Where Can I Get Objective Advice

When you ask your employer if you can get advice about your plan investments, make it clear youre looking for someone who will act as a fiduciary. Or you can check out a digital advice service that suggests investments for your 401, such as FutureAdvisor or Smart401k, or one that can manage your plan for you, like Blooom.

If You’re An Employer

If you already offer a 401 plan to your employees and would like to add a designated Roth 401 option to it, your plan’s service provider or custodian should be able to help. The IRS also has information for employers on its website, irs.gov, including Publication 4222, 401 Plans for Small Business and Publication 4530, andDesignated Roth Accounts Under 401, 403 or Governmental 457 Plans.

What Are The Most Common Mistakes People Make With Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover youve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you wont have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you cant stay in that house. Once youve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

You May Like: How To Calculate Employer 401k Match

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

E-Trade |

|

|

$0/trade |

$0/trade |

Notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you. However, E*TRADE does stand out as having the most robust options.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Can I Take Out My 401k To Pay Off Debt

What Is The Best Retirement Plan For A Self

Allec says that, for most businesses, the solo 401 is the best option. Many small businesses can contribute more to a solo 401 than, say, a SEP at the same income level. With an IRA, you can contribute only $6,000 or $7,000 in 2022. With a SEP IRA, you cant contribute as both employer and employee, only as an employer.

There are several other types of retirement plans besides self-employed 401s. These include the following:

Summary: The solo 401 is the best retirement plan for a self-employed person, but traditional IRAs, Roth IRAs, SEP IRAs and SIMPLE IRAs remain options.

Recommended Reading: How Does 401k Transfer Work

How Much Should Employees Contribute

Like the employer, employees are free to contribute as much as they like to the plan, within IRS limitations. For 2022, salary deferrals are $20,500, plus a catch-up contribution limit of $6,500 for employees 50 and older. Consider ways to help employees improve their financial wellness and increase their 401 participation. Doing so could benefit your business in the form of happier, less-stressed employees who are more engaged and productive.

Read Also: How Can I Get Access To My 401k

Is There A Roth 401 Option

The tax break you get from contributing to a 401 is a powerful motivator to save, but some plans offer the option of making after-tax contributions using a Roth 401. You dont get the tax break upfront, but the money is tax-free when you withdraw it in retirement.

Having money in both regular and Roth accounts can give you more flexibility to control your tax bill in retirement. If youre young or expect to be in a higher tax bracket in retirement, contributing to a Roth 401 can make sense.

What Are The Most Common Mistakes People Make With Their Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover youve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you wont have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you cant stay in that house. Once youve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the prohibited rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

Additional reporting by Max Freedman

Also Check: How Do You Max Out Your 401k

Distribution Rules Must Be Followed

Generally, distributions cannot be made until a “distributable event” occurs. A “distributable event” is an event that allows distribution of a participant’s plan benefit and includes the following situations:

- The employee dies, becomes disabled, or otherwise has a severance from employment.

- The plan ends and no other defined contribution plan is established or continued.

- The employee reaches age 59½ or suffers a financial hardship.

See When can a plan distribute benefits?

Benefit payment must begin when required. Unless the participant chooses otherwise, the payment of benefits to the participant must begin within 60 days after the close of the latest of the following periods:

- The plan year in which the participant reaches the earlier of age 65 or the normal retirement age specified in the plan.

- The plan year which includes the 10th anniversary of the year in which the participant began participating in the plan.

- The plan year in which the participant terminates service with the employer.

Loan secured by benefits. If survivor benefits are required for a spouse under a plan, the spouse must consent to a loan that uses the participant’s account balance as security.

