How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If you’re like most, you’ve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if you’ve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, it’s vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employer’s human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrator’s contact information and what they do with former employees’ 401s.

How Service Providers Get Paid From Plan Assets

Most people dont know how 401 plan service providers get paid, and they may even assume their plan is free. Even with increased fee disclosure, its not always clear where the money comes from and where it goes. How does it happen? This page will give you a basic understanding of how 401 plan assets turn into revenue for service providers, and why its important to watch asset based fees over time.

Read Also: How Does A 401k Benefit The Employer

% Off Schwab Rollover Ira Promotion Verified

Is Charles Schwab better than TD Ameritrade? After testing 11 of the best online brokers over three months, TD Ameritrade is better than Charles Schwab . TD Ameritrade delivers $0 trades, fantastic trading platforms, excellent market research, industry-leading education for beginners, and reliable customer service

Read Also: How Can I Borrow Money From My 401k

How Many People Have 401k Money

How many Americans have 401 s? In 2020 there were approximately 600,000 401 plans with approximately 60 million active subscribers and million former employees and retirees.

How much does the average person have in their 401k?

The average 401 balance is $ 106,478, according to Vanguards 2020 analysis of over 5 million plans. But most people havent saved that much for retirement. The median balance of 401 is $ 25,775, a better indicator of what Americans have been saving for retirement.

How many people have $1000000 in their 401k?

The number of 401 accounts with $ 1 million or more with Fidelity Investments rose 84% year over year to 412,000, while the number of seven-digit IRAs in the 12 months ended the second quarter, Fidelity said .

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Recommended Reading: How To Find Out If I Have Money In 401k

Tracking Down A Lost 401

It’s easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps that’s why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 If left unattended for too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If you’re among those with misplaced savings, here’s how to locate and retrieve them:

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you arent sure if you had a 401 with a previous employer, there are several ways to find out.

Also Check: How To Change A 401k To A Roth Ira

Recommended Reading: How To Transfer 401k From Old Job To New Job

How To Check Your 401 Balance

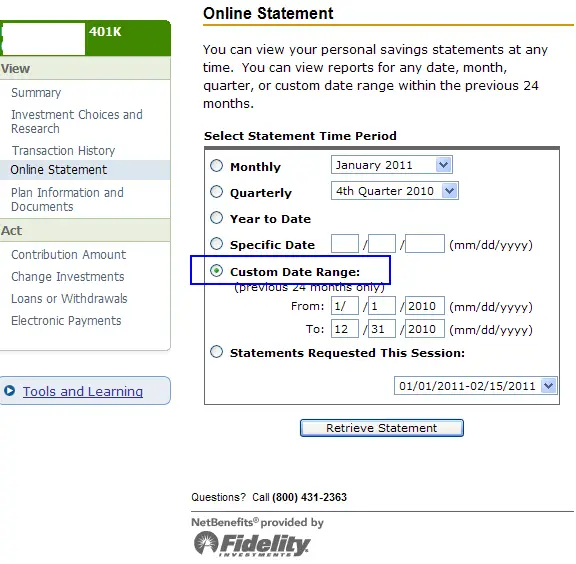

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Free Report, T. Rowe Price – Get Free Report, Vanguard, Charles Schwab – Get Free Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

Contact Your Old Employer

When you cant locate an old 401, your prior employer is the first entity you should contact. Reach out to human resources and they should be able to point you in the right direction.

Be prepared to provide the dates you worked for them, your full name and your Social Security number.

Note that if there was more than $5,000 in your 401, your funds are likely to still be in your old workplaces account. If your balance was $1,000 or less, however, its possible that your employer sent a check for the total amount to your last known address.

You May Like: When I Withdraw From My 401k

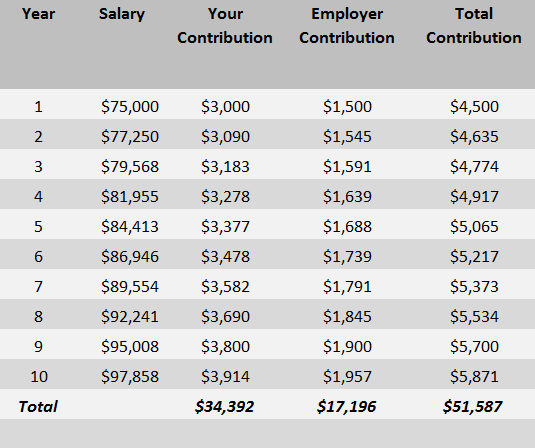

Is There A Company Match And If So What Are The Rules

Many employers offer incentives for employees to contribute to their 401 plans by matching contributions up to a certain point. For instance, some companies may match every dollar you contribute with 50 cents of their own, up to a certain percentage of your salary. Thats a nice benefit you dont want to miss out on. But individual plans vary widely, and there may be restrictions on qualifying for the company match or vesting schedules for the match. Ask your plan administrator for the rules that apply to your companys plan.

