How To Roll Over An Old 401

8 Minute Read | September 27, 2021

Back in the old days, it was pretty common for someone to work for the same company for 40 years before retiring with a nice pension and a gold watch. Well, those days are long gone.

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.1 Did you hear that? Twelve! And younger generations are even more likely to look for greener employment pastures. In fact, almost a third of millennials say they would quit their jobs as soon as possibleif they could.2

But in the process, many American workers are leaving behind a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind!

Theres even a name for those retirement accounts that are left behind: orphan 401s. Even the name is sad! Its time to stop for a minute and think about giving the money in those long-forgotten accounts a new home.

Thats where rollovers come in.

Dont Miss: Do I Need Ein For Solo 401k

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: How To Figure Minimum Distribution On 401k

A Possible Backdoor Solution

There is a possible solution in what’s called a “backdoor Roth.” Currently, it’s possible to convert a traditional IRA to a Roth IRA even if you’re above the income limits . Basically, you first open a traditional IRA and make a contribution. There are no income limits for making a contribution to a traditional IRA, but you may not be able to deduct the amount.

You then convert that IRA to a Roth. You’d have to pay income taxes on any deductible contributions and earnings converted to the Roth, but from then on, you’d enjoy the tax-free benefits. This works well if you’ve never had a traditional IRA before. However, if you have an existing IRA, the distribution rules get more complicated.

If this is something you think might work for you, I recommend talking to a financial or tax advisor before taking action.

Rolling A 401 Into A Sep Ira

One possible situation that we havenât yet discussed is switching from being employed by another party to becoming self-employed or a business owner. In this scenario, transferring the contents of your 401 into a might be the better choice.

What is a SEP IRA? The SEP part stands for simplified employee pension and it is a self-directed individual retirement account that works quite similarly to a traditional IRA. Like a regular IRA, a SEP offers tax-deferred growth but you will have to pay taxes when withdrawing the money.

There are two main differences that make up the advantage a SEP has over a regular IRA for one, the contributions are tax-deductible, and two, the contribution limit is much larger. In comparison with a regular IRAâs contribution limit of $6,000 $6,500, an for 2022 is $61,000 and will increase to $66,000 in 2023.

Also Check: Can I Have A 401k If I Am Self Employed

Converting The Traditional Ira To A Roth Ira By Means Of Backdoor Roth Conversion

The next step begins once the assets from the 401 are safely tucked away in your traditional IRA. The next thing to do is to convert or transfer the assets from the traditional IRA to the Roth IRA and this is done via backdoor Roth Conversion.

Much like the last step, this process entails contacting your custodian or account manager for a Roth conversion form. Once that is filled out, signed, and submitted, it should only take another day or two for the funds to arrive in your Roth IRA.

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Recommended Reading: How Do I Look At My 401k

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Recommended Reading: Can You Leave Money In 401k At Your Old Job

Not Investing Your Funds

Its not enough just to open the account, Goedtel explained. I see a lot of people who open an account, make the contribution, but then just leave it in cash. Thats like putting all the ingredients together for a cake and never baking it. The best part of a Roth IRA is the tax-free growth. Its not growing if its sitting in cash.

In addition to simply funding your account, you need to decide how youre going to invest those funds. If you arent sure of a good investment strategy, consider reading up on the subject or asking a financial professional for help. Otherwise, youll miss out on the magic of compound interest and your money wont be as helpful when you retire.

You May Like: Can I Withdraw My 401k If I Quit My Job

Read Also: Should I Roll My 401k Over To An Ira

Rollover To A Roth Ira Or A Designated Roth Account

Are you eligible to receive a distribution from your 401, 403 or governmental 457 retirement plan?

You can roll over eligible rollover distributions from these plans to a Roth IRA or to a designated Roth account in the same plan .

You may want to note the differences between Roth IRAs and designated Roth accounts before you decide which type of account to choose. For example, when you reach age 70 1/2, you may have to take required minimum distributions from designated Roth accounts, but not from Roth IRAs.

Roth IRAs and designated Roth accounts only accept rollovers of money that has already been taxed. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Withdrawals from a Roth IRA or designated Roth account, including earnings, will be tax-free if you:

- have held the account for at least 5 years, and

Mistake #: Withdrawing Earnings Too Soon

Original contributions to a Roth IRA are treated differently than earnings you make on investments in your account. In general, you can withdraw Roth IRA contributions any time without tax or penalty.1 But to withdraw any earnings tax-free, you must be 59½ or older and have had your account for at least five years. If you withdraw them before this time, you may owe a 10% penalty and ordinary income tax on the earnings.

That said, the IRS does allow some exceptions for investors under 59½. For example, you might qualify for an early withdrawal without tax or penalty if you use the money for a first-time home purchase , for adoption expenses, or if you become disabled.2

“While it might be possible to take an early withdrawal, we generally recommend leaving Roth IRA assets alone as long as possible,” says Hayden. “That way, your money will have longer to potentially benefit from tax-free growth.”

