S To Roll Over Your 401

Before you can roll over your 401, youll need to open an account to roll it into. Consider your options, like your new employers 401 or an IRA.

Dont Miss: How Do I Rollover My 401k To My New Job

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

How Do I Get A 401 Loan

Not all, but most employer-sponsored 401 plans allow their participants to take out 401 loans. It is an excellent way for employees to tap into their retirement funds without paying income taxes and early withdrawal penalties.

If your 401 plan utilizes an online portal to do the operations of its accounts, you can apply for a 401 loan from there. This option usually is the quickest as it doesnât have to go through a person to facilitate the loan process. From application to approval, it can take anywhere from a couple of business days up to a week.

401 plans that donât have an online presence can still offer 401 loans. Youâll need to contact your planâs administrator or human resource department and complete an application form. This process may take a little more time since a person will need to review your documentation and grant an approval.

Also Check: How Long Does A 401k Rollover Take

Don’t Miss: How To Get Money From 401k Fidelity

How Much Can You Borrow In 401 Loans

Every loan no matter the type or where you get it from will come with a limited amount you can borrow. What makes your 401 different is that you are borrowing from your own account. This means that you cannot borrow more than your account value. At the same time, your employer will not allow you to take out everything you have in the account as a loan.

So, how much can you borrow from your 401?

According to Fidelity Investments, you can borrow up to 50% of your total account savings per year. Also, the maximum amount you can borrow cannot go over $50,000. In addition, you must pay off all your 401 loans within 5 years. Some companies will require consent from your spouse or family members. Finally, there might be a limited number of outstanding loans you can have on your account.

These rules will differ from one employer to another. Some employers do even allow 401 loans.

Roll The Money Into An Individual Retirement Account

Another option is to open what is known as a rollover IRA, a retirement account that exists to consolidate other retirement accounts in one place. Its like a basket into which you can throw all of your old 401s. Money moved into a rollover IRA remains tax-deferred for retirement, and you can invest it in any way you choose.

Read Also: What Is The Difference In A 401k And An Ira

Inaction Can Lead To Automatic Cashing Out

It may seem odd, but you can choose to do nothing.

Many employers allow former employees to leave 401 accounts invested in the companys plan. You will not be able to make future contributions to this specific account, but the investment portfolio will otherwise continue as normal. It will grow based on its underlying investments. You can make changes to the assets based on the rules and preferences of this specific 401 account. And the existing account manager will continue to oversee these investments. Most companies use an outside financial firm to manage their 401 accounts, so your ongoing relationship would be with that firm rather than with your former employer.

Not every employer allows this though. If you have a relatively small amount of money in your account, some employers will close out your 401 automatically when you leave.

If you have less than $1,000 in your account, the IRS allows your employer to automatically cash you out of its plan. In this case you will receive a check for the account balance. Your employer will withhold income taxes, but you will not pay early withdrawal penalties as long as you place this money into a qualified retirement plan, generally an IRA, within 60 days.

If you have more than $5,000 in your account, many employers will allow you to keep your account in place. However, even then they may apply onerous terms such as high maintenance fees and access restrictions. Plans like this are rarely a good option for retirement savers.

How To Transfer 401 To A New Job

If you want to transfer your 401 to your new employer then you must contact both your old and new 401 plan administrator. Your new 401 plan administrator can confirm if they will accept the transfer, and can give you the details you need for the rollover. You will likely need to fill up a rollover form with your old 401 plan administrator to initiate the transfer.

Don’t Miss: Can I Withdraw From My 401k To Buy A House

What To Do With Your 401 When You Leave A Job

DNY59 / E+ / Getty Images

You’ve landed your dream job, or you’ve been laid off, and you’re ready to say goodbye to your current employer. But before you go, you have some decisions to make about your 401.

While there may be some guidance from human resources, is generally up to you to decide what you should do with your retirement savings when you change jobs. So, what happens to your 401k plan when you leave a job?

