Can I Rollover Retirement Ira To 401 Solo

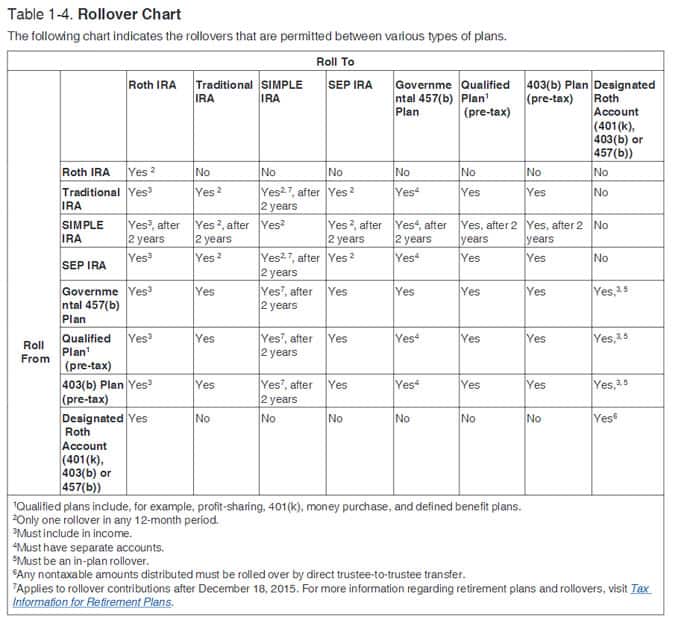

Can i rollover retirement ira to 401 solo? Yes. You can consolidate your retirement assets by rolling over 401, 403, 457 and SEP IRA accounts into a Merrill Individual 401. You can also roll over a SIMPLE IRA after you have participated in the account for 2 years.

Can you roll a traditional IRA into a Solo 401k? You can generally rollover any pre-tax retirement account into the Solo 401k. You can rollover your 401k, 403b, 457 or Thrift Saving Plan from a previous employer. You can transfer a Rollover IRA, Traditional IRA, SEP IRA, Simple IRA, Keogh and Defined Benefit Plan.

Can you move money from an IRA to a 401k without penalty? Moving money the other way, from an IRA into a 401, is known as a reverse rollover. A rollover is tax terminology for when you move the balance from one retirement plan into another plan. As long as you complete the rollover within 60 days, its penalty-free and non-taxable.

Can you roll an IRA into a 401k to avoid RMD? If you are age 72 or older and you have an IRA, you will be required to take a distribution from your IRA each year. If your 401 plan allows it , you can rollover your existing IRA account into your 401 plan.

Rolling Over Your 401 To An Ira

You have the most control and the most choice if you own an IRA. IRAs typically offer a much wider array of investment options than 401s, unless you work for a company with a very high-quality planusually the big, Fortune 500 firms.

Some 401 plans only have a half dozen funds to choose from, and some companies strongly encourage participants to invest heavily in the companys stock. Many 401 plans are also funded with variable annuity contracts that provide a layer of insurance protection for the assets in the plan at a cost to the participants that often run as much as 3% per year. IRA fees tend to run cheaper depending on which custodian and which investments you choose.

With a small handful of exceptions, IRAs allow virtually any asset, including:

If youre willing to set up a self-directed IRA, even some alternative investments like oil and gas leases, physical property, and commodities can be purchased within these accounts.

Transfers From Simple Iras

You may be able to transfer money in a tax-free rollover from your SIMPLE IRA to another IRA or to an employer-sponsored retirement plan , 403, or governmental 457 plan). However, during the 2-year period beginning when you first participated in your employer’s SIMPLE IRA plan, you can only transfer money to another SIMPLE IRA. Otherwise, you are considered to have withdrawn the amount transferred and you will have to:

- include the amount in your gross income, and

- pay an additional 25% tax on this amount, unless you are at least age 59½ at the time of the transfer or you qualify for another exception to the additional tax.

After the 2-year period, you can make tax-free rollovers from SIMPLE IRAs to other types of non-Roth IRAs, or to an employer-sponsored retirement plan. You can also roll over money into a Roth IRA after the 2-year period, but must include any untaxed money rolled over in your income.

Don’t Miss: What’s The Maximum Contribution To A 401k

Who Should Choose A Sep Ira Instead Of A Solo 401

When a newly minted entrepreneur or gig worker lands at Henrys door and asks whether to open an SEP IRA or a solo 401, he asks one question: Do you have any plans to hire an employee, even in the future? If the answer is maybe, he steers them toward an SEP IRA, which can be used to fund employee retirements.

