Questions To Ask If You’re Considering A 401 Loan

If youre thinking of borrowing from your 401, plan ahead by asking your 401 service provider about the borrowing process, such as:

- Are loans allowed? Ask about the types, terms, and costs.

- How much can I borrow? This varies with your plan balance.

- What are the steps? Processes differ, and there may be paperwork if you want a home loan.

Keep in mind that loan checks are usually mailed, so they may take time to reach you.

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. If you cant repay it, the amount of money you still owe will be considered a deemed distribution and could be taxed as it would be if you were to default on the loan.

That means if you left your job in January 2021, you would have until April 18, 2022 when your 2021 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Don’t Take A 401 Loan Without Reading This

Borrowing money from a 401 is a common strategy used to get through hard times.

There are some perks to it, including the fact that you don’t need good credit to qualify for a 401 loan and you pay interest to yourself instead of a creditor. Some Americans decide these advantages outweigh the considerable downsides such as passing up potential investment gains on the borrowed money.

If you’re in the process of deciding whether borrowing from your retirement account makes sense, here are seven things you need to know.

Don’t Miss: How To Transfer 401k To New Company

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

Preparing To Apply For A Business Acquisition Loan

Before researching lenders and formally applying for financing, youll also need to gather specific documentation.

Personal information and documents the lender will request include:

- Your name and Social Security number

- Recent tax returns and bank statements

- A business plan that outlines your operational plans and funding needs

- A letter of intent detailing the terms and conditions of the proposed acquisition

- Financials for other companies you own

Its also helpful to have these business documents handy:

- Requested loan amount and purpose

You May Like: Do I Need An Ira If I Have A 401k

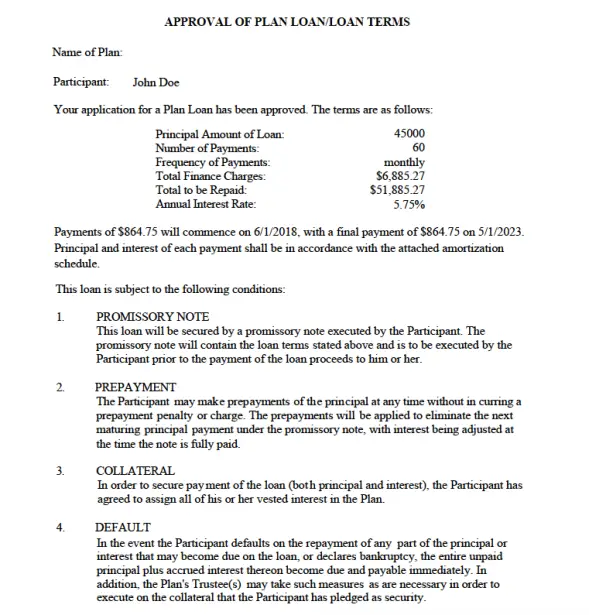

An Example Of A 401 Loan

Suppose you have $5,000 in and $50,000 in a 401 plan. You borrow $5,000 and agree to pay off the debt within five years at an annual percentage rate of 4.25%. At the end of the five years, after having made payments of $92.65 per month, you will have replenished your account and paid yourself $558.83 in interest.

If you were to take the same amount of time to pay off the $5,000 of credit card debt, which had an annual percentage rate of 14.25%, using money left over after meeting your other expenses, you would have paid the card issuer $2,019.47 in interest after having made monthly payments of $116.99.

The Cares Act And 401 Loans

The Coronavirus Aid, Relief, and Economic Security Act, which became law on March 27, 2020, enables people who had taken out a 401 loan to delay for up to one year payments owed from that date through December 31, 2020. Interest would still accrue on your outstanding balance during the period of delayed payments.

Read Also: How Much In 401k To Retire

Can You Borrow From Your 401

Plan offerings: Before you count on a loan, verify that you actually can borrow from your 401 under your plans rules. Not every plan allows loans its just an option that some employers offer and theres no requirement that says 401 plans need to have loans. Some companies prefer not to. Employers might want to discourage employees from raiding their retirement savings, or they may have other reasons. For example, they dont feel like processing loan requests and repayments. How do you find out if you can borrow from your 401 plan? Ask your employer, or read through your plans Summary Plan Description . If loans are not allowed, there might be other ways to get money out.

Former employees: 401 loans are generally only allowed while youre still employed. If you no longer work for the company, youd have to take a distribution from the plan instead. Former employees dont have any way to repay the loan: You cant make payments through payroll deduction because youre not on the payroll any more.

Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

- You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2021 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans had outstanding loans based on 2018 data. So you may need to seek funds elsewhere.

- You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

- Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to take a loan on it.

- You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

- Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Read Also: How Can You Take Out Your 401k

Where To Get A 401k Loan

If you have a short-term financial need, you could consider tapping into your 401. Find out where to get a 401 loan.

If you have been contributing to a 401 plan, you might be able to take a 401 loan. You can take a 401 loan to buy a business, pay down payment for your primary residence, or make a big purchase. If your 401 plan has a loan provision, it is a better alternative to an early withdrawal that has tax implications. A 401 loan is not subjected to a credit check, and you can get approved in a few days.

