When You Can Withdraw Money From A 401

You generally must be at least 59 1/2 to withdraw money from your 401 without owing a 10% penalty. The early-withdrawal penalty doesn’t apply, though, if you are age 55 or older in the year you leave your employer.

Depending on the plan sponsor, you may be allowed to borrow up to 50% of your vested account balance or $50,000, whichever is less, but unless the money is used to buy a primary residence, you will generally need to repay the loan within five years, making payments at least quarterly. If you miss a payment, the remaining balance is treated as a distribution, with taxes and penalties for early withdrawals applying.

Distribution Of Excess Contributions

If you do exceed your contribution limits, to avoid double taxation, contact your plan administrator and ask them to distribute any excess amounts. The plan should distribute the excess contribution to you by April 15 of the following year . For information about taxes on excess contributions, see What Happens When an Employee has Elective Deferrals in Excess of the Limits?

When deciding from which plan to request a distribution of excess contributions keep in mind:

- getting the maximum matching contribution that may be offered

- type of investments

How Is The Ira Tax Credit Changing

The new law will repeal and replace the IRA tax credit, also known as the “Saver’s Credit.” Instead of a nonrefundable tax credit, those who qualify for the Saver’s Credit will receive a federal matching contribution to a retirement account. This change in tax law will start with the 2027 tax year.

Congress also amended the IRS laws for retirement account rollovers from 529 plans, which are tax-advantaged savings accounts for higher education. Currently, any money withdrawn from a 529 plan that’s not used for education is subject to a 10% federal penalty.

Beneficiaries of 529 college savings accounts will be allowed to roll over up to $35,000 total in their lifetime from a 529 plan into a Roth IRA. The Roth IRA will still be subject to annual contribution limits, and the 529 account must have been open for at least 15 years.

Also Check: What 401k Do I Have

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Itâs also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, itâs a good way to save money, stay organized and make your money work harder.

Recommended Reading: How To Find My 401k Balance

For Those With Less Side

Typically, a SEP IRA is the best option for someone who already maxed out a 401 at work or who earns enough self-employment income reach the $61,000 contribution ceiling. Employers can only contribute the lesser of 25% of compensation or $61,000, so if you earn $100,000 from your side-job, the most you can contribute to a SEP IRA is $25,000. And if you do earn $300,000, you are still limited to the $61,000 max. Those with a lower level of side income can navigate these limits by considering another option: the solo 401.

The solo allows you to pay yourself twice, both as the employer and as the employee. The employee contribution you can make is limited to $20,500. The employer portion is again limited to 25% of compensation. Added together, the employee and employer parts must be $61,000 or below. So, for our investor friend making $100,000 on the side, they can only contribute $25,000 to a SEP IRA. However, if they instead open a solo 401, they can make an employee contribution of $20,500 in addition to the employer contribution of $25,000 . Its important to note that employee contributions are aggregated across all your retirement income plans you cant double-up here. So if youve maxed $20,500 of contributions to your companys 401, you cannot add any additional employee contribution to the solo 401 set up for your side business. Your total solo 401k limit will be 25% of compensation or $61,000, whichever is lower.

Recommended Reading: Can I Have A 401k Without An Employer

What Is A 401 Account

Many employers offer the option to save for retirement using a 401 account. This type of account is named for the section of the tax code that helped establish it. It offers tax advantages for employees who use it to save money for their golden years.

Employers usually offer a match on contributions so it always makes sense to at least get the full match, regardless. For example, the company may offer to match dollar-for-dollar contributions made by employees up to a certain amount. This is free money in addition to your salary and can be a great way to supercharge your savings.

You cannot tap the money in your 401 account until age 55 or 59.5, or you will face a 10 percent early withdrawal penalty. Once you reach 55 or 59.5, you can withdraw your contributions, earnings, and dividends penalty-free. Keep in mind you will have to pay income tax on the distributions from a traditional 401 account.

You may also have the option to contribute to a Roth 401 account. Unlike traditional 401 accounts, money contributed to a Roth 401 is taxed similarly to a Roth IRA i.e. you pay taxes on contributions. However, all earnings and contributions can be withdrawn tax-free upon reaching 55 or 59.5 years of age. This can be an advantage for those who may be in a higher tax bracket in retirement.

