Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

If youve lost track of a pension, request a pension benefits statement from the plan administrator. Give the administrator your address and phone number so it can reach you to begin payments. You may need to prove your work history and eligibility for the pension you can do so by providing the plan administrator with old W-2 forms or an earnings statement from Social Security, which you can get by filing Form SSA-7050. You can get this form at www.socialsecurity.gov/online/ssa-7050.pdf or by calling Social Security at 800-772-1213.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

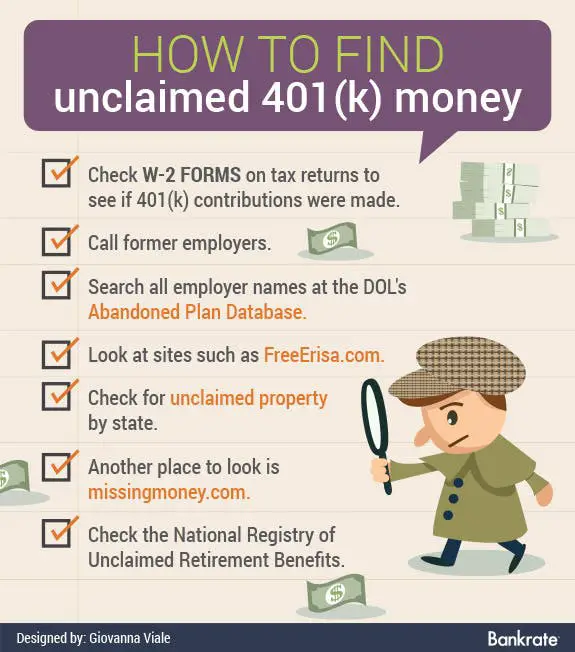

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Also Check: Do I Have A 401k Out There

What Is A Roth 401

Some 401s allow you to make Roth contributions. A Roth 401 contribution has a different tax structure than your standard 401 deposit. While the traditional 401 contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

You May Like: How 401k Works After Retirement

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Recommended Reading: How To Roll Over 403b To 401k

Don’t Miss: Can I Transfer My Old 401k To Roth Ira

Can I Cash Out My 401 While Still Working

One of the most common questions I get asked is whether or not you can cash out your 401 while still working. The answer is yes, but there are some important things to keep in mind before you do.

- First, you will likely have to pay taxes on the money you withdraw.

- Second, you may be hit with a 10% early withdrawal penalty if you are younger than 59 ½.

- And finally, remember that once you cash out your 401, the money is gone for good you cant put it back in.

With that said, there are some situations where cashing out your 401 while still working makes sense. For example, if you are facing financial hardship and need the money to cover essential expenses, or if you leave your job and dont want to roll your 401 into a new employers plan. Just be sure to weigh all of your options carefully before making a decision.

Rollover 401 To An Ira

The second option is to roll your employer 401 into an Individual Retirement Account . A new IRA can be opened at your choice of financial institutions like M1 Finance, or put into an existing IRA you already have.

Keep in mind that there are different tax advantages for different types of IRAs. For example, you may want to consider moving your 401 into a traditional IRA when you quit in order to continue deferring taxes. If you want to learn more about IRAs, check out Roth vs. Traditional IRA | How to Choose.

Also Check: How Much Is 401k Taxed

How Do I Find My Old 401

If you’re not sure where your old 401 is, there are three places it could likely be. Here’s where to find your old 401:

Right where you left it, in the old account set up by your employer.

In a new account set up by the 401 plan administrator.

In the hands of your states unclaimed property division.

Heres how to start your search:

