How Long Does It Take To Transfer 401 Money To The Bank

Transferring funds from a 401 account to a bank account can take seven to 10 days or more. This period includes a withdrawal processing period which can be anywhere from five days to seven days. After that, the funds will be released, and you can expect to receive the withdrawal in one or two days if you selected direct deposit or up to five days if you opt to receive a mailed check. However, this duration may vary depending on the plan custodian.

Generally, 401 funds are invested in mutual funds, which mainly comprise stocks and bonds. When you make a withdrawal request, your, and the proceeds transferred to the 401 plan administrator. Once the plan custodian receives the money, the funds are transferred to your bank account via direct deposit or mailed check.

Consider Converting Your 401 To An Ira

Individual retirement accounts have slightly different withdrawal rules from 401s. So, you might be able to avoid that 10% 401 early withdrawal penalty by converting your 401 to an IRA first. s and IRAs, of course.) For example:

-

Theres no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. You still have to pay the tax when you file your return, though. So if youre in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know theyre getting refunds.

Withdrawing Funds Between Ages 55 And 59

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan after leaving your job in order to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure you understand the rules around the age requirement for penalty-free withdrawals. The age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59½.

Don’t Miss: What Age Can I Withdraw From 401k

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Dont Miss: How To Find Out 401k Balance

How To Withdraw Money From A 401 After Retirement

Shawn Plummer

CEO, The Annuity Expert

When you retire, one of the first things youll want to do is figure out how to access your 401 funds. This can be a little confusing, as there are several ways to go about it. This guide will walk you through the process of withdrawing money from your 401 after retirement. We will also answer some common questions, such as do you pay tax on 401 when you retire? and how do you not run out of 401 money. So read on for all the information you need to make the best decisions for your retirement!

Don’t Miss: Can 401k Be Split In Divorce

Who Qualifies To Take A Cares Act 401k Withdrawal

To qualify for the tax penalty exemption:

- The account owner, their spouse, or dependent must have been diagnosed with COVID-19 by a CDC-approved test, or

- The account owner must have experienced adverse financial consequences as a result of COVID-19-related conditions. For example, adverse financial consequences might include a delayed start date for a job, a rescinded job offer, quarantine, lay off, job furlough, reduction in pay or hours, a reduction in self-employment income, the closing of a business, an inability to work due to lack of child care, or other factors.

The IRS explains those qualifications in more detail in Notice 2020-50, Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans Under the CARES Act.

Read Also: How Much Can You Put Into A 401k Per Year

How To Calculate 401 Income After Retirement

Before you retire, you will want to calculate how much income you will need to cover your expenses. Make sure to account for inflation and rising costs of living. You can use a retirement calculator to help you with this.

Once you know how much income you need, you can start planning how to generate that income from your 401. Our annuity calculator can help you estimate how much income you can generate from your account.

Read Also: Can You Invest 401k In Stocks

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59½ even if you haven’t yet retired. The best idea for old 401 accounts is to roll them over when you leave a job. You won’t be hit with penalties if you withdraw from your old accounts if you’re at least age 59½. But you should check with your human resource department about the rules for withdrawing from your current 401 if you’re still in the workplace.

Read Also: How Do I Get My 401k Money From Walmart

What Hardship Withdrawals Will Cost You

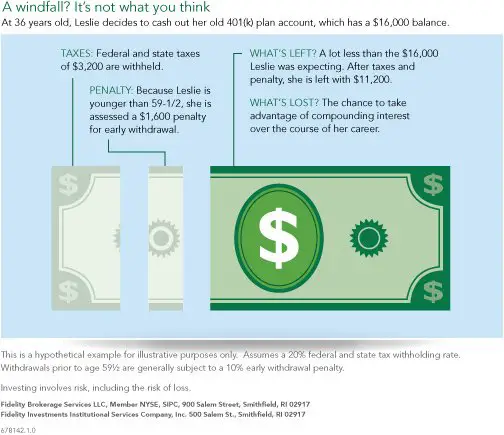

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Read Also: What Percentage Should I Contribute To My 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. Its a free service, and it only requires your Social Security number.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Recommended Reading: How Much Can I Put In A Solo 401k

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

It’s fairly easy to put money into a 401, but getting your money out can be a different story. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal.