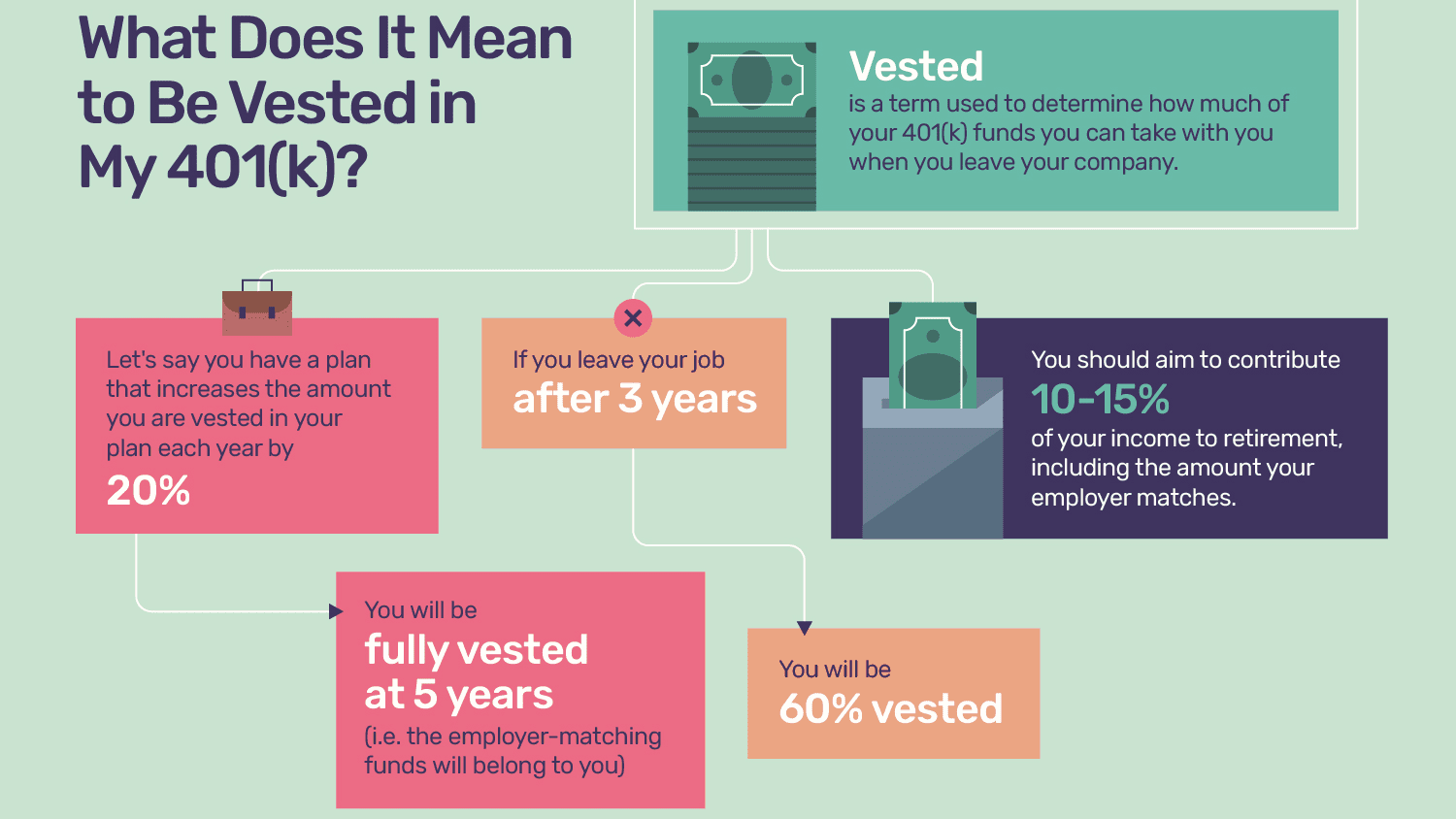

Aim To Save At Least 10% Of Your Income Each Year Automatically

An all too common mistake new investors make is that they focus on what to invest in, rather than how much to invest, says Rapplean.

âYounger investors get really hung up on the investment choices, when the focus really should be on your savings rate,â says Rapplean. Academic research suggests someone in their 20s needs to aim to save at least 10%â15% is even betterâto land at retirement in solid shape. If you get a later start, you will want to aim to save even more.

If you canât reach that threshold right now, donât get disheartened. Many people canât itâs equally important to get any amount of money you can into the market to start benefiting from compounding returns. Even small sums can become small fortunes over decades.

