How Do Roth Iras Offer Tax Diversification In Retirement

A lot of people assume that your taxable life ends with your working life, but taxation covers your entire life and a little ways beyond. As your working income phases out and you begin to withdraw from a 401, for example, those distributions become your reported taxable income. Any other income, including dividends, royalties, bond interest, and so on, will push that taxable income upwards.

Taking a part-time contract, something much more common for retirees now, can also overlap with required minimum distributions from traditional IRAs. This results in an uncomfortable situation where every dollar earned through enjoyable work in retirement is lessened by taxes, discouraging some retirees who want to continue doing meaningful work from doing so. In a Roth IRA, however, you can still supplement any retirement income with your retirement savings without affecting your tax situation.

Limiting Taxes With A Simple Ira Rollover

You will normally pay income tax on withdrawals you take from your SIMPLE IRA plan. Youll have to pay an additional 10% penalty if you take withdrawals before you reach age 59½ unless you qualify for an exception, such as if you have a disability or you receive the withdrawal as an annuity.

You can avoid either of these financial losses if you roll your SIMPLE IRA assets into a 401 when you leave your employer. Your age isnt a factor in this case, either, because the rollover isnt considered to be a withdrawal when you time it properly.

Dont Miss: Can A Small Business Set Up A 401k

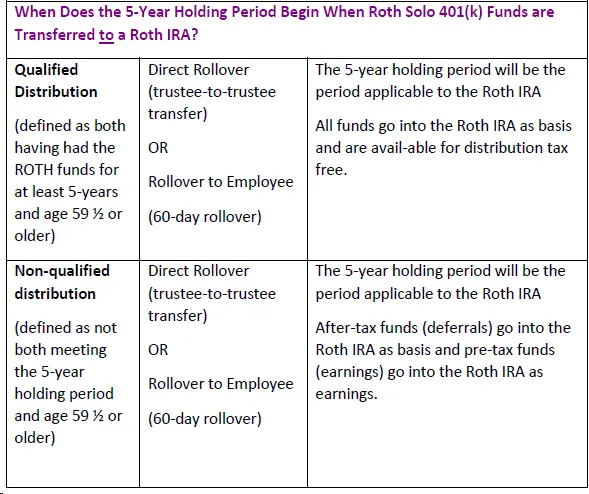

How Long Before I Can Withdraw Rollover Funds From A Roth

You will be subject to a 10% early withdrawal penalty if you do not wait five years from the rollover. Note that the rollover is considered to have been made at the beginning of the calendar year in which the rollover is complete. For example, if you roll $5,000 from your traditional IRA to your Roth IRA on Feb. 15, 2022, you will be eligible for tax and penalty-free withdrawal of the funds as early as Jan. 1, 2027.

You May Like: Is A 401k Rollover To Ira Taxable

Millions Of 529 Accounts Hold Billions In Savings

There were nearly 15 million 529 accounts at the end of last year, holding a total $480 billion, according to the Investment Company Institute. That’s an average of about $30,600 per account.

529 plans carry tax advantages for college savers. Namely, investment earnings on account contributions grow tax-free and aren’t taxable if used for qualifying education expenses like tuition, fees, books, and room and board.

However, that investment growth is generally subject to income tax and a 10% tax penalty if used for an ineligible expense.

This is where rollovers to a Roth IRA can benefit savers with stranded 529 money. A transfer would skirt income tax and penalties investments would keep growing tax-free in a Roth account, and future retirement withdrawals would also be tax-free.

Rolling A Pension Into A Roth Ira: An Overview

The two major types of employer retirement plans are defined-contribution plans and defined-benefit plans. In a defined-contribution plan, such as a 401 or a 403, you contribute money out of your paycheck, and your employer may match some portion of your contributions. With a defined-benefit plan, commonly known as a traditional pension, your employer funds the plan and promises you a certain benefit upon your retirement, typically based on your salary and years of service.

With a defined-contribution plan, you get to decide how the money will be invested, within the range of choices offered by the plan. With a defined-benefit plan, your employer makes the investment decisions and is responsible for delivering its promised benefits.

When you leave your job, you can generally take the money in your defined-contribution plan with you. You also may be able to take your defined-benefit plan in the form of a lump sum, if the rules of your employers plan allow it. When you retire, your defined-benefit plan may give you a choice of regular payments for the rest of your life or a lump sum.

The amount of the lump sum will be calculated based on your age, interest rates, the value of the benefits to which you would be entitled in the future, and the extent to which you are vested in the plan.

Recommended Reading: How To Find Out If I Have 401k

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time during the contributed tax year, regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Calculate Employer Contribution To 401k

Also Check: Why Choose A Roth Ira Over A 401k

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Recommended Reading: How To Roll Over 401k To A New Employer

How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

Why You Should Move Your 401 Into An Ira

Getty

The 401 is a blessing for many people, as it allows them to build wealth over time using dollar-cost averaging. Still, sometimes it makes more sense to channel some of that money from the employer-based account into your own individual retirement account. The ever-astute Rick Kahler, the founder of Kahler Financial Group, in Rapid City, S.D., tells us why:

Larry Light: Why and when should you move your 401 into an IRA?

Rick Kahler: If your employer offers a 401 or other retirement plan, contributing to that plan is a foundation of your retirement savings. However, as you approach retirement age, you might consider moving some of your retirement funds out of your employers plan and into an IRA at a custodian like TD Ameritrade or Fidelity.

