How Much Should I Have In My 401

If youre enrolled in a 401 plan, here is what you need to know about this retirement savings vehicle.

If you ask any Morningstar specialist for advice, theyll tell you to save early and save often. No matter the stage of life and investing youre in, one thing is for certain: You need to save for retirement.

One popular way to do this is by enrolling in your companys 401 retirement plan. With this retirement savings vehicle, your contributions arent taxed and many companies offer an employee match.

Multiples Of Your Annual Income

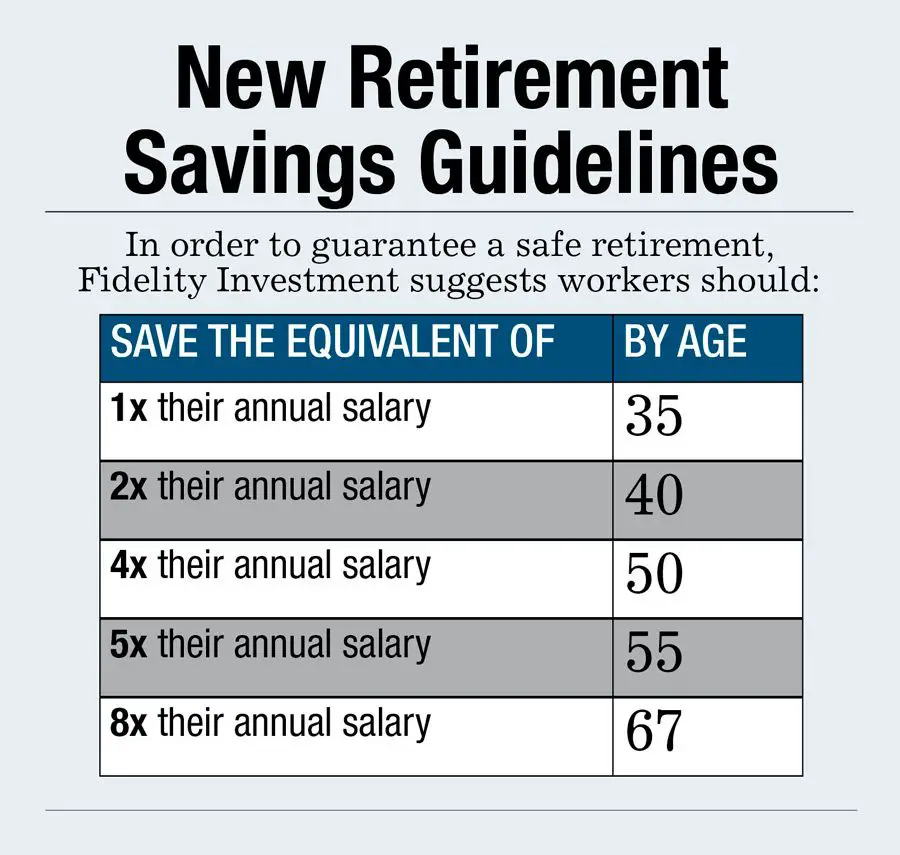

Fidelity recommends saving a certain percentage of your salary based on your age and income. It recommends this strategy because your age has a huge impact on the amount you need to save for retirement.

You start off at a smaller percentage when youre younger so by the time you reach retirement age, compound interest will have done its work, helping you achieve a comfortable retirement.

The brokerage suggests you start by saving at least 15% of your gross salary when youre 25 and investing heavily in more aggressive assets like stocks. By the time youre 30, you should have saved at least 50% of your salary. Of course, you could be more aggressive with your 401 savings goals.

Retirement Goals By Age

Heres a table that shows an estimate of how much of your annual income you should budget for retirement by age.

Make Savings A Priority

Keep your eye on your dreams. Do the best you can to get to at least 15%. Of course, it may not be possible to hit that target every year. You may have more pressing financial demandschildren, parents, a leaky roof, a lost job, or other needs. But try not to forget about your futuremake your retirement a priority too.

Also Check: How Do I Access My 401k Funds

Key Investing And Retirement Definitions

401: This is a plan for retirement savings that companies offer employees. A 401 plan gives employees a tax break on money they contribute. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employees choosing .

