Your Retirement Plan Fees Don’t Match The Value

The costs of a 401 plan can vary widely among service providers. As an employer, you should make time each year to review the fee structure of your plan and decide whether it still makes sense, given your employee utilization. If your fees seem higher than other plans, don’t hesitate to question what value you’re receiving in return. In some cases, switching 401 providers may help you bring fees down. With a lower-cost plan, you could be saving your employees money in the long run, which could help them meet their retirement goals.

Control Risk And Reduce Your Fiduciary Burden

Today, the Employee Benefits Security Administration, part of ERISA, is actively overseeing, and ensuring the integrity of, the private employee retirement system in the U.S. Sponsoring a retirement plan makes your company responsible for the investment selection and monitoring associated with your plan. Thats often more than most small or midsized companies want to take on. ADP can help you reduce this investment fiduciary burden.

- For plans working with an advisor, Mesirow Financial offers co-fiduciary or investment manager services, depending on the support needed.3

- For plans not working with an advisor, ADP’s affiliate, ADP Strategic Plan Services, LLC, is available.4

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

⢠You donât meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

⢠Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you canât meet, or they might not provide the services you want.

Recommended Reading: How Do You Roll A 401k Into Another

Dont Be Scared Lower Your 401 Fees

Cost matters when you and employees save for retirement. That said, you should replace your 401 provider when their fees drag down the investment returns of plan participants needlessly.

Fortunately, making a 401 provider switch is typically a straightforward process. Your new provider should guide you and do the heavy lifting. In general, youll just need to get them the information they need to do that. This role should only take a few hours a small price to pay for making retirement more affordable for yourself and your employees.

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Read Also: Can I Invest My 401k In My Own Business

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you’ll pay no taxes until you start making withdrawals, and you’ll retain the right to roll over or withdraw the funds at any point in the future.

The cons: You’ll no longer be able to contribute to the plan, and the plan provider may charge additional fees because you’re no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Freeze Retirement Account Changes

Under normal circumstances, participants can update their contributions, make withdrawals, or request loans at any time. But when youre in the middle of switching 401 providers, that kind of activity can complicate the behind-the-scenes work needed to make the handoff a success. Thats why switching requires you to go through a blackout period where employees cant touch their retirement accounts.

Because blackout periods can last as long as two months, companies are required to give plan participants written notice at least 30 days beforehand, per IRS rules.

Also Check: How To Transfer 401k When Leaving Company

Make Sure Your Starting And Ending Balances Match

Among the most important checks: Confirming that your post-transition account balance and investment shares match their pre-transition totals.

To do so, workers can consult the final account statement issued by the 401 plan’s former administrator and the first statement issued by the new administrator, according to financial advisors.

It may be several weeks before workers receive both documents, whether online or in the mail.

If there’s a mistake, “immediately call the record keeper and say, ‘This is the statement from the last record keeper. It shows I had a $15,000 end number, and your beginning number was $14,900. What happened to my $100?'” said Chao, providing a hypothetical example.

“If they don’t give a satisfactory answer, then you need to go to your HR to get an answer,” he added.

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arenât high fees and that the investments available work for you.

Read Also: Can Bankruptcy Take Your 401k

What To Do When Your Company Switches 401k Providers

Lately weve noticed an increased number of employers switching 401k providers with the majority of these moving to more attractive plans for the employees! Maybe they saw this recent article Lousy 401 plans may spark more lawsuits

As you may or may not know, all 401ks are not created equal. Two key areas where they can differ are quality of fund choices and expenses of these funds. Sometimes the employer pays expenses to a Third Party Administrators and outside financial advisors on behalf of the employee, but sometimes these expenses are passed on to the employee. This is on top of the mutual fund expense ratio that the employee pays.

Given the items above your employer may have decided to switch 401k service providers. If you fall under this category here is what you need to do:

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

Don’t Miss: What Is The Best 401k Fund

Other Things To Look Out For

When rolling over assets to a 401 or IRA, there are a couple of things to keep in mind. First, no amount is too small. Sharma stresses that even a small 401 account can make a big impact.

A small amount of money today can grow into a sizable sum with the power of long-term investing and compounding, particularly because money in an IRA can grow tax-free. For example, $3,000 in assets today could turn into over $40,000 at retirement if invested appropriately.

