Best Places To Throw :

In your case, you may need your Extend 401. For example, if you take the opportunity to change your previous employer, you will most likely have limited time to renew your account. Even if you dont plan to renew your 401 anytime soon, do a little research and find out where you plan to make money and choose a specific renewal option if necessary.

Short Of Cash Be Cautious

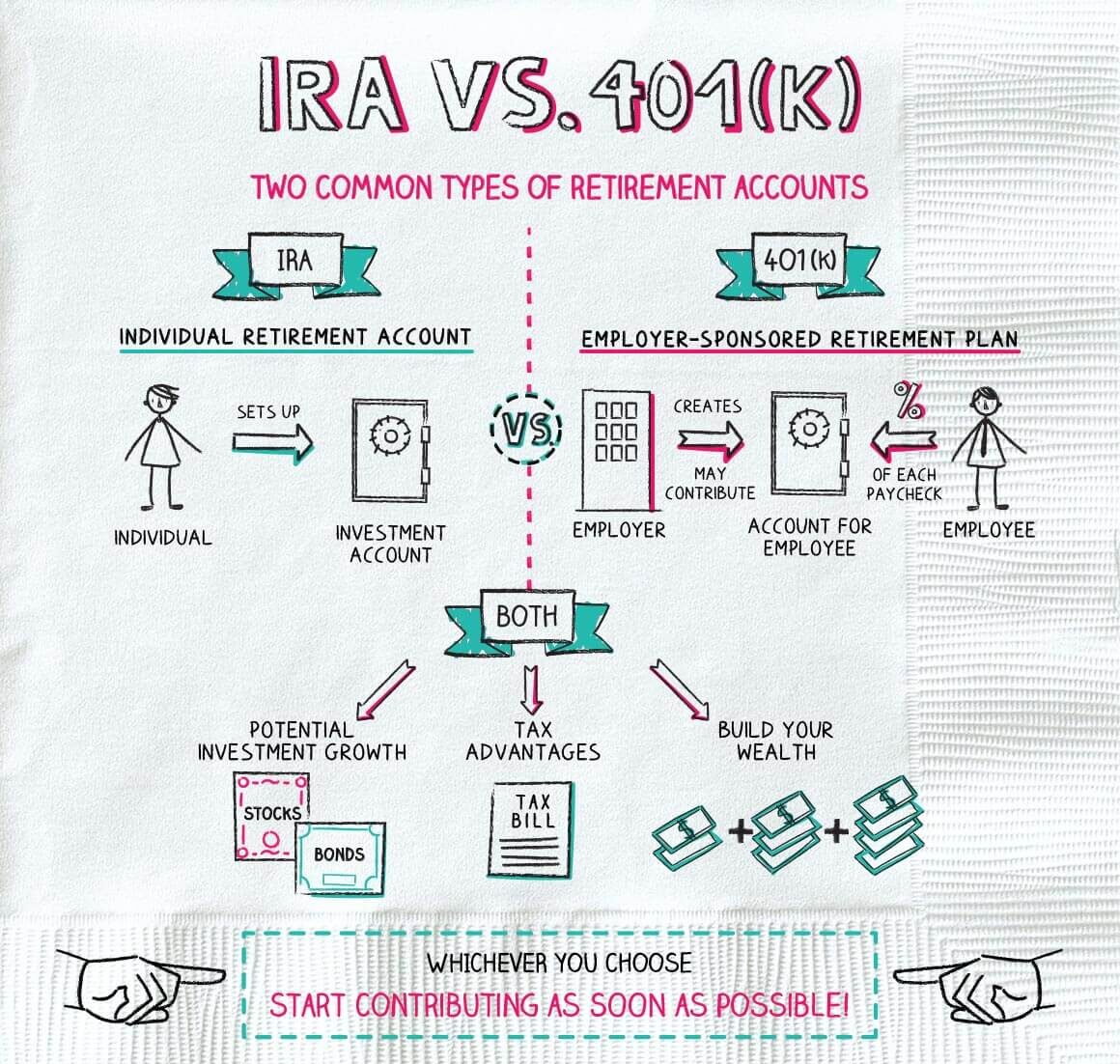

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

You May Like: Can I Take All My Money Out Of 401k

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Option : Roll Over The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your investments by putting them in one place. And you also have higher contribution limits with a 401 than you would with an IRAwhich means you can save more!

