Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

Can You Access Your Paystub Details While You Are At Work In Store

While working in the store, if something disturbs you about the pay, you may wonder Whether I can access my Walmart paystub? Without wasting any time, let me inform you that you can have access to your Walmart paystub even when you are working in the store. Every store has a dedicated training room, where you can access the touchscreen computers and login into your Walmart account. We have already discussed the process of login. Once you log in to the account you will get all the employee information including the paystub.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Don’t Miss: Should I Roll My 401k Into My New Job

Wait Where Did My 401 Account Go

American workers could be losing a collective $2 trillion in lost retirement savings simply by not rolling over their 401 savings accounts when they change jobs.

A practice referred to as forced transfers or forced rollovers is the reason for much of these losses, according to the Employee Benefit Research Institute.

Unlike many other countries, the United States doesnt have a centralized pension database that keeps track of workers defined-contribution retirement accounts or a standardized, centralized mechanism by which workers can easily roll over a 401 into their new employers plan when they change jobs. As a result, their account often gets left behind and thats where the problem begins.

You May Like: Can 401k Be Used For Home Purchase

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Recommended Reading: What Is Difference Between 401k And Roth Ira

Complete Secure Online Transactions

Complete your payroll contributions and monitor your billing.

Whether youre managing your employees contributions, adding your company match, or making a payment for retirement services, you can complete secure financial actions on our website. Well even help validate your data and let you know if we find any errors when you upload your payroll contributions.

Dont Miss: How To Receive 401k Cash Out

What Is Considered A Good Amount Of Retirement Money

How much you decide to place into your retirement fund every month is entirely dependent on how much you want to place into it.

However, a number of experts believe that a good retirement fund should stand at around 10 times your average working wage.

For example, if you are earning around $35,000 a year, then you should aim to have around $350,000 in your retirement fund when you retire.

It is suggested to aim to save around 12 percent of your monthly wage.

Also Check: How Can I Find An Old 401k Account

You May Like: How Can You Borrow From Your 401k

Walmarts 401 Contribution Matching

Like many companies, Walmart offers an employer contribution to help boost its employees retirement savings. Walmart has a generous contribution match It promises to match its employees 401 contributions dollar for dollar, up to 6% of their pre-tax income.

When compared to other companies, Walmarts 6% contribution match really stands out. According to a 2020 study, the majority of companies offer a match between 3% and 5%, with the average match being 4.5% of income.

Walmart doesnt just have a better 401 match than most companies. It also beats out some of its biggest competitors. For example, Target offers its employees a match of up to 5% of their income. And Amazons employer match tops out at just 2% of an employees income.

Walmart also has an excellent vesting policy for its 401 plan. Many companies have an extended vesting schedule, meaning employees have to work at the company for a specific amount of time before they qualify for their employer match. But Walmarts employees are immediately 100% vested in the 401 plan for both their contributions and the company match.

Donât Miss: How Do I Find My 401k Plan

Introducing The In Marriage Qdro

A solution exists that allows you to access your retirement account while avoiding many of the rules and regulations associated with taking an early distribution. This involves a well known, often utilized legal process to access a retirement account by transferring the funds from one spouse to another. This process is completely legal, highly effective and often makes far more financial sense than paying heavy fees and penalties.

Don’t Miss: How To Retrieve 401k Money

How Will All This Change Your Retirement Package

An existing Saver’s Credit would also be expanded so that more people — earning less than $41,000 a year for individuals and $71,000 for married couples — can access the government match of up to $2,000.

A few more technical provisions make it easier to roll over funds from college savings to Roth IRAs, give employers tax incentives for establishing a new 401k plan and create a national database to improve the situation for those who change jobs and cannot always find or access past savings profiles.

Different provisions would come into effect at different times — employers will be able to match their workers’ student loan payments from the last day of 2023 but mandatory 401k enrollment would not come into effect until December 31, 2024. While some have criticized the changes for not going far enough, the retirement portion of the bill has not been particularly controversial given that technical rules of saving for retirement are updated fairly frequently.

“We can’t expect Congress to solve all of our nation’s retirement challenges in one piece of legislation, but this includes a host of provisions that will move the ball forward,” Shai Akabas, director of economic policy at the Bipartisan Policy Center, told the New York Times.

