What Is The Deadline To Make Salary Deferrals Into The Individual 401k

Sole proprietorship, partnership or an LLC taxed as a sole proprietorship – The deadline for depositing salary deferrals into the Individual 401k is generally the personal tax filing deadline April 15 .

S corporation, C corporation or an LLC taxed as a corporation The salary deferral contribution must be made into your Individual 401k within 15 days of the period in which you are paying yourself. For example, 401k salary deferral contributions made at the end of a calendar year on December 31 need to be deposited into the Individual 401k by January 15 at the latest.

Rule # 4 You Only Get One Sep Simple Or 401 Per Unrelated Employer Per Year

Each unrelated employer should only have one of these three types of accounts for each tax year. However, you could open a SEP-IRA for your self-employment income in March 2021 for tax year 2020, and then open an individual 401 in June 2021 for tax year 2021 if you like. Remember that just because you are the sole owner of two separate businesses doesnt mean you get two different retirement accounts. Those businesses are a controlled group.

Benefits And Drawbacks Of A 401

The prospect of employer matches and large contribution limits can give the 401 an edge, but it does have its limitations. For instance, companies typically place stricter restrictions around your funds. No law states they must allow hardship withdrawals, for example.

And some plans can involve hefty administration fees and fund expenses that can add up, taking a chunk out of your retirement savings. Thats why you should learn everything you need to know about 401 fees. Generally speaking, though, the larger the company, the lower the fees.

