Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

How To Rollover An Ira To 401

Youve opened and contributed to a traditional IRA, invested it, waited several months, and youre now ready to exercise the option to convert it into a Roth IRA. Now, because youve read the blog on how to do a backdoor Roth IRA correctly, you also know that before you do that Roth conversion, you need to move any pre-tax IRAs out of the IRA into a 401 or similar plan. This includes IRAs like a SEP IRA or a rollover IRA. While a reverse rollover may not be common, there are times a IRA to 401 rollover makes sense. In this blog, we will explain the reasons for and against an IRA to a 401 rollover and how you can do it.

Dont Miss: Can You Use Your 401k As Collateral For A Loan

How To Move A 401k To Gold Ira

The first step is finding a custodian specializing in physical precious metals IRAs. This entity will hold your gold in an IRA-approved form and lessen the transaction. Ensure the custodian is qualified and certified to administer gold IRA accounts.

Once you find a custodian, you can transfer funds from your current 401 k into a new gold IRA account. Furthermore, this process is known as a rollover, allowing you to move your retirement account from one account to another without incurring any taxes or penalties.

Your custodian should be able to provide you with the necessary paperwork and instructions for the rollover.

Once the funds are in your precious metal IRA, you can purchase physical gold. The custodian will store the precious metals on your behalf, ensuring it is in an IRS-approved form.

Finally, once you have purchased the precious metals, you can keep them in your precious metal IRA for as long as possible without incurring any penalties.

However, it would help if you kept in mind that gold does not produce any earnings, so its essential to monitor the value of the precious metal to ensure it is still performing well.

Don’t Miss: When I Withdraw From My 401k

What Is A Gold Ira

A Gold IRA is a retirement savings account that holds physical or gold-related assets, such as mining stocks and gold futures.

Unlike a traditional or Roth IRA account, which can only hold stocks, bonds, and other types of securities, a Gold IRA allows you to diversify your retirement savings portfolio by adding gold.

In addition, this is a self-directed IRA, which means you have more flexibility when deciding where to invest your savings compared to other types of IRAs. Youll also have more control over your gold IRA investments, allowing you to make strategic decisions as the market fluctuates.

Another benefit of holding gold in your IRA is that it is a tangible asset, meaning youll have something physical to show for your gold investments should you ever need to liquidate them.

This feature is essential to consider if the gold and silver markets ever experience a complete collapse, as it may be difficult to sell other assets on time during high-stress situations.

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Recommended Reading: When Do You Have To Draw From 401k

How Long Does It Take To Rollover A 401k To An Ira

How long does it take to rollover 401 to an IRA? Find out the rollover rules for moving funds from a 401 to IRA, including the time limits and costs involved.

If you are changing jobs, one of the considerations you should make is what to do with your 401 plan. Do you cash it or roll it over to an individual retirement account ? While cashing it out is an option, you will get a lower payout after tax and penalty deductions. Your best bet is to move funds to an IRA.

A 401 rollover to an IRA takes 60 days to complete. Once you receive a 401 check with your balance, you have 60 days to deposit the funds in the IRA account. If you choose a direct custodian-to-custodian transfer, it can take up to two weeks for the 401 to IRA rollover to complete.

Generally, when choosing what to do with your 401 money, remember the IRS wants the retirement money to remain in a retirement account. If you cash it out or do an early withdrawal, the distribution will be subjected to ordinary income taxes and penalties. However, moving funds from a 401 to an IRA keeps the funds intact as long as you observe the 60-day deadline.

Option : Leaving Money In Your Former Employer’s 401 Plan

Leaving money in your current 401 may be an option, depending on the terms of your plan. Many additional factors, such as the option to add money and make certain investment choices, will also depend on the terms of your plan. Here’s what you should know:

- Ability to add money: Once you leave your employer, you generally won’t be able to add money to your plan.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your former employer’s plan beginning at age 72.

Contact your plan administrator to learn more about fees and the terms of your plan. Your Participant Fee Disclosure and/or Summary Plan Description should have this information.