Remember: Hiring just one employee for your business in the futurebeyond your spousewould eliminate the solo 401 as an option. And switching from a solo 401 to an SEP IRA at some future date can be a big hassle, Henry warns.

Entrepreneurs who go with an SEP IRA because of potential future hires have another important consideration: All employee contributions must be the same percentage of compensation. For instance, an entrepreneur who wants to put 10% of their net income into their SEP IRA must put 10% of worker pay into their SEP IRA, too.

But even in some cases where hiring employees simply isnt in the cards, Henry sometimes advises the self-employed to choose a SEP IRA. Simplified is in the plans name for a reason: They can be easier to set up than solo 401 plans, according to Henry, and theyre more widely available.

Every situation is different, and an individual should assess the option that is best for their financial goals, but there is some truth to the fact that a SEP is easier to open, says Cherill. In fact, most taxpayers can simply open a SEP account online with their brokerage firm and manage it themselves.

How To Convert A Sep To A Roth Ira

Contact the financial institution that manages your SEP IRA to convert to a Roth IRA. In IRS-speak, this is the trustee for the account. You can rollover the money into a Roth account at that institution or somewhere else if you choose.

The most straightforward way to execute a Roth conversion is to request that the trustee transfer the funds to the Roth IRA directly. This is what the IRS calls a trustee-to-trustee transfer, since the financial institution holding your SEP IRA makes the payment directly from that IRA to the financial institution holding the new Roth IRA.

Its more complicated to have the funds paid directly to you. This means a check is made out to your name. If youve been paid directly and dont redeposit the check into the Roth IRA within 60 days, it counts as a distribution, and youll pay taxesplus an early withdrawal penalty of 10%, if youre under the age of 59½.

Also Check: When Can I Rollover 401k To Ira

Don’t Miss: Can You Take Money From Your 401k

Exceptions To Additional Taxes

You dont have to pay additional taxes if you are age 59½ or older when you withdraw the money from your SIMPLE IRA. You also dont have to pay additional taxes if, for example:

- Your withdrawal is not more than:

- Your unreimbursed medical expenses that exceed 10% of your adjusted gross income ,

- Your cost for your medical insurance while unemployed,

- Your qualified higher education expenses, or

- The amount to buy, build or rebuild a first home

You May Like: How To Get Your 401k Without Penalty

Sep Iras Dont Require Annual Filings Or Paperwork To Maintain

Simplified is part of the name for a reason. Unlike 401s, which are subject to rigorous reporting requirements, SEP IRAs are much easier to set up and maintain. Since SEP IRAs dont require annual filings or paperwork to maintain, small business owners can bypass the monetary risk associated with accidental failure to comply with ERISA rules. This makes them a great choice for business owners who dont have the time or resources to manage annual filings.

In fact, in a recent interview with Forbes Advisor, Ted Benna, the so-called Father of the 401 discussed the 401 plans shortcomings, one of which being the administrative headaches. He admitted that for many small businesses, a simpler solution may be a better fit.

Read Also: How Do You Invest Your 401k

Traditional Ira Or 401

Traditional IRAs and traditional 401 plans are deferred tax retirement accounts. That means you dont pay income taxes on the money you contribute to the plans but you pay taxes on the money you take out of them when you retire.

There typically are no tax implications for moving money from your traditional IRA or 401 plan into an annuity. The easiest way to do this is to make a direct rollover through the insurance company handling the annuity.

The money you roll over goes directly from your retirement plan into the annuity and you pay income taxes on the money you receive when you retire.

How To Open A Sep Ira

Nearly all brokerage firms offer SEP IRAs, and in most cases they can be opened online. A formal written agreement is required, known as IRS Form 5305-SEP, but the brokerage will usually take care of that. Opening fees and annual fees are often zero.

You can benefit from SEP IRA tax breaks for a given tax year by opening your account by your annual tax filing deadline, which is usually in mid April.

When opening an account, be sure to note minimum investment requirements and investment options. While SEP IRAs usually have a broader range of choices than 401 accounts, the choices are more limited than those available in a standard brokerage account.

Read Also: How To Roll 401k Into New Job

Irs Updates Guidance On Expansion Of Simple Ira Rollover Options

The IRS has updated the information it provides on the expansion of rollover options, which includes SIMPLE IRA plans. The information is contained in an issue snapshot that describes the change made by the Protecting Americans from Tax Hikes Act of 2015 to Code Section 408 to allow SIMPLE IRAs to accept contributions from other plans under certain circumstances.The PATH Act expanded the portability of retirement assets by permitting taxpayers to roll over assets from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403 or 457 plan, into a SIMPLE IRA plan.

Restrictions

There are some restrictions to the changes made by the PATH Act:

- SIMPLE IRAs cannot accept rollovers from Roth IRAs or designated Roth accounts.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law applies to rollovers from other plans to SIMPLE IRAs made after Dec. 18, 2015, the date the PATH Act was enacted.

- The one-per-year limitation that applies to IRA-to-IRA rollovers applies to rollovers from a traditional, SIMPLE, or SEP IRA into a SIMPLE IRA.

The IRS also notes that the PATH Act did not change the limitations for payments made from a SIMPLE IRA during the two-year period following initial participation.

Audit Tips

The IRS offers the following audit tips related to the changes the PATH Act made.

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Recommended Reading: What Happens To Your 401k When You Switch Jobs

How Does An Ira Or 401 Into An Annuity Rollover Work

Say youre interested in using your retirement funds to buy an annuity. Should you withdraw the funds from your retirement account, pay the taxes and then buy the annuity? Or can you just roll over the funds directly into the annuity, continuing to avoid taxes until you receive the income stream payments?

In most cases, the IRS allows qualified funds to be transferred into, or out of, qualified annuities. So, its important to know the annuity rollover rules before making this decision.In short, there are two ways to roll over your retirement account into an annuity directly through a transfer, or indirectly through taking a qualifying withdrawal.

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

You May Like: Can I Rollover 401k To Ira While Still Employed

How To Roll Your 401 Into An Ira

Rolling your 401 into an IRA is not as complicated as it seems.

Choose the financial institution you want to roll over your savings into, such as a bank, online investing platform, or brokerage.

Once you have selected the institution, contact your previous employers 401 administrator and request a direct rollover of your savings into your new IRA account.

Hence, in making rollovers, there are two types that either could be your option.

- Direct Rollovers

Direct rollovers occur when your money is transferred from one account to another electronically.

- Indirect Rollovers

The funds come to you to re-deposit in an indirect rollover.

You have only sixty days to deposit the funds in a new plan if you get the money in cash rather than transferring it directly to the new account. Missing the deadlines means that you opt to withhold taxes and penalties.

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

Also Check: How To Withdraw Money From My Fidelity 401k

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Recommended Reading: How To Calculate 401k Match

Take Steps To Ensure A Tax

Confirm the date. Once you think it has been two years since your first SIMPLE IRA contribution, confirm with the plans custodian. Be sure that you have met the two-year rule before beginning any transfer paperwork. Keep in mind that some custodians calculate that period with different start dates.

Remember the IRA One-Rollover-per-Year Rule.Per IRS rules, you are limited to one non-taxable IRA rollover per 12-month period. If you make more than one per year, the distribution will count as income. It may be subject to the 10% early withdrawal tax.

Consider waiting until the two years are up.Are you concerned about the timing of your IRA rollover? To keep things simple, you may want to keep the funds where they are until the two years are up. Again, be sure to confirm with your plans custodians that you have met the two-year rule before starting the rollover.

Recommended Reading: Is Fidelity A 401k Plan Administrator

For Emergency Issues We Recommend You Call Us Right Away We Are Available 24/7

11545 W. Touhy Ave., Chicago, IL 60666

Routing #271081528

You are leaving Alliants website to enter a website hosted by an organization separate from Alliant Credit Union. The products and services on this website are being offered through LPL Financial or its affiliates, which are separate entities from, and not affiliates of, Alliant Credit Union.The privacy and security policies of the site may differ from those of Alliant Credit Union.

You are leaving an Alliant Credit Union website and are about to enter a website operated by a third-party, independent from Alliant Credit Union. Alliant Credit Union does not manage the operation or content of the website you are about to enter. Alliant Credit Union is not responsible for the content and does not provide any products or services at this third-party website. The privacy and security policies of the site may differ from those of Alliant Credit Union.

You are leaving an Alliant Credit Union website and are about to enter a website operated by a third-party, independent from Alliant Credit Union. Alliant Credit Union does not manage the operation or content of the website you are about to enter. Alliant Credit Union is not responsible for the content and does not provide any products or services at this third-party website. The privacy and security policies of the site may differ from those of Alliant Credit Union.

You May Like: Can You Use Your 401k To Buy Stocks