Will You End Up In A Higher Tax Bracket

All or a portion of the money you convert could be considered âreportable incomeâ by the IRS. If youâre on the cusp of the next tax bracket, thereâs a chance youâll get bumped up in the year you convert.

To avoid this, consider converting a portion of your traditional IRA. This could help you:

- Stay out of that higher tax bracket.

- Spread the taxes related to the conversion over a few years instead of getting hit with the entire bill in 1 year.

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether youre a manage it for me type or a DIY type.

-

If youre not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Alternatives To Roth Conversion

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

Heres the deal: We want you to be careful as you think about transferring your retirement savings into a Roth 401. It might make sense for you if you can pay cash for the taxes without taking money out of your 401 and if youre still several years away from retirement. If those scenarios dont apply to you, you probably want to think about a different option.

But before you do anything, make sure you talk with an investing professional. They can help you understand the tax impact of a 401 conversion and weigh the pros and cons of each option.

Don’t Miss: How Do I Find My 401k From A Previous Employer

Could You Benefit From Advice

The best path forward for you will depend on several factors. Having a trusted advisor to talk through your options can bring clarity to your process and help you feel confident in your decisions. Some employer-based plans provide access to advice and even cover the advisory fees. If thats the case, you may want to hold on to that benefit and retain some or all your funds in the 401.

If not, a qualified financial advisor or robo-advisor can provide ongoing guidance and help keep your investments on track.

Note: An advisor can help with IRAs but might have limited access to your 401 plan. If youre going to hire someone, Lobel says, find out whether they can offer advice on your plan. It may not be a deal breaker, depending on your situation, but youll certainly want to know before you decide.

Should You Pursue A Roth Conversion

When considering whether to rollover retirement funds, you may want to consider moving funds to a Roth IRA or Roth 401. You would owe tax on the funds you convert in the year that you convert them. But from that point forward, you will enjoy the benefits of a Roth account.

If you also want your heirs to be able to convert the retirement assets they inherit from you into Roth accounts, talk to your tax advisor about how best to accomplish your goals with qualified plan dollars.

Read Also: How Do I Find My Old 401k Account

Also Check: How To Use Your 401k

How Does A 401 To Roth Ira Conversion Work

Converting a 401 into a Roth IRA gives you greater ownership and direction over your money. A 401 is a tax-advantaged retirement account that is managed by an employer, while a Roth IRA is a tax-advantaged retirement account that is managed by you.

In practice, this means youll open a Roth IRA account at an online brokerage firm and then roll any money in your 401 into your new account.

Beware: this will likely be a taxable event. Most, but not all, 401 accounts are tax-deferred. This means that youve never paid any taxes on the money within. Roth IRAs, on the other hand, are post-tax, meaning that they must contain only money that has already been taxed. If you have a tax-deferred 401, also known as a traditional 401, you will owe ordinary income taxes on the amount of money you convert into a Roth IRA.

Youll Pay Higher Tax Rates Later

Theres also a rule of thumb for when a conversion may be beneficial, says Victor. If youre in a lower income tax bracket than youll be in when you anticipate taking withdrawals, that would be more advantageous.

The reason you might be in a higher tax bracket could be anything: living in a state with income taxes, earning more later in your career or higher federal taxes later on, for example.

Lets say that you are a Texas resident and you convert your IRA to a Roth IRA and then in retirement, you move to California, says Loreen Gilbert, CEO, WealthWise Financial Services in Irvine. She points to high-tax California and no-tax Texas as examples. While the state of California will tax you on IRA income, they wont be taxing you on Roth IRA income.

In this example, you avoid paying state taxes on your conversion in Texas and then avoid paying income taxes in California when you withdraw the funds at retirement.

You May Like: How Do I Find My Fidelity 401k Account Number

Transfer Your 401 To Your New Job

Transferring your 401 to your new job is like a 401 to 401 rollover. Depending on the set up of your new plan, its probably a better option than leaving it behind but might not be as beneficial as rolling your 401 to an IRA. Check the plan documents of your new employers 401 to confirm the plan accepts incoming rollovers.

Also Check: What Is Asset Allocation In 401k

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

Don’t Miss: Who Is My 401k Through

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Is A Rollover Or Transfer Right For You

Speak with one of our trusted Financial Consultants.

MondayFriday, 8 a.m.8 p.m. ET

*Consider all available options, which include remaining with your current retirement plan, rolling over into a new employer’s plan or IRA, or cashing out the account value. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses, availability of services, and distribution rules . Depending on your plan’s investment options, in some cases, the investment management fees associated with your plan’s investment options may be lower than similar investment options offered outside the plan.

Read Also: How Much Can You Put Into 401k Per Year

What We Know About The Unknown

Recently, there has been a spike in interest among retirees regarding Roth IRA conversion resulting from rumors, reports, promises and other speculation about the future of taxation on retirement wealth. The reality of the situation is that only you and your financial advisor can determine the right path for your retirement. Make sure that if you do decide on a Roth IRA conversion, its for the right reasons. Changes in the system are only one factor in your financial situation, your retirement and your choices.

Are The Income Eligibility Limits Still In Place To Make An Annual Contribution To A Roth Ira

Yes. The income limits for annual contributions are still in effect, so its possible to take advantage of a Roth conversion but not be eligible to make an annual contribution. Since there are no income eligibility limits for conversions, however, one common strategy is to make a non-deductible contribution to a Traditional IRA then convert it to a Roth IRA. This may not be an appropriate strategy if you have other Traditional, SEP, or SIMPLE IRA balances, as the pro-rata rule would apply. Please consult a tax advisor to see if this strategy would work for you.