Also Check: How To Rollover 401k Into Fidelity

How Do I Convert My Old 401k To A Self

$6,000The contribution limits for a self-directed IRA or self-directed Roth are the same as other IRAs. The annual contribution limit for a self-directed IRA is $6,000 for those under 50.If youre age 50 or above, you can contribute up to $7,000. The contribution limit applies across all IRA accounts.

How much can you roll into self-directed IRA?In some ways, a self-directed IRA is like a traditional IRA or a Roth IRA. The account is designed to provide tax advantages, and participants must follow the same eligibility requirements and contribution limits. The maximum contribution limit for 2022 is $6,000, or $7,000 if youre age 50 or older.

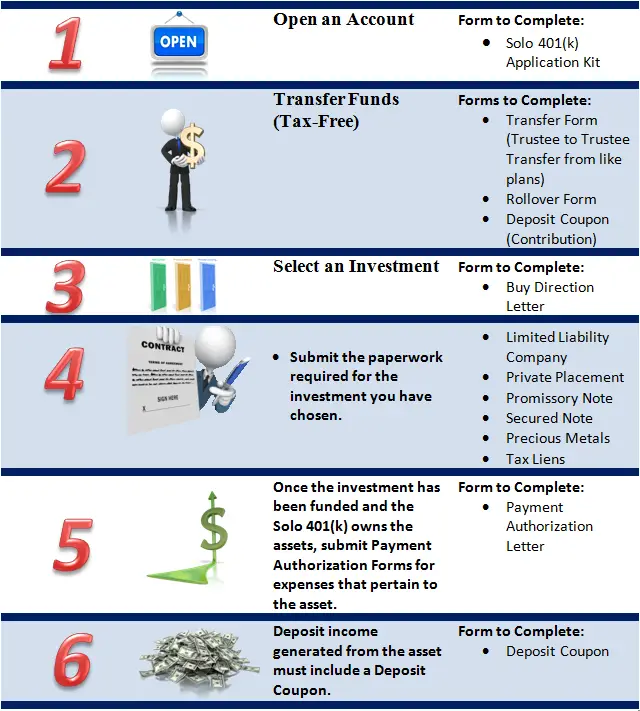

How do I rollover into a self-directed IRA?

First, open or establish an IRA at IRAR and complete our Rollover Certification Form. Then, contact your plan administrator and request the forms that you need to complete to move the plan assets or retirement savings to the self-directed IRA. The transfer of accounts can be done from one custodian to the other.

How much money can you put in a self-directed IRA?

$6,000In many ways, a self-directed IRA follows the same template as a standard IRA. The annual contribution limit is the same: $6,000 in 2021 and 2022. You can choose to open a self-directed IRA as a traditional IRA or a Roth IRA, with the same pre-tax and post-tax contribution rules.

What are the disadvantages of rolling over a 401K to an IRA?

A few cons to rolling over your accounts include:

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Read Also: What Is The Maximum Contribution For A 401k