But 2022’s high inflation, rising interest rates and rocky stock market all have some investors itching to cash out early. In a November 2022 Wells Fargo & Company study,

If you’re thinking of cashing out a 401 before you reach 59½, proceed with caution. You could pay a steep price.

» Dive deeper:What to do when the stock market is crashing

Don’t Miss: How Do I Take Money Out Of My Fidelity 401k

You May Owe A Penalty In Addition To Any Taxes Due

Unless youre facing one of the IRS-defined hardships and youre below 59 ½ you will likely be liable for an additional 10% early withdrawal penalty. These costs can add up quickly and can take a huge bite out of your retirement savings, so make sure you really need the money before you opt to cash out.

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

You May Like: Can You Contribute To 401k After Leaving Job

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

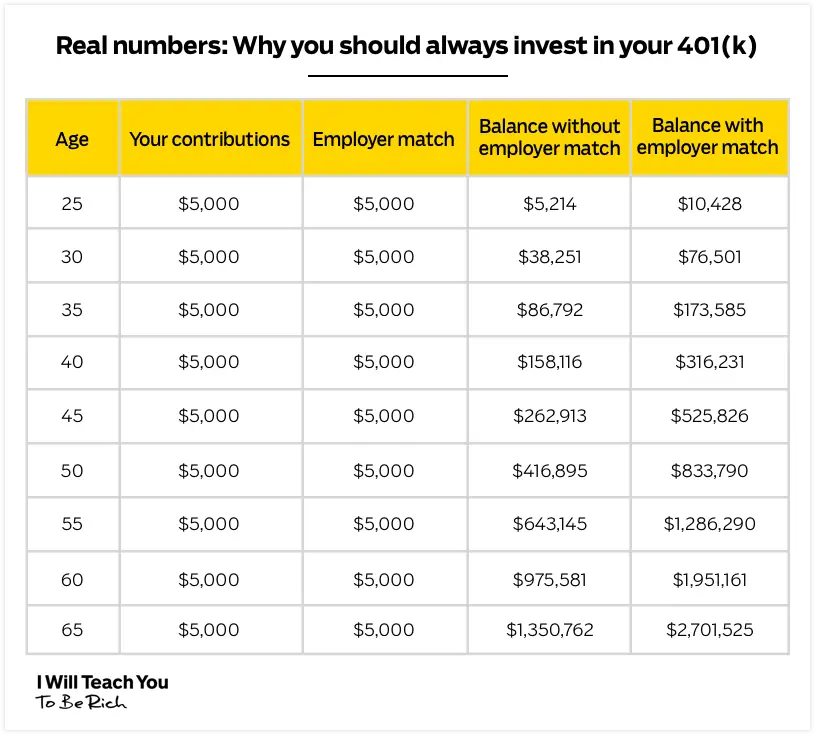

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

What If You Cant Pay Back The 401 Loan

The main downside of a loan occurs if you either cant repay the loan or, in some cases, if you leave the employer prior to having paid off the loan.

If you default on the loan this becomes a distribution that is subject to taxes and to a 10% penalty if you are younger than 59 ½.

In some cases, leaving the company with an unpaid loan balance may trigger a distribution, but your plan may have repayment provisions that extend after you leave the company that allow for repayment without triggering taxes or a penalty.

Its always best to check with your companys plan administrator so you can fully understand the provisions of the loan.

You May Like: How To Open 401k For Small Business

Recommended Reading: How To Contribute To Retirement Without 401k

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Roll Over Your 401 To A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Dont Miss: Can You Contribute To 401k After Leaving Job

Recommended Reading: Can I Contribute To Traditional Ira And 401k

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.