Rolling Over Your Old 401 To A New Employer

Many companies offer 401 plans, so people often end up having multiple 401s over their years in the workforce. If youd rather keep your funds in a single 401 or dont want to open an IRA, you might have the option of transferring assets from your old 401 to your new one at your current job. If not, youll need to keep an eye on how each is performing individually.

The process for this is as simple as talking to both your current and past plan providers to make sure they will both accept a transfer of assets. While the providers can offer more specific instructions, youll likely use one of the methods above to complete the rollover.

Note that not all plan providers will accept employees past 401 funds as a rollover. This is because they may not be willing to add more assets to the plan, which could overwhelm it.

Assets May Also Be Temporarily Frozen

Access to your funds, vested or not, may also be blocked if litigation related to the plan is in process. In such instances, assets may be temporarily frozen. Similarly, short-term restricted access to your funds may happen in the event the plan sponsor is changing record keepers or there is a blackout period in which funds cannot be changed or accessed in any way. You should know about this in advance as this is legal, and notices must be provided to active participants at least 30 days prior to the blackout start date.

Recently terminated employees may also be subject to different rules regarding access to their plans. These rules are governed by things such as resolving any lingering financial issues around a worker’s departurean outstanding loan, for example. If you’ve taken out a 401 loan and leave your job, you’ll have a specified time period in which to pay it back.

Finally, a lock may occur due to suspected fraudulent activity on the account. While fraud alerts are meant to protect account holders, sometimes they may be unaware of the alert and will need to call customer service to release the hold.

Vesting May Limit Access To Some 401 Funds

In principle, it’s illegal for a company to restrict access to your personal 401 funds and the earnings they have made. However, in practice, the balance in the account may not all be yours, because some money may have been contributed by your employer via employer matching and you may not have worked long enough in the job for those company contributions to have vested to you.

Once you have reached the point of becoming fully vested, often within a few years, the funds are all yours, and barring other issues, the company is obliged to release them. If you are restricted from accessing your vested 401 funds, that is indeed illegal. At all times you have full rights to withdraw all of your contributions made to the plan in addition to fully vested employer matching contributions, if applicable.

Nevertheless, if there was a vesting schedule associated with matching contributions, and you left before the date those funds fully vested, you can legally be denied access to them.

A company’s vesting schedule determines when employees own their employer’s contributions to their 401 accounts workers are always fully vested in their own contributions.

You May Like: What Does Vested Mean In 401k

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

⢠You donât meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

⢠Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you canât meet, or they might not provide the services you want.

Previous Employers Dont Have To Be Helpful

Likewise, your old employer doesnt necessarily have any motivation to help you with the process. Especially if you were fired, laid off, or if the company went out of business. How are you supposed to contact your old HR department for help with a 401k rollover when that department literally just no longer exists?

To be fair, some employers make 401k rollovers or direct transfers mandatory when an employee leaves the company. But its far more likely that they just ignore your retirement plan after they complete your exit interview.

Recommended Reading: Can I Trade Stocks In My 401k

How Long Do You Have To Move Your 401 After Leaving Your Job

Theres no time limit on how long you can keep your 401 after leaving your job. You can leave it in your former employers plan, roll it into an IRA, or cash it out. Each option has different rules and consequences, so its important to understand your choices before making a decision.

If you leave your 401 in your former employers plan, youll still be able to access your account and make changes to your investment choices. However, you may have limited options for withdrawing your money and may be subject to higher fees.

Rolling your 401 into an IRA gives you more control over your account and typically lower fees. Youll also be able to access your money more easily. However, youll need to roll over the account within 60 days to avoid paying taxes and penalties.

Cashing out your 401 should be a last resort. Youll have to pay taxes on the money you withdraw, and you may also be hit with a 10% early withdrawal penalty if youre under age 59 1/2. Cashing out will leave you without the tax-deferred savings to help you reach your retirement goals.

How To Handle Your 401 When You Get A New Job

If your former employer cashed out your 401 account and gave you a check, you need to roll the money into a qualified retirement account within 60 days to avoid paying taxes on it. If you didnt get a check, and youre able to park your 401 with your former employer for now, take some time to consider your options.

You May Like: Does Employer 401k Contributions Count Towards Limit

Don’t Miss: How To Check 401k Balance Adp

Rollovers With An Advisers Help

When you move money from one retirement account to another , there are three possible methods. The first two are the methods financial advisors use to roll accounts over, which is either a direct rollover or a trustee-to-trustee transfer.

The details of each vary, but the important thing is the advisor sets up your new account and has the money transferred directly to the custodian of the new account . Because the money stays within your two accounts, the IRS treats it as though you never touched the money even though you are the owner of both accounts. This means the rollover happens with no tax implications.

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Don’t Miss: Can I Transfer Roth 401k To Roth Ira

Roll The 401 Over Into An Ira

What if youre not moving to a new employer immediately or your new employer doesnt offer a 401? What if your employer requires you to put in a number of years before you become vested and eligible to participate in their 401 plan?

In these circumstances, stashing your money in an IRA with the financial institution of your choice is a freeing solution. Youll be able to choose where, how, and when you invest unless you agree to pay a broker to manage the funds for you. A direct rollover is ideal to avoid paying taxes on the amount transferred over you have 60 days to roll your 401 over into the new IRA.

Also Check: How To Find My 401k Contributions

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Read Also: Can I Use 401k For Real Estate Investment

Is It A Good Idea To Withdraw Money Early From Your 401k

There are not many benefits to early 401k withdrawals. You will incur a 10% extra penalty on top of any taxes you owe if you make withdrawals before age 5912.

Some companies do, however, permit hardship withdrawals for unanticipated expenses like property purchases, funeral fees, or unforeseen medical expenses.

Although you can avoid the early withdrawal penalty in this way, you will still be responsible for paying taxes on the withdrawal.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Read Also: Can I Borrow Against My Fidelity 401k

