Employer Matching Contributions May Be Limited

Many people think they can still take full advantage of an employer match late in the year, by contributing larger sums of money in just a few months. But many 401 plans calculate matching on a per-pay-period basis. For these plans, your matching contribution is calculated based only on that pay periods contributionnot the whole year.

Lets look at an example:

Adams Apples sets up a 401 plan to start November 1, with 4 pay periods left. They provide a dollar-for-dollar match up to 5% of an employees pay. Adam makes $250,000 and contributes 5% of his pay, $12,500. It seems like Adam should get $12,500 in employer matching as well. But if its a per-pay-period match, Adam will only get a match during the pay periods he contributes. Since there are only 4 pay periods, he would only get $2,083 in matching contributions.

If you start your plan on January 1, you can generally avoid this confusion for your employees and prevent a lot of unintended miscommunication. Most employees tend to spread their contributions throughout the year to keep things manageable. Be sure to also inform your employees of how the per-pay-period match works, even if its January, so that the certain strategic employees understand not to front or backload their contributions for the full year!

Supplement Your 401 With A Roth Ira

Some employer 401s suffer from a lack of investment options. This is where an individual retirement account comes in handy.

And if your employer doesnt match contributions, you might choose to forgo your 401 altogether, says Ned Gandevani, program coordinator and professor in the masters of science in finance program at the New England College of Business. When theres no contribution from your employer towards your plan, theres no need to invest in it. By investing in a restricted plan, you end up paying too much with no benefits from your employer.

Its All About Decumulation Planning

To learn more about how planning for retirement is different, read our Founder, Dana Anspachs 5-star rated book Control Your Retirement Destiny. It gives you a step-by-step outline of how to plan for a transition out of the workforce. Or check out her course, How to Plan the Perfect Retirement, on Wondrium.

You can also watch & share our short video below,Age Related 401 Plan Rules in 5 Minutes Or Less.

Also Check: How Much Can You Rollover From 401k To Ira

Deadlines: The Bottom Line

Both employers and employees receive tax benefits for contributing to a 401 plan. Employees can build their nest eggs tax-free, while employers enjoy tax credits and write-offs, lower employee turnover, and a more productive workforce. If youre a small business, a low-fee retirement program can benefit your employees and your bottom line.

Looking for a 401 provider that will help make sure youre covered on all of these deadlines? Human Interest provides support for compliance for 401 and 403 plans. to find out more about Human Interest.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Important Plan Provision Changes: New plan loan provisions are no longer offered in the TD Ameritrade Individual 401 plan. All outstanding plan loans must be paid off by May 31, 2022 to continue to use the TD Ameritrade plan document. Roth 401 deferral contributions in the Individual 401 plan will no longer be accepted as of December 1, 2022.

Recommended Reading: Can I Rollover My Ira To My 401k

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer.

You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal, but you can only do this from a current 401 account that’s held by your employer. You can’t take loans out on older 401 accounts.

You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59½ even if you haven’t yet retired. The best idea for old 401 accounts is to roll them over when you leave a job. You won’t be hit with penalties if you withdraw from your old accounts if you’re at least age 59½. But you should check with your human resource department about the rules for withdrawing from your current 401 if you’re still in the workplace.

You May Like: Do I Need An Ira If I Have A 401k

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

Recommended Reading: Can I Move Money From 401k To Ira

How Much Can You Take Out Of 401k At Age 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

What is the 59.5 rule?

Most Americans who are fortunate enough to have a retirement savings in the Individual Retirement Account are likely to be aware of the 59.5-year law, where dividends from IRA before that age began not only on tax deductions, but. a 10% penalty on initial distribution.

How much can you withdraw from your 401k at one time?

Generally, you can borrow up to 50% of your closed bar account or $ 50,000, whichever is less. The Senate Bill also doubles the amount you can borrow: $ 100,000. Generally, if you lose your job with a 401 credit book, the loan is treated as a deduction and you are at the tax office.

