Can I Cash Out My Old 401 And Take The Money

Employees are enabled to put away $19,500 from their wage into a 401 for 2020 and 2021 – can i invest in gold through my 401k.

Enrollees can choose from a range of funds, consisting of little- and large-cap funds, mutual fund, index fundsall with various growth potential. Since these strategies are so essential, enrollees can make the most of major market opportunities. That’s why investors might be interested in shifting a part of their 401 investment portfolio possessions to benefit from precious metals rates and the gold market – can i invest in gold through my 401k.

But there’s a catch when it concerns 401s: Very couple of plans in fact permit investors the choice of investing directly in gold bullion . In reality, the huge bulk of 401 plans do not allow people to make any direct financial investments into the precious metal. This suggests you can’t head out and purchase gold bullion or gold coins as part of your retirement plan portfolio.

The vast bulk of 401 strategies don’t enable enrollees to invest directly in gold. For financiers who are eager to put their money into gold, there are still options. If your 401 does not provide prepared access to financial investments in gold, you might still have some flexibility to purchase gold through mutual funds or exchange-traded funds .

Why Put Gold In Your Ira

Individual Retirement Accounts protect your retirement as well as your family’s financial security. These special accounts allow you to set aside tax protected savings that you can use in the future.

With these long term accounts it’s important to allocate a significant portion to assets that are solid and reliable, so you have a secure future.

You can have cash in an IRA, but that is devaluing at a rapid pace and inflation is out of control.

You need an asset that’s reliable, retains it’s value, and even increases in value over time, and there is no better asset for this than gold.

With the world’s economy struggling through lockdowns, shortages, wars, and inflation, uncertainty has never been higher and investors are protecting themselves by placing physical gold in IRA’s.

A gold IRA investment prospers from these crisis that negatively affect most other assets.

Risk is knowing the economic dangers and doing nothing to protect yourself and your family.

Safety is knowing the economic dangers and taking action to ensure your financial future, and this is easy to do with a Gold IRA.

Can I Roll My 401k Into Gold

Fortunately, it is possible to entirely convert an existing 401 into gold or another precious metal. However, this does not give you a get-out-of-jail-free card. You will still have to pay your taxes without any further deductions.

In addition, you will need to leave your present job before moving your 401k to a self-directed IRA account. You can purchase gold and silver products with the money you’ve transferred from your 401 to your new IRA.

Recommended Reading: Should I Roll My Ira Into My 401k

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Savers Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayers adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Savers Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, its $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Top Companies To Convert Your 401 Into Gold

Several companies will help you to invest in gold and otherprecious metals through your IRA and/or 401. However, the fees and termsvary widely from one to the next. So, do your research and read all the fineprint in detail before you open your new account with one of these companies.According to our own research, below are the three best companies at currentthat can assist you with investing in gold.

Also Check: When Do You Have To Take 401k Distributions

Can Ira Hold Gold And Silver

Opening up an account with American Hartford Gold is basic. The firm will certainly review your current pension and also investment portfolio to ensure they remain in good hands. Once you have actually completed the first documentation, you can pick the sort of gold you want to purchase. American Hartford Gold’s account executives will work with you to choose the ideal type of silver and gold products. After that, you’ll be able to withdraw your funds, however you might have to wait a few days for your money to arrive.

American Hartford Gold has no minimal account size. They do not charge any type of compensations for gold trades, but you can expect to pay account maintenance fees. Depending upon the size of your account, these costs are waived for approximately three years. While this seems like a high cost, it’s absolutely worth it in the long run. American Hartford Gold has actually made the endorsement of Ron Paul, Chuck Norris, and Sean Hannity, so if you’re searching for a reputable, reputable business, American Hartford Gold is a solid option.

Related article :

