What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax year 2021 and $20,500 or 100% of compensation for tax year 2022. If you are over 50, an additional $6,500 catch-up contribution is allowed bringing the total contribution up to $26,000 for 2021 and $27,000 for 2022. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $58,000 for tax year 2021 and the maximum 2022 solo 401k contribution is $61,000. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

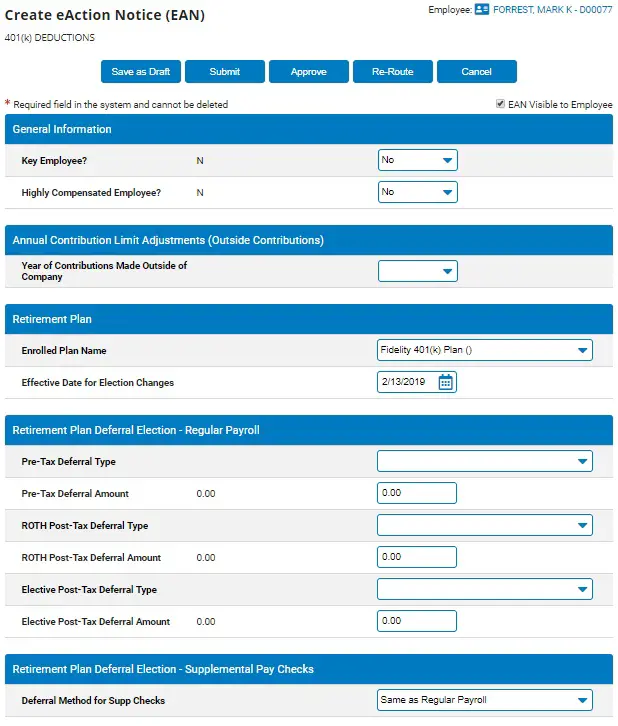

Dont Miss: How Do I Change My 401k Contribution Fidelity

How Do Employers Choose The Best Mutual Funds To Offer Employees

Managing investments is sometimes beyond the expertise of employers. Thats why many of them outsource the process of selecting, diversifying and monitoring plan investments to an investment advisor. Professional assistance helps ensure that the investment options are in the best interest of the plan and its participants.

This article is intended to be used as a starting point in analyzing 401k and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. ADP, Inc. and its affiliates do not offer investment, tax or legal advice to individuals. Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

ADPRS-20220422-3172

Recommended Reading: Can You Withdraw Your 401k When You Leave A Company

How To Set Up A Safe Harbor 401 Plan

A popular retirement solution for small business owners

- Maximize your retirement plan contributions

- Incentivize your team to save for their future

- Sail through required IRS compliance testing

- Receive up to $16,500 in tax credits over three years when you open a 401 with auto-enrollment

Establish your Safe Harbor Plan with Ubiquity.Call or schedule a time to meet with a retirement expert.

Looking to reward your employees with higher retirement contributions and allow higher contributions for owners, while legally bypassing potentially expensive annual nondiscrimination testing?

The Safe Harbor 401 Plan is easier and less expensive to administer than a traditional 401, but you will need to talk with your retirement plan provider to set it up.

Take a lesson in Safe Harbor 101:

Read Also: What Age Can I Withdraw From 401k

What Is 401k Matching

The 401 Matching is not compulsory for employers and may be done later in the program. But an additional contribution will be a great way for employees to see how the company invests in its people. In fact, 51% of companies offering 401K provide matching for their employees.

Employers can offer to match dollar for dollar or 50 cents to a dollar, depending on the limit they set for their employeesâ plans. For example, if an employee makes $50,000 a year and has allotted 6% of it for their 401, you can match their contribution for every dollar at $3,000 per year. In the same way, if you agreed to match 50 cents to a dollar, your matched amount will be $1,500 per year.

However, the amount that the employees will own upon the termination of their 401k will depend on the vesting schedule that the employers have set. The vesting period may be graded or cliff:

Graded vesting period: Entitles the employee to receive a gradual percentage of the matched amount depending on the years of service with the company,

Cliffed vesting period: Entitles the employee to receive the full amount after serving the required years of service with the company.

Also Check: Can You Use 401k To Pay Taxes

Do You Have To Offer A 401

The short answer is, Not quite. Currently, a handful of states require all but their smallest private-sector and nonprofit businesses to offer employees a retirement savings plan, or enroll eligible workers in a state-sponsored Roth individual retirement account plan. However, these states do not require traditional 401 plansat least not yet. Read more about state-mandated retirement programs and how they compare to a 401.

K Plan: A General Definition

The 401k plan is an employer-sponsored retirement savings plan where employees give a portion of their salary into an investment account. Contributions made to the plan will be placed in each of the employee’s 401 accounts and will be invested and diversified in the stocks, bonds, or mutual funds that they have chosen. The investment choices will be set by the plan sponsor or the employer.

The maximum contribution that an employee can give in a year for this plan is $ 20,500.

These savings will be protected by the Employee Retirement Income Security Act of 1974. Additionally, it is considered a qualified retirement plan and is subject to tax benefits under the Internal Revenue Service .

Don’t Miss: How Much Can I Borrow From 401k

What’s So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Don’t Miss: Which 401k Investment Option Is Best

How To Deduct Over $100000+ Per Year In A Retirement Plan

| Play in new window | Recorded on September 27, 2022

In this episode of Anderson Business Advisors, Toby Mathis speaks with Jeff Mason and Chris Hammond about cash balance pension plans for business owners. This is not a 401, its not an IRA, its a way to defer and even reduce a portion of the taxes you might need to pay and set yourself up with an annual income when you retire if you are a business owner.

This is for all business entities. True pass-throughs, S Corps, sole proprietorships, and partnerships work best in this savings scenario. Many people that have even heard of defined benefit plans, or cash balance plans, might think you cant start contributing until later in life, and that used to be true, but now people like Chris and Jeff are designing plans for people in their 30s.

Jeff and Chris will go over what the benefits, timelines, and rules are regarding these plans, give you some sample scenarios with actual clients they have helped, and also answer some specific questions that Toby has about their validity, value and future potential for participants.

What Is The Role Of The Employer In Administering 401k Plans

Under ERISA, plan fiduciaries, including the employer and any third parties who manage the plan and its assets, must act solely in the interest of the plan beneficiaries. Some of their responsibilities include:

- Managing the plan with the exclusive purpose of providing the plans retirement benefits to participants

- Ensuring that the investment menu offers a broad range of diversified investment alternatives

- Choosing and monitoring plan investment alternatives prudently

- Ensuring that the costs of plan administration and investment management are reasonable

- Filing reports, such as Form 5500 Annual Return/Report, with the federal government

These tasks should be taken seriously since fiduciaries can be held personally liable for plan losses or profits from improper use of plan assets that result from their actions.

Recommended Reading: How To Do Your Own 401k

Myth : 401s Are Too Expensive For Small Businesses

While no longer true, in the past, traditional 401 providers designed and priced their plans for large businesses with a high number of employees. Fees to administer plans, manage assets, and other charges made offering a 401 too expensive for small businesses. Modern 401 providers use technology to offload many of these upfront charges that make traditional plans so expensive.

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Don’t Miss: Can I Cash Out My 401k From Previous Employer

% Of Small Businesses Add Safe Harbor Contributions

Safe harbor 401 plans are very popular with small businesses. Unlike a traditional 401 plan, they automatically pass the ADP/ACP and top heavy nondiscrimination tests when mandatory contribution and participant disclosure requirements are met. This benefit is well worth the cost for many business owners, who often bear the brunt of the consequences when nondiscrimination tests fail.

Arrange A Trust For The Plans Assets

One requirement for starting a 401 plan on your own is that you set up a trust to hold assets . This guarantees that only the participants and their beneficiaries can use the funds.

When arranging the trust, you need to select a trustee. Deciding on a trustee is an important part of establishing a plan, as they must handle contributions, plan investments, and distributions.

You May Like: How Long Does It Take To Rollover 401k To Ira

Solo 401 Contribution Limits For 2022

| Category | |

|---|---|

| Up to 25% of compensation as defined by the plan | |

| Total Contributions | $61,000 |

* A business owner employed by a second company and participating in its 401 plan should note limits on elective deferrals are by person, not by plan. Consider the limit for all elective deferrals you make during a year.

An alternative to the Solo 401 is the simplified employee pension individual retirement account . While both plans allow you to contribute a maximum of $61,000 each year, the SEP-IRA only allows you to contribute up to 25% of your income or $61,000, whichever is less.

Also, if you have a SEP-IRA and hire additional full-time staff, youre required to make contributions for those employees whenever you make contributions for yourself. It can be rolled over to a new 401 plan, whether it be solo or traditional, should you unexpectedly need to hire staff.

Who Is Eligible For Solo 401 Plans

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the Internal Revenue Service -established maximums.

Don’t Miss: Can You Use 401k For Down Payment

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Learn How To Pass Nondiscrimination Testing

Each year, the IRS requires plans to undergo nondiscrimination testing. These are tests designed to ensure that your plan isnt favoring business owners or highly-compensated employees . These tests can place big limits on how much your owners or HCEs can contribute, so youll want to take proactive steps and partner with providers who can help you pass your testing. Learn more about this in our guide on nondiscrimination testing!

Recommended Reading: How To See How Much 401k You Have

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits. Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.