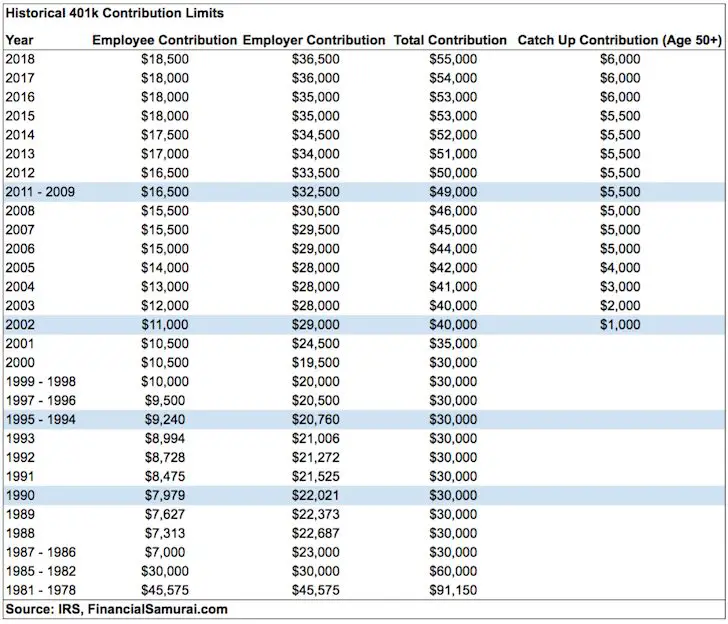

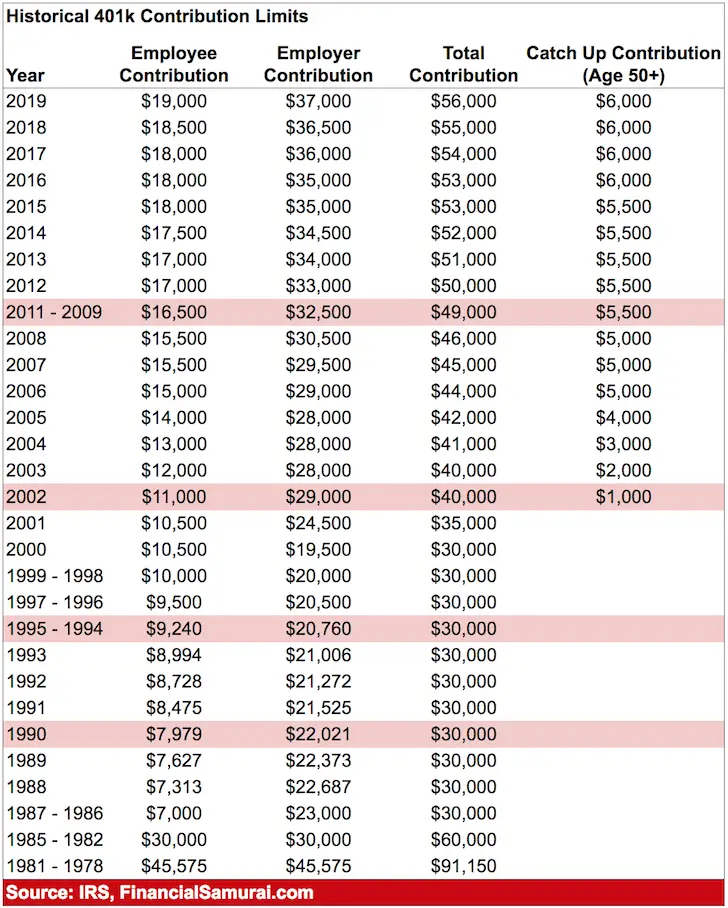

What Are The Contribution Limits For 401 Accounts?

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

You May Like: How To Set Up 401k Fidelity

How Can Paying Off Student Loan Debt Soon Help Save For Retirement

One of the more revolutionary changes included in the Secure 2.0 Act of 2022 is the option for employer plans to credit student loan payments with matching donations to 401 plans, 403 plans or Simple IRAs. Government employers will also be able to contribute matching amounts to 457 plans.

