Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Dont Miss: How To Take A Loan Out On Your 401k

Rolling A 401 Directly Into A Roth Ira

If you qualify, you can do an eligible rollover distribution from your old 401 directly to a Roth IRA. You’ll owe taxes on the amount of pretax assets you roll over.

Note also, if you have assets in a Designated Roth Account ) and would like to roll these to an IRA, the assets must be rolled into a Roth IRA.

As with Traditional IRA conversions to Roth IRAs, if you are required to take an RMD in the year you roll over into an IRA, you must take it before rolling over your assets.

Can I Convert To A Roth Ira Even If I Earn Too Much To Contribute

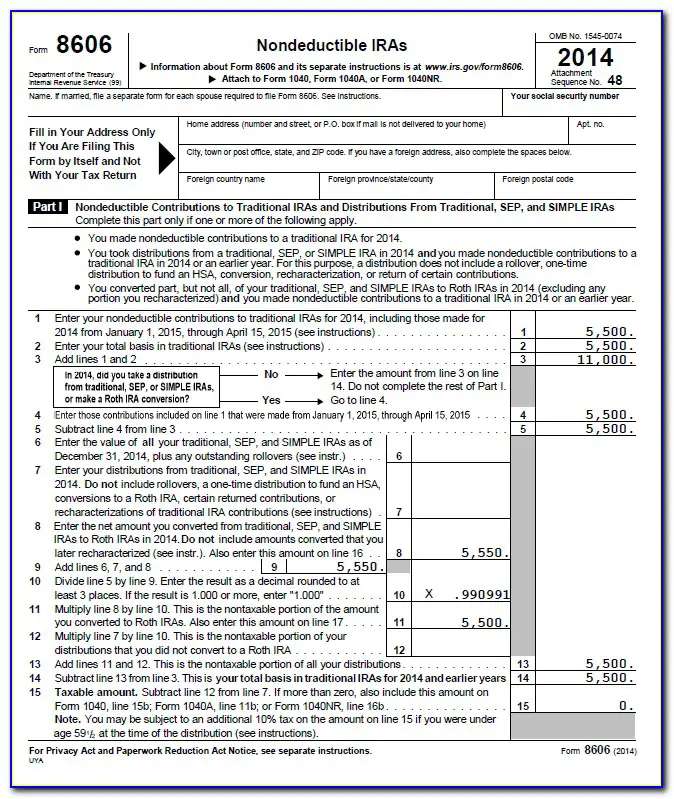

Yes, there are no income limits on conversion. Also, if you and/or your spouse have high income levels and are not eligible to contribute directly to a Roth IRA, and you do not already have a traditional IRA, you may want to consider opening a traditional IRA and making a nondeductible contribution, then converting it to a Roth IRA. This strategy is sometimes called a back-door Roth contribution.

Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

Also Check: Can You File Bankruptcy With A 401k

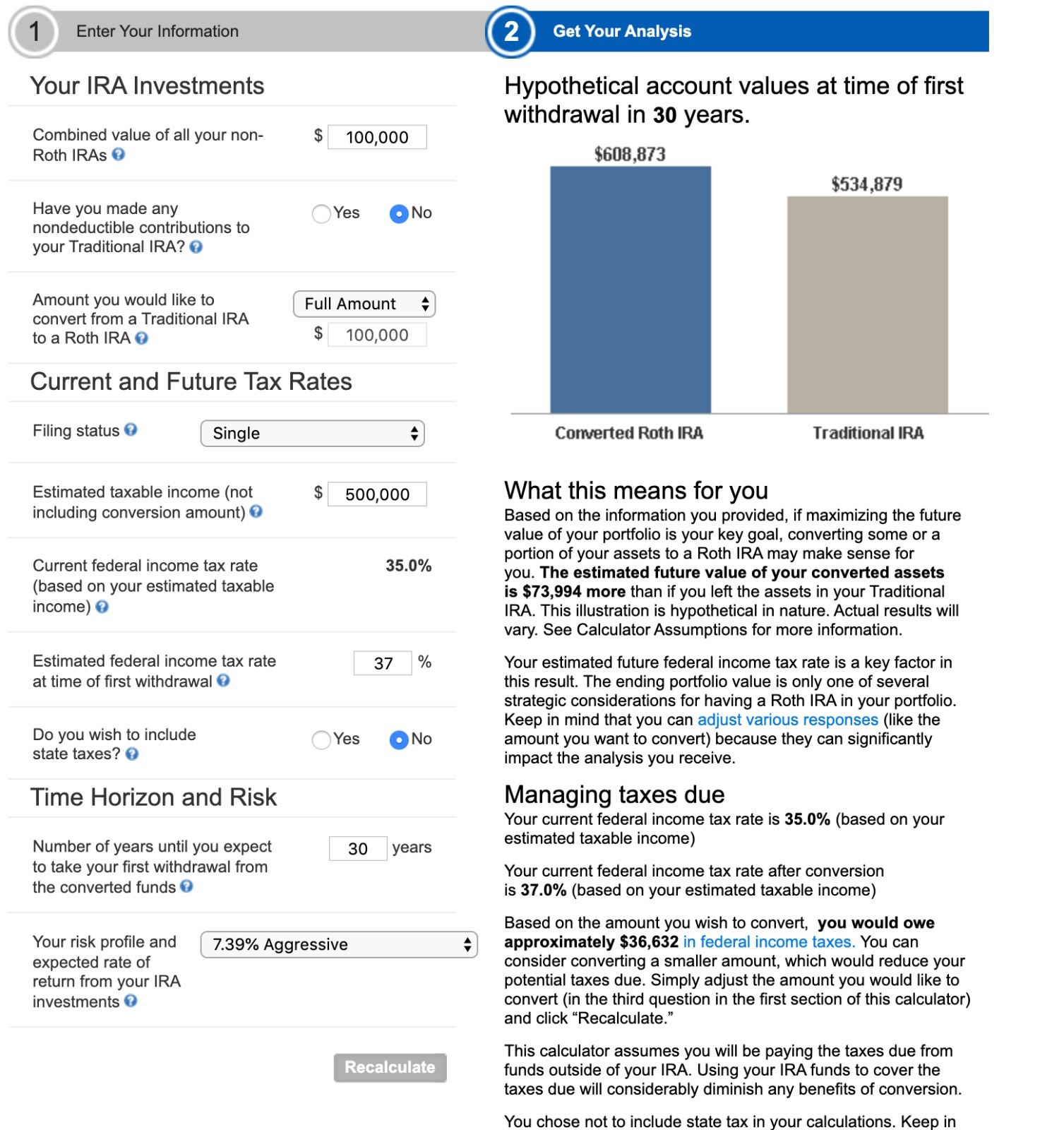

How Can I Manage Taxes On A Roth Conversion

Tax deductions can also help offset the tax cost of a Roth IRA conversion. For example, you may be able to take a tax deduction for donations to qualified charities. In general, by making charitable contributions with cash, you can deduct your charitable contribution up to 60% of your adjusted gross income . The deduction is usually limited to 30% of AGI for donations to some private foundations and some other organizations, as well as for contributions of non cash assets. Note, however, that if your itemized deductionswhich include charitable contributionsdo not exceed the standard deduction, there wouldn’t be any tax benefit from those charitable contributions. So be sure to consult with your tax advisor to plan your charitable strategythere are techniques that can help ensure you enjoy the potential tax benefits of your charitable giving.

Learn more at FidelityCharitable.org

Roth Ira Conversion Methods

There are several ways to enact a Roth conversion, depending on where you hold your retirement accounts:

- With a 60-day indirect rollover, you receive a distribution in the form of a check paid directly to you from your traditional IRA. You then have 60 days to deposit it into your Roth IRA.

- A simpler way to convert to a Roth IRA is a trustee-to-trustee direct transfer from one financial institution to another. Tell your traditional IRA provider that you’d like to transfer the money directly to your Roth IRA provider.

- If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method is called a same-trustee or direct transfer.

Read Also: How To Find Out About Your 401k

How Can I Do An In

If your plan allows them, you can do an in-plan Roth:

- Direct rollover by asking the plan trustee to transfer your non-Roth amount to a designated Roth account in the same plan , or

- 60-day rollover by having the plan distribute an eligible rollover distribution to you from your non-Roth account and then depositing all or part of that distribution to a designated Roth account in the same plan within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

The Benefit To Heirs And Beneficiaries

Each of your retirement and savings accounts have a beneficiary. This is the person that will inherit your account when you pass. For most, this is your spouse or your children.

If you pass along a traditional IRA, your beneficiary will have to pay taxes on every dollar they withdrawal from the account- And the government will force them to take this money out.