Recommended Reading: How Do I Put My 401k Into An Ira

Don’t Miss: Is There A Limit For 401k Contributions

How To Contribute To A 401

Contributions to a 401 are handled by your employer via payroll deductions. In 2022, individuals can contribute up to $20,500 to their account, or $27,000 if theyre aged 50 or older.

If your employer offers a 401 match, you should save enough to qualify for the maximum amount of matching contributions.

Remember to not leave your company 401 behind when you change jobs, says Christie Whitney, CFP, director of planning at investment advisor Rebalance. Make sure to roll those dollars over into an IRA or your new companys 401 plan, so that you dont lose track of your investments.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Recommended Reading: Can I Start My Own 401k Plan

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax year 2021 and $20,500 or 100% of compensation for tax year 2022. If you are over 50, an additional $6,500 catch-up contribution is allowed bringing the total contribution up to $26,000 for 2021 and $27,000 for 2022. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $58,000 for tax year 2021 and the maximum 2022 solo 401k contribution is $61,000. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022.

Recommended Reading: Can You Use 401k To Pay Off Debt

Exceptions For Solo 401 Early Distribution Penalties

The IRS may waive the 10% penalty for early withdrawals in certain circumstances. Youll still owe taxes on any contributions or earnings that havent been taxed. The exceptions include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

Certain military service

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

In the case of a distribution paid to an ex-spouse under a QDRO, the 401 owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.

Unlike an IRA or SEP IRA, a Solo 401 doesnt allow penalty-free withdrawals for higher education expenses or first-time homebuyers.

Benefits Of Having Both A 401 And An Ira

Instead of investing in only an IRA or your companys retirement plan, consider how you can blend the two into a powerful investment strategy. One reason this makes sense is that you can invest more for your retirement, with the additional savings and potential growth providing even more resources to fund your retirement dreams.

Since employers often match 401 contributions up to a certain percentage , this supplement boosts your overall savings. The employer match is essentially free money that you could get simply by making the minimum contribution to your plan. Every company is different, so check with your employer to determine their policy on matching 401 contributions.

Now imagine adding an IRA to the picture. One of the best things about an IRA is the flexibility you have when investing. With a 401, you have limited options when it comes to investment funds. With an IRA, youre able to decide what youd like to invest in, whether it be stocks, bonds, mutual funds, ETFs, or other options.

By investing in both a 401 and IRA, you are taking advantage of employer-matched contributions and diversifying your retirement portfolio which can help manage risk and potentially improve the overall performance of your investments in aggregate.

That said, if you choose to invest in both types of accounts, its important to make sure your investment choices dont overlap.

Don’t Miss: Should I Invest In 401k Or Roth Ira

Leave Something Behind For Your Loved Ones

When you start investing in gold earlier in life or take on a more aggressive investing strategy, the value of the gold in your vault may be worth more than the amount you’ll need to live out your retirement. This means you’ll have gold remaining in your vault at the end of your life. Your gold IRA company’s representative can help you set up a beneficiary for the contents of your vault, allowing you to pass your gold holdings onto a spouse or another loved one.

An important thing to note is that the contents of a self-directed IRA won’t go through the probate process. This is because the ownership of those assets, including the gold in your vault, will pass directly to your beneficiary at the time of your death. As soon as you die, your loved one will take ownership of the remaining gold and silver in your vault. Your beneficiary can use it to help them manage their finances after you’re gone, or they can save it for their own retirement.

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Don’t Miss: How To Use My 401k To Start A Business

Complete Plan Documents & Disclosures

After selecting a provider, youll receive a collection of documents called an employer kit or employer application. These documents will help you set up your plan.

Documents that need to be completed for your provider include:

- Client agreement

- QRP basic plan document

- Adoption agreement

This is the stage in the process when youll make initial investment choices. Those initial choices can be changed at any point in the future. Youll receive disclosures and instructions on how to remain compliant. These disclosures will include information on the plan and the benefits of tax-free savings.

In addition, youll receive information regarding items that would go on IRS Form 5500 if you have over $250,000 in your account or have additional plan participants. If you eventually convert your solo 401 to a traditional 401 with more participants, those participants will also receive the same disclosures from the plan administrator.

The primary disclosures for a solo 401 plan include: