Roll The 401 Over Into An Ira

What if youre not moving to a new employer immediately or your new employer doesnt offer a 401? What if your employer requires you to put in a number of years before you become vested and eligible to participate in their 401 plan?

In these circumstances, stashing your money in an IRA with the financial institution of your choice is a freeing solution. Youll be able to choose where, how, and when you invest unless you agree to pay a broker to manage the funds for you. A direct rollover is ideal to avoid paying taxes on the amount transferred over you have 60 days to roll your 401 over into the new IRA.

Also Check: How To Find My 401k Contributions

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

How To Handle Your 401 When You Get A New Job

If your former employer cashed out your 401 account and gave you a check, you need to roll the money into a qualified retirement account within 60 days to avoid paying taxes on it. If you didn’t get a check, and you’re able to park your 401 with your former employer for now, take some time to consider your options.

You May Like: Does Employer 401k Contributions Count Towards Limit

Roll Over Your 401 To A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense not to roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt not to defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell itimmediately or in the futureyour taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Don’t Miss: How To Take Money From 401k

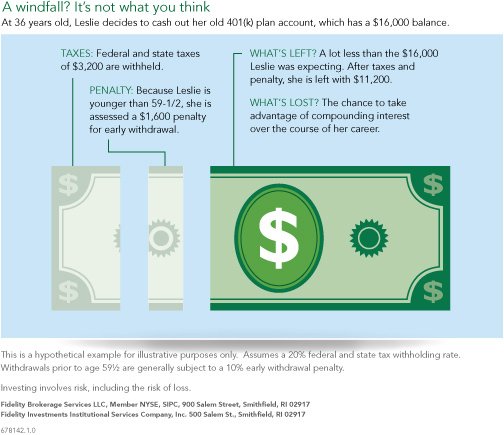

Is It A Good Idea To Withdraw Money Early From Your 401k

There are not many benefits to early 401k withdrawals. You will incur a 10% extra penalty on top of any taxes you owe if you make withdrawals before age 5912.

Some companies do, however, permit hardship withdrawals for unanticipated expenses like property purchases, funeral fees, or unforeseen medical expenses.

Although you can avoid the early withdrawal penalty in this way, you will still be responsible for paying taxes on the withdrawal.

How Do I Transfer An Old 401 To My New Job

Even if youre happy at your job, its always a good idea to keep your options open. If youre considering a move to a new company, one of the first things youll need to do is figure out what to do with your old 401. Fortunately, transferring an old 401 to your new job is usually a pretty straightforward process.

So, if youre planning a job change, dont forget to take care of your retirement savings. With a little effort, you can ensure that your hard-earned money stays right where it belongs in your pocket.

Also Check: How To Check My 401k Amount

Dont Take Your Pension Early

Unless you have an urgent need for the money, it is usually best to leave it until retirement. You will be able to grow your pension while still needing it to fund you in retirement, and you will be able to reduce the number of years it will be required to fund you. When and how is the best time to take out a pension? There is no deadline for when you will need to retire. Typically, the age at which you can begin collecting retirement benefits is 65, though many pension plans allow you to begin collecting as early as 55. Can you compare lump sum or pension? You will have greater control over your assets with a lump sum. The decision to accept a lump sum lump sum payment is, however, more about protecting your income sources in the future rather than receiving an annuity payment from the pension plan. What would happen if I take out my pension and not live the life I want? Can you withdraw pension money early? When certain conditions are met, it is possible to withdraw your pension early. Although this may appear to be a cost-effective option, it can also be costly. You may be able to withdraw from your pot before you reach the age of retirement, but you may have to pay 55% tax on that withdrawal.

