Will Taxes Be Withheld From My Distribution

- IRAs: An IRA distribution paid to you is subject to 10% withholding unless you elect out of withholding or choose to have a different amount withheld. You can avoid withholding taxes if you choose to do a trustee-to-trustee transfer to another IRA.

- Retirement plans: A retirement plan distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll it over later. Withholding does not apply if you roll over the amount directly to another retirement plan or to an IRA. A distribution sent to you in the form of a check payable to the receiving plan or IRA is not subject to withholding.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Direct And Indirect Rollovers

A direct rollover occurs when the eligible employer plan or IRA sends all or part of your money to the TSP. Money that is directly rolled over is not taxed as income at the time of the rollover.

In an indirect rollover, the plan or IRA sends you the money and you send all or part of it to the TSP. Generally, you have 60 days from when you received it to make the rollover. If you wish to roll over the entire amount of the distribution you received from your other plan and the plan withheld money for income tax, you will have to add the amount withheld from other funds.

We will accept both direct and indirect rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 to the traditional balance of your account.

We will accept direct rollovers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s to the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the rollover will create one.

We do not accept indirect rollovers of Roth money and do not accept either type of rollover from a Roth IRA.

Don’t Miss: What Happens To 401k In Divorce

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

Moving Money From A Retirement Plan Is Only One Of The 8 Common Ways To Free Up Money To Fund A Bank On Yourself Plan

These range from restructuring debt, to reducing funding of your traditional retirement account, converting existing life insurance policies, and tapping your savings.

Moving some of your safe money into the Bank On Yourself wealth-building strategy can result in your dollars working much harder for you, without losing sleep. The return is many times greater than you can get in a CD, money market or savings account but without the risk of stocks, real estate or other volatile investments.

The Bank On Yourself Professionals are masters at helping people restructure their finances to free up more seed money to fund a plan that can help you reach your goals and dreams in the shortest time possible without taking any unnecessary risk.

Recommended Reading: Is It Worth Rolling Over A 401k

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the company’s stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

If you’re willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

You May Like: What Age Can You Draw From 401k

Q: What Do I Need To Apply For A Business Loan

This is a list of the general information that may be needed to apply for a business loan at Fidelity Bank: Name of the business, Tax identification number, Legal structure , Validation of business existence , State of formation, Nature of business , Financial documentation , Mailing and physical address , Contact phone number, Purpose of account , Expected level of cash activity . Certain accounts may require additional information.

Note: Any contributions to your account made after the effective date of this change will be directed into the investments you select.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: Can You Open A Personal 401k

Opening An Ira Account

If you cant roll your old 401 into a new 401 and you dont already have an individual retirement account, now is the time to get one set up.

Youll want to keep in mind the conditions of a 401 rollover from your previous employer and your own financial situation when selecting an account: Does the provider allow for a direct rollover to a different financial companys traditional IRA as in, can you do a direct rollover from a Principal retirement account to an account from Fidelity? If not, are you able to front 20% of the actual value of the account? Would a Roth 401 make more sense based on your potential future income, despite the bigger tax bill this year?

With all of these in mind, you then need to decide what type of IRA youd like and where you want to open an account. But some may have high minimum initial deposits and fees or have limited options for allocating your money between stocks, bonds, mutual funds and ETFs. You can learn more about IRA options here: What Is an IRA?