If the account beneficiary has a high income at the time the account owner passes, they are already in a high income tax bracket. Then, the income from the inherited IRA will push their total taxable income even higher and it will all be subjected to a higher tax rate.

For example, if the inheriting household has a taxable income of around $180,000, they are in the 24% income tax bracket for 2022:

This means that if your heir inherits $100,000 in a traditional IRA at least $24,000 of it will likely go to taxes! After taxes, that $100,000 inheritance is down to $76,000.

Roth conversions give you the chance to pay those taxes in advance, potentially at a much lower rate. Remember our example client above who was able to convert a significant portion of their traditional IRA into a Roth IRA just by filling up the 12% income tax bracket? That action would cut their familys net tax bill by $12,000.

And that savings amount potentially increases as the value of the inherited account rises. If you could have similar savings on a larger Roth IRA balance, say $500,000, that tax savings for your heirs rises to $70,000!

Don’t Miss: How Do I Protect My 401k In A Divorce

Will A Roth Conversion Satisfy My Rmd

No, you are required to take an RMD even if you do Roth conversions. The amount that is converted does not count as a withdrawal and is instead classified as a rollover.

If you have earned income, you may be able to use the proceeds from your RMD to contribute to a Roth IRA if you meet all the requirements to be eligible for Roth IRA contributions.

How The Five

Roth IRAs offer plan participants several tax advantages. Because youve already paid taxes on the money in the account, you can withdraw your original contributions at any time without a penalty. When you retire, qualified distributions from a Roth IRA are tax-free as well.

There is one caveat: the five-year rule. This states that in order to minimize or avoid the tax implications associated with a Roth IRA withdrawal, your account must be open and active for at least five years.

While this rule usually holds steadfast, there are some exceptions where even non-qualified distributions can be tax-free. For example, if you become permanently disabled, you can withdraw from your Roth IRA before age 59.5 without a penalty.

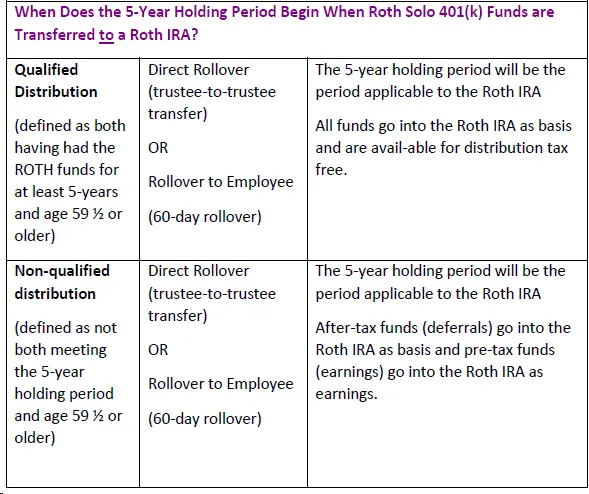

The five-year rule also applies to funds held in a Roth 401 account. So if youve had a Roth 401 and a Roth IRA for at least five years and youve been actively contributing to both, then the five-year rule shouldnt be an issue for rollovers. To ensure this goes smoothly, be sure to plan ahead quite a bit.

If you have an existing Roth IRA that is older than five years, then you can roll over the Roth 401 and take a distribution with no problem, assuming youre 59.5 or older, Lowell said. If you open a Roth IRA for the first time in order to receive Roth 401 rollover funds, then you must wait five years to take a distribution penalty-free.

Read Also: How To Get 401k From Old Employer

How Is The 5

When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated Roth account does not count toward the 5-taxable-year period for determining qualified distributions from the Roth IRA. However, if you had contributed to any Roth IRA in a prior year, the 5-taxable-year period for determining qualified distributions from a Roth IRA is measured from the earlier contribution. So, if the earlier contribution was made more than 5 years ago and you are over 59 ½ a distribution of amounts attributable to a rollover contribution from a designated Roth account would be a qualified distribution from the Roth IRA.

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

However, you should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Recommended Reading: How To Rollover Money From One 401k To Another

What Is A Roth Ira And How Is It Different From A Traditional Ira

Originally called an “IRA Plus,” the Roth IRA was introduced with the Taxpayer Relief Act of 1997. It’s named after William Roth, a senator from Delaware who sponsored the legislation.

In contrast to traditional IRAs, contributions to Roth IRAs are not tax deductible. Instead, investors can receive tax-free money from their accounts after they turn 59 and a half years old, with some restrictions. With a traditional IRA, all distributions of money — including the initial contributions and investment income earned on them — are taxed at the current rates when you receive them during retirement.