Compound interest: The interest you earn on both your original deposit and on the interest that original deposit earns. For example, a $1,000 investment earning 6% compounded annually could become roughly $4,300 in 25 years.

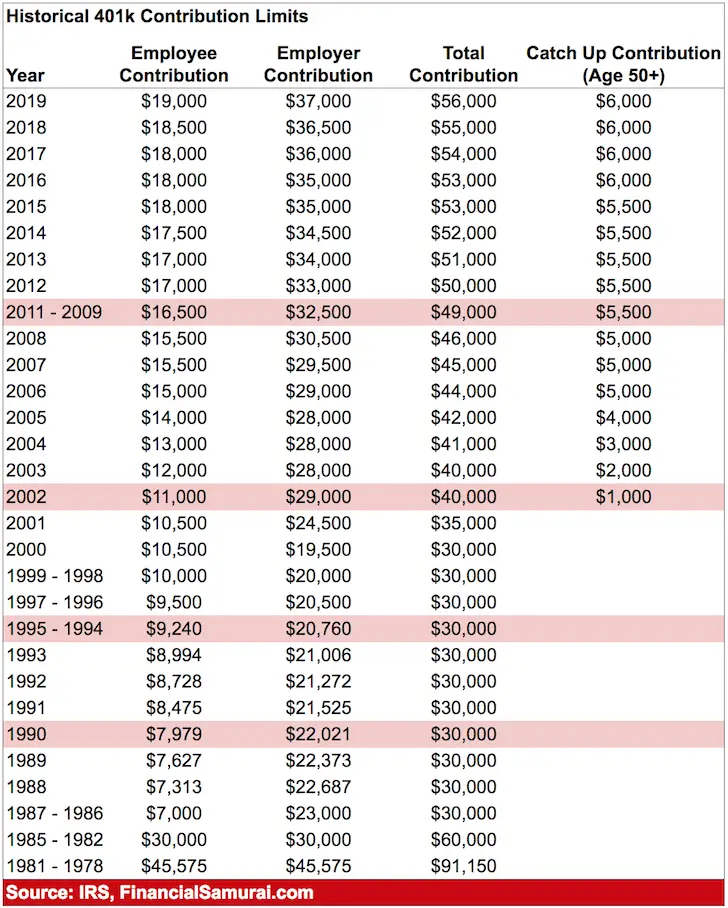

Contribution limits: The IRS puts limits on the amount of money that can be contributed to 401s and IRAs each year. These limits sometimes change from year to year.

Financial advisor: A financial advisor offers consumers help with managing money. Financial advisors can advise clients on making investments, saving for retirement, and monitoring spending, among other things. A financial advisor can be a professional, or a digital investment management service called a robo-advisor.

IRA: An individual retirement account is a tax-advantaged investment account individuals use for retirement savings.

Income: The money you get from working, investing, or providing goods or services.Inflation: This happens when the price of goods and services increases as time passes. The result is a decrease in purchasing power, or the value of money.

Nest egg: A sum of money you have set aside for the future in this case, retirement.

Returns: The money you earn or lose on an investment.

How Much To Retire At 55

Fidelity estimated that those saving for retirement should have a minimum of seven times their salary by age 55. That means that if your annual salary is currently $70,000, you will want to plan on saving at least $490,000 saved. This is, as you would imagine, a ballpark estimate, and with inflation, by the time you retire, your salary will have gone up. The bottom line is that you need to save as much as you can for your retirement. Aiming for seven times your salary by age 55 may be a smart strategy. But experts note that there is no-one-size-fits-all solution, and depending on your time horizon and how much your retirement will cost, you may need to save substantially more.

