Video Result For How To Start A Ira Account

Vanguard IRA Account Setup Step by Step Tutorial

How To Open A Roth IRA

When Should You Open An IRA? (Individual Retirement

How To Invest Roth IRA For Beginners 2020 (Tax Free

How to open up a Vanguard Roth IRA account in 5 Mins –

How to open a ROTH IRA account | For Beginners

How to Open a Fidelity Roth IRA Bank Account in 10

Individual Retirement Accounts IRA | PNC

Copy the link and share

to a to a a to to

Establishing A SIMPLE IRA Plan | Internal Revenue Service

Copy the link and share

Read Also: Is Leasing Solar Panels A Good Idea

About Individual 401 Plans

An Individual 401 Plan allows a self-employed individual , to make highest possible retirement contributions.

Please review the Individual 401 Profit Sharing Plan Basic Plan Document before completing the Adoption Agreement and Employer-Sponsored Retirement Plan Information and Services Agreement.

Keep the original Adoption Agreement and send a copy to T. Rowe Price. Original Adoption Agreements submitted will not be retained. We will only retain an electronic copy.

This form allows you to transfer money from another Individual 401 plan to your T. Rowe Price Individual 401 Plan.

This form allows you to roll over assets from a former employers 401 or other eligible retirement plan.

A unique Operator ID will be mailed to you once your application has been processed. It should arrive within 7 to 10 days.

Once youve received your Operator ID and temporary password, you can access Plan Sponsor Web, which allows you to administer your plan online.

Once youve established your Plan Sponsor Web site, you can begin contributing.

Also Check: Where Are Most Solar Panels Manufactured

Opening An Account : Selecting Funds

To open a solo 401 with Vanguard you have to download and print the Individual 401 kit for employersfrom their small business website. The kit is pretty straightforward, although there are a few sections I want to highlight.

In section 3 of the New Account Form you have the option of opening either a traditional, pre-tax account, a Roth, post-tax account, or both.

If you open a pre-tax account, you have to select at least one fund to receive your contributions:

Likewise if you open a Roth account, you have to select at least one fund:

Theres a $20 annual fee charged per fund held in each account, so if you open both accounts youll have to pay $20 per fund each year, even if you hold the same fund in both accounts. The $20 fee is waived if you have $50,000 in assets across all your Vanguard accounts .

Note that Solo 401s do not have access to Vanguards lower-cost Admiral shares. That matters for two reasons: first, youll pay slightly more for funds that you currently own as Admiral shares. Thats bad. But it also matters because when people compare the fees on Vanguards all-in-one funds to a do it yourself portfolio of Vanguard funds, they are usually comparing the all-in-one fund costs to the cost of Admiral shares. But if you dont have access to Admiral shares, thats not the right comparison.

Also Check: How To Transfer 401k To Vanguard

Choose The Right Provider

With your provider, its important to ask questions. Two common questions people ask are how to make contributions with the Solo 401, and how to use the Solo 401 loan.

However, tailor your questions to your specific needs. At IRA Financial Group, you can call at 401 specialist for a free consultation. With the 401 specialist, you can answer any questions you may have regarding the Solo 401 retirement plan.

You have a few options when choosing a provider to set up a Solo 401k plan. Here are the three options you have to easily set up a Solo 401.

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

Also Check: How To Find Out If You Have Unclaimed 401k Money

Also Check: How To Transfer 401k To Fidelity

Third Party Solo 401k Providers

If you need or want a solo 401k that is a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

How is this possible? Your plan provider simply creates your plan documents that govern your 401k plan. You can then take those documents to your favorite broker , and you open a non-prototype account. These are equity-holding accounts that simply manage your equity investments. What they don’t do is any of the paperwork associated with your plan. Did you withdraw from your plan? You’re responsible for creating the 1099-R.

Some of the most popular online providers include:

Best For Account Features: E*trade

E*TRADE gives you more flexibility with its solo 401 offering. E*TRADE supports both traditional individual 401 plans and Roth 401 plans. You are also able to take out a loan on your 401 balance at E*TRADE, all of which makes E*TRADE best in our review for account features.

-

Choose between traditional or Roth 401 contributions

-

Support for 401 loans

-

No recurring account fees, and commission-free stock and ETF trades

-

Now run by Morgan Stanley, meaning changes are likely

-

High fee for broker-assisted trades and some mutual fund trades

E*TRADE has a long history of supporting online investors, with its first online trade placed in 1983. It is now a subsidiary of Morgan Stanley after an acquisition that closed in October 2020. At E*TRADE, you can choose between traditional and Roth individual 401 plans, which allows you to choose between pre-tax and post-tax contributions. You can also take a 401 loan from an individual 401 account at E*TRADE.

There are no listed fees to open or keep a solo 401 account at E*TRADE. Stock and ETF trades are commission free. The brokerage also supports over 4,400+ mutual funds on its no-load, no-transaction-fee list. E*TRADE supports options, futures, and fixed-income bonds and CDs, as well.