Dont Miss: How To Rollover My Fidelity 401k

Recommended Reading: How To Find 401k Account Number Fidelity

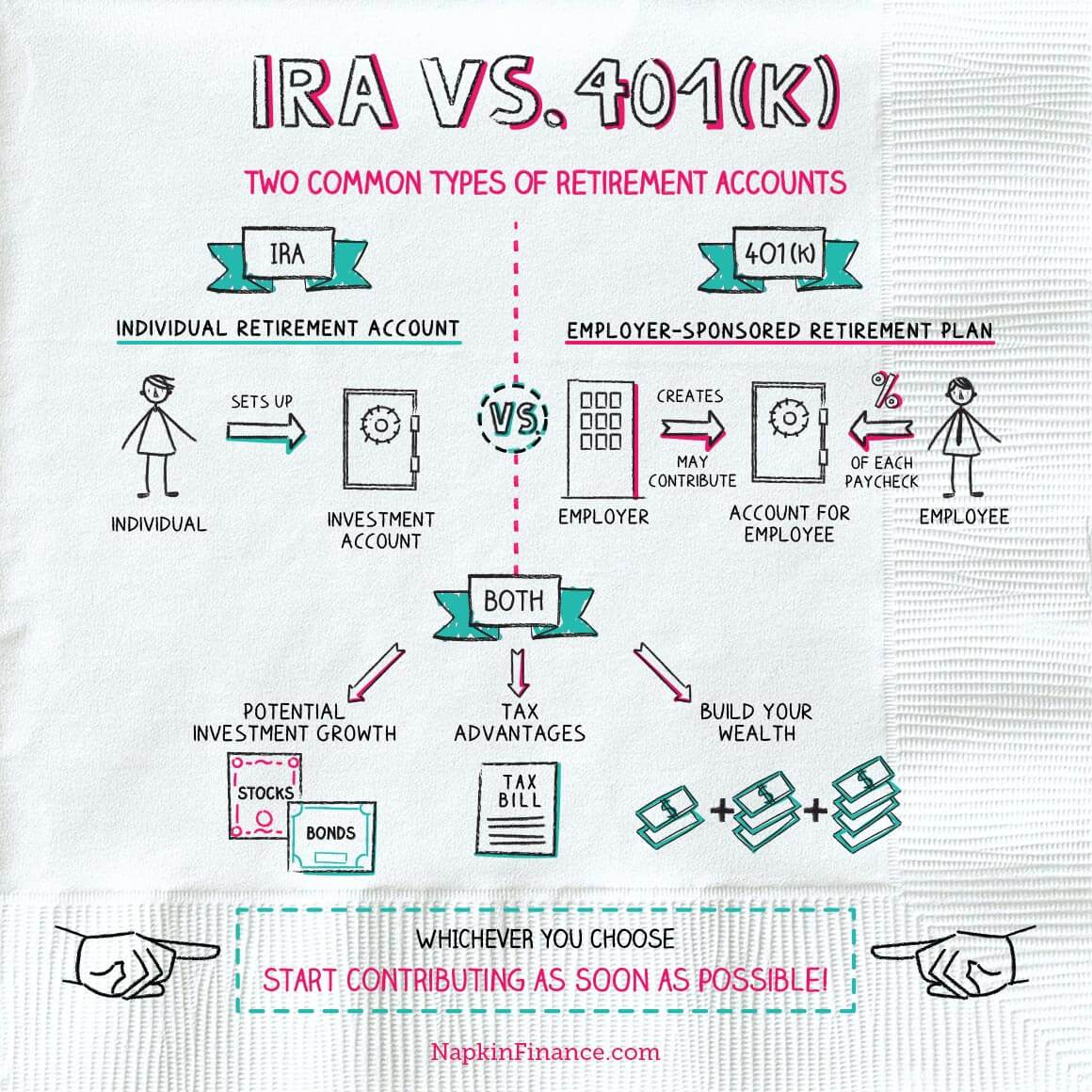

What Are Alternative Investments

Self-directed IRAs are in most ways similar to other individual retirement accounts , meaning they have tax advantages designed to encourage Americans to save for retirement. As a result, the Internal Revenue Service gets some say in what an IRA can and cannot be invested in, which includes some alternatives to the usual stock and bond funds.

As of 2021, the IRS permits self-directed IRAs to invest in real estate, development land, promissory notes, tax lien certificates, precious metals, cryptocurrency, water rights, mineral rights, oil and gas, LLC membership interest, and livestock.

The IRS also has a list of investments that are not permitted. That list includes collectibles, art, antiques, stamps, and rugs.

Dont Miss: Why Roll 401k Into Ira

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours a year in your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Recommended Reading: How Do I Invest In My 401k