But there are lots of rules and restrictions for rolling money over into your new employers plan, so its usually not your best bet. Plus, your new 401 plan probably only has a handful of investing options to choose from too. And if youre feeling iffy about those options, why put all your retirement savings there? Which brings us to . . .

You May Like: What Percentage Should I Be Contributing To My 401k

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Start a Quote

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Recommended Reading: How To Find 401k From An Old Employer

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Read Also: Should I Open A 401k

Roll Your Money Into An Ira

What if your new company doesnt offer a 401 plan? Or perhaps you want more control over your investments and a wider array of asset options. If so, rolling your 401 into an IRA may suit your needs.

After opening an IRA with a bank or brokerage firm, youll use a direct rollover or 60-day rollover to move the money from your 401 into the IRA. By rolling your retirement savings into an IRA, youll assume control over your investments and may have a broader range of options.

While contributions to a 401 or traditional IRA are taxed when money is pulled out of the account, a Roth IRA allows your money to grow tax-free because the contributions are made after being taxed. Its important to note that some 401 plans wont allow you to roll over your money directly into a Roth IRA. If thats the case, you can move the funds into a traditional IRA and then convert it to a Roth account, but a financial advisor can help you through this process.

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

Recommended Reading: What Is The Minimum 401k Distribution

List Of Top 10 Best Place To Rollover 401k In Detailed

- Replaces RS232 serial port perfectly, connects to any laptop/PC’s USB port directly to a console port like a charm. No more RS232 Female and male adapters Note: This is Not a USB Ethernet Cable.

- An essential accessory of branded routers, switches, firewalls and wireless LAN controllers with CONSOLE port, such as Cisco, Ubiquiti, Juniper, Fortigate, Mikrotik, TP-Link, Huawei, HP ProCurve devices and more. Our unique cable works flawlessly and quickly on laptop and desktop computer

- Moyina usb rollover cable uses the ft232rl chip imported from the UK FTDI Company and the most advanced manufacturing technology to make the product more stable and reliable. It can support a variety of super terminals. Please choose according to your personal habits

- Full support for 32-bit and 64-bit Windows, MAC OS, Linux and Android, except Chrome OS. For details of OS compatibility, please scroll down this page and take a look at ‘Product description’

- USB2.0 CONSOLE’s DTE Pinouts: RTS, DTR, TXD , GND, GND, RXD , DSR, CTS so Moyina RJ45 cable is 1-CTS, 2-DSR, 3-RXD, 4-GND, 5-GND, 6-TXD, 7-DTR, 8-RTS. Cable length 1.8m/6ft, Maximum RS232 speed 500kbaud

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

You May Like: What Happens To Your 401k When You Switch Jobs

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

How To Roll Over Your 401

There is a multi-step process for initiating and completing a 401 rollover to your new traditional or Roth IRA. More specifically, youll need to choose what kind of account you want, where to open it, how youll transfer the funds and what investments youll make once the assets are available. Be sure to follow each step in order so you dont run into any tax issues with the IRS.

Below is a step-by-step breakdown of how to handle your 401 rollover.

Also Check: What’s The Max You Can Put In 401k Per Year

Reasons To Avoid A 401 Rollover

There are some cases when it doesnât make sense to roll your 401 into another account:

⢠IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

⢠Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

⢠Limited investment choices. A new employerâs 401 might have more limited investment choices. If thatâs the case, you might want to stick with your existing 401 because the assets work better for your situation.

⢠A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs donât have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Don’t Miss: Can I Change My 401k Contribution At Any Time