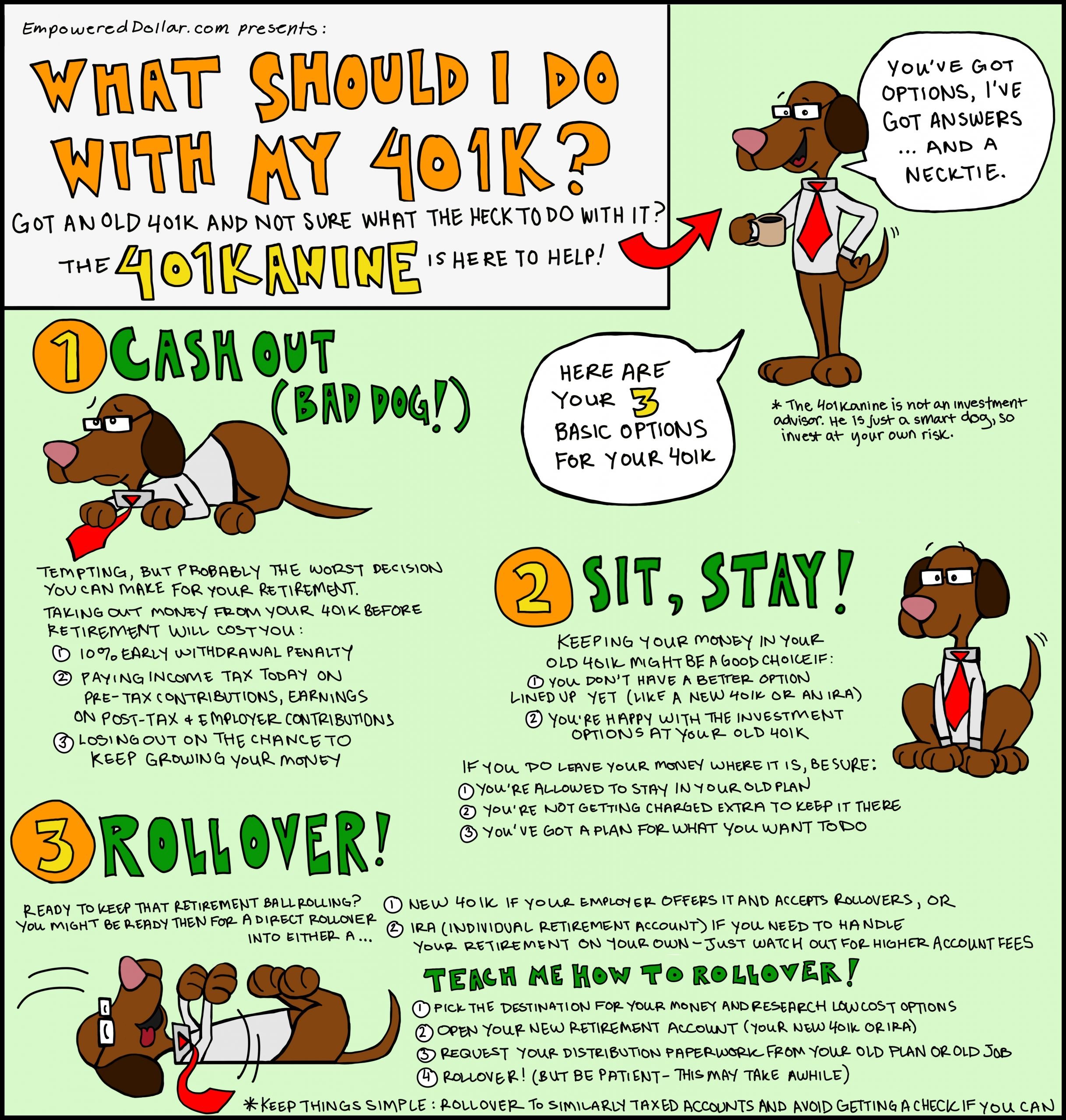

Leave The Money Where It Is

Assuming your current employer allows it not all do you may decide to leave your 401 right where it is.

If the plan has top-notch, low-cost investment options, this might not be a bad choice.

Know that when leaving money behind in a 401, there may be restrictions on whether you can take a loan against that account or on the size of any pre-retirement withdrawals you might make so check the rules of the plan before making your final decision.

The decision to stay with your current plan, however, might not be yours to make if your balance is below $5,000. A majority of workplace plans will require that you transfer the balance elsewhere or cash it out, according to the most recent survey of workplace retirement plans by the Plan Sponsor Council of America.

If your balance is over $5,000 but your current plan doesn’t have great, low-cost investments, you might be better off transferring the money to another tax-advantaged retirement account .

The same is true if you already have several other existing retirement accounts at old employers.

“A really bad outcome is to have lots of little accounts scattered around. It’s easy to forget about them. It doesn’t let you appreciate how much you’ve really saved. And the odds of screwing something up gets higher,” said Anne Lester, the former head of retirement solutions at JP Morgan Asset Management who founded the Aspen Leadership Forum on Retirement Savings in partnership with AARP.

Don’t Miss: How Do I Roll My 401k Into Another 401k

When To Withdraw Your Pension After Leaving A Job

There are a few things to consider when thinking about whether or not to withdraw your pension money after leaving your job. One thing to keep in mind is taxes. Withdrawing your pension money may mean that you have to pay taxes on the withdrawal. Another thing to consider is whether you need the money now or if you can wait to receive it later. If you need the money now, you may want to withdraw it so that you can use it. However, if you do not need the money now, you may want to leave it in the pension so that it can continue to grow.

When you leave your job, you can transfer your pension in a variety of ways. Pension defined-benefit plans are typically available to you for either leaving the pension where it is or transferring it to another employer. Thevesting period, as it is commonly known, is typically between two and seven years in length, but it varies by company. Do you leave your pension with your current employers pension plan or do you move it out? The copycat annuity is a popular retirement plan choice among employees who have left defined-benefit pension plans. It pays you the same pension as your former company, but it is paid out by a Canadian insurer rather than you. When you resign or retire in Canada, you are protected from being fired or disqualified from receiving your pension benefits.

Contact Your Old 401 Plan Administrator To Begin The Rollover Process

To transfer funds from your old 401, you’ll need to get in touch with your former employer’s plan administrator and indicate that you want to roll over your account.

There are two ways for administrators to transfer your funds to your rollover destination: direct and indirect rollover.

Direct rollover: A direct rollover is the easiest way to roll over your 401. If this is available to you, it’s the best option to avoid any pitfalls that could result in taxes and penalties.