Recommended Reading: How To Withdraw My 401k

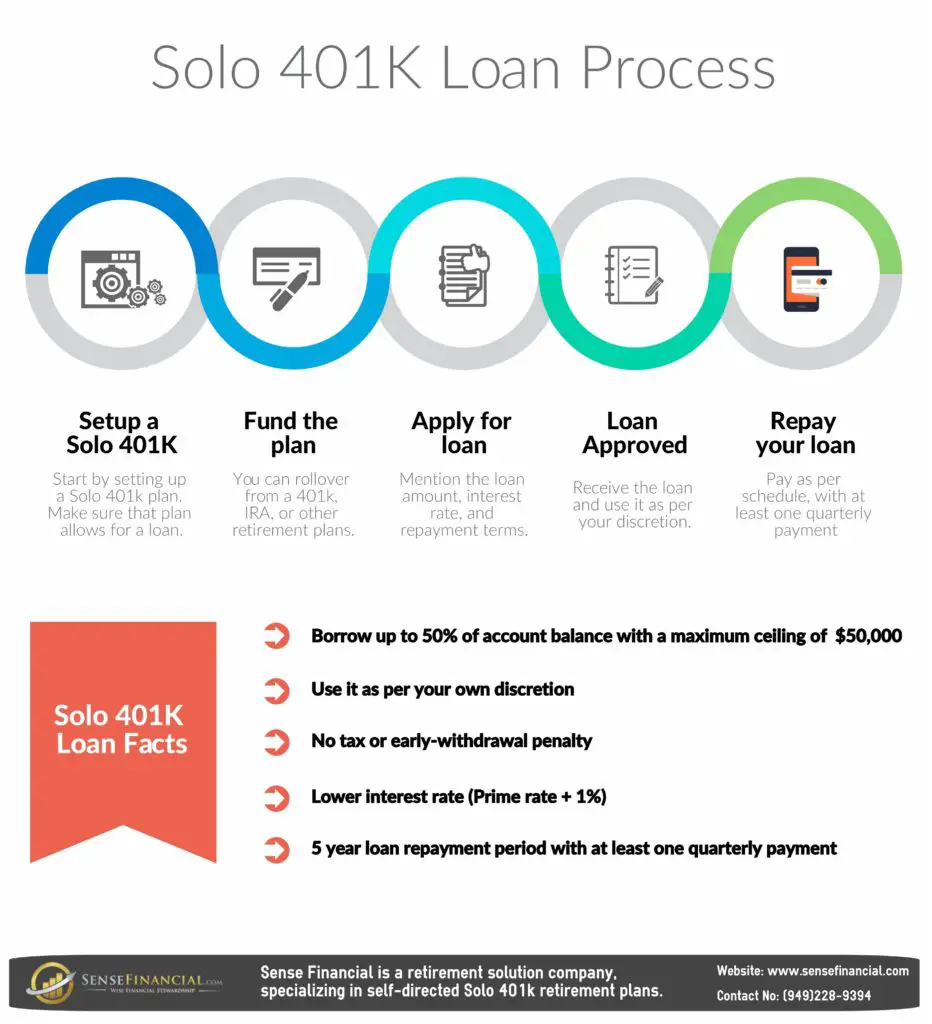

What Are The Advantages Of Using An Individual 401k Loan As A Small Business Loan

- The loan can be used for any purpose.

- Since you are using your Individual 401ks balance, you are automatically approved for the loan.

- There are no income or credit qualifications. As a result, bad credit wont prevent you from getting a 401k loan.

- Since you are borrowing your own money, principal and interest payments are paid back into your own 401k.

- 401k loan interest rates can be as low as the Prime rate plus 1% or 2%.

Stinks Start Your Own Plan

Iâm always inundated with waves of studies that show how little Americans are saving for retirement. And then people I meet start telling me how 401s are simply not up to the task.

I agree with most of the research out there that shows how inadequate 401s are. They are strictly voluntary, loaded with fees and not effective â unless you work for a big company and save as much as you can.

The latest piece of damning evidence on this subject comes from the Economic Policy Institute, a think tank funded by the Labor Movement. Itâs âRetirement Inequality Chartbookâ calls 401s âan accident of history,â that is obscure parts of the U.S. tax code that were never meant to be substitutes for pensions, which were largely abandoned by corporate employers.

Those with high salaries do very well in 401s, the report notes, although everyone else comes up short. Thatâs because the high earners get the lionâs share of tax benefits, causing a widespread inequality among savers.

âRetirement insecurity has worsened for most Americans as retirement wealth has become more unequal,â the EPI report notes. âFor many groups, the typical household has no savings in retirement accounts and balances are low even when focusing only on households with savings.â

Yet this doesnât mean that the helter-skelter retirement system is an outright failure. Retirement savings have increased overall. Itâs just that those in the middle and lower-income groups arenât saving enough.

Also Check: Can You Cash Out 401k To Buy A House

Employee Salary Deferral Contribution:

For 2019, as an employee, you can make a contribution to your individual 401k plan up to $19,000 if youre under 50. If youre over 50, you can make a contribution up to $25,000. This is the $6,000 catch-up feature.

You can make contributions in pre-tax, after-tax or Roth. Its important to note that you cannot defer more than you make. Therefore, if you only make $15,000, you can only defer $15,000.

Mom And Brothers Participation Question:

Yes provided they are all owner-employees in the S-corp with not other full-time W-2 common-law employees. The S-corp would sponsor the solo 401k plan and all 5 would participate in the same solo 401k plan. Each participant would separately hold their retirement funds in participant accounts. Lastly, when it comes time to determine if a Form 5500-EZ will need to be filed for the plan, all of the participants balances will need to be added up and if the combined value exceeds $250,000, a Form 5500-ez will need to be filed each year by 07/31.

Also Check: When Can You Draw From 401k

Why Employers May Not Offer A 401

Facilitating a 401 plan can be expensive for a company. The IRS requires testing and reporting to ensure retirement plans keep up with regulations. As a result, many small businesses simply can’t afford to administer a 401 plan.

If a company is brand new and trying to get off of the ground, they may not have the time to organize a retirement plan for their employees. Since bringing in an outside firm costs even more money, usually, small businesses don’t have a 401 plan in place.

And because nearly a half of Americans work for small businesses, the amount of people left to their own means to save for retirement is significant.

Solo 401 Contribution Limits

The total solo 401 contribution limit is up to $57,000 in 2020 and $58,000 in 2021. There is a catch-up contribution of an extra $6,500 for those 50 or older.

To understand solo 401 contribution rules, you want to think of yourself as two people: an employer and an employee . Within that overall $57,000 contribution limit in 2020, your contributions are subject to additional limits in each role:

-

As the employee, you can contribute up to $19,500 in 2020 and 2021, or 100% of compensation, whichever is less. Those 50 or older get to contribute an additional $6,500 here.

-

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself. The limit on compensation that can be used to factor your contribution is $285,000 in 2020 and $290,000 in 2021.

Keep in mind that if youre side-gigging, employee 401 limits apply by person, rather than by plan. That means if youre also participating in a 401 at your day job, the limit applies to contributions across all plans, not each individual plan.

Read Also: How Does A Solo 401k Plan Work

Read Also: When I Withdraw From My 401k

Both An Employee And Self

You can be an employee of a business and also be separately self-employed. In this case, you are still eligible to establish a Solo 401 for your own business, even if you may also be participating in a 401 or other retirement plan through your primary employment. In such cases, your ability to make employee contributions will be capped at the overall limit of $19,500 if you are under age 50 or $26,000 if you are 50 or older. Your business that sponsors the Solo 401 can make a profit sharing employer contribution up to the plan maximum, independent of the other employer plan, however.

You May Like: How Much Can You Put Into A Solo 401k

What Are My Responsibilities To Properly Maintain My Individual 401k

You are responsible for submitting the salary deferral and profit sharing contributions by their required deadlines. If you have a loan, you are required to make the loan repayments according to the terms of the loan amortization schedule or risk a loan default. When the total assets in your plan reach $250,000, the IRS requires that IRS Form 5500 is completed and submitted to them annually.

You May Like: How Does 401k Match Work

Bankruptcy & Creditor Protection For Solo 401k Plan

QUESTION 4: I am trying to better understand the protections of the solo 401k. I believe it qualifies for unlimited bankruptcy protection, but does it also have unlimited lawsuit protection under ERISA ?

ANSWER:

- Bankruptcy: Solo 401K plans have creditor protection under the federal bankruptcy rules.

- As far as protection from non bankruptcy creditors, the protection falls at the state level. While solo 401K plans are not covered by the federal creditor protection rules of ERISA, they are generally protected under most state laws subject to certain carve outs .

Retirement Plans For The Self

You made the decision to quit your 9-5 job and start your own business. There are several advantages to being your own boss. However, there is one perceived disadvantage: you no longer have an employer 401 plan. However, there are a number of retirement plans designed specifically for self-employed individuals and small business owners.

Because you are self-employed, you will likely benefit most from a retirement plan designed to fit your specific needs. There are three self-employment plans. These are:

- Simplified Employee Pension IRA

- Savings Incentive Match Plan for Employees IRA

- Individual 401k, also known as a Solo 401

Out of all of these retirement plans, the Individual 401k is the best option to choose. First, getting started with the Individual 401k is easy and cost-effective. Lets take a look at a few other benefits.

Related:Why Chose an Individual 401k over a SEP IRA

Read Also: How Can You Borrow From Your 401k

Transfer Funds From Current Employer 401k That We Rolled Over From Another Employer 401k Question:

Good question, and yes those funds from the former employer 401k that are currently held in the existing employer 401k can certainly be transferred to the solo 401k plan as long as the current employers plan allows for it. It is a tricky situation because even though the rules allow for it, the current employer can restrict the transfer of funds transferred into the plan from a former employer 401k plan. We strongly recommend getting a copy of the existing employers 401k plan Basic Plan Document or Summary Plan Description Agreement as specific language will be embedded in these documents regarding this topic. We will gladly review those documents for you once you obtain them from your current employer 401k provider.

How Does A Roth 401 Affect My Paycheck

A lot of people are hesitant to begin a Roth 401 because they are worried about how it will affect their take-home pay. At a minimum, its always recommended to contribute up to your employers match even if you are focused on getting out of debt or saving for a new home. This is essentially free money.

There is no getting around that your contributions will directly affect your take-home pay. The contributions are made with after-tax dollars. But remember, the future earnings in your Roth 401 are not taxable. This can end up paying off big time once you hit retirement.