Be Aware Of The Fees Associated With Your Plan

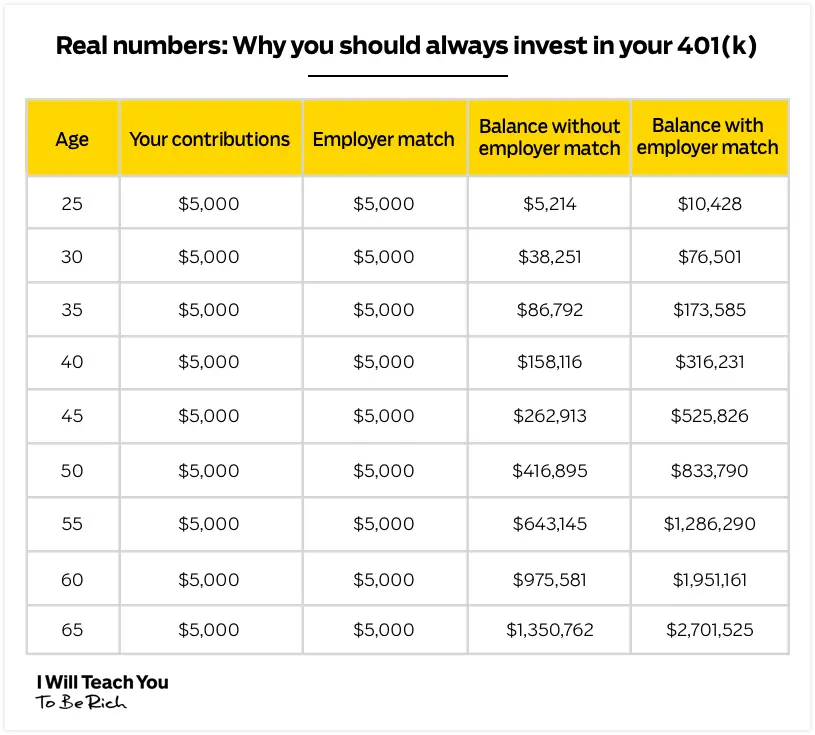

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

Don’t Miss: Is There A Max Contribution To 401k

Can I Invest My 401k In Gold

ave you ever wondered how to convert your 401 into gold? Its a question that has come up quite often, especially in recent months. Things are changing quickly in the world of finance, and people are looking for ways to protect their retirement funds.

Unfortunately, there is no easy answer to this question. It would depend on what type of 401 plan you havedifferent types offer different conversion options. But if you wanted to explore your options, heres what you need to know.

Best Books on Gold

How We Ranked The Top Gold Investment Companies

Choosing the right gold IRA company is essential to having a positive experience with your precious metals IRA.

Your IRA company will be responsible for thousands of dollars of your retirement savings, and you need to trust that they will manage your precious metals products well. Additionally, some gold IRA companies make buying physical gold and investing in self-directed IRAs easier than others.

When we created our list of the top gold IRA companies, we reviewed several factors, including the following:

Also Check: How To Get 401k Money From Old Job

How Do You Move A 401 Into Gold

Now that you have made the exciting decision to buy gold, the next step is figuring out how to actually carry out your plan. Most likely, your current 401 plan does not offer gold investment options. Many 401 plans offer limited investment options, so you need to find a new plan that allows you to invest directly in gold.

To avoid paying taxes on this transition, you will have to do a 401 rollover. A 401 rollover is when you transfer funds from your old 401 plan to a new one. You can transfer money to a new 401 or IRA.

According to the Internal Revenue Service , you must complete this transfer within 60 days. If you do not finish it in time, your transaction is treated like a 401 withdrawal. Unless you want to pay taxes and penalties on your withdrawal, you must follow the IRS rules.

When you convert to a new 401 or IRA, you can enjoy new perks. Employer plans generally have limited options and high fees. An employer typically offers the plan as a benefit to their employees, but they do not have an incentive to shop around for a great plan. Because of this, you may need to get a new 401 if you want cheaper investments, lower account fees and more gold investment options.

In order to convert your 401 plan to a gold IRA or 401, you have to do the following steps.

- Pick the account you want.

- Open your new account.

Dont Miss: Which App Is Best For Mutual Fund Investment

How Long Does It Take To Open Up A New Gold Ira

Opening a new IRA should take no more than three weeks. The longest step in the process is waiting for your current IRA custodian to transfer funds from your account to your new IRA. This process can take anywhere from 10 to 14 days.

Once this transfer is complete, youll need to choose the silver and gold products you want to include in your account. Your account representative will then finalize your purchase, which should take no more than a few days.

Also Check: How Do I Close Out My 401k

Is There A Difference Between A Gold Ira Rollover And A Gold Ira Transfer

While the two may sound the same, there are key differences between a gold IRA rollover and a gold IRA transfer. Of the two, a gold IRA transfer is a lot more secure while a gold IRA rollover has more rules that investors will need to be aware of.

To make it clearer for investors who wish to buy gold using funds from their 401, here are some of the differences between a transfer and a rollover:

- The 60-day transfer rule only applies to a gold IRA rollover and not to transfers

- In a gold IRA rollover, early withdrawals before the age of 59 and half years will attract a 10% penalty, but there are no penalties in a transfer

- An IRA gold transfer is not taxable, while any violation of the 60-day rule in rollovers is regarded as a taxable event

- Only a single rollover can be done in any one year while there are no restrictions on the number of transfers that can be made

The most crucial difference is that in a transfer, the funds are moved directly from one custodian to another without ever reaching the account owner’s bank account. This is why some people prefer to transfer funds rather than go through the rollover process.

Benefits Of Investing In Precious Metals Like Gold

Physical metals are:

- Tangible, maintenance-free investments you proudly own

- Outperforming stocks and bonds over the last two decades

- Doing well in uncertain markets when other asset classes do not

- Portable, but immune to theft or ransom by hackers

- A private way of accumulating and storing wealth

- Preceded by a 3,000+ year history of retaining value

- Available without specialized knowledge or training required for purchase

- Able to retain value over time, making them the perfect asset to pass on to heirs

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

S To Handle A 401 To Gold Ira Rollover

Once youve opened your gold IRA, you can contact the company managing your 401 account to begin the rollover process. First youll have to choose between a direct and indirect rollover. In an indirect rollover, you withdraw the funds from one account and then deposit them in another. With a direct IRA rollover, the funds move directly from one account to another. The direct option is usually much simpler, and it comes with less risk of IRS penalties.

