Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Yes You Should Care You Have A Few Options

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Many Americans don’t have access to 401 plans, a lot of which are self-employed or younger workers. Meanwhile, others work for smaller companies without established benefit packages. If your company doesnt offer a 401, you still have options, such as opening an individual retirement account at another financial institution.

Income Limits: The Mistake Executives Earning Over $305000 Make All The Time

Many executives believe that they’re maxing out their 401 contributions year after year. However, due to the IRS’ 2022 401 limitation of $305,000 in income and the impact it has on both individual and company contributions to a 401, many of these corporate professionals unknowingly miss out on thousands of dollars in potential contributions.

Also Check: How To Do Your Own 401k

Savings Incentive Match Plan For Employees Or Simple Ira

SIMPLE IRAs are for business owners with 100 employees or less, and theyre inexpensive and easy to set up and maintain. Individuals can contribute up to $13,500, and anyone who is 50 or older can make an additional $3,000 in catch-up contributions. If you invest in a plan as an employer as well, the total from both contributions cant exceed $20,500.

When you file your taxes, you can deduct the money you place in your SIMPLE IRA. You can also deduct contributions to employee accounts of 1% to 3% as business expenses. Like traditional IRAs and 401s, youll still need to pay taxes on withdrawals, and people who start using their funds before they turn 59 1/2 will have to pay an additional tax penalty.

Benefits Must Not Be Assigned Or Alienated

The plan must provide that its benefits cannot be assigned or alienated. A loan from the plan to a participant or beneficiary is not treated as an assignment or alienation if the loan is secured by the participant’s account balance and is exempt from the tax on prohibited transactions under IRC 4975 or would be exempt if the participant were a disqualified person. See Publication 560 for additional information on prohibited transactions. A loan is exempt from the tax on prohibited transactions under IRC section 4975 if it:

- Is available to all such participants or beneficiaries on a reasonably equivalent basis,

- Is not made available to highly compensated employees ) in an amount greater than the amount made available to other employees,

- Is made in accordance with specific provisions regarding such loans set forth in the plan,

- Bears a reasonable rate of interest, and

- Is adequately secured.

Also, compliance with a qualified domestic relations order , does not result in a prohibited assignment or alienation of benefits.

You May Like: What Does It Mean To Roll Over Your 401k

The Benefits Of Benchmarking Your 401 Plan

Ultimately, the primary responsibility of plan fiduciaries is to act in the best interest of their plan participantsand to diversify the plan’s investments and minimize the risk of loss. If youre a plan sponsor, you have a fiduciary responsibility to ensure the fees the plan or plan participants are paying are reasonable. To help meet this fiduciary responsibility, its important to compare the fees your service provider charges to those charged by other providers in a process called benchmarking.

Benchmarking is the process of evaluating if a retirement plans services and fees are competitive with other plans of a similar size or type. This can limit fiduciary liability by:

-

Checking a 401 plan is paying appropriate fees for the services received

-

Ensuring a 401 plan still achieves the objectives of your participants financial goals

Read what you need to know about 401 benchmarking.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Is Rolling Over 401k To Ira Taxable

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $61,000 in 2022, up from $58,000 in 2021. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $305,000. Even at that level, the employer would have to contribute a hefty amount to reach the $61,000 limit.

