Why Is 401k Not Good

Theres more than a few reasons that I think 401s are a bad idea, including that you give up control of your money, have extremely limited investment options, cant access your funds until youre 59.5 or older, are not paid income distributions on your investments, and dont benefit from them during the most

Dont Miss: How To Manage 401k Investments

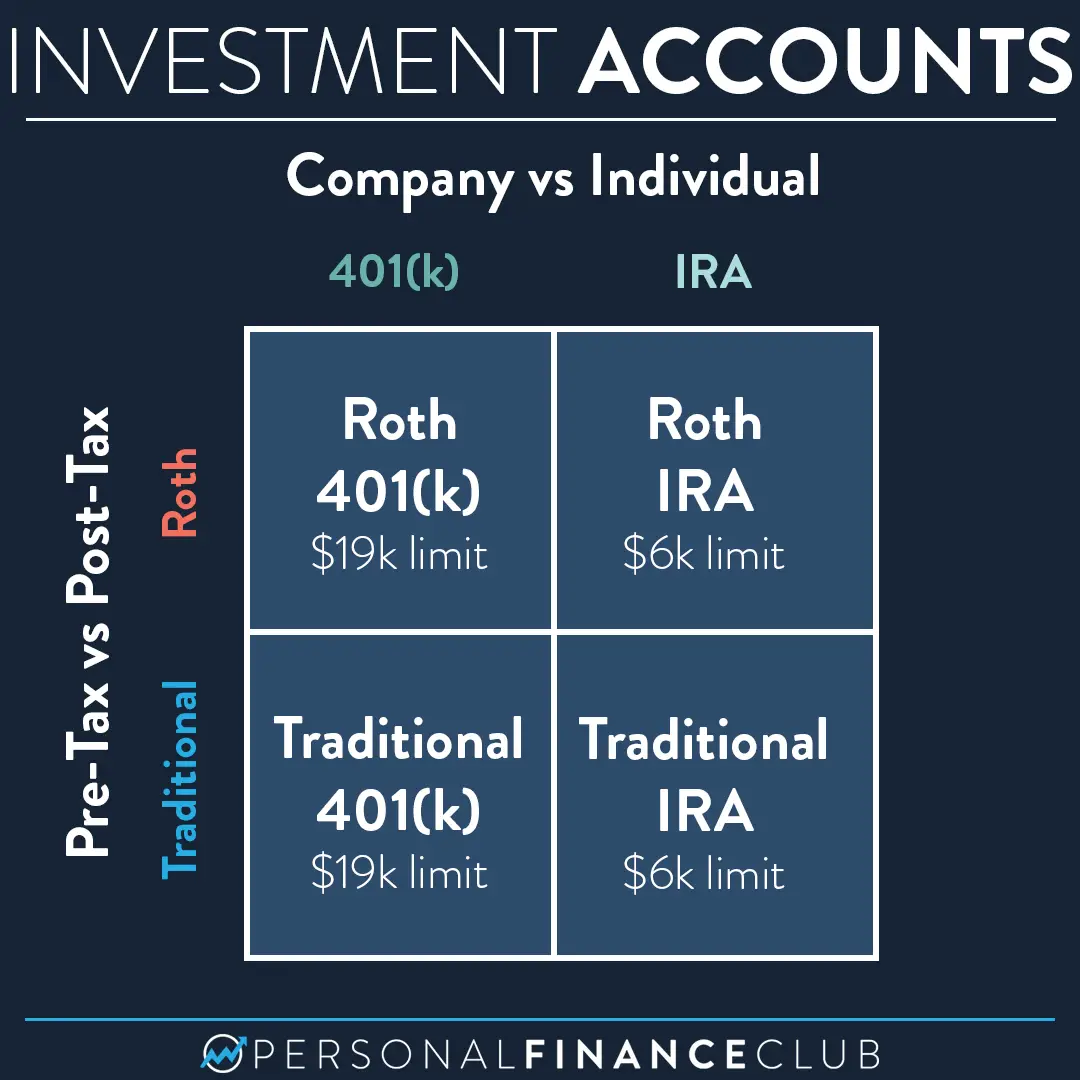

What Is The Biggest Advantage To Investing In A 401 K Instead Of A Traditional Ira

401s generally allow higher contributions but offer fewer investment options, while IRAs have lower contribution limits and income limits for high earners but offer the ability to invest in nearly any stock, bond, or mutual fund.