This means that people with significant student loan debt can still save for retirement just by making their student loan payments, without making any direct contributions to a retirement account.

The new regulation will take effect in 2025.

Cons Of Multiple 401s

Having more than 401 account increases the paperwork of saving for retirement, as savers have to keep track of the account statements and other documentation. It can be simpler and easier to develop an investment strategy where all 401 accounts are combined into one.

Each 401 account also has fees for administration and other costs associated with it. To the extent these fees could be eliminated by combining 401 accounts, it may make sense and improve investment returns by putting all retirement funds into one account.

Also Check: What’s The Most You Can Contribute To A 401k

Contributions In Excess Of Annual Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the annual limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Can We Sponsor Two 401 Plans

We get this question a lot from our clients. Sometimes, the answer is a clear yes, and, in other cases, the answer is a maybe. Below are three typical Q& As that highlight the most common scenarios where this question arises.

Question #1: We are opening a non-union facility in another state and the cost structure of that new facility has to be kept to a minimum for it to be profitable. Can we set up a separate 401 plan for employees at the new facility with a lower matching contribution than we provide under the 401 plan that covers the rest of our employees?

Answer #1: MAYBE it depends on whether both of the plans can pass a coverage test.

At its most basic, the coverage test compares the percentage of non-highly compensated employees who are eligible for the plan to the percentage of highly compensated employees who are eligible for the plan. In general, if a plans result is at least 70% , then the plan passes the test.

Lets assume that the employer who asked the question employs a total of 340 NHCEs and 32 HCEs. Under the main 401 plan, 300 of the NHCEs and 30 of the HCEs are eligible to participate. Under the new 401 plan, the remaining 40 NCHEs and 2 HCEs will be eligible. Here is how the coverage test would play out:

| 12% | 6% | 12/6 | 200% Test Passes! |

Since the result for both plans is above 70%, they both pass their test. In this case, then, it would be OK to maintain two separate 401 plans.

Note the following important points:

You May Like: How To Project 401k Growth

Heres An Example Of How You Can End Up With Multiple 401 Retirement Accounts:

On your first job, you signed up for your employer-sponsored 401 and accumulated a balance of $1,500 after two years. At that point, you accepted a dream job all the way across the country and had to arrange a big move. With so many moving pieces you forgot about your 401 and left no instructions to your plans administrator.

On your second job, youre automatically enrolled in a new 401 and accumulated a balance of $9,000 over a four-year period. Fast forward to today, you decide to accept a new job offer and find that the third employers qualified plan doesnt accept rollovers from other 401 plans. Since youre happy with the 401 from your second employer, you decide to leave the $9,000 there. You remember your 401 from your first job, and you contact the plan administrator and find out that the balance of that account is now at a forced-transfer IRA.

In summary, now you have:

-

A forced-transfer IRA account from your first employer

-

A 401 from your second employer

-

A 401 from your current employer

Maintaining multiple 401 plans hurts your nest egg, and there are many reasons why keeping several 401 plans is a bad idea.

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Don’t Miss: How Do I Find 401k From Previous Jobs

Maximizing 401ks And Benefits While Moonlighting Multiple Jobs

Have you ever wondered if you could maximize contributions to more than one 401K while moonlighting multiple jobs? Youre not alone. Years ago, when I landed my first contracting side hustle, I did some research and started a solo 401K . Since then, Ive been maxing out multiple 401Ks per the IRS rules and so can you. Ill focus exclusively on the solo 401K because it provides more flexibility than other self-directed retirement plans like the SEP-IRA. You can read why here.

TLDR the solo 401K is superior. Additionally, Ill delve into how you can optimize employer-provided benefits like healthcare and life insurance while doubly employed perks that are often overlooked when considering taking a second job as a contractor versus an employee.

To make things simple, well assume only pre-tax retirement contributions. Its better to delay taxes until old age when your tax liability is lower unless, of course, your employers offer the mega backdoor Roth IRA option . More on the mega backdoor Roth IRA in a fast follow-on.

Side note: Overemployed is technically sunlighting since youre working multiple full-time jobs simultaneously. But hey, whatever.