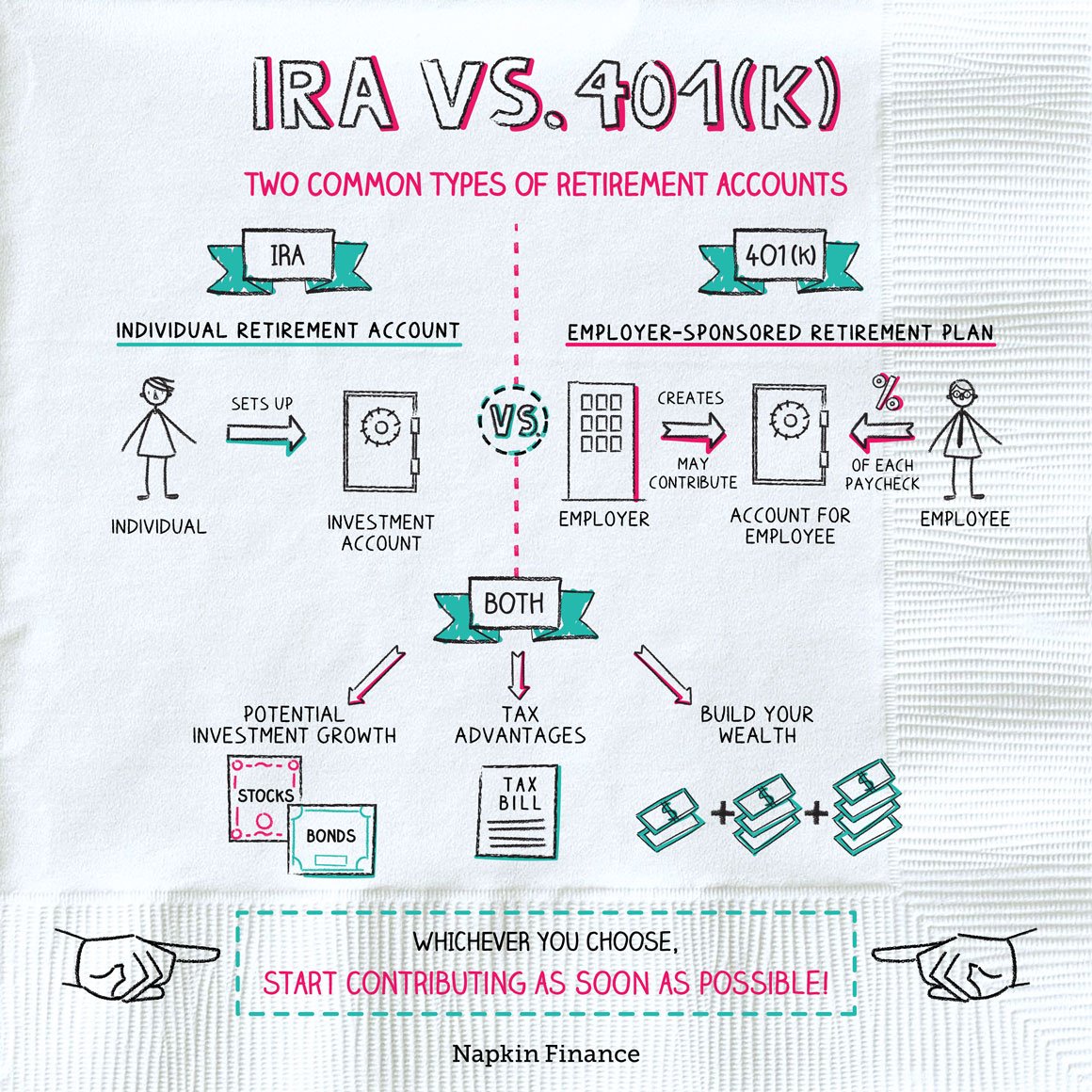

What Is A 401k

A 401k is an employer-sponsored retirement account. It allows employees to dedicate a percentage of their pre-tax salary to a retirement account. These funds are invested in various vehicles like stocks, bonds, mutual funds, and cash.

Depending on your benefits with your company, your 401k may include an employer contribution, which often is paid as matching funds your employer will match what you contribute up to a set amount or percentage.

Also Check: Should I Borrow From My 401k

Are There Alternatives To A 401 For Small Businesses Or Self

When youre self-employed or working for a small business that doesnt offer a 401 plan, a SEP IRA could help you save. The limits on this account are much higher than other types of IRAs, at either 25% of your pay, or $61,000, whichever is lower. While its not a 401, it should help you build up your retirement funds.

What Are The Benefits Of Offering A 401k To Employees

Helping employees plan for the future is a big responsibility, but it can also be very rewarding. Employers who offer a 401k may be able to:

- Attract and retain talent In addition to competitive salaries and health benefits, retirement savings plans can be a major influencer with candidates who are weighing different job offers.