Read Also: How To Withdraw Money From 401k Before Retirement

Why Would You Choose A Roth Over A Traditional Ira Or An Annuity

Generally, people choose to convert to a Roth when they believe they are headed into a higher tax bracket in the future. That’s because you won’t pay taxes on distributions from a Roth after retirement.

Another good reason for choosing a Roth is the belief that your income will increase. While current tax law does not restrict Roth conversions based on income, contributions to a Roth IRA are. Let’s say you think you will earn more than the maximum allowable to contribute to a Roth in the future. You may want to invest in a Roth now and open a traditional account later so you can diversify your tax structure.

Finally, you may choose to convert your 401 to a Roth if you wish to hold off on making withdrawals for as long as possible. Federal law requires investors to take withdrawals from traditional IRAs and some other vehicles beginning at age 72Roth IRAs do not contain this stipulation.

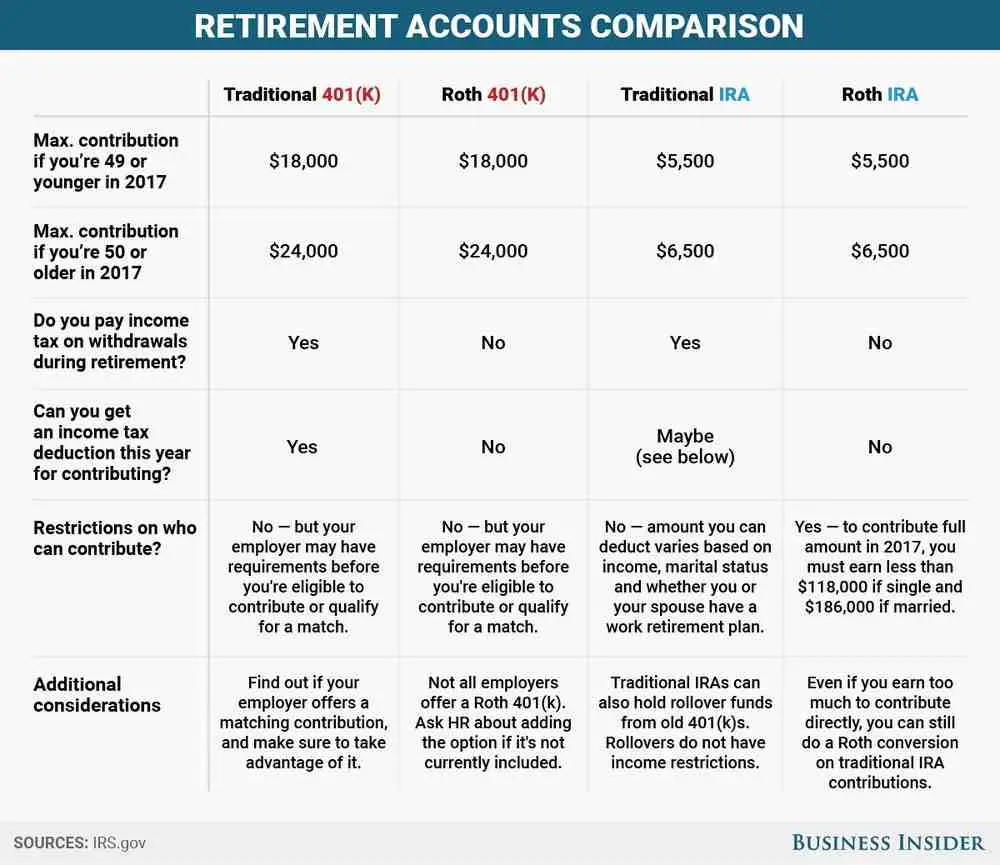

What Is A Roth 401 Or Ira

A Roth 401 or Roth IRA is a type of Individual Retirement Account. It is similar to a traditional 401 or IRA in that the gains are not taxed while the account continues to grow. However, a traditional 401 or IRA tax your gains when you take out the money. With a Roth 401 or Roth IRA, you can withdraw your contributions and earnings tax and penalty-free after age 59½ provided the account has been open for five years. There is also no annual required minimum distribution for a Roth 401 or Roth IRA as there is with a traditional IRA. This different treatment is explained by the fact that traditional 401 and IRA accounts are funded with pre-tax dollars, whereas Roth 401s and Roth IRAs are funded with after-tax dollars.

There is an income cap for Roth IRAs, so you may not be eligible to establish this type of account and make direct contributions to it depending on your income. However, taxpayers who are not eligible to contribute directly to a Roth retirement account may still be able to convert a traditional retirement account to a Roth account and reap the benefits that Roth accounts provide.

You May Like: How Do I Close Out My 401k

Are There Any Downsides To 401

You might lose some protection against creditors. Additionally, you forfeit the ability to access 401 money penalty-free if you separate from your employer at 55 or older. You can, however, still access money for certain eligible purchases and life events, regardless of whether its in a 401 or IRA.

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

Also Check: How To Withdraw My 401k From Fidelity

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you don’t already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Rules For Roth Ira Conversions And Other Considerations

Once you start evaluating how a Roth IRA might work for your retirement goals, taxes start to become a significant consideration. Working with your tax professional will help you determine:

- The best times and ways to move money between retirement accounts including between different companies, especially if you are consolidating accounts

- When and how to pay taxes on the money in your retirement accounts

- Which IRS rules may impact your strategy

It may be a good idea to talk with your financial professional or tax professional about if participating in a Roth IRA, no matter how you do it, makes sense for you todayor in the future years.

Don’t Miss: Can You Transfer Money From 401k To Bank Account

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Recommended Reading: How Much Do You Get Taxed On 401k