Read Also: Can You Convert A 401k To An Ira

Roth Iras Have Income Limits

While anyone can contribute to a regular IRA when it comes to Roth IRAs, the IRS does discriminate and it does so based on annual income. The rationale behind this particular piece of regulation was that it would prevent high earners from somehow abusing the tax-advantaged nature of a Roth IRA as an investment vehicle.

The way that these income limits work is through a process of gradual phasing out. Once a certain threshold is reached, individuals, can contribute less money to a Roth IRA on an annual basis than those who earn less.

As income grows, the limit grows ever tighter until, at one level of income, investing in Roth IRAs becomes impossible.

The points at which these income caps kick in and come into play arenât set in stone they are adjusted each year with an eye toward inflation. For example, in 2021, the phaseout range for single filers began at $125,000 in MAGI, and the point of total exclusion was set at $140,000.

In the same years, married couples who filed jointly saw phaseouts begin at $198,000, with the point of total exclusion being $208,000.

There are two crucial pieces of good news, though the first is that converting a 401 into a Roth IRA sidesteps the issue of income limits completely.

Rolling Over Into A New 401

When transferring jobs, it might be possible to also transfer your previous 401 into the 401 plan of your new employee. The easiest way to check if this is available is by getting in touch with the plan administrator for the new 401 program.

There are some conditions that can apply. For example, some employers require that a certain amount of time while employed has passed before the old 401 can be rolled over into the new one. If you choose to go this route, you will not owe any additional taxes.

You May Like: What Is The Difference In An Ira And A 401k

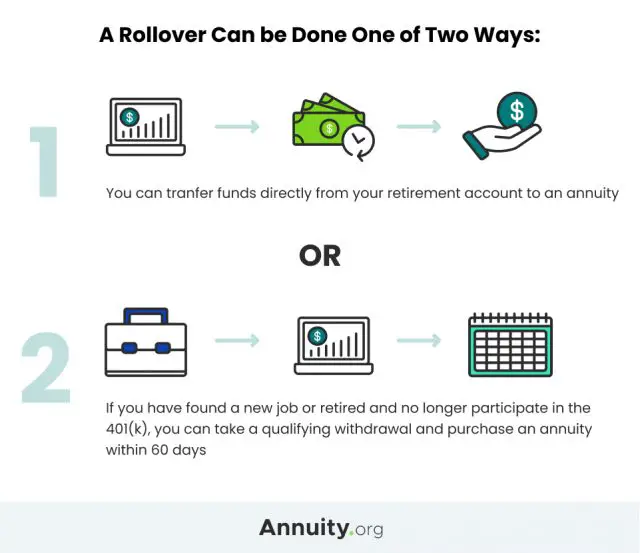

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesn’t offer a 401 or offers one that’s less substantially less advantageous. For example, if the old plan has investment options you cant get through a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think you’ll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

You might want to stick to the old plan, too, if you’re self-employed. It’s certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Some things to consider when leaving a 401 at a previous employer:

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

Don’t Miss: When Can I Take Money From My 401k

Open A Roth Ira Account

Start by opening a Roth IRA account through brokerage or Robo-advisor.

If you want to manage your investments, you can open a Roth IRA with a broker so that you can buy and sell investments on your own. An alternative is to open a Roth IRA with a Robo-advisor if you want a managed retirement service.

Dont Miss: How To Get Old 401k Money

How Much Can I Roll Over Into A Roth Ira

A rollover is considered a balance transfer from one retirement plan to another retirement plan and does not count toward the annual Roth IRA contribution limits.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Don’t Miss: How To Transfer 401k To Ira Fidelity

Roll Over Your 401 To A Traditional Ira

If you’re switching jobs or retiring, rolling over your 401 to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are tax-deferred1 retirement accounts.

- Pros

-

- Your money can continue to grow tax-deferred.1

- You may have access to investment choices that are not available in your former employer’s 401 or a new employer’s plan.

- You may be able to consolidate several retirement accounts into a single IRA to simplify management.

- Your IRA provider may offer additional services, such as investing tools and guidance.

- Cons

-

- You can’t borrow against an IRA as you can with a 401.

- Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a 401.

- Some investments that are offered in a 401 plan may not be offered in an IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

- Whether or not you’re still working at age 72 RMDs are required from Traditional IRAs.

Requesting A Direct Rollover To The Traditional Ira

Once the first step is taken care of, investors will need to contact the administrator of their current 401 plan and request a direct transfer of the funds in the plan to their traditional IRA account. Investors should also take care to request a direct custodian-to-custodian transfer and also emphasize to their current plan administrator that this is a non-taxable transfer.

Once that is done, the plan administrator will give investors a couple of forms. Investors will need to provide details about the account as well as the new custodians and may be required to give specific wire instructions.

Once those forms are filled and submitted, the process has begun and there is nothing to do but wait usually no more than a day or two. Keep in mind that wire transfers might incur a small fee and that wire transfers are the most common method of custodian-to-custodian transfers.

Don’t Miss: Why Move 401k To Ira