- Improve retirement readiness Employees who are financially prepared for retirement can leave the workforce when the time is right, thereby creating growth opportunities for other employees and new talent.

- Take advantage of tax savings Businesses that sponsor a 401k are potentially eligible for a $500 tax credit to cover startup administration costs during the first three years of the plan. Additional tax deductions may be available if the employer matches employee contributions.

- Enhance productivity through financial wellness A retirement savings plan is one of the cornerstones of financial wellness. And when employees feel secure about their future, they tend to be less stressed and more productive at work.

Recommended Reading: How To See How Much Money Is In Your 401k

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Don’t Miss: How To Transfer Voya 401k To Fidelity

Defined Benefit Plan Or Cash Balance Plan

A personal defined benefit or cash balance plan is similar to a pension. Since annual actuarial calculations are required, it has higher expenses than a one-participant 401. Contribution limits are often very high, and its a good way for people who are close to retirement to save a lot quickly. The ceiling is calculated based on your age, the annual benefit you expect to receive after retirement, and your expected investment returns. The maximum annual benefit is $230,000.

People with employees usually offer them the same defined benefit plan and contribute for their employees. Youll need to fund the plan with a certain amount every year, and changing that amount will create additional fees. Contributions are usually tax-deductible, but distributions are taxed. An actuary must calculate your deduction limit, and your investment options are more limited than with other types of accounts.

Human Interest makes starting a 401 and offering it to employees easy for small businesses. We provide automated administration, skilled investment advising, and advanced security and encryption to protect your funds and your personal information. Its an affordable way for companies to help employees plan for their futures. People can check their balances, decide how much they want to contribute, initiate rollovers, and more. Contact us to get started on a 401 for your business.

Article By

The Human Interest Team

Know Your Retirement Provider Options

It can take some time to find a new provider and review the ins and outs of their administrative offerings. But because you have a fiduciary responsibility to your plan participants, its essential to take the process seriously. Youre responsible for due diligencealthough the right providers can help ease administrative burdens and lower your overall costs in the process.

Human Interest offers an affordable, full-service 401 thats meant to streamline much of the manual work of plan administration. By integrating with more than 200 leading payroll providers, were able to automate things to cut costs and save you time. And by selecting an service level that makes Human Interest a 3 fiduciary for select plan administrative functions, you can both reduce your fiduciary liability and the amount of time you spend on plan administration.

Don’t Miss: How Much Money Do You Need In 401k To Retire

What Is A Vesting Schedule

401 employee deferrals are 100% immediately vested . However, an employer may wish to incentivize longer-term employment by offering partial ownership of employer contributions over time. This requires that the plan set a vesting schedule that establishes what percentage of the employer contributions an employee owns as they continue employment with the plan sponsor.

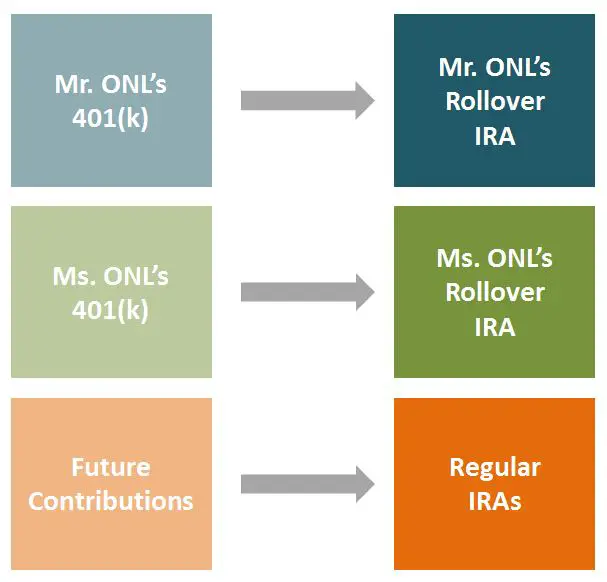

Roll Your 401 Balance Into Ira

Another possibility is for you to roll the balance over into an IRA. When moving the money, make sure you initiate a trustee-to-trustee transfer rather than withdrawing the funds and then depositing them into a new IRA. Many IRA custodians allow you to open a new account and designate it as a rollover IRA so you dont have to worry about contribution limits or taxes. When rolling your 401 balance into an IRA, make sure you place traditional 401 funds in a traditional IRA, and Roth funds in a Roth IRA.

Don’t Miss: What Is An Individual 401k

If I Offer A 401 To My Employees Are There Compliance Regulations I Must Follow Or Can The Retirement Plan Provider Help With These

Certain employers who offer 401 and other retirement plans must abide by the Employee Retirement Income Security Act of 1974, as amended, which helps ensure that plans are operated correctly and participants rights are protected. In addition, a 401 plan must pass non-discrimination tests to prevent the plan from disproportionately favoring highly compensated employees over others. The plan fiduciary is usually responsible for helping comply with these measures.

This information is intended to be used as a starting point in analyzing employer-sponsored 401 plans and is not a comprehensive resource of all requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services. For specific details about any 401 they may be considering, employers should consult a financial advisor or tax consultant.

Unless otherwise agreed in writing with a client, ADP, Inc. and its affiliates do not endorse or recommend specific investment companies or products, financial advisors or service providers engage or compensate any financial advisor or firm for the provision of advice offer financial, investment, tax or legal advice or management services or serve in a fiduciary capacity with respect to retirement plans. All ADP companies identified are affiliated companies.

Income Limits Affect Employer Contributions To Your 401

The 401 limits apply not only to employee contributions but also to employer contributions. Once you earn over the benefit-eligible contribution limit , your employer is no longer able to put money into your 401. Many employers will set up non-qualified retirement plans so they can continue making contributions even if they cannot direct them to the 401, such as:

- At Chevron, the company continues to contribute the 8% but allocates the 8% for every dollar of income earned over and above the $305,000 limit to the Retirement Restoration Plan .

- Learn more about maximizing savings for BP employees

These non-qualified retirement plans have additional limitations and restrictions making them a nice benefit, but less attractive than traditional 401s. If you have a non-qualified plan, there are many considerations you should assess leading up to and before electing a retirement date to maximize your benefits and minimize taxes.

Recommended Reading: How To Direct Transfer 401k To 403b

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

Employer Matching Contribution Formulas

Most often, employers match employee contributions up to a percentage of annual income. This limit may be imposed in one of a few different ways. Your employer may elect to match 100% of your contributions up to a percentage of your total compensation or to match a percentage of contributions up to the limit. Though the total limit on employer contributions remains the same, the latter scenario requires you to contribute more to your plan to receive the maximum possible match.

Some employers may match up to a certain dollar amount, limiting their liability to highly compensated employees regardless of income. For example, an employer may elect to match only the first $5,000 of your employee contributions.

The IRS requires that all 401 plans take a nondiscrimination test annually to ensure that highly compensated employees dont benefit more from tax-deferred contributions.

“Your employer could match 100% or even a dollar amount based upon some formula, but this can get expensive and normally owners want their employees to take some ownership of their retirement while still providing an incentive,” says Dan Stewart, CFA®, president, Revere Asset Management Inc., in Dallas, TX.

Recommended Reading: How To Sell 401k Stock

An Individual Retirement Account

Unlike 401s, IRAs arent tied to your employer. Anyone who has earned income can set themselves up with an IRA and start investing for retirement. Which is great news, because they come with some sweet tax benefits.

There are two main kinds of IRA traditional and Roth and you can use either or both . With a traditional IRA, you put tax-deductible money in today and then pay the taxes when you withdraw it in retirement. With a Roth, its the opposite. You put money in after paying taxes today, it can grow tax-free, and then you get to withdraw it tax-free, too.

The most you can put into an IRA is $6,000 a year . Thats the limit across both Roth and traditional accounts .

So thats a great place to start, even though you might not be maxing it out just yet. You can work your way up over time. But as you get closer to the age you want to retire, even investing the max on an IRA may not be enough to fund your entire retirement. Which brings us to