Recommended Reading: Should I Move My 401k To Bonds 2020

Recommended Reading: What Is The Average Employer Contribution To 401k

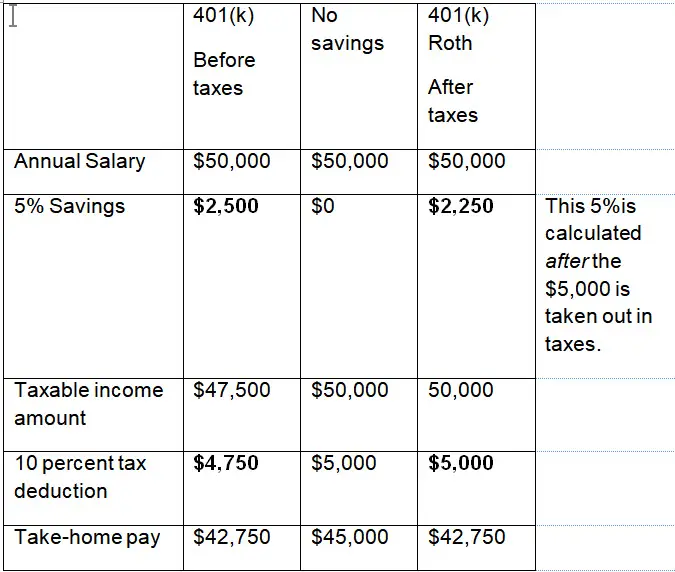

Benefits To You And Your Employees

Investments in the plan grow tax-free after contributions are made, and no tax is paid on investment gains until employees take out the money. Contributions to the plan can reduce taxable income for the year.

Employees can make contributions through payroll deductions, and move the assets in their plan to another employers plan when they change jobs.

Dont Miss: How Much Are You Allowed To Contribute To 401k

How Much Should You Contribute To Your 401

When youre young, its hard to visualize your life in 30 or 40 years and predict how much money youll need.

Just a couple of decades ago, pensions were common benefits offered by many employers, and life expectancies were much lower making it easier to finance your retirement.

Today, employers offering pensions are less common, the future availability of Social Security is less certain and, more importantly, people are living longer.

While your grandparents may have lived only 10-15 years in retirement, odds are your retirement years may span 20 to 30 years! Thats a much longer period youll need to finance.

For that reason, many experts recommend investing 10-15 percent of your annual salary in a retirement savings vehicle like a 401.

Of course, when youre just starting out and trying to establish a financial cushion and pay off student loans, thats a pretty big chunk of cash to sock away. You may need to begin at a smaller percentage and set a higher number as your ultimate goal.

Here are a few considerations to keep in mind:

Read Also: Does Employer 401k Contributions Count Towards Limit

Editors Note: Looking For Employee Retirement Plans For Your Company If You Would Like Information To Help You Choose The One Thats Right For You Use The Questionnaire Below To Have Our Partner Buyerzone Provide You With Information For Free:

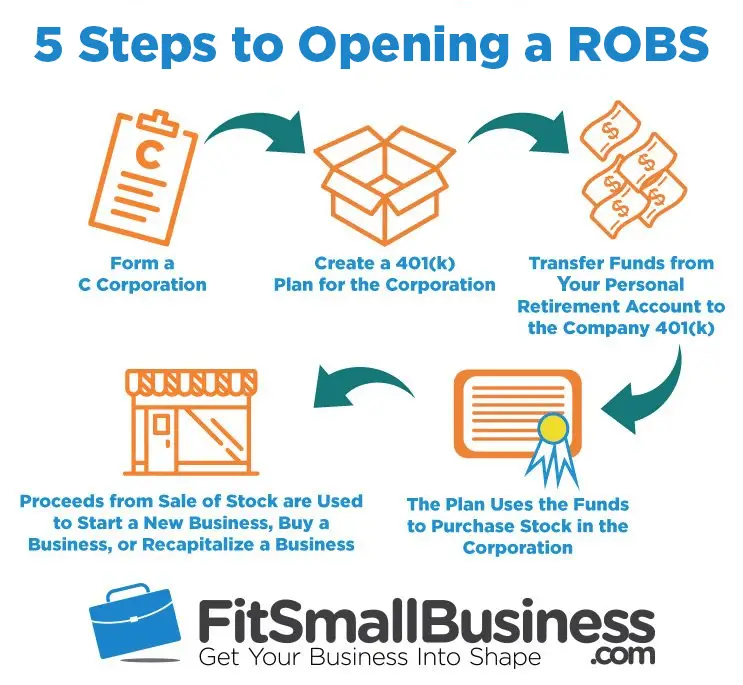

Again, the steps are minimal to get going, but youâll need a tax attorney or CPA to handle the formation of the corporation and the new retirement plan. Importantly, the people handling these matters should be well versed in the Employee Retirement Income Security Act, or ERISA, which contains many of the laws regulating employee benefit plans.