When Changing Jobs Is This Your Best Option

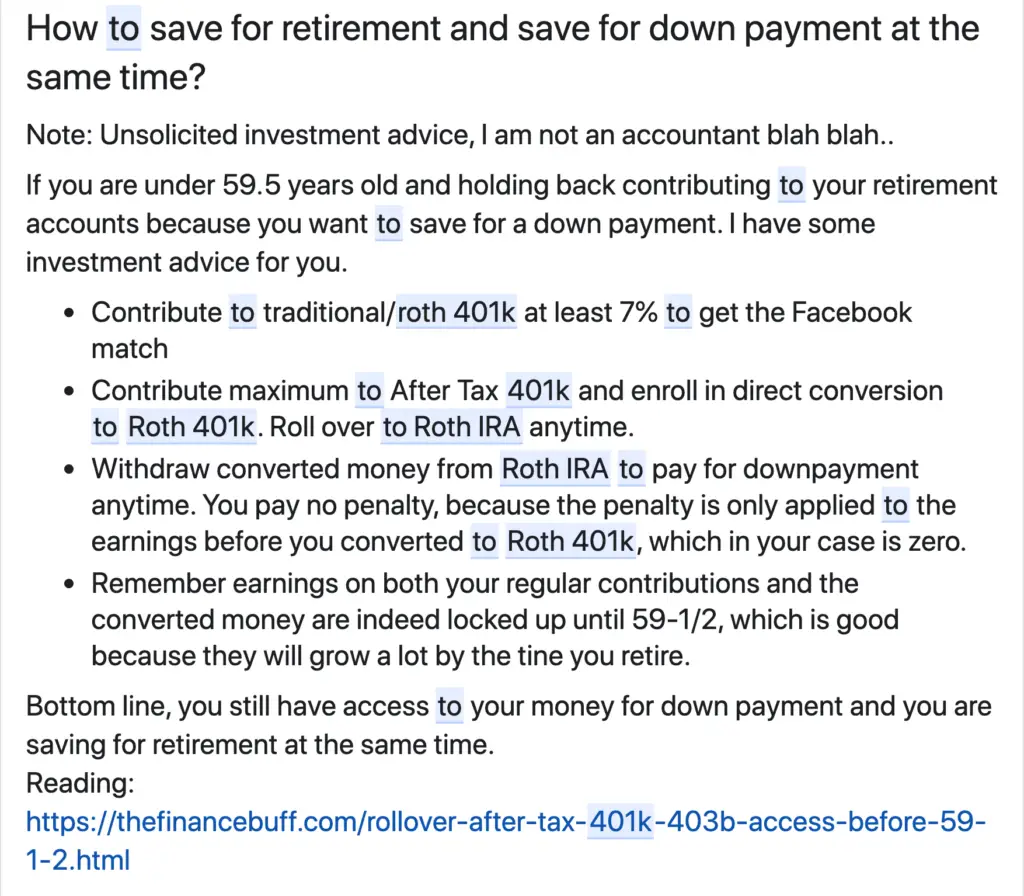

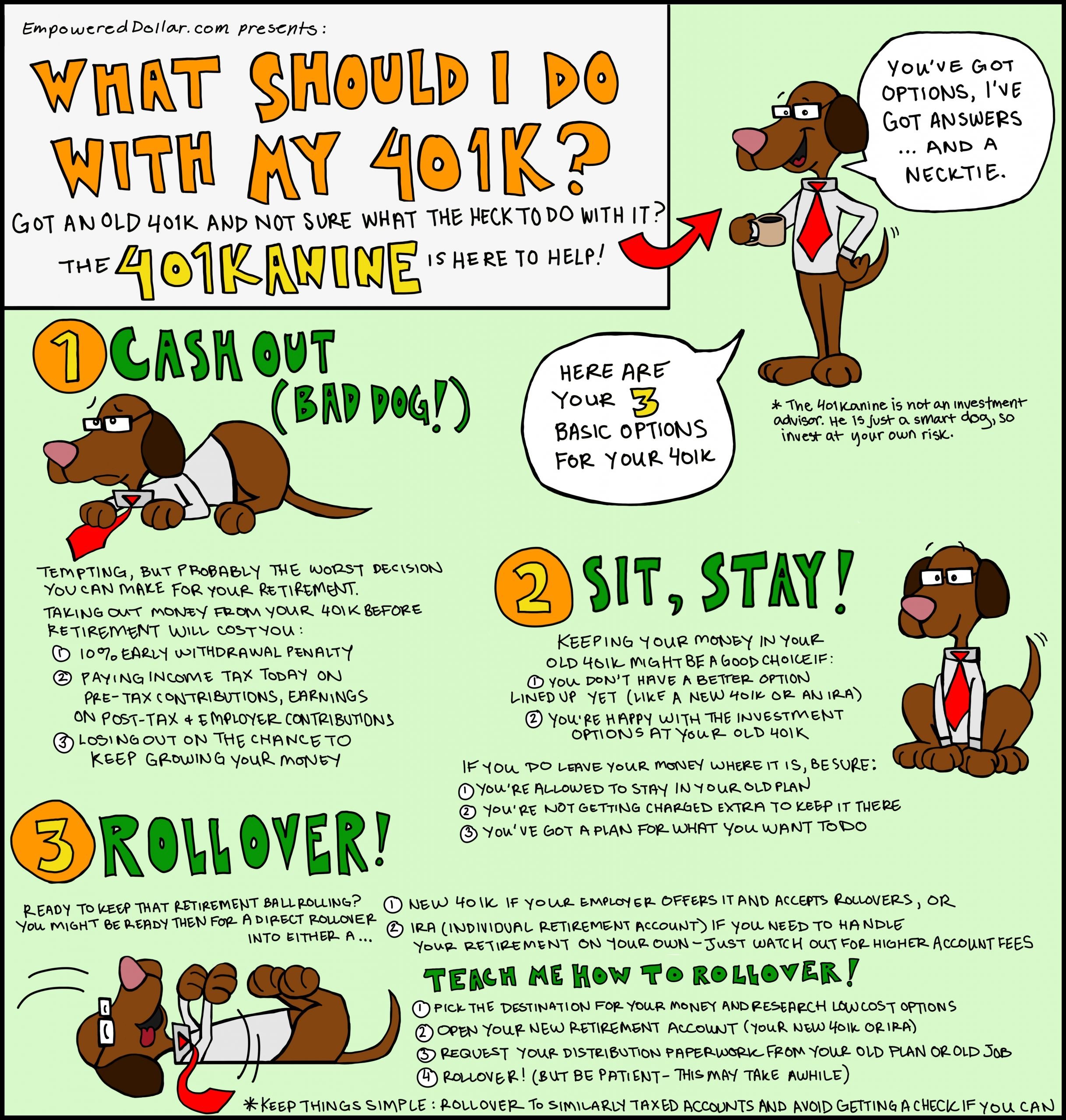

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employers 401, certain steps are necessary.

You May Like: Which 401k Plan Is Best For Me

Decide Where To Open Your New Ira

When opening an IRA, most people will look towards a brokerage, and for obvious reasons. 401 accounts are notorious for their relatively limited investment selections. But by rolling your funds into an IRA at a brokerage, youll get to choose from a significantly larger pool of potential investments. In fact, many offer some combination of stocks, bonds, exchange-traded funds , mutual funds, options and more.

Managing your own retirement funds takes a lot of time and energy, but a financial advisor can do it for you. Many financial advisors specialize in retirement planning and investing, which is exactly the combination youll need. If you go this route, your advisor will manage your investments in an IRA according to your needs and current savings situation.

If you prefer an even more hands-off approach to investing, a robo-advisor could be a good option. When you open an IRA with a robo-advisor, an asset allocation profile will be created for you based on your age, risk tolerance and proximity to retirement. The robo-advisor will then invest and manage your assets for you according to this plan.

Regardless of which way you go, make sure you understand any account, investment or advisory fees you may incur. An overbearing fee structure can have an extremely negative effect on your portfolio, so keep an eye out for this.

Also Check: How To Project 401k Growth

Open A New Account Or Use An Existing One

You may need to open a new 401 or establish an IRA before initiating a rollover. After all, you need an account to roll your funds into. If you already have a 401 or IRA account that you want to use, then you don’t need to open a new account. However, if you prefer to keep your rollover funds separate from an existing account, then opening a new account is still an option.

Opening an IRA is a simple and straightforward process with most online brokers. It can be done entirely online with just a few forms and clicks.