But you shouldnt only be thinking about how much money you need to retire at 55. Because you dont want to outlive your retirement funds, you also should think about the life you will probably be leading during your retirement years. Here are five factors to consider:

Recommended Reading: Should I Roll My 401k Into An Ira After Retirement

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Also Check: How To Get Into Your 401k

How To Save In Your 50s: Consider Moving

With home values up sharply in many regions, now could be a good time to consider making a move, said Shobin Uralil, COO and co-founder of Lively, an HSA provider. Not only might you walk away with a chunk of profit you can tuck away for retirement, your monthly housing costs. If youve got a large empty nest, making a move in your 50s could give you hundreds of dollars of monthly savings to use for other financial goals. If youre intent on staying put in your current home, make it a priority to be mortgage-free before you retire.

Age : Resist The Temptation

The most common mistake is that people let their spending increase commensurate with their new salary. For instance, people move into a bigger apartment or buy a more expensive car or home to reward themselves for receiving the raise, said Dr. Robert R. Johnson, a professor of finance in the Heider College of Business at Creighton University. What happens is they are unable to improve their financial condition because they spend everything they make. People are wise to effectively invest any money from a raise as if you didnt receive the raise. That is, continue to live the same lifestyle you led before receiving a raise and invest the difference.

An example will help illustrate how investing a raise can help build true long-term wealth. Suppose one receives a $5,000 annual raise early in ones career. If you simply invest that $5,000 annually into an investment account growing at a 10% annual rate, you will have accumulated over $822,000 in 30 years.

Read Also: How To Set Up Personal 401k

How Much Do You Need To Retire At 55

If youre thinking of retiring early, you may be wondering how much you need to retire at age 55. The exact amount of income you should have put away is going to depend on different factors. But if you want a general rule of thumb, financial experts say you should have saved a minimum of seven times your salary by age 55 for retirement. Heres what you need to know.

A financial advisor can help you create a financial plan for your retirement needs and goals.

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines:

Read Also: How To Invest In A 401k For Dummies

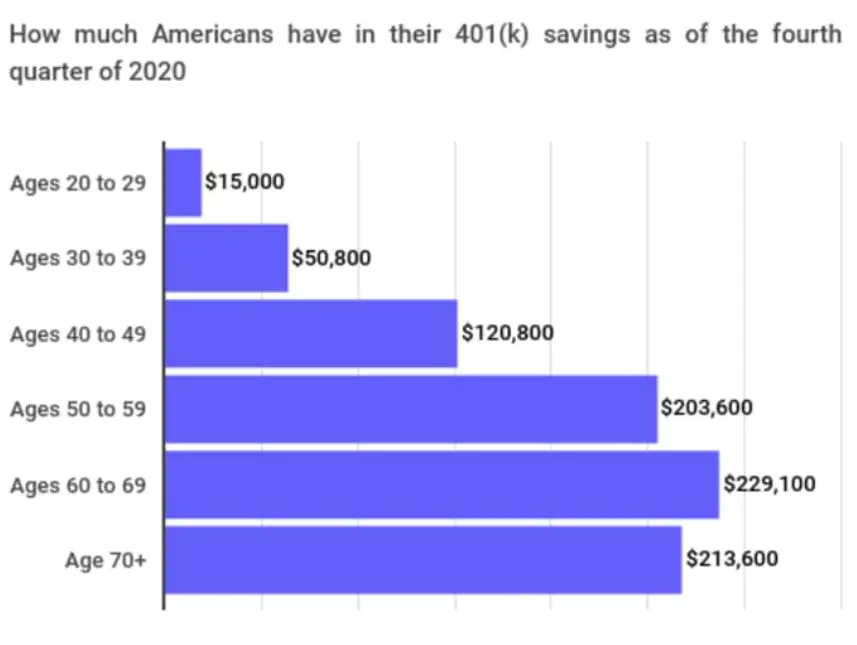

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

How Much You Should Save For Retirement In Your 40s

In your 40s, you should be nearing your peak earning years and striving to max out your contributions to your 401. This is when college also creeps up on parents with kids. If the choice is between saving for your retirement and saving for college, focus on the former. There are other ways to pay for college, including having your children pay a portion. There are no second chances to save for retirement.

