How Many 401 Rollovers Per Year

The once-per-year rule does not apply to 401 rollovers, and you can rollover multiple 401s in a year. When you transfer money from one 401 to another 401, the check is made payable to the new 401 and not the name of the account holder. Therefore, this transfer is considered a trustee-to-trustee transfer, and hence, it is excluded from the once-per-year rule. Also, this rule does not apply to 401 rollovers to an IRA or Solo 401 account.

Can You Convert A Roth 401k To A Roth Ira

A Roth 401 can be rolled over to a new or existing Roth IRA or Roth 401. As a rule, a transfer to a Roth IRA is most desirable, since it facilitates a wider range of investment options. If you plan to withdraw the transferred funds soon, moving them to another Roth 401 may provide favorable tax treatment.

How To Roll Over An Old 401

8 Minute Read | September 27, 2021

Back in the old days, it was pretty common for someone to work for the same company for 40 years before retiring with a nice pension and a gold watch. Well, those days are long gone.

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.1 Did you hear that? Twelve! And younger generations are even more likely to look for greener employment pastures. In fact, almost a third of millennials say they would quit their jobs as soon as possibleif they could.2

But in the process, many American workers are leaving behind a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind!

Theres even a name for those retirement accounts that are left behind: orphan 401s. Even the name is sad! Its time to stop for a minute and think about giving the money in those long-forgotten accounts a new home.

Thats where rollovers come in.

Dont Miss: Do I Need Ein For Solo 401k

Read Also: Can The Government Take Your 401k For Student Loans

Is There A Limit On How Much I May Contribute To My Designated Roth Account

Yes, the combined amount contributed to all designated Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited ). The limit is $22,500 in 2023 , plus an additional $7,500 in 2023 if you are age 50 or older at the end of the year. These limits may be increased in later years to reflect cost-of-living adjustments.

How To Become A Millionaire By The Time You Retire

How can you become a millionaire? Personal finance experts say to start your retirement saving early and sock away a certain amount every year.

In December, President Joe Biden signed a $1.7 trillion spending bill that includes a provision allowing beneficiaries of 529 plans to roll over unused funds into a Roth IRA account without worrying about taxes or penalties.

There are currently minimal workarounds for money not used if your child doesnt go to college or doesnt need the full amount of the 529 accounts, Heidi King, an education and partnerships associate at College Inside Track, told Yahoo Finance. A rollover option for unused savings in the 529 account allows a family to better utilize the investment opportunity without the fear of being penalized for leftover funds should a child decide against a post-secondary education or simply not need the entire amount.

If you have had funds stranded in a 529 for at least 15 years, youll be able to roll it over into an IRA account after Dec. 31, 2023. However, its important to note that the amount you can roll over is subject to Roth IRA contribution limits. For 2023, the total contribution you make is limited to $6,500 or $7,500 if youre 50 or older.

You May Like: Should You Withdraw From 401k To Pay Off Debt

Limiting Taxes With A Simple Ira Rollover

You will normally pay income tax on withdrawals you take from your SIMPLE IRA plan. Youll have to pay an additional 10% penalty if you take withdrawals before you reach age 59½ unless you qualify for an exception, such as if you have a disability or you receive the withdrawal as an annuity.

You can avoid either of these financial losses if you roll your SIMPLE IRA assets into a 401 when you leave your employer. Your age isnt a factor in this case, either, because the rollover isnt considered to be a withdrawal when you time it properly.

Dont Miss: Can A Small Business Set Up A 401k

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. Youll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Also Check: Where To Invest 401k Now

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

-

Potential for earlier access to that money: If you leave your job, you could start tapping your 401 as early as age 55. Qualified distributions from traditional IRAs cant begin until 59½ unless you start a series of substantially equal distributions a commitment to take at least one distribution per year for at least five years or until you turn 59½, whichever comes last. The distribution amount is based on IRS calculation methods that take into account your IRA balance, age, life expectancy and, in some cases, interest rates. It could mean taking more than you need, for longer than you want to.

Compare costs among your retirement plans to find out where youre getting the better deal.

» See how a 401 could improve your retirement: Try our 401 calculator.