Recommended Reading: How Much Can I Put In A Solo 401k

Consult With A Financial Advisor

Before making any decisions about your 401k, its important to consult with a qualified financial advisor. A financial advisor can help you understand your options and make sure you are making wise decisions. The advisor can also help you understand the fees associated with different types of 401k plans and the tax implications of cashing out.

When consulting with a financial advisor, be sure to ask questions such as: What are my options for accessing my 401k funds? What are the potential risks associated with cashing out my 401k? What other strategies could I use to access the funds I need?

Read Also: Can I Sign Up For 401k Anytime

Checking Your 401k Balance

Now you are currently working with an employer, having been withdrawing money from your retirement plan under the financial hardships category, yet you want to know how much money left in your plan. To check your 401K balance, is one way of knowing how much you indeed have in your plan. However, with the dramatic change of the current economy who knows how much you do have in your retirement plan.

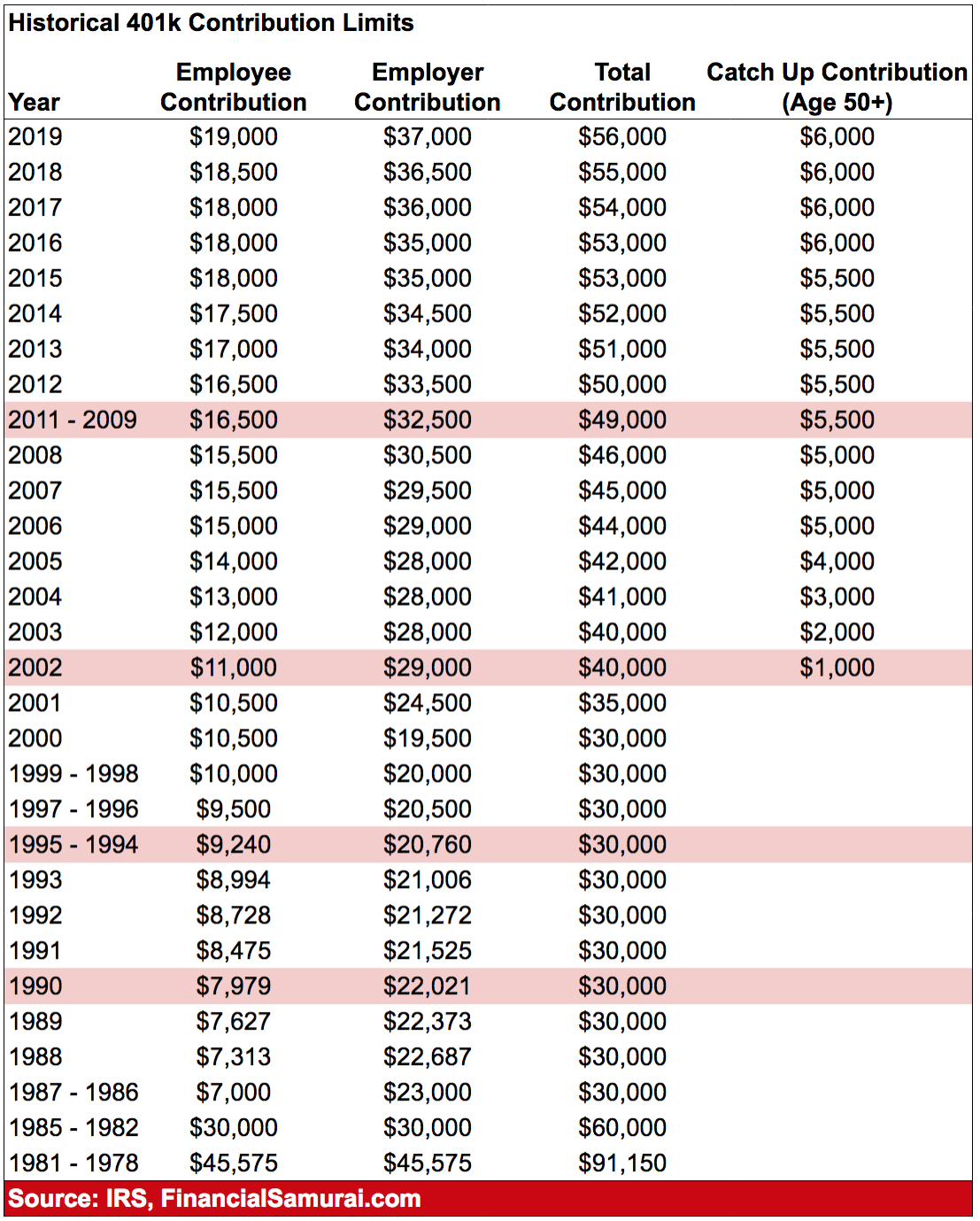

First, let us define what is 401K before deciding to check your check 401K balance. 401K is a retirement plan which is sponsored by your employer, the employee can also set aside a portion of his or her salary and be contributed to the retirement plan. However, the federal government has limited the contribution, it had laid down the maximum amount one should contribute. Upon retirement, the employee can get his money and the amount will now depend the growth of the plan. Therefore, the employee should be keen enough to choose which investments his or her plan should invest into. When the employee, starts taking the money then, such withdrawals are now taxed. If money is being withdrawn before reaching the age of 59 and a-half, then there is such a thing for early withdrawal penalty.

- Mon Fri: 10 am 8 pm

Search Your State’s Unclaimed Property

Still no luck finding your old 401? Visit the website of the National Association of Unclaimed Property Administrators. There, you can search by state. Once you click on your state on the site’s interactive map, you’ll be directed to the state agency that handles unclaimed property.

And if you’ve lived in several states, you can conduct a multistate search for an old 401 at MissingMoney.com, which is endorsed by the National Association of Unclaimed Property Administrators.

Once you find your old 401, you can start the process of filing a claim for the account.

Recommended Reading: What’s A Good Rate Of Return On A 401k

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so its important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts youre considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Other Forgotten Funds And Where To Find Them

Retirement funds arent the only assets that may be lost or forgotten. Others include insurance accounts or annuities unpaid wages pensions from former employers FHA-insurance refunds tax refunds savings bonds accounts from bank or credit union failures. In addition, heirs may easily overlook one or more accounts, if the estate plan failed to list all of them.

The National Association of Unclaimed Property Administrators reports that about 1 in 10 Americans have unclaimed property, and more than $3 billion is returned to owners each year.