Cashing Out A 401 After Leaving A Job

The IRS established the 401 as a tax-advantaged plan for employees, rather than the self-employed. This works fine most of the time, but in an era when people change jobs far more often than they used to it also has created some confusion. What do you do with this account, thats supposed to grow over decades, when you change employers? There are a few common options. A financial advisor can offer you valuable insight and guidance on handling tax-advantaged accounts.

Recommended Reading: Is A Rollover From A 401k To An Ira Taxable

Keeping Your 401 With Your Previous Employer

The easiest choice in the short term may be to simply leave the money with your previous employer if that’s an option. This route may make sense if you like the investment options your previous company offered, or they came with lower fees than those at your new job.

There are also some potential downsides here, too. You can’t add new funds to the account and managing more than one retirement account could make it more difficult to track your overall savings.

What Happens To My 401k If I Get Fired Or Laid Off

Getting laid off or fired can be a scary experience. Make sure all of your financial bases are covered, including your 401k.

If youve been let go or laid off, or even if youre worried about it, you might be wondering what to do with your 401k after leaving your job.

The good news is that your 401k money is yours, and you can take it with you when you leave your old employer. Whether that means rolling it over into an IRA or a new employers 401k plan, cashing it out to help cover immediate expenses, or simply leaving it in your old employers 401k while you look into your options, your money isnt going anywhere.

You May Like: Can You Move Money From 401k To Roth Ira

When Is It A Bad Idea To Take Out 401 Loans

You should always avoid 401 loans as much as possible, especially if one or more of the following conditions is true:

- If you can find money from other alternatives

- You are thinking about changing jobs

- When you are in financial hardship already

- You are borrowing money to finance expensive purchases or luxury items

- Your company is undergoing financial difficulties or has been acquired by another company which could end with restructuring

- When you are close to retiring

If any of the above conditions are true, you should not borrow against your own 401 retirement plan.

Also Check: Can You Convert Your 401k To A Roth Ira

Plan Options When You Leave A Job

If you have an employer-sponsored 401, you will likely be faced with four options when you leave your job.

- Stay in the existing employers plan

- Move the money to a new employers plan

- Move the money to a self-directed retirement account

Before deciding, here are a few things to consider with each option.

Recommended Reading: How Do I Take Money Out Of My Fidelity 401k

Rolling Over Your 401 Into An Ira Or New 401

Some workers like having all their retirement funds in one place. If that’s you, you might consider rolling over your old account into either your new 401 plan or an individual retirement account .

One of the advantages of moving your funds into your new employer’s plan, if it allows a 401 rollover, is the ability to manage all your workplace retirement assets from one place. You can also opt to roll your funds into an IRA, which may offer a greater range of investment options than a 401 or similar plan.

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement-related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or, if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

