How To Roll Over An Empower 401

If you have a 401 at Empower Retirement from a previous job, there are a few options for you to consider when doing a rollover. Depending on your plan, the process for Empower can be done over the phone or by filling out a form, and a check will either be mailed to your new account provider or sent directly to you to deposit into the new account.

You May Like: How To Grow 401k Fast

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Cashing Out: The Last Resort

Avoid this option except in true emergencies. First, you will be taxed on the money. In addition, if youre no longer going to be working, you need to be 55 to avoid paying an additional 10% penalty. If youre still working, you must wait to access the money without penalty until age 59½.

Most advisors say that if you must use the money, withdraw only what you need until you can find another income stream. Move the rest to an IRA or similar tax-advantaged retirement plan.

You May Like: How Much Tax To Rollover 401k To Roth Ira

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

Recommended Reading: What Is A 401k For Self Employed

Is A Rollover Or Transfer Right For You

Speak with one of our trusted Financial Consultants.

MondayFriday, 8 a.m.8 p.m. ET

*Consider all available options, which include remaining with your current retirement plan, rolling over into a new employer’s plan or IRA, or cashing out the account value. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses, availability of services, and distribution rules . Depending on your plan’s investment options, in some cases, the investment management fees associated with your plan’s investment options may be lower than similar investment options offered outside the plan.

Are There Exceptions To The 10% Early Withdrawal Penalty

If youre under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Read Also: Should I Open A 401k

Recommended Reading: How To Get Old 401k Money

Rolling Over Into An Ira

Well handle the entire process for you online, for free!

- Well help you choose an IRA provider if you dont already have one

- Customer support available if you have questions along the way

- We get paid by the IRA provider if you open an account so our service comes at no cost to you!

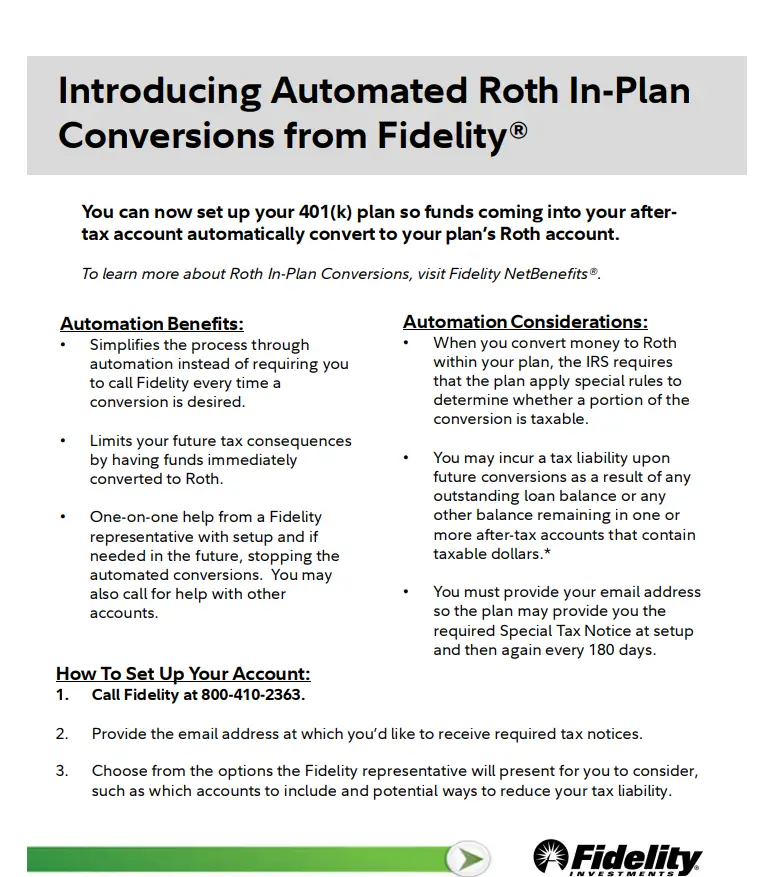

If you have a 401 at Fidelity from a previous job, there are a few options for you to consider when doing a rollover. The process for Fidelity requires a form to sign, a phone call to authorize, and a check to be mailed for you to deposit into the new account.

Weve laid out a step-by-step guide to help you roll over your old Fidelity 401 in five key steps:

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Dont Miss: When Can You Take Out 401k

Don’t Miss: Is It Worth Rolling Over A 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