Such a rollover is often done when you leave an employer, though many employers give you the option of keeping your retirement account with them. What isnt popularly understood is that you also can do a rollover while youre still employed, as long as you are over 59½.

Light: Why do this?

Kahler: One reason to consider leaving your employers plan is that most of them have higher overall fees than an IRA, especially if you choose from low-cost index mutual funds or exchange traded funds from a company like Vanguard or Dimensional Fund Advisors. Its not uncommon to save up to 1% annually by making a rollover into these mutual funds.

Light: What about withdrawing the money to live on? Is there a difference?

Don’t Miss: Can I Roll Over 401k Into Ira

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

You May Like: How Do I Cash Out My 401k After I Quit

Can Retired Persons Transfer A 401 To A Roth Ira

While traditional IRAs and 401 plans have been around since 1974, the Roth IRA is just a baby, created in 1997. This relative newness, combined with Roth income restrictions, means that many people may reach retirement without the benefits of Roth IRA savings options. Retirees can convert traditional 401 accounts to Roth IRAs, but there are a number of factors to consider when deciding if it is the right thing for you.

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Recommended Reading: How To Increase 401k Contribution Fidelity

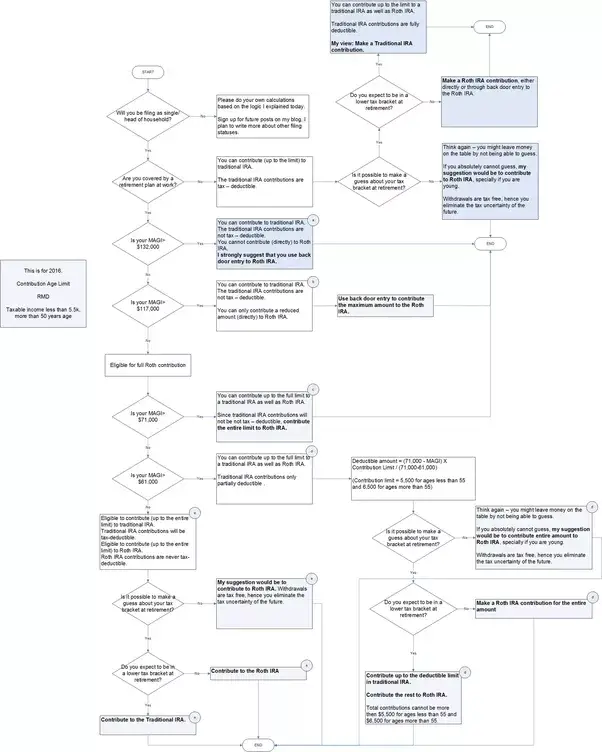

Why Roll Over Your 401 To A Roth Ira

If you keep a former workplace 401 plan you will have to pay taxes on your contributions and earnings in retirement. Converting to a Roth IRA may help you save money on income taxes if you expect your income to rise in the future or you have a particular year in which your income is low. When you complete a Roth IRA conversion, your pre-tax dollars from a workplace 401 plan are taxed at the time of the conversion, so if you are in a lower income tax bracket you will owe less in taxes. Then, in the Roth IRA, your contributions and earnings will grow tax-free.

How Does The Effective Date Apply To A Roth Ira Conversion Made In 2017

A Roth IRA conversion made in 2017 may be recharacterized as a contribution to a traditional IRA if the recharacterization is made by October 15, 2018. A Roth IRA conversion made on or after January 1, 2018, cannot be recharacterized. For details, see “Recharacterizations” in Publication 590-A, Contributions to Individual Retirement Arrangements .

Disclaimer

This FAQ is not included in the Internal Revenue Bulletin, and therefore may not be relied upon as legal authority. This means that the information cannot be used to support a legal argument in a court case.

- Certain other tangible personal property.

Check Publication 590-A, Contributions to Individual Retirement Arrangements , for more information on collectibles.

IRA trustees are permitted to impose additional restrictions on investments. For example, because of administrative burdens, many IRA trustees do not permit IRA owners to invest IRA funds in real estate. IRA law does not prohibit investing in real estate, but trustees are not required to offer real estate as an option.

Recommended Reading: What Is The Benefit Of A Roth Ira Vs 401k

Are 529 Plans Already Flexible Enough

Some education savings experts think 529 accounts have adequate flexibility so as not to deter families from using them.

For example, owners with leftover account funds can change beneficiaries to another qualifying family member thereby helping avoid a tax penalty for non-qualified withdrawals. Aside from a kid or grandkid, that family member might be you a spouse a son, daughter, brother, sister, father or mother-in-law sibling or step-sibling first cousin or their spouse a niece, nephew or their spouse or aunt and uncle, among others.

Owners can also keep funds in an account for a beneficiarys graduate schooling or the education of a future grandchild, according to Savingforcollege.com. Funds can also be used to make up to $10,000 of student loan payments.

The tax penalty may also not be quite as bad as some think, according to education expert Mark Kantrowitz. For example, taxes are assessed at the beneficiarys income-tax rate, which is generally lower than the parents tax rate by at least 10 percentage points.

In that case, the parent is no worse off than they would have been had they saved in a taxable account, depending on their tax rates on long-term capital gains, he said.

Recommended Reading: How To Withdraw From Fidelity 401k

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Recommended Reading: What Is The Best Way To Roll Over 401k

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Recommended Reading: What Is A Self Directed 401k Plan