

If you think that cryptocurrencies could rebound and they have in past, you could put a small percentage toward these investments Just make sure youre only investing money you can afford to lose.

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

Recommended Reading: What Age Can You Start A 401k

Invest In Real Estate

Depending on where you live, $100,000 could be enough to make a down payment on a real estate property. You can use it as your primary residence or an investment to earn rental income. However, it might not be enough in high-priced metro areas, especially if youre trying to put down 20% of the total purchase price.

Keep in mind the upfront down payment is just the beginning of costs when you buy property. You would also have the ongoing mortgage payment, property taxes, insurance, and maintenance costs to cover.

If you dont think you have enough for a property or dont want to commit that much upfront, you could also invest in real estate investment trusts . These are like mutual funds but for real estate. The fund combines your money with many other investors to build a portfolio of properties. Youll receive a share of your rental income and additional investment profits for your contribution.