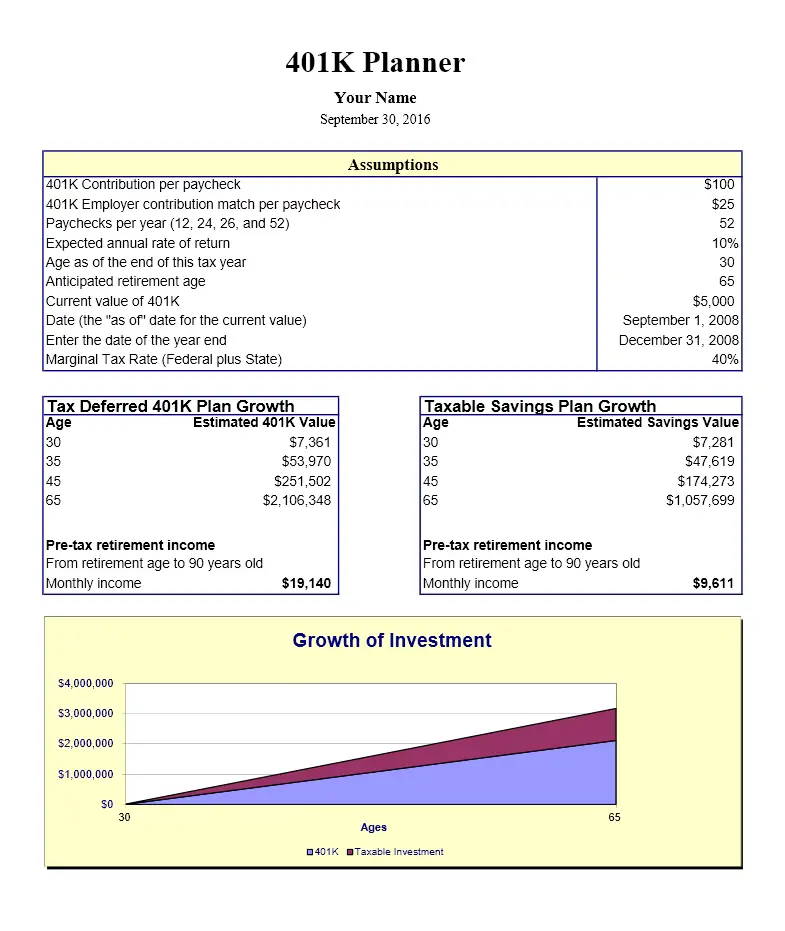

Now What What Can You Do About Fees

Unfortunately when you have high fees in your retirement plan, theres not much you can immediately do about it. But just the knowledge of your fees will help you answer questions like:

- Should I consider investing in different funds within my plan?

- What should I do with investment dollars after I reach my company 401K match?

- Should I leave my companys 401K plan because of the absurdly high fees?

- Should I divert funds to a discount online stock brokers?

- What should I do with those funds once I leave my job?

Luckily, the tide is turning, and we are seeing new pressure from U.S. lawmakers to make this fee information more apparent. Sites like BrightScope are also doing a good job of exposing the truth about the company 401K plan.

This guest post is from PT Money: Personal Finance. Follow along as PT discusses things like the best places to store your short-term cash, how to spend your money wisely, and the best cash back credit cards to earn more money on your spending.

Read Also: How To Offer 401k To Employees

Why Does The Calculator Ask About My Highest Level Of Education

All questions in the calculator help us make more informed predictions about your future. Knowing your level of education lets us determine a more realistic estimate of how much youll earn in the future and in turn provide an estimate of what you may need in retirement. And although this information helps us provide you with a more personalized calculation, it is optional.

Cherish Your Valuable Pension

All three individuals with pensions above are millionaires due to their long-term dedication and pensions. Even if you were only receiving a $15,000 a year pension, its still worth more than $500,000 a year using a 2.55% divisor and 90% payout probability.

Given the median net worth in America is around $100,000, we can conclude that anybody with a pension is considered very well off. Less than 20% of Americans have pensions in the new decade.

Theres one key variable that I havent discussed, and thats a pension owners lifespan. Unfortunately, the foreign service officer with a pension worth $2,833,333 cant sell his pension to anybody for that amount. Nor does the pension keep paying out after death. Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is ones pension value fades as the owner inches closer towards the end.

Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension. The same logic goes for anybody with passive income, including social security. The richer you are, the healthier you should try to be!

The value of your pension is subjective. You could even multiply your annual pension amount by the average P/E multiple of the S& P 500 to come up with its value. There are many variables and variable amounts to consider.

Recommended Reading: How Much Does A 401k Cost An Employer

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

You May Like: How Do I Get A 401k Loan

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Read Also: Can You Use Your 401k As Collateral For A Loan

Read Also: How To Transfer 401k From Old Job To New Job

How To Max Out A 401k

For 2022, the 401k contribution limit is $20,500 in salary deferrals. Individuals over the age of 50 can contribute an additional $6,500 in catch-up contributions.

Yet, most people dont know how to max out a 401k. According to a Vanguard study , only 12% of plan participants managed to max out their 401k in 2019. Here are some strategies on how to max out your 401.

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

You May Like: How Much Tax To Convert 401k To Roth Ira

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you arent sure if you had a 401 with a previous employer, there are several ways to find out.

Also Check: Should I Convert 401k To Roth Ira

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

Read Also: What Are The Benefits Of A 401k Plan