What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Also Check: How Do You Check Your 401k

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs arent sponsored by employersyou own them directlyyou wont have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether youre employed. Also, youll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Recommended Reading: Can You Borrow From Your 401k

How Long Do I Have To Roll Over My 401

You can roll over a 401 at any point after you switch jobs or retire. Bear in mind, though, that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another plan. And youre only allowed one rollover per 12-month period from the same IRA.

If you miss the 60-day deadline, the taxable portion of your 401 distribution will be taxed. And if you are under the age of 59½, there will be an additional 10 percent tax penalty.

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Recommended Reading: Can You Open 401k Your Own

How Does A 401 Rollover Work

You will need to take a few steps to complete a 401 rollover.

First, you will need to contact your old 401 plan administrator and let them know that you want to do a rollover. They will likely have some paperwork for you to fill out.

Next, you will need to open a new 401 account with the investment company of your choice.

Once your new account is set up, you will instruct your old 401 plan administrator to send your money directly to your new account. This is called a direct rollover.

If you choose to do an indirect rollover, you will withdraw the money from your old 401 and then deposit it into your new 401 or annuity within 60 days. Again, you will need to contact your old 401 plan administrator and let them know that you want to do a rollover. They will provide you with the necessary paperwork.

Once you have withdrawn the money from your old 401, you must deposit it into your new 401 within 60 days. You can do this by writing a check or by transferring the money electronically.

Its important to note that if you do an indirect rollover, you will be taxed on the withdrawal. However, as long as you deposit the money into your new 401 within the 60-day window, there are no penalties.