You May Like: How To Start A 401k Account

What Paperwork You Need To Fill Out To Open Your Account

I was surprised at how much paperwork is required to open a solo 401k account. Youd think it would be simple, with very common forms to fill out. However, its completely the opposite. It becomes even more challenging if you add a Roth solo 401k, and you have to do double the paperwork if youre adding a spouse to your plan.

When opening your solo 401k plan, you will need to create the following documents. You will need to create separate plan documents for both your Traditional and Roth Solo 401ks. They are both considered separate plans for tax purposes.

Plan Documents For Traditional Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Plan Documents For Roth Solo 401k

- 401k Plan Adoption Agreement

- Designation of Successor Plan Administrator

Required Documents For Individual

- Brokerage Account Application for 401k Account

- Brokerage Account Application for Roth 401k Account

- Designation of Beneficiary Form for Account

- Power of Attorney

When youre done with all these documents, youll have two solo 401k plans, and 4 accounts .

Dont Miss: What Is Max 401k Contribution For 2021

Are Individual 401k Contributions 100% Tax Deductible

Yes, salary deferral and profit sharing contributions are generally 100% tax deductible. Roth 401k contributions made with the salary deferral portion of an Individual 401k are not tax deductible.

Subchapter S and C corporations or LLCs electing to be taxed as a corporation can generally deduct the salary deferral contribution from personal W-2 earnings and the profit sharing contribution as a business expense.

A sole proprietorship, partnership or an LLC taxed as a sole proprietorship can generally deduct salary deferral and profit sharing contributions from personal income.

Also Check: How To Roll Your 401k Into Another Job

Things To Consider When Opening A Solo 401k

If youre considering opening a solo 401k, there are a few things to consider when it comes to plan features.

There are five key areas that you need to decide before you open your solo 401k:

Everyone who opens a solo 401k will have different requirements. However, I would recommend you open a solo 401k plan with the most options and flexibility. While you can always amend your plan documents, it can be a hassle and can cost you money . As such, it makes sense to create a solo 401k plan with the most options up front.

Dont Miss: Can I Transfer 401k To Roth Ira

What Are The Maintenance Costs For Setting Up A 401

Once you establish a 401, your business will have ongoing costs in the form of administrative fees and any matching contributions. Fees generally fall into three categories: day-to-day operations, investment fees, and individual service fees.

There are also potentially fees or penalties associated with being non-compliant with regular 401 benchmarking, which you’ll want to avoid at all costs. A few examples of 401 penalties include:

- Non-compliance with ERISA for failing to meet certain filing and notification requirements

- Failing to file Form 5500 with the IRS each year

- Not providing 402 notices to plan participants who are seeking distributions from their retirement plan accounts

One way to avoid fines and penalties is working alongside a knowledgeable retirement services provider that can help ensure compliance when it comes to retirement plan forms, deadlines, and notifications.

Don’t Miss: Can You Transfer 401k To New Employer

Investing Outside Of Retirement Accounts

You donât have to stop saving for retirement just because you reach your maximum allowed savings for the year. You can save with other investments. It doesnât have to be an official retirement account.

In fact, youâll want to have a good portion of your benefits in separate accounts if youâre planning on retiring early so you can access the money without being hit with an early withdrawal penalty. You arenât allowed to take money from either an IRA or a 401 without a 10% penalty until you reach age 59½. But there are a few exceptions.

You may want to retire sooner than that. Other investments will allow you to withdraw money before age 59½ to avoid the penalties.

Also Check: How Do I Take Money Out Of My Voya 401k

How Do I Invest My Sep Ira

Once youve opened the account, you can choose from the investments your account provider offers. The selection typically includes stocks, bonds and mutual funds.

Once the account is open and funded, youll want to invest it according to your age, planned retirement age and risk tolerance. If you have a fairly strong stomach for market swings and a long time until retirement, your investment selection should sway toward stocks, specifically stock index funds, which track a segment of the market and hold a diverse mix of stocks within that segment.

The less time you have until retirement and the less patience you have for a market downturn the more youll want to allocate toward bonds and bond funds. You can also buy index funds for bonds.

» Want more investing guidance? Read our post on how to invest your IRA.

» Ready to set up a SEP IRA? See NerdWallets picks for best IRA providers.

Recommended Reading: When Can You Start Drawing From 401k