Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

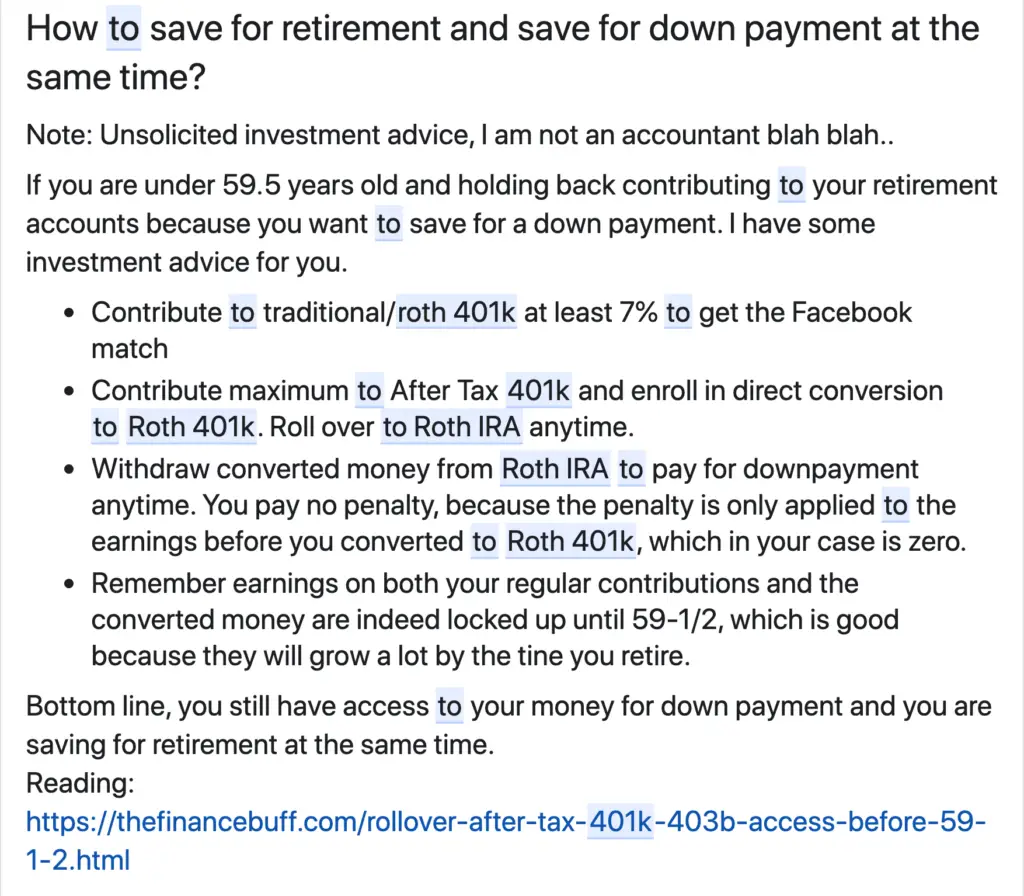

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2021, the contribution limits are $19,500 if you’re under age 50. If you’re 50 or older, you can add an extra $6,500 catch-up contribution for a total of $26,000. In 2022, the amount is $20,500.

Plus, many employers will match some or all of the money you contribute. A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $19,500 or $26,000 , or $20,500 in 2022, with the $6,500 catch-up amount, depending on your age.

Can I Max Out 401k And Ira In 2022

A 401 plan has a higher contribution limit than a traditional or Roth IRA$20,500 versus $6,000 in 2022. You can contribute more if youre 50 or older, and there are special rules if you participate in both types of retirement plans.

Can I max out a 401k and an IRA in the same year?

Limits on 401 plan contributions and IRA contributions do not overlap. As a result, you can contribute fully to both types of plans in the same year as long as you meet the different eligibility requirements.

What is the max 401k and Roth contribution for 2022?

After taxes starting in 2022, employees under the age of 50 can defer up to $20,500 of their wages into a pre-tax regular account or a Roth 401 account. However, you can make additional after-tax contributions to your traditional 401, allowing you to save more than the $20,500 cap.

Tax Breaks For Roth Ira Contributions

The incentive for contributing to a Roth IRA is to build savings for the futurenot to obtain a current tax deduction. Contributions to Roth IRAs are not deductible for the year when you make them rather, they consist of after-tax money. That is why you dont pay taxes on the funds when you withdraw themyour tax bill has been paid already.

However, you may be eligible for a tax credit of 10% to 50% on the amount contributed to a Roth IRA. Low- and moderate-income taxpayers may qualify for this tax break, called the Savers Credit. This retirement savings credit is up to $1,000, depending on your filing status, AGI, and Roth IRA contribution.

Here are the limits to qualify for the Savers Credit for the 2022 tax year:

- Taxpayers who are married and filing jointly must have incomes of $68,000 or less.