With a direct rollover, you provide the administrator of the prior 401 plan with the information for the receiving account for your funds, and they transfer the funds to the new 401 account directly.

Sometimes you might receive a check made out to your new IRA or 401 plan, and it’s your responsibility to forward the check to the appropriate party. If you have any questions about where to send the check, you can contact your new 401 plan administrator or your IRA brokerage for clarification.

Indirect rollover: The other option is an indirect rollover. Instead of transferring funds directly from your old 401 to your rollover destination, the plan administrator sends the funds to you. You are then responsible for depositing the funds in the amount of your old 401 into your rollover account.

Don’t Miss: Can I Buy Real Estate With My 401k

What Happens To Your 401 When You Switch Jobs

What happens to your 401 balance when you leave your job? In part, that depends on how much money is in your account. Regardless of the amount, you’ll keep all the contributions you’ve made to the plan, plus the portion of your employer match that’s vested.

Money withdrawn from a 401 is called a distribution. The plan’s administrator is required by law to give you a written explanation of your distribution options, including the ability to have the money transferred directly to another 401 plan or to an individual retirement account .

In most cases, you can also leave your 401 money in your former employer’s plan. However, if your plan balance is $1,000 to $5,000, the plan administrator may deposit the money into an IRA for you if you don’t cash it out or roll it over into another retirement account. If your balance is less than $1,000, your plan administrator may automatically cash it out and send you a check. In this case, quite a bit of tax will be withheld. To keep your plan administrator from making a decision for you, contact them as soon as you know you’re leaving your job to go over your options.

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employer’s 401, certain steps are necessary.

You May Like: Which 401k Plan Is Best For Me

You Could Withdraw The Money

Technically, youre allowed to withdraw your money from your old 401, but unless youre facing some really dire financial circumstances, we advise against it. Thats because youd get hit with big penalties from the IRS and likely owe taxes on the money, too which could all add up to as much as 50% of the balance in your account. Yeah ouch.

Decide Where You Want Your Money To Go

You have a few destination options to choose from when you roll over a 401.

Use a rollover IRA: The most commonly used is a rollover IRA. This is simply a traditional IRA except it houses funds rolled over from another retirement account like a 401.

Investors typically roll over funds into like accounts — a traditional 401 into a traditional IRA and a Roth 401 into a Roth IRA. You may also roll over funds from a traditional account into a Roth account, but you’ll owe taxes at your current income tax rate on the amount converted. If you expect a year of low income, perhaps from an extended gap between jobs, then this conversion may be advantageous.

Transfer to a new 401: The other option is to roll over funds from an old 401 into your new employer’s 401 plan. This keeps all of your retirement investments consolidated so that they’re easier to manage. For high-income earners, another reason to transfer to a new 401 may be to keep the backdoor Roth IRA option available by sidestepping the IRA aggregation rule. As long as the fees are reasonable for the current 401 plan, this isn’t a bad option.

You May Like: How To Get Money Out Of Fidelity 401k

Reasons To Avoid A 401 Rollover

There are some cases when it doesnât make sense to roll your 401 into another account:

⢠IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

⢠Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

⢠Limited investment choices. A new employerâs 401 might have more limited investment choices. If thatâs the case, you might want to stick with your existing 401 because the assets work better for your situation.

⢠A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs donât have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Roth 401k Vs Traditional 401k

Companies and their employees only had one option when 401k plans first became available in 1978: the traditional 401k.

Next, Roth 401ks were introduced in 2006. Named after a former U.S. Senator William Roth of Delaware served as the main proponent of the 1997 law that established the Roth IRA.

Although Roth 401ks took a bit longer to gain popularity, many businesses now provide them. Employees frequently have to choose between a Roth and a traditional 401k plan as their initial selection.

Employees who anticipate being in a lower marginal tax bracket when they retire, in general, may prefer to choose a traditional 401k and benefit from the immediate tax break.

Employees who anticipate being in a higher tax bracket after retirement, on the other hand, can choose the Roth in order to defer paying taxes on their funds.

The fact that there is no tax on withdrawals, which means that all the money the contributions earn during decades of being in the account is tax-free, is also significantespecially if the Roth has years to grow.

Practically speaking, the Roth lessens your ability to spend money right away more than a typical 401k plan. If your budget is tight, that is important.

The tax rates of the future cannot be predicted, thus neither sort of 401k is guaranteed. Because of this, many financial advisors advise clients to diversify their investments by investing a portion of their funds in each.

Don’t Miss: How To Roll 401k To Ira

Can You Cash Out A Pension When You Leave A Job

Most pension plans allow you to cash out your pension when you leave your job. However, you may be required to pay taxes and penalties on the amount you withdraw. You should check with your pension plan administrator to see if there are any restrictions on cashing out your pension.

You may have funds in a retirement account if you leave a job. Depending on your age and plan, you can take that money with you. Work for the company at least a minimum of ten years before being eligible for any money from the company. To withdraw money from your retirement account, you must first meet certain requirements. A distribution is one of the types of distributions that the IRS defines. If you are under the age of 59 1/2, you will be required to pay a 10% early withdrawal fee. A variety of financial institutions allow you to roll your money into your own personal IRA.