Increased 2023 Hsa Contribution Limits

The IRS also increased HSA contribution limits for 2023 for both individuals and families . As a reminder: A health savings account helps those with high-deductible health plans save taxes on money earmarked for medical expenses not covered by the plan. But unlike a flexible spending account , the assets you contribute to an HSA can be rolled over each year. Plus, an HSA offers a triple tax advantage: Money put in isnt taxed and grows tax-free, and youre not taxed when you withdraw funds for qualified medical expenses.

| Coverage type |

|---|

Read Also: How To Stop Your 401k

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAcontributions can be withdrawn any time, tax- and penalty-free

What Is A 401k

A 401k is a type of retirement account set up by an employer. Its a defined contribution plan offering tax advantages and investing in stocks, bonds, mutual funds and other assets. 401k is an acronym for the United States Internal Revenue Code section 401, which provides tax-deferred retirement savings plans for employees of private employers.

401ks are typically offered to employees as part of the compensation package. Employees contribute a certain percentage of their salary to the 401k plan on a pre-tax basis and then can invest in various types of securities such as stocks, bonds and mutual funds through the plan. The contributions are made through payroll deductions before taxes are withheld from them.

401ks have made it easier for people to save and invest in the future. It has also helped the economy by stimulating investments and increasing the amount of capital available in the market.

In addition, the 401k is instrumental in reducing poverty and improving the quality of life for low-income families, who may not be able to afford retirement savings or investment opportunities without this plan.

Recommended Reading: How To Get Money From 401k After Retirement

Don’t Miss: Can You Convert Your 401k To A Roth Ira

What Happens To My 401k If I Quit Walmart

Your 401 Plan account will continue being credited with earnings and losses until you receive a payout. After your termination, you may not participate in the 401k Plan. However, your account will remain in the Plan until your total vested Plan balance is paid.

Hey, my name is Noah. Weve done a lot of research on it by visiting different Walmart stores My goal is to provide you with accurate information about the services offered by Walmart and their benefits.

Can Wells Fargo Finally Turn A New Leaf

Wells Fargo expressed support for the decision and echoed similar statements about how it will work to rebuild customer trust.

“Wells Fargo is pleased with this decision, which found that the county’s claims regarding our lending practices were unfounded,” a Wells Fargo spokesperson told TheStreet in a statement. The bank further said that it plans to “continue to focus on helping customers succeed financially and expanding homeownership opportunities.”

It is understandable that Wells Fargo wants to move on from past scandals and craft a new image — amid news of the CFPB payment, stock was down 2.12% to $40.25 on Thursday afternoon and is down more than 16% annually.

But many of the accusations are so long-running and far-reaching that it is unlikely that past problems will be forgotten. One lawmaker who is keeping her foot on the accountability gas with Wells Fargo is Elizabeth Warren In October, the senator published a long report accusing the bank of “rampant fraud and theft” through the instant payment transfer service Zelle.

“I’ve said it once, and I’ll say it again: We need to break up Wells Fargo,” Warren said in a Twitter post immediately after the CFPB payment was announced.

You May Like: What Happens To My 401k From My Old Job

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Don’t Miss: Does Max Contribution To 401k Include Employer Match

Pro: Enough Funds To Build Custom Portfolios

Retirement single-fund solutions are a great choice. The downside to many target-date funds is overexposure to large U.S. stocks.

Many funds offered to U.S. investors do the same thing as asset managers in other nations: they overweight their portfolios to stocks based abroad.

A portfolio that consists of 60% U.S. stocks and 40% international stocks is closer to the current market capitalization for all stores.

Building your portfolio will make you more inclined towards small caps if you believe that large caps will outperform small caps over long periods.

If you are looking for more exposure to international stocks and small caps, the Walmart 401k can help you build one. Compare the below allocation with the 2050 MyRetirement Fund.

These two portfolios are very different.