Is There A Benefit To Having Multiple Retirement Accounts

If you max out one type of retirement account, it could be worthwhile to open more accounts. Saving in several types of retirement accounts also provides a chance to diversify your savings and tax allocations. … It can be difficult to keep track of investments held in too many different retirement accounts.

Recommended Reading: How To Rollover 401k When You Change Jobs

How To Contribute To More Than One 401

So, wait. If you cant contribute to an old employers 401, how can you contribute to more than one 401? There are two options.

The first is having an employer 401 and an individual 401.

Individual 401s are only available to people who have their own companies or are self-employed. Individuals with self-employment income and people who have C corps, S corps, or LLCs and no employees can create their 401 plans.

The individual 401 is unique in that the contribution limits are higher because you can match your contributions as both the employee and the business owner you can match your contributions. This strategy isnt free money the way an actual employer match is since youre contributing both sides, rather than one side coming from a company but it effectively allows you to have a much higher contribution limit than a standard 401.

The second option is to have more than one job.

If you work two jobs, and both of them offer 401 plans to their employees, you are free to have both. In some cases, this can be a good idea because it allows you to access different asset mixes and funds and accrue more employer matching above the contribution limits.

How Often Can You Borrow From 401

If your employer allows multiple 401 loans, you can borrow more than one loan at a time. However, any new loan should not exceed the plan loan limit. 401 plans place limitations on borrowing from 401 over a 12-month rolling period. This means that, if you took two loans between February of the previous year and February of the current year, and you have used up the loan limit, you cannot borrow another loan in the same period even if you paid the first loan early. Hence, you will have to wait after the 12-month period to take another loan.

Don’t Miss: How To Divide 401k In Divorce

Unseen Benefit #: Potentially Double Leave Of Absence Sick Days Covid Leave

If COVID didnt convince you that 2 or even 3x is wise, then imagine an essential worker getting sick and having to tough it out without benefits. If you 2x in tech, youre tremendously privileged. Lets take a moment and thank those who support our lives by tipping more, using more words of appreciation, and helping those with less to get to where the Overemployed is at.

Having a baby? No worries. Depending on where you live, you may be able to take double maternity or paternity leave, like in Michigan.

Got a case of the Monday and just dont want to work? Take a double sick day off.

Caught COVID, take two weeks off from both employers. No questions asked.

Oh, got one of those wellness days off? If youre lucky, maybe both of your employers have the same day off.

Should I Have More Than One Financial Advisor

We do believe people should have a financial advisor. Advisors can help you with how much and what type of insurance you may need, planning for your estate, how to invest your money, what you can do to help reduce taxes, and most importantly, how to get the most enjoyment from the money you worked so hard for.

If advisors are great, you might be thinking, Should I have more than one financial advisor? Generally, we do not think this is good idea. The reason is if youre turning to several advisors, you become responsible for what each advisor is doing, as if you were managing your own accounts. Ultimately, it creates more work for you as the go-between and you may be reducing efficiencies in the process.

You May Like: Can I Borrow From My 401k To Refinance My House

You May Like: How Do You Access Your 401k

Can I Have More Than One 401

It is possible to enroll in more than one 401 at a time. In fact, it is not uncommon to accumulate several over a lifetime. This can occur in various situations.

Scenarios that Can Lead to More than One 401

- You may have a 401 account from a previous employer and enroll in a second 401 plan when you start a new position. This process could be repeated until you have accumulated several 401 accounts.

- You may hold two positions simultaneously with two separate employers and enroll in a tax-deferred 401 plan with each employer.

- You may work at a job and also earn money from self-employment. Individuals who are self-employed can set up and contribute to their own 401 plan, separate from and in addition to an employer-sponsored plan.

Keep Overall Contribution Limits in Mind

The IRS imposes limits on the amount you can contribute to a 401 in any given year. If you have more than one 401 account, these limits apply to your total 401 contributions. In 2020, the limit is $19,500. Additional catch-up contributions for employees age 50 or older are limited to $6,500 in 2020.

Another IRS rule limits the total amount you and your employer together can put into your 401 account. In 2020, that limit is $57,000, or $63,500 if you are 50 or older. It includes employee contributions, employer matches, and employer contributions. However, this limit applies to unrelated employers separately. This means, if you have more than one 401, you have more than one $57,000 limit.