- All head of household filers must have incomes of $51,000 or less.

- Single taxpayers must have incomes of $34,000 or less.

The amount of credit that you get depends on your income. For example, if you are a head of household whose AGI in the 2022 tax year shows income of $29,625, then contributing $2,000 to an IRA generates a $1,000 tax credit, which is the maximum 50% credit. The IRS provides a detailed chart of the Savers Credit.

The tax credit percentage is calculated using IRS Form 8880.

Don’t Miss: What Happens To Your 401k If You Leave Your Job

Choose Where To Open Your New Ira Account

You have a few different options here, but it is important to do your research to make sure you are getting the best deal. Most people choose online brokerages because they offer low-cost trading and a wide variety of investment options.

You may also opt for a full-service broker, but this will likely come at a higher cost. Finally, some people choose to set up their IRA account with their current bank.

Dont Miss: Where Can I Get A 401k Plan

Option : Cashing Out Your 401

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means youll have to pay taxes on the withdrawal, and theres typically an additional 10% tax penalty if youre younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If youre considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine whats important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

Don’t Miss: How To Transfer 401k To Another Account

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

Fees and Expenses

How To Contribute To A Roth Ira

You open and contribute to a Roth IRA independently of any particular job or employer. There is a much lower IRA contribution limit: $6,000 in 2022, or $7,000 if you are age 50 or older.

IRAs are not eligible for any sort of matching contributions. However, they typically offer a much broader range of investment options than the limited menu of funds offered by the average 401 plan.

But its the freedom from paying income tax on withdrawals that is the Roth IRAs biggest superpower. In addition, there are no mandatory withdrawals once you turn 72so-called required minimum distributions .

The beauty of being able to contribute to a Roth IRA is that a portion of your retirement savings are not subject to ordinary income tax upon withdrawal, and you are never mandated to start withdrawing, says Whitney.

Don’t Miss: Should I Rollover My 401k Into A Roth Ira

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Confirm The Roth Is Right For You

| Tax benefits |

Any potential earnings grow tax-free and may not be taxed when you withdraw money in retirement.1 |

|---|---|

| Access to your money |

You can withdraw your contributions at any time, for any reason, without taxes or penalties. |

| Flexibility |

As long as you have earned income , you can contribute to a Roth IRA. |

Also Check: How Much Do You Get Taxed On 401k

Can I Contribute To A Traditional Or Roth Ira If Im Covered By A Retirement Plan At Work

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan . See the discussion of IRA Contribution Limits. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels, you may not be able to deduct your entire contribution. See the discussion of IRA deduction limits.

Also Check: Can I Transfer Money From 401k To Ira

Rolling A 401 Directly Into A Roth Ira

If you qualify, you can do an eligible rollover distribution from your old 401 directly to a Roth IRA. You’ll owe taxes on the amount of pretax assets you roll over.

Note also, if you have assets in a Designated Roth Account ) and would like to roll these to an IRA, the assets must be rolled into a Roth IRA.

As with Traditional IRA conversions to Roth IRAs, if you are required to take an RMD in the year you roll over into an IRA, you must take it before rolling over your assets.

Recommended Reading: How To Transfer 401k Without Penalty

Can I Get A Distribution While I Am Still An Employee And Roll Over That Distribution As An In

Your plan may limit in-plan Roth rollovers to distributable amounts. If so, your plan may allow an in-service distribution of vested amounts in your plan accounts that you may be able to roll over to a designated Roth account in the same plan. Your plan must state the rules for when you may obtain an in-service distribution.

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Read Also: How Do I Sign Up For 401k

Also Check: How To Cash Out My 401k

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but there’s the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure you’re allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether you’re allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much you’d like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can’t do a partial conversion but don’t want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There aren’t any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

The Ins And Outs Of Opening And Contributing To A Roth Ira

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

You May Like: How Much Can You Transfer From 401k To Roth Ira

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Retirement Plans Faqs On Designated Roth Accounts

A designated Roth account is a separate account in a 401, 403 or governmental 457 plan that holds designated Roth contributions. The amount contributed to a designated Roth account is includible in gross income in the year of the contribution, but eligible distributions from the account are generally tax-free. The employer must separately account for all contributions, gains and losses to this designated Roth account until this account balance is completely distributed.

These FAQs provide general information and should not be cited as legal authority.

You May Like: How To Find My 401k Money

Is A Rollover Or Transfer Right For You

Speak with one of our trusted Financial Consultants.

MondayFriday, 8 a.m.8 p.m. ET

*Consider all available options, which include remaining with your current retirement plan, rolling over into a new employer’s plan or IRA, or cashing out the account value. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses, availability of services, and distribution rules . Depending on your plan’s investment options, in some cases, the investment management fees associated with your plan’s investment options may be lower than similar investment options offered outside the plan.