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, youll want to consider two factors before making a decision:

Also Check: How To Find A 401k From Previous Employer

Also Check: Should I Let Fidelity Manage My 401k

How To Check Your 401 Balance

If you already have a 401 and want to check the balance, its pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

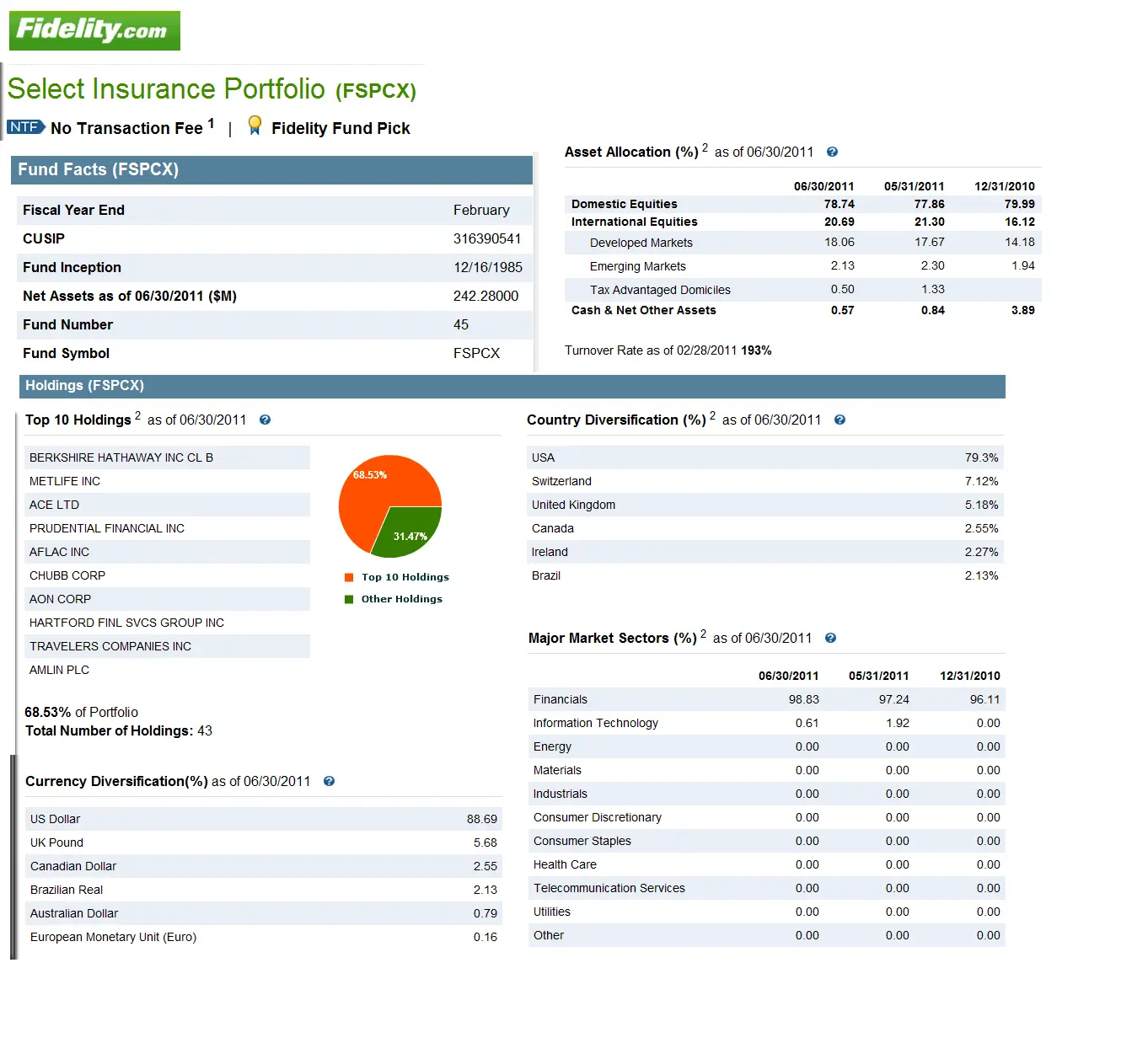

Some of the largest 401 investment managers include Fidelity Investments, Bank of America Get Free Report, T. Rowe Price Get Free Report, Vanguard, Charles Schwab Get Free Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Also Check: How To Pull Money From Your 401k