Roth IRAs are more flexible than traditional IRAs for withdrawals. Roth IRA owners can withdraw their original contributions at any time tax-free, and you can withdraw earnings from your investments tax-free if you are 59 and half years old and the account has been open for five years.

Another benefit of Roth IRAs is that they are not subject to required minimum distributions when you reach a certain age, as traditional IRAs are.

What Should I Do With An Old 401

You might have an old traditional 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of mutual funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.

You May Like: How To Transfer 401k From One Company To Another

Completing The Roth 401k Rollover Process

It is important to complete the rollover in a timely manner so that you can avoid 401k taxes and 401k withdrawal penalties for an early withdrawal. The deadline is not flexible, and you may want to choose where you want to open your IRA before you begin the process of cashing out your 401k. They may be willing to work with you on the paperwork, and have the check for the proceeds of your 401k mailed directly to them. Be sure to follow up on the process to make sure everything is in place before the deadline.

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employer’s 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

Also Check: Can You Borrow From Your 401k To Buy A House

Should I Convert My Current 401 Into A Roth 401

If you already have a traditional 401 at your current job and the company just introduced a Roth 401 option, converting that 401 into a Roth might sound like a good idea. But is a conversion your best option? It depends on your situation.

The main drawback of converting a traditional 401 into a Roth 401 is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money because it hasnt been taxed yet.

Lets say you have $100,000 in your traditional, pretax 401 and you want to convert the account into a Roth, after-tax 401. If youre in the 22% tax bracket, that means youd be paying $22,000 in taxes. Thats a lot of cash!

If you convert your 401 into a Roth 401, you need to have the cash on hand to cover the tax billno exceptions. Do not use money from the investment itself to pay the taxes. If you do, youll lose a lot more than $22,000. You could get charged a 10% early withdrawal penalty if youre under age 59 1/2. And youll also miss out on years of compound growth on that $22,000, which is typically about 11% a year.

For example, after 30 years, a $100,000 account could grow to about $2.67 million. An account with a starting point of $78,000 would grow to $2.08 million. Thats a difference of $587,000!

Want to run the math on your retirement account balance? Try our investment calculator that will do the calculations for you.

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you dont already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Recommended Reading: How To Take Money Out Of Your 401k Fidelity

Benefits Of Roth Ira Conversions

But, our retired couple can avoid some of these high tax rates by doing Roth IRA conversions early in retirement.

Remember that the couples tax rate was very low early in retirement? If that couple could convert assets from their Rollover IRAs to a Roth IRA in those early years, they would pay a very low tax rate.

For example, what if we had this couple convert just enough assets to be taxed at the 12% tax rate, but no higher?

Then their future tax burden looks something like this:

Notice that the couples taxes are higher for the next few years

But, their tax rate later in life is greatly reduced. Gone are the years of a 32% marginal tax rate!

With this simple Roth conversion schedule, our retired couple has reduced their total tax bill to just over $700,000 a near $400,000 reduction in total taxes paid compared to if they did no conversions at all.

What Is A Roth Ira Conversion

A Roth IRA conversion shifts money from a traditional IRA or a qualified employer sponsored retirement plan such as a 401 or 403 into a Roth IRA. It is also sometimes called a backdoor IRA conversion.

There are many reasons to consider a Roth IRA conversion tax-free investment earnings, lowering taxable income in retirement and not having to bother with required minimum distributions, to name a few. Heres how to convert an existing retirement account into a Roth, along with guidance on whether it makes sense for you.

You May Like: What Is A 401k Audit

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

When Is The Best Time To Roll Over A 401

The best time to roll over your 401 may be when you leave your job. Some companies automatically roll over your 401 to a traditional IRA account in your name at a brokerage firm.Some allow you to keep your money in the plan. But in this case, your 401 would be dormant and you cant contribute to it anymore. And while investment earnings will continue growing tax-deferred, your account may still be subject to administrative fees.Convert your 401 to a Roth IRA or roll over your 401 into a traditional IRA on your own. Plenty of brokerages offer IRA and Roth IRA accounts with low fees, vast investment options and no minimum deposits.If you roll over your 401 when youre young, time is on your side. Youll have more time to contribute to your retirement savings and enjoy the benefits of compound interest.

Also Check: How To Borrow Money From My 401k