Read our full E*TRADE review.

You May Like: Can You Contribute To 401k And Ira

The Unique Challenges Of Setting Up And Managing Solo 401 Plans

While solo 401 plans can offer higher contribution potential and increased flexibility to make Roth or after-tax contributions, the flip side is that they can also come with greater administrative complexity to implement and maintain than other types of retirement plans.

This is because, in the eyes of the IRS, solo 401 plans are the exact same type of entity as the standard 401 plans offered by larger employers. And although they are exempt from the nondiscrimination testing that plans with multiple participants are subjected to, solo 401 plans are still required to follow IRS rules regarding the establishment and administration of qualified retirement plans as summarized in IRS Publication 560. These requirements include:

- The adoption of a written plan document

- Filing Form 5500-EZ when plan assets exceed $250,000 and

- Meeting the required deadlines for establishing and contributing to the plan.

Its worth going into more detail on the above to better understand the requirements for solo 401 plan owners and what elements of the plan they must either manage themselves or outsource to a third party.

Nerd Note:

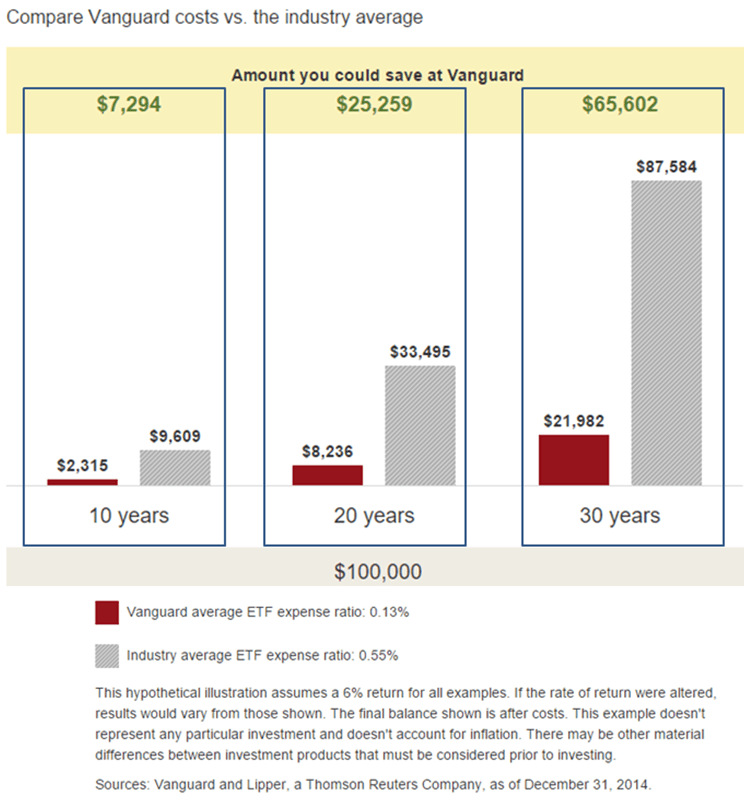

Solo 401 Accounts From Vanguard With Beneficial Illustrations And Calculations

April 18, 2017 by indyfinance

One of the great advantages of being self-employed is the ability to open and manage your own small business retirement account. Employed people have to either take or leave their employers 401 or 403 plan offerings, regardless of the quality or cost of the funds it offers, while the self-employed get to choose their own plan provider and pick exactly the assets they want to invest in. Naturally, many choose Vanguard, and since I recently opened a solo 401 with them, I thought it would be useful to share my experience.

You May Like: How Do I Put My 401k Into An Ira

What Is A Solo 401

A solo 401 is a tax-advantaged retirement account for self-employed business owners. A solo 401 is the same as a large company 401 but limited to just the business owner and his spouse. Like a 401 from an employer, you may be able to make either pre-tax or after-tax contributions and take out 401 account loans. Depending on the account provider you choose, your investment choices and costs may vary.

Open An Account With Your Provider

Now that youve chosen your provider and obtained all required documents and disclosures, its time to open the Solo 401. This account should be formed any time prior to your tax-filing deadline and needs to be formed in accordance with any guidelines in your plan documents.

While youre allowed to set up a Solo 401 account after the year ends and make prior-year contributions in a way thats similar to how you fund an IRA, its typically a best practice to set up a new account in the year that itll be effective and make your first contributions in the same year.

Recommended Reading: Should I Buy An Annuity With My 401k

What Is A Solo 401 And How Does It Work

A solo 401 is a retirement plan for the self-employed.

If youre a business owner, a solo 401 is a way for you to access the same retirement benefits that youd get as a corporate employee.

In this article, I’ll explain the myriad of solo 401 rules and compare solo 401s to SEP IRAs. I’ll also share with you the solo 401 contribution limits for 2021.