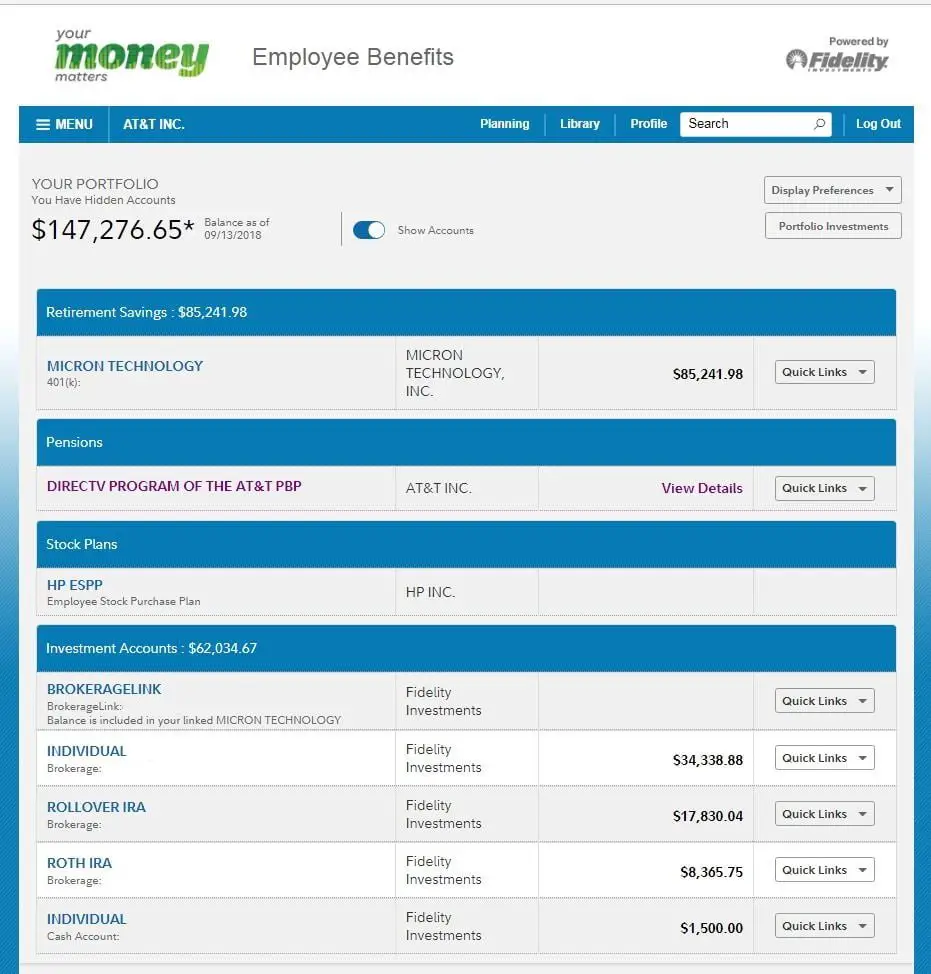

How To Find & Calculate Fidelity 401 Fees

To understand how much youre paying for your Fidelity plan, I recommend you sum their administration and investment expenses into a single all-in fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Fidelity plan to competing 401 providers and/or industry averages.

To make this easy on you, weve created a spreadsheet you can use with all the columns and formulas youll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Fidelity can be a bit of a pain, but not to worry well show you everything you need to do in 4 simple steps.

Step 1 Gather All the Necessary Documents

To calculate your Fidelity 401 fees, the only document youll need is their 408 fee disclosureâ what Fidelity has named a Statement of Services and Compensation.

Fidelity is obligated by Department of Labor regulations to provide employers with a 408. This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the reasonableness of these fees. This document can be found on the Fidelity employer website.

If you hired an outside financial advisor for your plan, youll need to factor their pricing into your Fidelity fee calculation. This information can usually be found in a services agreement or invoice.

Step 2 Locate Fidelitys Direct 401 Fees

Read Also: How To Rollover 401k To 403b

Transferring A 401 Plan And Ira To A Canadian Rrsp

Investment Insight

If youve been living and working in the United States, youd have likely accumulated retirement savings while employed. Now that youve returned to Canada, youre probably considering transferring the retirement savings you accumulated abroad to a Canadian registered retirement savings plan ¹ but are concerned about the tax implications and the logistics associated with such a transfer.

Where Can I Transfer My Retirement Account

Transferring funds from your old plan to your new employers 401 plan without taxes or penalties is possible with a direct 401rollover. The plan administrator of your new employers plan can help you allocate your savings into the new investment options.

Contents

Recommended Reading: How To Set Up A Company 401k Plan

How Long Does It Take To Get 401k Withdrawal Direct Deposit

Opting for Direct Deposit You will still need to wait for your withdrawal application to process which takes five to seven days on average before the funds are released into your account. Once the money is released, it could post as early as the same day, or within 48 hours, depending upon your banking institution.

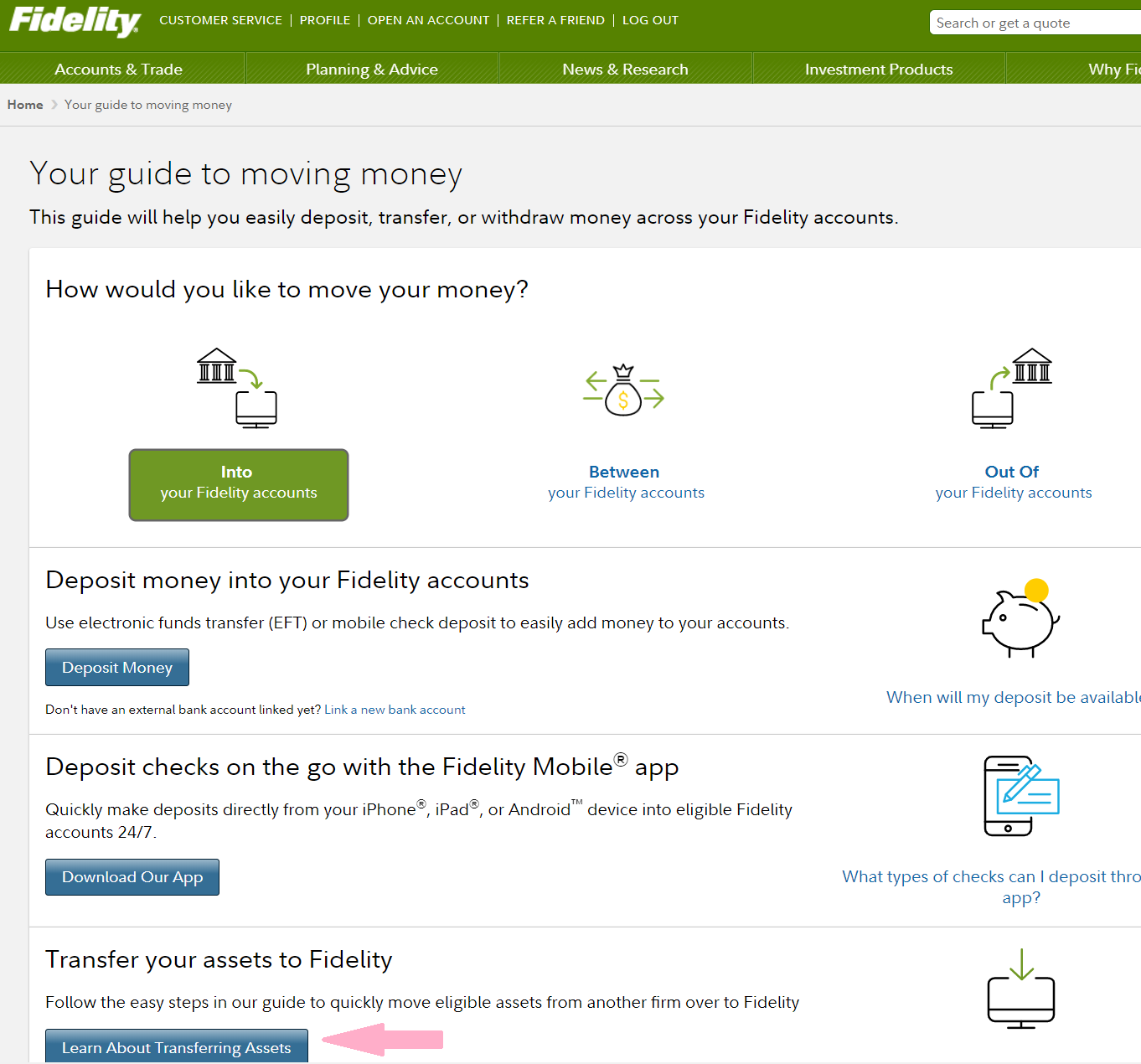

How To Rollover A 401 To A Bank Ira

A 401 is an employer-sponsored retirement savings account. When employment ends, 401 account owners can rollover 401 assets into a self-directed Individual Retirement Account. While there are many investment options approved by the Internal Revenue Service for IRAs, conservative investors who want to protect assets can open a bank IRA. The investment options include a bank savings, time certificate or money market account. Bank IRAs are insured by the Federal Deposit Insurance Corporation for up to $250,000 in total IRA bank assets per IRA owner.

Shop around at local banks for an institution offering the highest interest rates for the type of account you want your IRA to have.

Open a rollover IRA at the bank you choose to do business with. Make sure the bank titles the account the same way that the 401 is titled to ensure faster processing.

Fill out the rollover form using the bank rollover IRA account information. Check the box for a “direct rollover” and write down the name of the bank, the address and the account information where the 401 funds should be sent.

Submit the rollover form to the 401 administrator.

Tell the bank to expect the money within three to six weeks. A direct rollover moves assets from the 401 administrator directly to the new IRA custodian. This prevents federal tax withholding that is automatically taken from indirect rollover checks sent to 401 account owners.

References

Read Also: Can You Pull From 401k To Buy A House

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

You May Like: How Do I Add Money To My 401k

K Account Money Transfer

I have my own LLC taxed as an S Corp, so I am the employee and I use Quickbooks Payroll.I’m not sure if I have correctly set it up to take out the Roth contribution that I decided upon. I created a sub-account of my liabilities account for this. When I ran the payroll, it correct deducted the amount and put it in that Roth sub-account of liabilities. However, this 401k withholding is not in the liabilities section in the Payroll center.I also wish to track the 401k accounts in Quickbooks. I therefore created a bank account for the Roth and Traditional bank accounts that I have opened.Today I transferred the liability amount that was withheld from my paycheck in Payroll and sent it to the 401k bank account. I did this on my bank account website, not through Quickbooks.THE PROBLEM:

When I go to enter this transfer in Quickbooks, for some reason it is entering both as decrease or increase. I cannot figure out how to fix this. I tried just doing a transfer from the liabilities account to the 401k bank account. It correctly decreased the liabilities account, but it also decreased the bank account, instead of increasing it! What am I doing wrong? How do I make it decrease my liabilities sub-account and increase the bank account balance?

You May Like: What Is An Ira Vs 401k

How To Avoid Owing The 10% Early Withdrawal Penalty

You can avoid paying the 10% early withdrawal penalty by taking advantage of Internal Revenue Code 72. Thats shorthand for a provision in the tax code that allows you to take early distributions from your retirement plan or IRA and avoid the 10% penalty.

You can avoid that penalty as long as the distributions are made as part of a series of substantially equal periodic payments .

Once you start taking these distributions, you have to keep it going for the longer of five years or until you reach age 59-1/2.

There are three different methods you may use to determine what your withdrawals would be. Rather than spell that out here, heres a link to FAQs regarding the 72 on the IRS website.