Choose Your 401 Rollover Destination

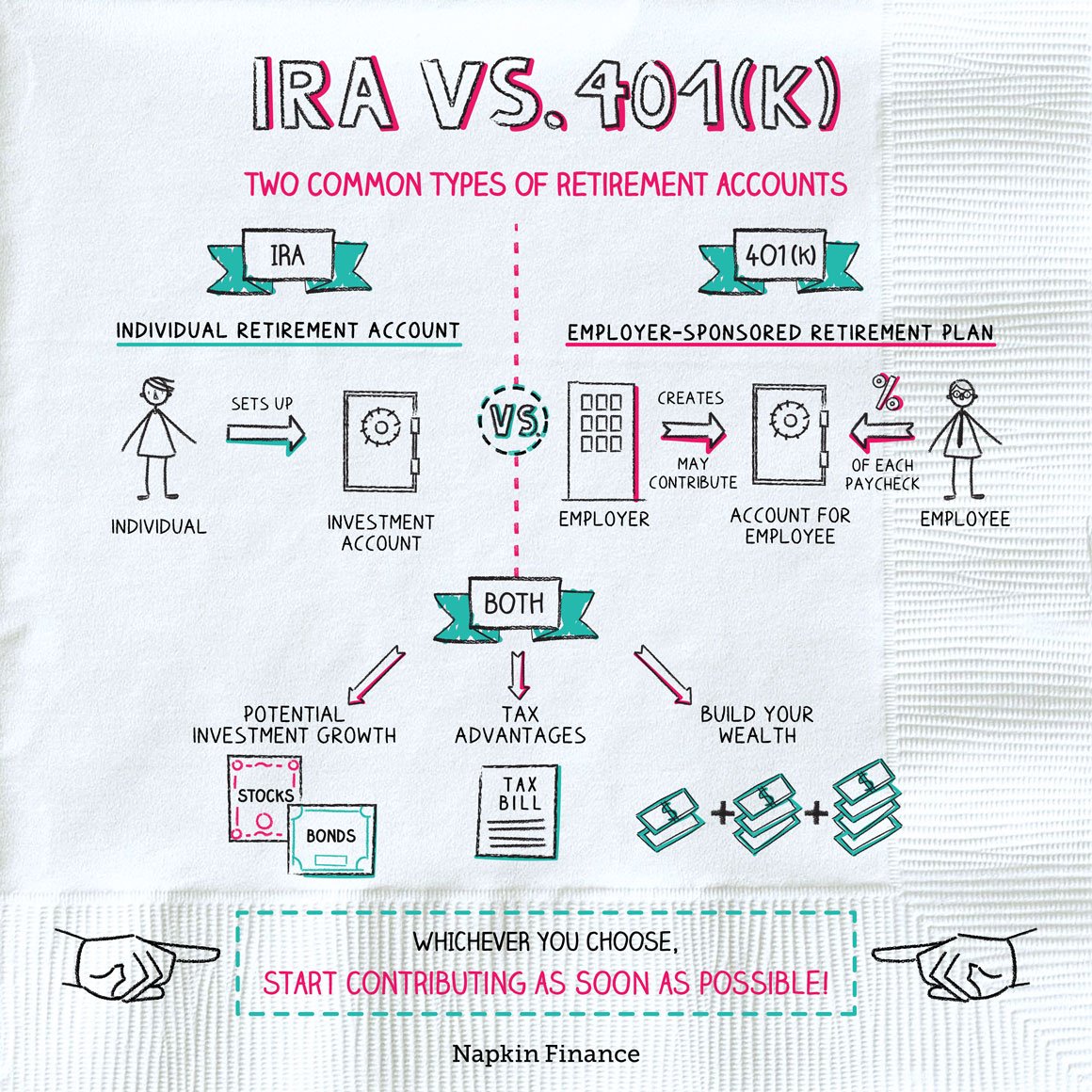

Consider whether a traditional IRA or Roth IRA makes the most sense for your 401 rollover.

401 Rollover to Traditional IRA: If you want to maintain the same tax treatment, this can be a good choice, Henderson says. You avoid extra hassle, and you just see the same RMD and tax treatment as you would with your current 401.

401 Rollover to Roth IRA: For those with high incomes, the 401 rollover to a Roth IRA can serve as a backdoor into a Roth tax treatment. But dont forget about the taxes, Henderson says. In addition, remember the five-year rule when it comes to Roth accounts: Even at 59 ½, you cannot take tax-free withdrawals of earnings unless your first contribution to a Roth account was at least five years before. Those close to retirement, therefore, may not benefit from this type of conversion. Talk to a tax professional if youre rolling into an account with different treatment, says Henderson.

How Does A Precious Metal Or Gold Ira Works

The precious metal IRA allows investors to purchase gold by using their money.

The precious metal is then held in an account that has the same rules as any other IRA account. The difference is that it holds bullions coins or bars instead of holding paper assets.

There is a set of rules for this Precious metal IRA that are quite similar to the 401k plan:

1) You can withdraw money after 59 ½.2) You need to take out your money or your contributions after 70 ½.3)The value of the account grows tax-deferred

Recommended Reading: How Do I Get My 401k Money From Walmart

You May Like: What’s The Max You Can Put In 401k Per Year

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

Can I Roll My 401 Into A Roth Ira Without Penalty

You May Like: Can I Open A Roth 401k On My Own

Also Check: How Does A Solo 401k Plan Work

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

Recommended Reading: Can I Cash Out My 401k From Previous Employer