Here are T. Rowe Prices guidelines for how much to have saved for retirement in your 40s if you earn $75,000 a year:

- 2 times your salary by age 40, or $150,000

- 3 times your salary by age 45, or $225,000

You May Like: How To Retire With A 401k Plan

Manage Debt Manage Spending

An excellent way to free up some cash is to stop making interest payments on debt. If you have existing debt, paying it off more quickly will reduce the amount that you spend on interest and fees. This will, in turn, give you more cash to dedicate toward your retirement account.

When it comes to long-term debt, like a mortgage, paying it off more aggressively can also reduce your potential expenses in retirement. You wont have to make those payments, which can reduce the amount of money youll need each month once youve stopped working.

At the same time, consider your overall lifestyle. If you think you may not have enough for your retirement, are there ways that you can shift your lifestyle over the long run that will reduce expenses? Is there someplace less expensive you could live, for example? This isnt as simple as skipping your morning latte. Instead, consider whether you can shift your monthly needs in a way that might significantly change your budget both today and in retirement.

Tips On Retirement Planning

- We can all use help with our finances, and never more so than when its time to save for retirement. Thats where a financial advisor can offer valuable guidance and insight.

Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Use SmartAssets 401 calculator to get a quick estimate of how much youll have in your 401 by the time you retire.

Recommended Reading: Can I Roll My 401k Directly Into A Roth Ira

Where To Invest If You Don’t Have A 401

Don’t worry if your employer doesn’t offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Calculate Your Retirement Earnings And More

A 401 can be one of your best tools for creating a secure retirement. It provides you with two important advantages. First, all contributions and earnings to your 401 are tax deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second, many employers provide matching contributions to your 401 account which can range from 0% to 100% of your contributions. The combined result is a retirement savings plan you can not afford to pass up.

Also Check: How Can I Get My 401k

How Much Should I Have In My 401 At 50

Most Americans have less in their retirement accounts than theyd like, and much less than the rules say they should have. So, obviously, if that describes you then youre not alone. Now, most financial advisors recommend that you have between five and six times your annual income in a 401 account or other retirement savings account by age 50. With continued growth over the rest of your working career, this amount should generally let you have enough in savings to retire comfortably by age 65.

Consider working with a financial advisor as you flesh out your retirement plan.

How Much Money Do You Need To Retire

A common guideline is that you should aim to replace 70% of your annual pre-retirement income. This is what the calculator uses as a default. You can replace your pre-retirement income using a combination of savings, investments, Social Security and any other income sources . The Social Security Administration website has a number of calculators to help you estimate your benefits.

It’s important to consider how your expenses will change in retirement. Some, like health care and travel, are likely to increase. But many recurring expenditures could go down: You no longer need to dedicate a portion of your income to saving for retirement. You may have paid off your mortgage and other loans. And your taxes are likely to be lower payroll taxes, which are taken out of each paycheck, will be eliminated completely.

Be sure to adjust based on your retirement plans. If you know you wont have a mortgage, for instance, maybe you plan to replace only 60%. If you want to travel every year, you might aim to replace 100% or even 110% of pre-retirement income.

Read Also: What Is A 401a Vs 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

How Much Savings Will You Need To Retire

Now let’s determine how much savings you’ll need to retire. After you’ve figured out how much income you’ll need to generate from your savings, the next step is to calculate how large your retirement nest egg needs to be for you to produce this much income in perpetuity.

A retirement calculator is one option, or you can use the “4% rule.” The 4% rule says that in your first year of retirement, you can withdraw 4% of your retirement savings.

So, if you have $1 million saved, you would take $40,000 out during your first year of retirement either in a lump sum or as a series of payments. In subsequent years of retirement, you would adjust this amount upward to keep up with cost-of-living increases.

The idea is that, if you follow this rule, you shouldn’t have to worry about running out of money in retirement. Specifically, the 4% rule is designed to make sure your money has a high probability of lasting for a minimum of 30 years.

To calculate a retirement savings target based on the 4% rule, you use the following formula:

We saw in the previous section that our couple would need $4,000 per month from their savings. So, in this case, they should aim for $1.2 million in retirement savings accounts, such as a 401 plan or individual retirement account , to provide $48,000 per year in sustainable retirement income.

Don’t Miss: What Is A Plan Administrator For 401k