You May Like: Can I Have 2 401k Plans

Make Sure You Understand These Rules Before Converting Your Retirement Savings

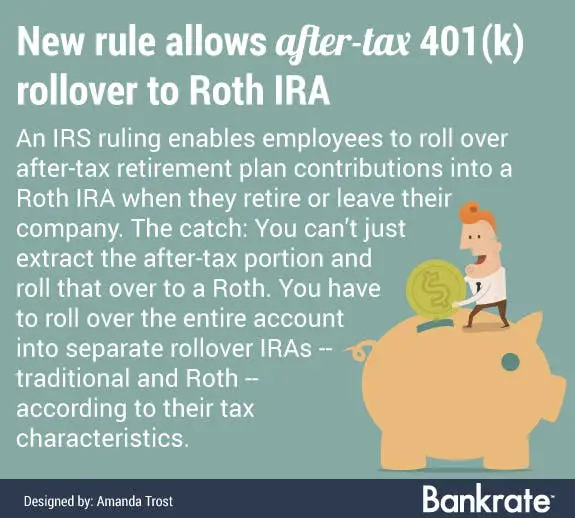

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youd like to convert. Heres a closer look at how 401 to Roth IRA conversions work and how to decide if theyre right for you.

Also Check: How To Qualify For 401k

Your Roth 401 Rollover Options

For the most part, your choices for a Roth 401 follow those of a traditional 401, but the transfers should be to Roth versions of the available accounts. If you opt to roll the funds over to an IRA, you should transfer the funds from the Roth 401 into a Roth IRA. If your new employer has a Roth 401 option and allows for transfers, you should also be able to roll the old Roth 401 into the new Roth 401.

Rolling a Roth 401 over into a Roth IRA is generally optimal, particularly because the investment choices within an IRA are typically wider and better than those of a 401 plan. More frequently than not, individual IRA accounts have more options than a 401. Depending on the custodian, sometimes your options in a 401 are limited to mutual funds or a few different exchange-traded funds , versus being able to invest in a plethora of choices in an IRA.

The best way to accomplish a rollover to either a Roth IRA or another Roth 401 is from trustee to trustee. This ensures a seamless transaction that should not be challenged later by the IRS, which may be concerned about whether the transaction was made for the full amount or in a timely manner.

If, however, you decide to have the funds sent to you instead of directly to the new trustee, you can still roll over the entire distribution to a Roth IRA within 60 days of receipt. If you choose this route, however, the paying trustee is generally required to withhold 20% of the account balance for taxes.

Can I Get A Distribution While I Am Still An Employee And Roll Over That Distribution As An In

Your plan may limit in-plan Roth rollovers to distributable amounts. If so, your plan may allow an in-service distribution of vested amounts in your plan accounts that you may be able to roll over to a designated Roth account in the same plan. Your plan must state the rules for when you may obtain an in-service distribution.

You May Like: How To Get My 401k Statement

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .6 All the money you put into your 401 is immediately vested, but your employers contributions might be vested over timemeaning the money isnt yours until its been in your account for a while. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if youre eligible.

Expecting Higher Than Average Returns From An Investment Opportunity

If youre about to make an investment you expect will produce huge returns, then itll be in your best interest to convert to a Roth.Wouldnt you rather pay tax on the smaller investment amounts now? Those larger returns will go back into your Roth IRA or 401k, where they will grow to an unlimited amount and come out tax free.I realize this is hard to predict. After all, if it was easy wed all be rich. However, a situation like this is bound to happen when youre investing in real estate, startups, pre-IPOs, and other investments.

You May Like: How Does A Company 401k Match Work

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Also Check: Can You Take All Your 401k Money Out

Tax Consequences When Rolling A 401 Into A Roth Ira

There are two main types of 401 plans available. Traditional 401 plans allow you to deposit pre-tax money into your retirement account. Youll need to pay taxes on these funds when you withdraw them.

Roth 401 plans, meanwhile, consist of after-tax money you contribute to your account. As a result, you wont owe any additional money when it comes time to withdraw. The same is true for a Roth IRA.

This means that there are tax consequences if you rollover a 401 to Roth IRA. Because a standard 401 is funded with before-tax dollars, you will need to pay taxes on those funds in order to move that money into an after-tax funded Roth IRA account.

Rollover To A Roth Ira Or A Designated Roth Account

Are you eligible to receive a distribution from your 401, 403 or governmental 457 retirement plan?

You can roll over eligible rollover distributions from these plans to a Roth IRA or to a designated Roth account in the same plan .

You may want to note the differences between Roth IRAs and designated Roth accounts before you decide which type of account to choose. For example, when you reach age 70 1/2, you may have to take required minimum distributions from designated Roth accounts, but not from Roth IRAs.

Roth IRAs and designated Roth accounts only accept rollovers of money that has already been taxed. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Withdrawals from a Roth IRA or designated Roth account, including earnings, will be tax-free if you:

- have held the account for at least 5 years, and

You May Like: What The Limit On 401k Contribution

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Don’t Miss: How To Roll Over 401k After Leaving Job

Option : Move The Money To Your New Employers 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employers plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: Youll generally be able to add money to your new employers plan as long as you meet the plans requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you cant get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.