What tax advantages do the 401 K and traditional IRA share?

The traditional individual retirement account and 401 offer the benefit of tax-deferred retirement savings. Depending on your tax situation, you may also be able to receive a tax deduction for the amount you contribute to a 401 and IRA each tax year.

What is the advantage of a 401 K over an IRA?

401s Offer Higher Contribution Limits The employer-sponsored plan allows you to add a lot more to your retirement savings than an IRA. For 2021, a 401 plan allows you to contribute up to $19,500. Participants 50 and older can add an additional $6,500 for a total of $26,000.

How Are Iras And 401s Similar

Which expert says you know more about traditional 401, let alone traditional IRAs? Lets talk about Roths reports. Roth 401s and Roth IRAs have different functions, including taxes. With a Roth account, you ?Pay tax on your balance up front and then withdraw tax-free money when you retire.2 Check with your tax advisor to find out what works best for this situation.

From Precious Metals IRAs to direct purchases of gold and silver, Goldco have helped thousands of Americans diversify and protect their 401k, IRA, and retirement savings accounts every day.

Don’t Miss: Where Is My 401k Money Invested

How Much Money Can You Contribute

- IRA: $6,000 if youre younger than 50 $7,000 if youre 50 or older. A high modified adjusted gross income can phase out or exclude you from contributing.

- 401: $19,500 if youre younger than 50 $26,000 if youre 50 or older. Including employer contributions, the limit is $58,000 if youre younger than 50 and $64,500 if youre 50+.

How To Choose Between A 401 & An Ira

If you only have enough money to contribute to one account or dont want to deal with multiple accounts, there are several rules of thumb you can use when deciding between a 401 and IRA.

A 401 is a better option if:

- Your employer offers a 401 match

- The investment options in your 401 match your investment plan

- The 401 doesnt charge high fees

An IRA is a better option if:

- You dont have access to a 401 through your employer and dont qualify for a solo 401

- Your 401 charges high fees

- You want to use investments that arent available in your 401

Read Also: How To Get The Money From Your 401k

You May Like: Should I Transfer 401k To New Employer

Should I Switch My 401k To A Roth

If your current portfolio is entirely or nearly all qualified retirement assets, it may make sense to contribute to a Roth 401. Having a diversity of types of accounts with your retirement savings will allow you to diversify your income sources in retirement, which can be helpful from a tax perspective.

Simple Ira Vs : The Pros And Cons Of Each Plan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

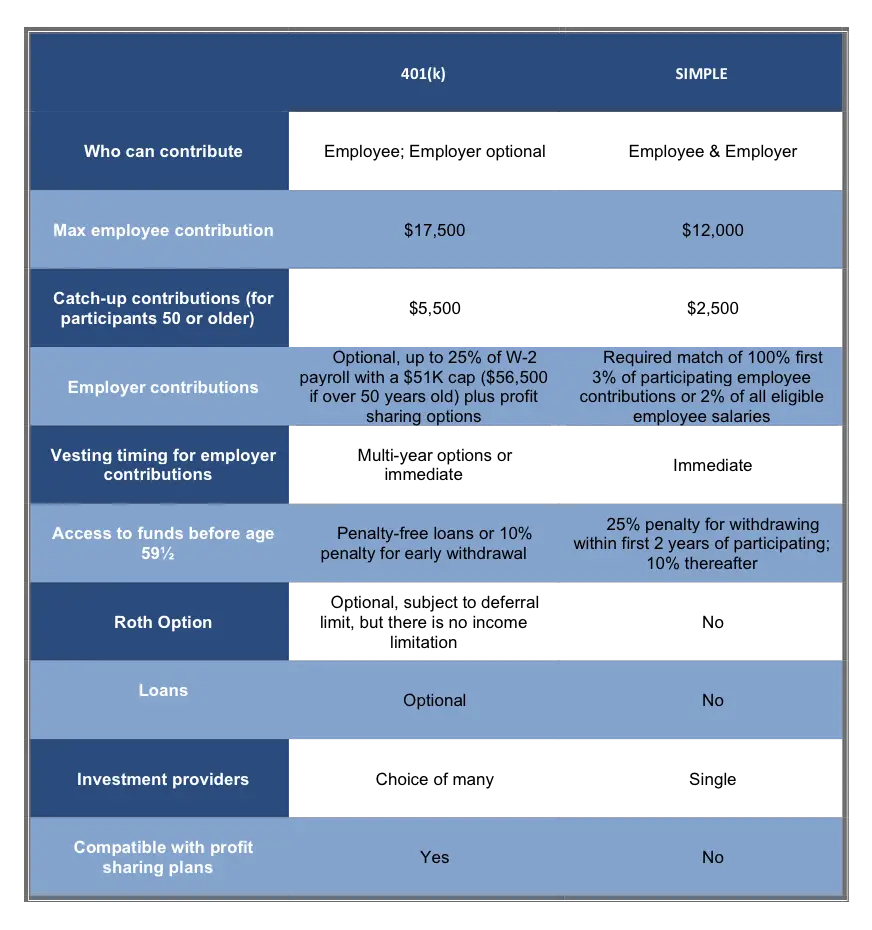

The SIMPLE IRA vs. 401 decision is, at its core, a choice between simplicity and flexibility for employers.

The aptly named SIMPLE IRA, which stands for Savings Incentive Match Plan for Employees, is the more straightforward of the two options. Its quick to set up, and ongoing maintenance is easy and inexpensive. But if you have employees, you are required to provide contributions to their accounts.

Although a 401 plan can be more complex to establish and maintain, it provides higher contribution limits and gives you more flexibility to decide if and how you want to contribute to employee accounts. Another big difference is that you can opt for a Roth version of the plan, whereas the SIMPLE IRA allows no Roth provision.

Recommended Reading: Why Roll 401k Into Ira

Where Do I Invest During A Recession

There is no one-size-fits-all answer to this question. It depends on your circumstances and goals. However, some people may invest in less risky investments, such as bonds and fixed annuities, rather than stocks. Additionally, you may want to consider investing in companies less likely to be affected by a recession, such as utility companies.

Can I Move My Pension To An Ira

Even if you plan to continue working, you can choose to transfer your retirement amount to an IRA. Your pension will then continue as usual with your employer and you will have full control over your money out of the hands of your employer. This also works with 401k plans.

Can I transfer my retirement to an IRA?

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment into another retirement plan or IRA within 60 days. You can also have your financial institution or plan transfer the payment directly to another plan or IRA.

How can I avoid paying tax on my pension?

To avoid the tax being fully impacted on your retirement benefit, it is recommended that you contact your investment representative, banker or your new employers pension provider before agreeing to receive your retirement benefit. Create a rollover IRA account with your investment broker or banker.

Read Also: How To Withdraw From Merrill Lynch 401k

Can You Roll A 401 Into An Ira Penalty

The IRS allows for a rollover or transfer of your funds from a 401 to an IRA. However, the process and guidelines outlined by the IRS must be followed so that the IRA transfer doesnt count as a distribution, which could incur a penalty. The easiest way to make sure funds roll over penalty-free is to do a direct rollover.

How Important Is It To Offer The Roth Option

As mentioned earlier, the IRS allows employers to offer a Roth 401. is funded with after-tax contributions in exchange for tax-free distributions in retirement.) There is no Roth version of the SIMPLE IRA. The account is subject to many of the same rules as a traditional IRA: Contributions reduce your taxable income for the year, but distributions in retirement are taxed as ordinary income. That said, the IRS allows participants to save in both a SIMPLE IRA and a Roth IRA at the same time.

Also Check: What Is A 401k Vs Ira

Roth Ira Vs : Which Is Better For You

11 Min Read | Nov 18, 2022

There are some points in your life where you have to pick a side: Friends or Seinfeld? Marvel or DC Comics? Michael Jordan or LeBron James?

As important as those questions are for you and your friends, theres one debate that could actually have a huge impact on your futureyour retirement future: Roth IRA or 401 . . . which one is better?

No matter what your retirement dream looks like, youll need money to turn those dreams into a reality. After all, those summer vacations you want to take or that lake house youve always wanted arent going to pay for themselves! And the truth is that a Roth IRA and a 401 are both great ways to build wealth for retirement.

Once you understand how both plans work, you can see how they can work together to help you maximize your savings. And thats not just fancy investing talk. Your choices today could result in thousandsif not millionsof dollars down the road! Lets go ahead and dive right in, shall we?

Hsa Vs 401k Vs Ira: How Do These Retirement Accounts Stack Up

Posted 2022-11-22November 22, 2022

by WEX Benefits

How is your HSA vs. your 401 vs. your IRA shaping up for retirement planning? Retirement planning is a lot easier when you imagine what you want it to be like. As Tori Dunlap of Her First $100K said at HSA Day, Ive gotten to care because I have them picture 65-year-old them.

Will you retire in Florida, or at a cabin in the woods? The average 65-year-old couple retiring today will need $351,000 to cover healthcare and medical costs in retirement. And even though Medicare helps pay for the healthcare needs of 63 million people, most recipients still spend thousands each year on out-of-pocket expenses. To help you prepare, here is a breakdown of three common retirement accounts: an HSA vs. a 401 vs. an IRA.

You May Like: Should You Convert 401k To Ira

Is A Roth Ira Better Than A 401k

A Roth 401 is usually better for high-income earners, has higher contribution limits, and provides employer matching funds. A Roth IRA allows your investments to grow longer, usually offers more investment options and makes for easier early withdrawals.

Is Roth better than 401k?

If you expect to be in a lower tax bracket upon retirement, a traditional 401 may make more sense than a Roth account. But if youre in a low tax bracket now and think youll fall into a higher tax bracket when you retire, a Roth 401 may be a better option.

How much does a Roth IRA earn per year?

Typically, Roth IRAs see an average annual return of 7-10%. For example, if you are under 50 and just opened a Roth IRA, $6,000 in contributions each year for 10 years at a 7% interest rate would yield $83,095. Wait another 30 years and the account will grow to over $500,000.

Prev Post

How To Protect A 401 And Ira During A Stock Market Crash

If a stock market crash occurs, and you havent been proactive, dont fret. A 401 or IRA owner can take a few options, waiting for the market to recover or move the money into a conservative vehicle like a deferred annuity.

Most deferred annuities offer principal protection, which means you cant lose money if the stock market takes a nosedive. Annuity owners either earn an interest rate or earn nothing at all . The annuitys value stays the same.

The variable annuity and the registered index-linked annuity are the exceptions to this rule, and an owner can lose some or all of their money if the stock market plummets.

Recovery Tip: Fixed indexed annuities can offer a premium bonus for new customers. The bonus could recover money lost from the crash.

Don’t Miss: How Can I Get My Money From 401k

Which Is Better For Taxes A Roth Ira Or 401

Weve talked briefly about the different tax implications of a 401 and Roth IRA, but lets dive a bit further into them here. As we mentioned, a 401 and a Roth IRA have different tax advantages.

In most cases, 401 contributions are made pre-tax, meaning they reduce your taxable income and, therefore, your tax burden in the current year. The money grows tax-deferred while its in your account, and youll pay taxes on your 401 withdrawals at your ordinary income tax rate at retirement.

A Roth IRA, on the other hand, allows you to make your contributions after taxes. While theres no tax advantage in the current year, your money grows tax-free in the account and you can withdraw both your contributions and earnings tax-free during retirement.

So which tax advantage is better? Traditional 401 contributions are generally more beneficial for taxpayers with a high income today who expect to have a lower income during retirement. In other words, you can get a tax break today if your tax rate is high, and then defer those taxes until youre in a lower tax rate. And vice versa.

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

Do I Have To Pay Taxes On Ira Withdrawal In 2020

You have taxable income of the CVD amount that you do not re-contribute, but you do not owe the 10% early withdrawal penalty that generally applies to IRA withdrawals made before age 59½. As explained in the examples, you can divide the taxable income from the CVD equally over three years, starting with 2020.