You can get a 401 loan directly from the 401 plan. Start by contacting the plan administrator to find out the process of getting a 401 loan. Usually, you may be required to file an online application indicating the amount of loan you are applying for and the purpose for which the funds will be used. If the plan administrator approves the loan, you should expect to receive the funds in a few days.

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form won’t let you borrow more than you’re entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, you’ll find an option for contacting fund administrators on the webpage.

Also Check: Where To Put My 401k

Possible Consequences If You Borrow From Your 401

Although paying yourself interest on money you borrow from yourself sounds like a win-win, there are risks associated with borrowing from your retirement savings that may make you want to think twice about taking a 401 loan.

- The money you pull out of your account will not be invested until you pay it back. If the investment gains in your 401 account are greater than the interest paid to your account, you will be missing out on that investment growth.

- If you are taking a loan to pay off other debt or because you are having a hard time meeting your living expenses, you may not have the means to both repay the loan and continue saving for retirement.

- If you leave your job whether voluntarily or otherwise, you may be required to repay any outstanding loan, generally within 60 days.

- If you cannot repay a 401 loan or otherwise break the rules of the loan terms, in addition to reducing your retirement savings, the loan will be treated as taxable income in the year you are unable to pay. You will also be subject to a 10% early distribution tax on the taxable income if you are younger than age 59½. For example, if you leave your employer at age 35 and cannot pay your outstanding loan balance of $10,000, you will have to include $10,000 in your taxable income for the year and pay a $1,000 early distribution tax.

What Is A Plan Offset Amount And Can It Be Rolled Over

A plan may provide that if a loan is not repaid, your account balance is reduced, or offset, by the unpaid portion of the loan. The unpaid balance of the loan that reduces your account balance is the plan loan offset amount. Unlike a deemed distribution discussed in , above, a plan loan offset amount is treated as an actual distribution for rollover purposes and may be eligible for rollover. If eligible, the offset amount can be rolled over to an eligible retirement plan. Effective January 1, 2018, if the plan loan offset is due to plan termination or severance from employment, instead of the usual 60-day rollover period, you have until the due date, including extensions, for filing the Federal income tax return for the taxable year in which the offset occurs.

Also Check: Can You Take From Your 401k To Buy A House

Is A Deemed Distribution Treated Like An Actual Distribution For All Purposes

No, a deemed distribution is treated as an actual distribution for purposes of determining the tax on the distribution, including any early distribution tax. A deemed distribution is not treated as an actual distribution for purposes of determining whether a plan satisfies the restrictions on in-service distributions applicable to certain plans. In addition, a deemed distribution is not eligible to be rolled over into an eligible retirement plan. -1, Q& A-11 and -12)

How To Qualify For A Loan To Purchase A Business

Whether you currently own a business or this will be your first rodeo, the lender will want to know more about the company youre hoping to acquire. What is it worth? Is the asking price reasonable? Is the company operating profitably? How much debt is owed to creditors, and are there any delinquent accounts? Be prepared to answer these questions and provide supporting documents to substantiate your claims.

Youll also need the following to convince lenders youre worthy of funding:

- Personal credit history and score. You should have a relatively clean personal credit history and a good or excellent credit score. A few blemishes on your credit report or a lower credit score dont mean youll automatically be denied a loan. Still, if approved, the borrowing costs will likely be higher.

- Business credit history and score. If you own other companies, the lender will likely take a peek at your business credit history and score to determine if its positive. Your business credit history should be free of late payments, foreclosures, liens and bankruptcies to get approved for a loan.

- Business experience. The lender wants reassurance youre entering an industry you know. So, you should have proof of work experience or extensive training in the field before applying.

Read Also: How Can I Access My 401k Money

What About 401 Hardship Withdrawals

401 loans are not to be confused with 401 hardship withdrawals. A hardship withdrawal isn’t a loan and doesn’t require you to pay back the amount you withdrew from your account. You’ll pay income taxes when making a hardship withdrawal and potentially the 10% early withdrawal fee if you withdraw before age 59½. However, the 10% penalty can be waived if you can provide evidence that the money is being used for a qualified hardship, like medical expenses or if you have a permanent disability.

Another key difference between the two is that with 401 hardship withdrawals, you would be unable to pay yourself back what you took from your account. This is not the case with 401 loans.

The qualifications for a 401 hardship withdrawal depend on your plan and the rules of plan’s administrator, so make sure to check to see how you can qualify for one.

What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

Read Also: How Do I Find My 401k Balance

Does A 401 Loan Hurt Me

Taking out a 401 loan can negatively affect your future finances because it prevents you from making contributions to your account or taking advantage of employer-matching contributions for the life of the loan, which could last 5 years. Additionally, the interest you earn on the loan may be less than if youd just kept the money in your account.

Consider A 401 Withdrawal

Some providers will allow you to take an early withdrawal if you demonstrate an emergency financial need. Circumstances can include, but may not be limited to:

- Medical care expenses

- Costs of purchasing your principal residence

- Tuition and other educational fees for you, your spouse or your dependents

- Eviction or foreclosure prevention costs

- Funeral expenses

- Damage repair expenses on your principal residence

The withdrawal amount will be limited to what is needed to cover the expense. While you dont have to repay a 401 hardship withdrawal, youll lose the money from your retirement account, and you may be taxed at 10%.

Don’t Miss: Which Is Better 401k Or Roth Ira

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.