Brokerage firms and other financial institutions must report unclaimed or abandoned accounts once they have made a diligent effort to locate the owner. Should they be unsuccessful, they must report it to the state agency that handles such matters. The agency then claims it through a process known as escheatment so that the owners can find it.

Websites you can use to find lost funds include your states unclaimed property site NAUPAs missingmoney.com the U.S. Department of Labor database for back wages or the Pension Benefit Guaranty Corp to claim your pension funds. To find accounts at failed banks, try the Federal Deposit Insurance Corp. For credit unions, go to the National Credit Union Administration.

A final note: Claiming your assets is free. Beware of anyone who wants to charge you for doing so.

Alsoof Interest

Read Also: How Much Should You Put In 401k

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

What Happens To My 401 When I Leave Does It Follow Me

When you quit your job, you wont be able to contribute to that particular 401 anymore, because its tied to your employer. But the money already in the account is still yours, usually, so it can just sit in that account for as long as you want with a couple of exceptions:

-

First, if you contributed less than $5,000 to that 401 while you were with that employer, they can legally tell you, Closing time! Your money doesnt have to go home, but it cant stay here.

-

If you contributed between $1,000 and $5,000, your employer might move your money into an IRA, a move otherwise known as an involuntary cashout.

-

If you contributed less than $1,000, they might just mail you a check for that amount. If that happens, you should deposit it into another retirement account ASAP so that you dont get hit with a penalty from the IRS .

Also relevant: If you had 401 matching, be sure to check whether there was a vesting schedule attached. If so, you only get to keep the employer contributions that had fully vested as of your last day. Your employer gets to take back any unvested contributions. If there was no vesting schedule in other words, if 100% of employer contributions vested immediately then its all yours.

Recommended Reading: Who Does Amazon Use For 401k

How Long Does It Take To Get A 401 Sent To You

The amount of time it takes your 401 custodian to send your funds to you depends on a number of factors including, the manner in which the funds are disbursed and the timing of your request to receive the money. 401 withdrawals are subject to taxation, and depending on your age, you may also have to pay an early withdrawal penalty.

Tips

-

When you decide to cash in your 401 account, a portion will be automatically withheld to ensure that all taxes are accounted for. The remainder of the funds will likely arrive within two weeks.

Also Check: Should I Roll My 401k Into An Ira

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Recommended Reading: What Is The Maximum 401k Contribution For Self Employed

What Is A 401 Again

Lets refresh: A 401 is a specific type of investing account that lets you put money away for retirement with some sweet tax benefits. There are two main 401 types: traditional and Roth.

If you have a typical 401, its because your employer offered it as a benefit. Any contributions you make to your 401 come directly out of your paycheck. employer match meaning your employer contributes money to your 401, too.)

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

Don’t Miss: How Do You Cash In Your 401k