What are the new IRA rules for 2020?

On the plus side, the law raises the age at which a person must start taking the required minimum benefits to 72 years . This change is effective for any IRA owner who turns 70 in or after 2020. This allows individuals to defer distributions for up to 72 years.

Will IRA withdrawals be taxed in 2020?

Those who have received distributions from traditional IRAs at any time in 2020 will receive a Form 1099-R reporting the distributions to them and the IRS. Putting these on your tax return to minimize taxes may be a little different than in the past.

Recommended Reading: How Much Can You Put In A 401k Per Year

Ira Vs : How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

A Roth Ira Doesnt Have Required Minimum Distributions

Did you know that the IRS will force you to start taking money out of your 401k when you turn 72?

A required minimum distribution is the minimum amount you are required to withdraw from certain retirement accounts.

This amount depends on a lot of factors, but ultimately it means that you arent allowed to leave your retirement investments alone and let them compound indefinitely.

The IRS requires you to begin taking distrubutions from your 401k at age 72, even if you are still working or dont need the funds just yet!

When you withdraw from a traditional 401k, youll also pay income tax on the amount withdrawn.

The IRS doesnt want you to get rich from perpetual compounding and avoiding income taxes for too long

This is your money that you worked hard to save, and now you dont even get to decide when to withdraw it?

I know that most of us will probably be planning to use money from our 401ks by the time were 72, so this probably wont affect you too much unless you have a ton of other passive income and dont need to tap the 401k just yet.

But this rule is pretty annoying and can change your retirement strategy to optimize for tax expenses.

The cool thing about theRoth IRA is that there are no required minimum distributions.

You already paid the IRS when you put the money in the account, so they dont care when you use the money .

Youll have full control over your money and when you withdraw it. Pretty neat!

Don’t Miss: How Do I Find My 401k Account

Pros And Cons Of Iras

There are a number of pros and cons to be aware of when considering an IRA. Here are some of the most important ones to keep in mind.

Pros

- Anyone with a source of earned income is eligible.

- Non-earning spouses are also eligible to contribute.

- You have numerous investment opportunities that give you more control over how your savings are invested.

- A Roth IRA provides flexibility, including the ability to withdraw contributions penalty-free.

- Its simple to establish conventional or Roth variants.

- Roth IRAs are excellent for estate planning.

Cons

- They have relatively low ceilings, so if you want to invest more than the maximum allowed, youll need to use other investment vehicles.

- Contributions are not tax-deductible if they exceed a certain threshold.

- They dont provide you with any investment advice, so you have to make those decisions yourself.

- A 401 is an investment vehicle that allows investors to invest in real estate, private equity, hedge funds, commodities, and collectibles. Its not a specific type of fund but rather a general term for any number of different types of investments.

Should I Put A Lump Sum Of Money I Receive Into An Employers 401 Plan Or An Ira

Generally speaking, a 401 plan is likely to be more expensive than an IRA. Still, a more important issue is whether your employer makes matching contributions to the 401 plan. Some employers will match, or at least partially match, some or all of the amount their employees contribute to the 401 plan. If you are eligible for this kind of matching contribution, it could very well outweigh any fee differential between a 401 plan and an IRA.

If your employer does not make matching contributions, then there might be a couple of advantages to putting your money into an IRA rather than a 401. One of these advantages is a broader range of investment options. Depending on which 401 platform your employer uses, there may be some limitation to the investment choices available to you. Most plans have a range of options ranging from low-risk to high-risk, but you are limited to the options the plan has chosen to make available. In an IRA, you can use any legitimate investment vehicle, from savings accounts to stocks to commodities.

Another advantage of an IRA may well be a lower fee structure. If you invest in a mutual fund or other managed investment vehicle, you will pay some form of fee, whether it is in a 401 or an IRA. On top of that though, 401 plans also have record-keeping and administrative fees, which can add another layer of cost.

When you leave a job, you also stop investing in that employers 401 plan. Youll need to decide how to invest the money in that account.

You May Like: Is A 401k An Ira