âBecause itâs retirement plan money thatâs being used for this, you have ERISA and internal revenue code penalties that apply unless all the Is are dotted and the Ts are crossed,â warns OâDonnell.

There are companies dedicated to guiding you through the process, such as BeneTrends of North Wales, Pennsylvania, and Guidant Financial Group in Bellevue, Washington. Guidant, for its part, charges a flat of $4,995 for setting up the plan. With that you also get two hours of time with an outside tax attorney. Additionally, Guidant charges a base fee of $800 annually to administer the retirement plan. If you have additional participants in the plan above the first two, there is a charge of $45 per participant.

How to Finance a Start-Up with Your 401: The Risks

The most obvious risk in financing your business with your retirement funds is, if for some reason your business fails, not only have you lost that business, but possibly a significant portion of your retirement nest egg.

So betting the whole farm on that Krispy Kreme franchise may not be the best way to go.

Recommended Reading: Can I Transfer My 401k To My Child

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Read Also: How To Transfer A 401k Account

Kathryn B Hauer Certified Financial Planner

Hi! Thanks for writing! I sure wish you could open a 401 on your own! As you know, its a tax-deferred retirement account, but its better than an IRA in that it allows you to defer up to $18,000 of earned income whereas the IRA only allows up to $5,500 and limits the deductibility of that IRA if you earn over a certain amount of money in that year. The 401 is a wonderful way for people to save for retirement when they work for a company that offers one. However, the 401 is a special kind of plan governed by U.S. Department of Labor Employee Retirement Income Security Act of 1974 rules that apply to companies, not individuals, and must be followed in order to offer a 401. ERISA sets minimum standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans.

For people who have their own business as a sole proprietor, LLC, or S Corp, there are retirement plans that small business owners can use that have similar characteristics ), but they do require owning some kind of business. I hope this helps!

What Other Debts Do You Have

Its also a good idea to look at your current debt situation before you start putting funds away for your retirement. Its generally recommended that if your employer matches 401k contributions, make sure you put in enough to get that match, even if you are in debt.

Next, look at the kind of debt you have. If you have credit card debt or loans with interest in the double digits, pay that off before putting more money towards your retirement.

Read Also: How To Transfer 401k From Old Job

How To Roll Over A 401 While Still Working

Some 401 plans allow you to roll them over while still employed with your company.

Anyone can roll over a 401 to an IRA or to a new employers 401 plan when leaving a job. Depending on your plans policies, you might be able to make the rollover while youre still with the company. Unlike a post-job rollover, your plan doesnt have to allow in-service rollovers, but many companies do. However, there are usually significant restrictions.

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether youve been laid off, fired or simply quit doesnt matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employers 401 early youd need to wait until you turned 59½.

Its also important to remember that while you can avoid the 10% penalty, the rule doesnt free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Read Also: How Do I Set Up A 401k For My Employees

When Can You Withdraw From Your 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If youre the kind of take-charge retirement planner whos diligently contributing to a 401 fund, receiving matching contributions from your employer, and watching your savings start to stack, you might find yourself wondering When can I withdraw from my 401 account?

The answer depends on a number of factors including your age, whether youre still working or already retired, if you qualify for a hardship withdrawal, whether it makes sense to take out a 401 loan, or rollover your 401 into another account.

Employee Participation Standards Must Be Met

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements:

- Has reached age 21

- Has at least 1 year of service

- plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not more than 2 years of service the participant is 100% vested in all plan account balances. However, the plan must allow the employee to participate by making elective deferral contributions after no more than 1 year of service.)

A plan cannot exclude an employee because he or she has reached a specified age.

Leased employee. A leased employee is treated as an employee of the employer for whom the leased employee is providing services for certain plan qualification rules. These rules apply to:

- Nondiscrimination requirements related to plan coverage, contributions, and benefits.

- Minimum age and service requirements.

- Vesting requirements.

- Limits on contributions and benefits.

- Top-heavy plan requirements.

Certain contributions or benefits provided by the leasing organization for services performed for the employer are treated as provided by the employer.

Read Also: How To Convert My 401k To Roth Ira

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Read Also: Can You Transfer Your 401k

Can You Open Other Types Of Retirement Plans At A Young Age

You can open other retirement plans, like individual retirement accounts , for a minor. Unlike with a 401, which is tied to employment, you can open an IRA for a minor who does not have a job. Both Roth IRAs and traditional IRAs can be opened for children, as long as they are set up as a custodial account by either a parent or another adult.

Don’t Miss: What Is The Best Place To Rollover A 401k