Kenny Senour, a certified financial planner for Millennial Wealth Management, cautions to keep an eye on investment options and their fees. He says, Your 401 plan may have access to a low-cost institutional share class with a high investment minimum. In this example, you may end up paying higher costs for an investment through a higher expense ratio for a comparable investment option in an IRA.

This means the same investment could be more expensive in a 401 than in an IRA.

Why Should I Move My Old 401

After you change jobs, your old employer-provided 401 can sit there forgotten, often accruing fees. Studies show leaving it behind could cost you nearly $700K in forgeone savings over 30 years. Rolling your old 401 ensures that you control where and how you invest your savings, not your former employer.

Read Also: Can You Move Money From 401k To Roth Ira

Surprise #: Your New Plan Will Probably Over

Actually, they wont overcharge you per se, because it will be according to their billing terms, but it sure feels like it. Heres what often happens.

Lets say you switch to a new 401 plan provider in September. The new 401 company bills quarterly, so you get your first invoice shortly after September 30. Thats when you find out that they charged you for July, August, and September even though the new plan is only a few weeks old.

Does this really happen? You betcha. All the time. Its all spelled out in their terms, and it suddenly dawns on you what it means when fees are billed quarterly in arrears.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Also Check: Can I Take Money From 401k To Buy A House

Switching 401 Providers What To Expect And Pitfalls To Avoid

Eric Droblyen

If your 401 provider is an insurance, mutual fund or payroll company, there is a good chance your 401 fees are too high. If youre a business owner, you have the power to lower them, but you may need to switch 401 providers to do it. This move can seem daunting if you have never done it before.

In truth, an experienced new 401 provider will lead the process and do most of the heavy lifting. Your role should take no more than a few hours. Heres what to expect and pitfalls to avoid.

Decide Where You Want The Money To Go

If youre making a rollover from your old 401 account to your current one, you know exactly where your money is going. If youre rolling it over to an IRA, however, youll have to set up an IRA at a bank or brokerage if you havent already done so.

Bankrate has reviewed the best places to roll over your 401, including brokerage options for those who want to do it themselves and robo-advisor options for those who want a professional to design a portfolio for them.

Bankrate has comprehensive brokerage reviews that can help you compare key areas at each provider. Youll find information on minimum balance requirements, investment offerings, customer service options and ratings in multiple categories.

If you already have an IRA, you may be able to consolidate your 401 into this IRA, or you can create a new IRA for the money.

Also Check: Can You Use Your 401k To Invest In A Business

Options When Employment Ends

There are a number of options an employee can take when leaving the job:

- Roll over to an IRA Rolling 401 assets to an IRA can allow participants to keep the same tax benefits, avoid penalties, choose from a wide range of investment options and, with a Roth IRA, avoid having to take distributions before theyre needed.

- Stay in the old plan Participants may be able to remain in the plan and keep the same benefits, although fees may increase and they wont be able to make contributions.

- Move to a new plan If the participants new employer accepts rollovers, participants can keep the tax benefits while consolidating their retirement plan money.