Open Schwab Investment Account: Rolling Over From A Schwab Ira

Open a Company retirement account . Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete the Schwab IRA distribution form In section 2, mark that youre completing a direct rollover to a qualified retirement plan:

In section 3, you should not need to have taxes withheld as this is a direct rollover from one qualified retirement plan to another:

In section 5, notate the funds will go to another Schwab account:

Fax your application and documents to Schwab at 888-526-7252, Attn: new accounts.

Note: It is not required you fund the account when establishing the Company retirement account. Additionally, you can submit your transfer documents rolling over funds while you establish the new Company retirement account.

The above steps will accomplish opening a new Company retirement account, withdrawing the funds from the Schwab IRA, transferring them to the new Company retirement account with Schwab and then accepting the rollover as your own plan administrator.

Recommended Reading: How To Find How Much Is In My 401k

Ongoing Considerations For Your Solo 401k

One of the great things about a solo 401k is that they are relatively easy to maintain, for the most part. Since you are technically the administrator of your own plan, you are personally required to submit required filings for the plan.

There are two ongoing paperwork requirements that you will need to stay on top of. First, if your plan has over $250,000 in assets on the last day of the plan year, you have to file a form 5500. This can be a bit complicated, but if you can fill out all of that paperwork above, you can likely handle it yourself.

You can submit the IRS Form 5500 for free, electronically here: EFAST2 Filing From The IRS.

If you don’t want to do it yourself, you’ll need your CPA to handle this for you, and they’ll likely charge a fee to do it. However, if you’re using a non-prototype plan, most of the plan providers will help you prepare the Form 5500 each year as part of your annual fee.

The second form you need to keep in mind is a 1099-R, but that form is only required if you take distributions from your 401k plan or if you roll it over, withdraw money of any kind, or change providers. This form is also relatively easy to fill out, but there is no free electronic filing for this form. You either have to pay a service to file it, or mail it in yourself.

Advantages Of A Solo 401

Here are some of the top benefits of a solo 401 plan:

- Access to a 401 retirement plan if you’re self-employed. You don’t have to be a W-2 employee at a large company to get access to a 401. If you’re self-employed, a solo 401 gives you another option.

- Can make employee and employer contributions. A SEP IRA, which is the biggest alternative to a solo 401 for the self-employed, allows only employer contributions.

- Much higher contribution limits than an IRA. If you contribute to an Individual Retirement Account, you’re allowed to put in a maximum of $6,000 per year . With a solo 401, you can set aside up to $58,000 per year in a tax-advantaged retirement account.

- Potential for a range of attractive features. Depending on the specifics of your solo 401 plan, you may be able to contribute to a Roth solo 401, access a huge range of investment options and take out a loan from your 401. Clark strongly advises against taking out a loan against your 401.

Read Also: How To Convert A 401k Into A Roth Ira

What To Look For In A Solo 401 Provider

When you’re looking for a solo 401 provider, there are a few things that you’ll want to look for to find the best fit for you:

- What types of contributions does it allow: Traditional, Roth, after-tax , or all of the above?

- Costs: Look at the costs to set up the plan and to maintain it and see what kind of transaction costs are there for the types of transactions you’re looking to do.

- Investment options: Are you limited to basic stocks and mutual funds? Or can you invest in alternative assets like real estate, art, startups, or cryptocurrency?

- Rollovers: If you’re planning a rollover, you’ll want to make sure your provider supports it.

Adding And Exchanging Funds

An important benefit of Vanguard retirement accounts is that its possible to contribute to funds without meeting the minimum initial investment requirement. In other words, you dont need to contribute $3,000 in order to purchase shares of a fund that otherwise has a $3,000 minimum investment.

However, this benefit is only extended to contributions processed through the small business investing portal. When you log into your personal investor account, youll see your 401 account there but wont be able to transact the funds in those accounts until you meet the minimum investment requirements.

If you want to add a new fund to your 401 but dont want to exchange shares in an existing fund, Vanguard can do this over the phone if you call 1-800-205-6189. The reasons for doing so might be to trigger the minimum investment waiver for future contributions to the account, or simply to diversify your existing funds.

Don’t Miss: How Do I Get My 401k Early

Vanguard Solo 401k Plan Document

Starting a Solo 401K at Vanguard is easy. If you are already a Vanguard client, you can set the account up online by logging into your account and choosing Individual 401K. If you dont have an account with Vanguard right now, you must call 1-800-992-1788 and a representative will walk you through the process.

Before you can apply for a Solo 401K, youll need an Employee Identification Number. You get this number directly from the IRS and it only takes a matter of minutes as they provide it to you instantly. Head to the IRS website and complete the required information to get your EIN.

Beyond the EIN, youll need to sign a few Vanguard documents, which they will send to you. Youll need to sign them and send back the originals, but make sure you keep a copy for yourself.

As a part of the process, youll also need to choose a plan administrator. Many business owners choose to handle it themselves, but if you dont want the responsibility, you can assign it to your spouse or your accountant .