With an indirect rollover, you have 60 days from the date you receive the funds to transfer the money to your custodian or gold IRA company. The funds become a taxable withdrawal if you dont complete the transfer in the 60 day period. If you are 59.5 years old or younger, a 10% early withdrawal penalty is also applicable.

With either rollover option, youll also have to make sure youve satisfied any special requirements the company might have for rollovers. Once youve met the requirements, the company will send a check with your funds to either you or your gold IRA custodian. At that point, youll have completed your 401 to gold IRA rollover.

Reasons Against A Gold Ira Rollover

We have looked at the many benefits of doing a gold IRA rollover and provided you with the best gold ira companies for rollovers. However, are there any reasons why an investor shouldn’t choose this route? While the benefits of a rollover to a gold IRA far outweigh the disadvantages, the following are some important considerations:

- Limited Legal Security

In cases where the investors face litigation, federal law protects against 401k accounts being used as part of compensation or punitive damage payments. A gold IRA only has limited protection from regional law, and the level of protection varies greatly.

This means the more money invested in a gold IRA, the more exposed the investor is in litigation cases. Therefore, if lawsuits are possible, it is better to stick to a 401k account until everything has been resolved.

- Fewer Loan Options

If there is an emergency and you require quick access to cash, having an active 401k will give you access to receiving loans. However, these options are greatly diminished if the bulk of your retirement account is in the form of a gold IRA.

- Cost of Account Maintenance

Gold in physical form attracts a lot of storage costs due to the need for extra security to prevent robberies. The IRS states that the custodian must hold gold in a safe and secure storage facility and that the reserves must be fully insured.

All these measures mean added costs to handling physical gold, and it is the investor who will bear the brunt of these costs.

Also Check: How Do I Transfer My 401k To A New Job

Preserve Long Term Purchasing Power

When you are investing for the long-term, you want to preserve the purchasing power of your wealth. Gold has held its value for thousands of years. Compare that to currencies that have a lifespan of one or two generations. With a Gold IRA, you can almost be certain that a certain percentage of your retirement will hold its value over decades.

Conduct An Ira Rollover

Next, you’ll need to move the money from your current retirement plan into a gold IRA rollover account. Your previous IRA custodian may send the money directly to your new custodian in a direct rollover. Or your previous retirement account’s holdings are sent to you straight, with the intention that you’ll conduct the IRA rollover yourself. You may need to file additional papers as proof. Specialists prefer a direct rollover as it takes less paperwork and time.

You May Like: How To Calculate 401k Minimum Distribution

Three Meeting Irs Custodian And Storage Requirements

Two important IRS rules for precious metals IRAs are as follows:

1 You must have a custodian trustee appointed to manage your account. Since your Gold IRA is a self-directed IRA, you make all the decisions regarding buying and selling precious metals investments, but your decisions must be executed by an IRS-approved custodian trustee. The trustee will also handle all necessary reporting to the IRS regarding your account. Custodian trustee firms are typically banks, trust companies, or similar entities.

2 You must keep your precious metals in an IRS-approved storage facility. You cant just keep your gold or silver in a drawer at your home. Brinks and Delaware Depository are two of the most well-respected companies that provide IRS-approved storage of IRA gold and silver.

Meeting these two requirements is actually part of the process of the initial setup of your Gold IRA, but were putting them as step three here since they dont matter in any practical sense until your account is funded and ready to invest with.

Can You Invest In Alternative Assets Inside A 401

Alternative assets include crypto, real estate, precious metals, wine, whiskey, and more. These alternatives tend to have low correlation to the stock market so they may outperform other investments during a recession.

Unfortunately, most 401 plans dont allow you to invest in alternative assets. In fact, most dont even allow you to invest in individual stocks and ETFs.

However, if youre self-employed, you may want to consider opening up a self-directed Solo 401. Money thats held inside self-directed retirement accounts can be invested in almost anything. Also, if you have a 401 from a previous employer, you can roll it into a self-directed IRA.

Just keep in mind that alternative assets are often riskier and more volatile than traditional investments like index funds. We recommend that investors limit their alternative investments exposure to 5% of their overall portfolios.

You May Like: What Percent To Put In 401k

Decide On Your New Investments

Once you have completed your direct or indirect rollover, you can determine how you want to use your money. You can invest in physical gold, or you can look at index mutual funds. Diversifying your portfolio can protect it from market fluctuations.

Many people buy gold coins and bullion, but there are some drawbacks to these investments. You may have to pay broker commissions and fees for storing the gold. If you want to diversify your gold portfolio, you can invest in gold using other techniques as well.

- Gold futures and options: These contracts are essentially agreements to buy or sell gold at a set price in the future. Because these contracts are traded on commodity exchanges, they are tightly regulated by the federal government.

- Stocks in gold mining: If you want to invest in gold mining and refining businesses, you can buy stock in a mining company. You should always research the company beforehand to see if they are financially stable. To reduce your risk, you can also buy shares in a mutual fund that invests in gold mining.

- Gold exchange-traded funds : An ETF is a basket of other assets. A gold ETF may own gold options, futures and physical gold. While mutual funds can only be exchanged after the market closes for the day, an ETF can be traded when the market is open.