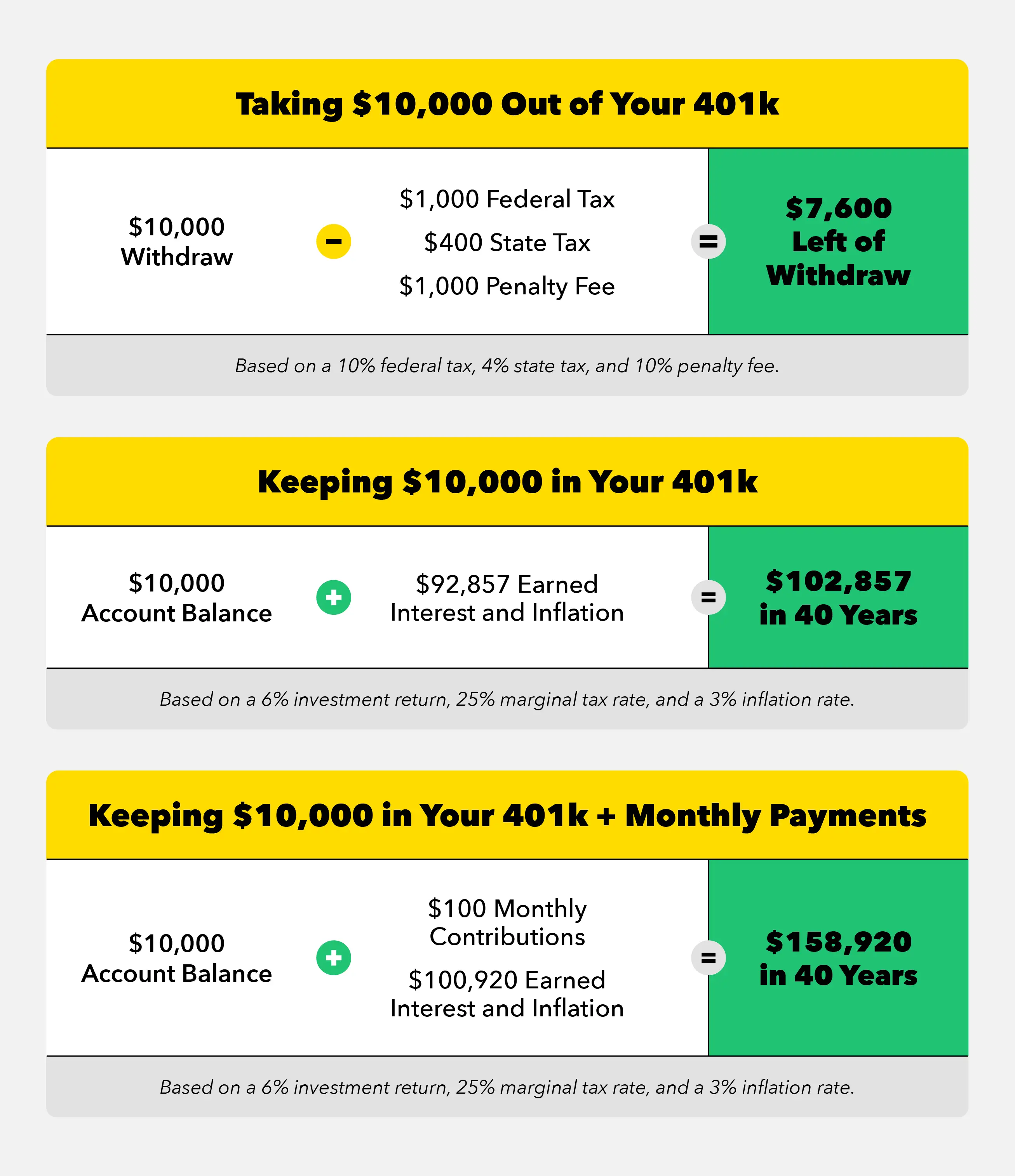

- Cash out Participants will owe applicable taxes and, if not yet age 59½ , an additional 10% early distribution tax. However, cashing out does give you cash in hand, which may make sense if you need money to take care of current needs.

To learn more about your options, contact your financial professional.

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Don’t Miss: How Much Of Your 401k Can You Take Out

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

How To Change Your 401 Provider

LAST REVIEWED Apr 01 20229 MIN READ

You want your small business to be an employer of choice so you offered the best possible 401 your company could find. But while the plan may have been a great fit at first, youre realizing it may not offer the highest value to your business or your employees year after year. From changing fee structures, to poor financial performance, to new 401 products on the market, there are several reasons you may be reevaluating your choice of a 401 provider.

Sound familiar? If youre looking to make a change, here are some tips that can help you evaluate your current provider and put a new plan in place if you do decide to switch providers.

You May Like: What Is A 401k For Dummies

Avoid These 3 Major Pitfalls

Pitfalls can easily happen during a 401 provider switch when you dont know what to look out for. Below are some common pitfalls and how to avoid them:

- Depositing Contributions Dont stop sending plan contributions to your outgoing provider until you are told to do so. Employee salary deferrals and loan repayments are always subject to deposit deadlines. When a deadline is not met, you must fund lost earnings to participant accounts and report the issue to the government on your Form 5500.

- Annual ERISA Compliance Confirm its covered for both the prior and current plan year. If nondiscrimination testing and/or Form 5500 has not yet been completed for the prior year, confirm which 401 provider will complete it. You should also confirm that your new provider has all the outgoing provider information they will need to complete nondiscrimination testing and Form 5500 for the current year.

- Fees Before you hire a new 401 provider, be sure to understand all the fees applicable to the switch. Some providers particularly insurance companies can charge punitive service termination fees. To protect the interests of plan participants, you want to keep these fees to a minimum.