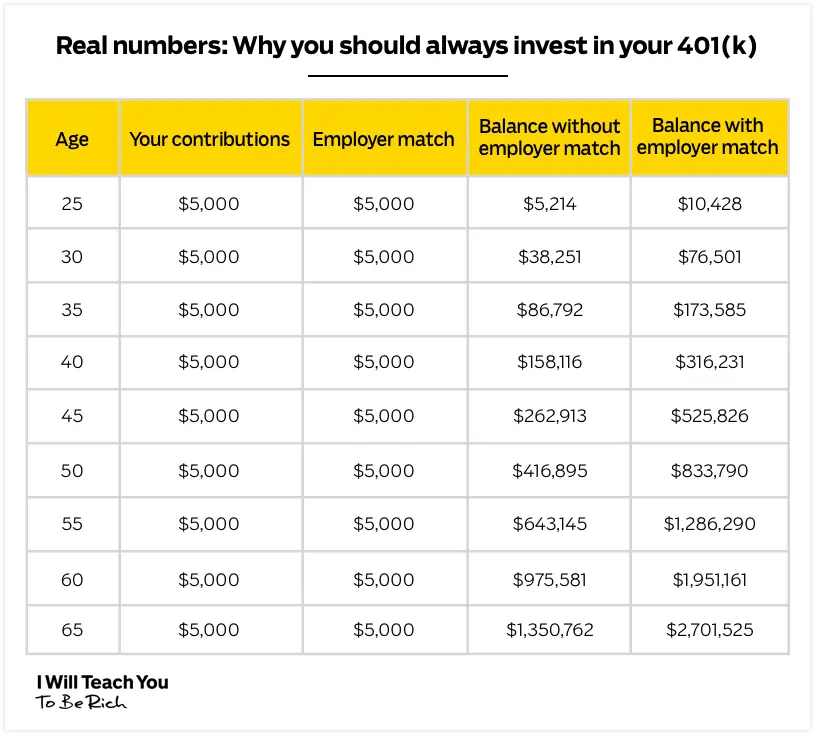

Based on historical rates of return, a $3,000 cash-out at age 24 leads to $23,000 less in your projected account balance at age 67 a total of 5 percent. Even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

You May Like: Can I Use My Fidelity 401k To Buy Stocks

How Do I Transfer An Old 401 To My New Job

Even if youre happy at your job, its always a good idea to keep your options open. If youre considering a move to a new company, one of the first things youll need to do is figure out what to do with your old 401. Fortunately, transferring an old 401 to your new job is usually a pretty straightforward process.

So, if youre planning a job change, dont forget to take care of your retirement savings. With a little effort, you can ensure that your hard-earned money stays right where it belongs in your pocket.

Look For New Investment Options

If you dont love the investment options or fees in your new 401, you may choose instead to roll the funds over into an IRA account. Rolling assets into a traditional IRA is relatively simple and can be done with a direct transfer from your 401 plan administrator. If your old 401 plan allows you to make a rollover into a Roth IRA, youll have to pay taxes on the amount that you convert.

The advantage of rolling funds into an IRA is a wider array of investment options. For example, a 401 might offer a handful of mutual funds or target-date funds. Whereas in an IRA, you have access to individual securities like stocks and bonds and a wide variety of mutual funds, index funds, and exchange-traded funds.

Don’t Miss: How To Find 401k From An Old Employer

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs aren’t sponsored by employersyou own them directlyyou won’t have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether you’re employed. Also, you’ll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

Before You Set Your Last Day

You’ve accepted an offer, and you’re looking forward to those greener pastures you see up ahead. Once again, consider taking a beat before you finalize your exit plans, as setting your last day strategically might help you maximize your benefits. In particular, look into the following:

If you have any doubts about your old or new employer’s policies, find someone in HR who can answer your questions . You might find that you’re still going to miss out on some benefits, even after finagling your last day, or decide that leaving sooner is still worth it for you. But at least you’ll be making a fully informed decision.

Closing a health insurance gap

Also Check: How Often Can I Rollover 401k To Ira

You Can Roll Your Plan Into An Ira

If youre undecided on where to move the funds, you have a third option: an Individual Retirement Account, or IRA. If you go this route, you can always move the account back into a future employers 401 plan later on. Using an IRA provides additional flexibility until you decide where you ultimately want to invest the proceeds.

Moving the funds into an IRA can be accomplished with a simple account-to-account transfer, which is a transaction your personal financial advisor can assist you with.

You May Be Able To Leave Your Account With Your Former Employer At Least Temporarily

Changing jobs is stressful, even in the best of circumstances. If youve lost a job and are scrambling for re-employment, youre likely focused on that. But eventually you will need to figure out what to do with your 401.

If your balance is $5,000 or more, you can leave the money right where it is, giving you time to decide the best course of action for you. In this case, youre under no obligation to move your money.

What you should do right away, regardless of the 401 balance in your old plan, and as early as your first day at the new job, is to sign up for your new companys 401 plan. Even if your new employer has an automatic opt-in feature that does not kick in for one to three months and if you rely on that, rather than taking the initiative you can miss 30 to 90 days of contributions and matching funds, Bogosian advises.

After six months, youve got a handle on the job, know youre going to stay and have some experience with your new plan. Youre now in a better position to compare your last 401 plan with this new one, including the diversity of the investments and the costs.

But what happens if the balance in your old 401 is less than $5,000? Your former employer may force you out of the plan by placing your funds in an IRA in your name or cashing you out and sending you a check.

Recommended Reading: How To Transfer Roth 401k To Roth Ira

Recommended Reading: Is Ira Safer Than 401k