You May Like: How Do I Take Money Out Of My Voya 401k

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

Read Also: How Do I Get My 401k Money From Walmart

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

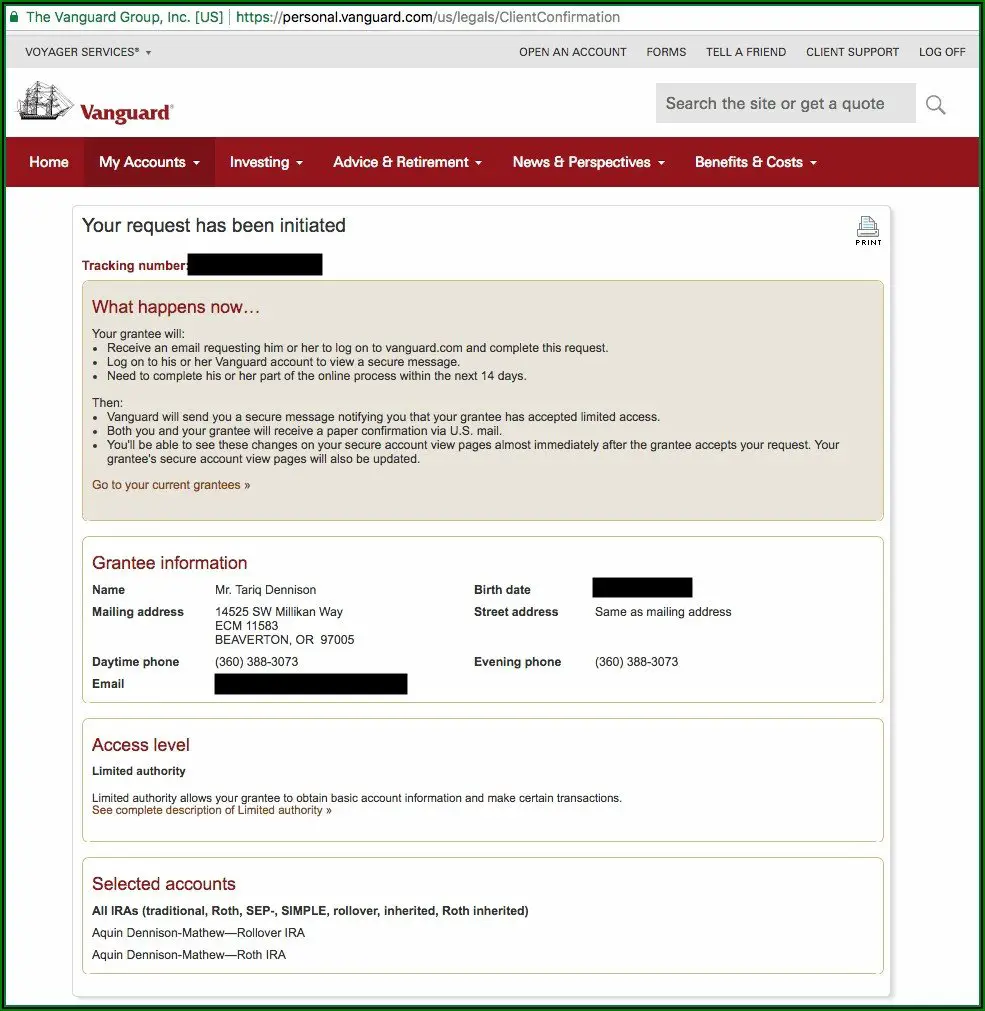

The Process Was Dead Simple

This part really surprised me. As I thought about how to start the process, I decided to call Vanguard to see what information about my Rollover IRA I would need to give Fidelity. I already had the IRA account from a rollover six years ago, but had long forgotten the actual steps needed to get the process moving.

My call was routed to a department that does nothing but handle rollovers. The rep walked me through the process and then offered to call Fidelity with me. So he dialed up Fidelity and did all the talking. I guess Vanguard really wanted my money!

We did hit one snag. According to the Fidelity representative, my old employer still had my status as an active employee. So I had to call my employer to get my status changed. That took a few days, and then the three of us got back on the phone to complete the rollover. It took all of five minutes.

You can check out an even more detailed description of the 401k rollover process here.

You May Like: How Does 401k Work For Employer

Confirm A Few Key Details About Your Fidelity 401

First, get together any information you have on your Fidelity 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

STEP 2

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Also Check: When To Start A 401k Plan

How Do I Choose An Ira Provider

Many financial institutions offer IRAs, including brokerage firms, banks, and newer fintech companies. In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want is a self-directed IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

The key features to compare when choosing among self-directed IRAs include:

- What do you want to invest in? The exact investment options among IRA providers varies. Most of them allow you to invest in stocks, ETFs and options. Other specialized IRA providers will let you invest in private assets and cryptocurrency.

- Access to research and data. Some brokers provide access to premium research and data. If youre a more hands-on investor, this might be important to you.

- Ease of use while user interfaces are getting better across the board, newer fintech providers tend to be more popular with those who really value an intuitive app experience.

The key features to compare when choosing an automated account include:

Get matched with an IRA provider based on your preferences! If you choose to do an 401-to-IRA rollover, well match you with a provider based on your preferences as part of our rollover process.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Read Also: Can I Transfer My 401k To Another Job

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companyâs robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

Donât Miss: What Happens When You Roll Over 401k To Ira

Read Also: Can You Switch A 401k To A Roth Ira

How To Rollover Your 401

The process to rollover your 401k is relatively simple and straightforward. All you do is open your new IRA , and then fill out some transfer paperwork.

If that sounds challenging, your new provider will usually handle everything for you. They will do the paperwork required, reach out to your old provider, get things transferred, and ensure that your new account is setup.

If even that sounds overwhelming, there are new services available like Meet Beagle and Capitalize that will do it for you .

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

Don’t Miss: Can A Small Business Set Up A 401k