The Sweet Spot Strategies For Fitting Roth Conversions Into Your Retirement Plan

Because Roth conversions generate income, there is some strategy on the optimal times to perform the conversions in order to avoid an unnecessarily large tax bill. For many retirees, finding a period of low income allows for larger conversions with smaller tax burdens. When is the best time for perform Roth conversions?

There is no single answer. It depends on your financial plan.

For example, if you retire at age 65 and are able to delay Social Security until age 70, you have 5 years with little to no income And therefore lots of room to perform IRA conversions!

Others may work longer, take Social Security earlier, or have pensions that make the optimal time to perform IRA conversions earlier Even if they are still working.

Younger savers may find other opportune times to convert. Young workers may see a short term reduction in income for various reasons Going back to school, a sabbatical, changing jobs, maternity or paternity leave, starting a business, etc. All of these can be great times to recognize some additional income with a Roth conversion.

Converting A Nondeductible Ira Contribution To A Roth Ira

You may know that if you or your spouse have a retirement plan available at work, it limits the deductible contributions you can make to a traditional IRA.3 If you’re in that boat and want to make the most of your tax-advantaged saving options, you can still make nondeductible IRA contributions. Earnings on these contributions will be tax-deferred but you do have the option of converting to a Roth IRA. In that case, your nondeductible contributions wont be taxed again, although any earnings would be treated as pre-tax balances, which means they would be taxable when converted. This type of conversion is sometimes called a backdoor Roth IRA.

If you do decide to convert either pre-tax or non-deductible contributions, the timing can be a little bit tricky. Some time should pass between the date of the contribution and the date of the conversion, but it’s not completely clear how much is enough. If you do decide to convert, consult your tax advisor first to ensure that you understand the full scope of potential tax consequences.

Can You Convert 401 To Roth After Retirement

Read Also: Where Can You Rollover A 401k

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

You May Like: Can I Take Money From 401k To Buy A House

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employer’s 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Recommended Reading: Can You Rollover A 401k Into A Simple Ira

How Do I Avoid Taxes On A Roth Ira Conversion

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

Don’t Miss: How To Retire With A 401k Plan

Both The Young And The Old Might Be Able To Benefit From This Smart Tax Move

Now might be a great time to convert some of your retirement savings from a traditional IRA to a Roth account.

While you might be unhappy about the declining value of your retirement account, you can make lemonade out of lemons. Right now is a great opportunity to convert funds, while stocks have come down in value. You’ll only pay taxes on the value of the conversion, so depressed stock prices means a lower tax bill.

There are two groups of investors who can really make the most of a Roth conversion.

Image source: Getty Images.

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time during the contributed tax year, regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Don’t Miss: How Can I Use My 401k

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

What Happens If You Cash Out Your 401

If you take your 401 money before you reach age 59 ½, you might have to pay taxes at your regular tax rate, on top of a penalty from the IRS, on any money that hasnt been taxed before. You may be able to avoid any penalties for certain life events or purchases, but youll still probably owe taxes on any previously untaxed money.

Read Also: How Do You Split A 401k In A Divorce

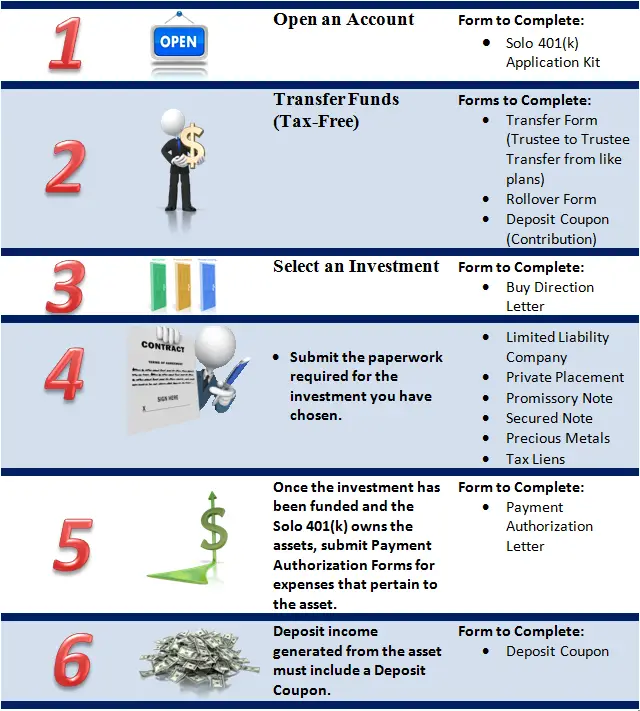

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

Read Also: How To Save For Retirement Without A 401k

Read Also: Does Fidelity Offer Self Directed 401k

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

Traditional 401s Vs Roth 401s

Employer-sponsored 401 plans are an easy, automatic tool for building toward a secure retirement. Many employers now offer two types of 401s: the traditional, tax-deferred version and the newer Roth 401.

Of all the retirement accounts available to most investors, such as 401 and 403 plans, traditional IRAs, and Roth IRAs, the traditional 401 allows you to contribute the most money and get the biggest tax break right away. For 2022, the contribution limit is $20,500 if youre under age 50. If youre 50 or older, you can add an extra $6,500 catch-up contribution for a total of $26,000. In 2023, the contribution limit increases to $22,500 and the catch-up contribution raises to $7,500, for a total of $30,000.

Plus, many employers will match some or all of the money you contribute. A Roth 401 offers the same convenience as a traditional 401, along with many of the benefits of a Roth IRA. And unlike a Roth IRA, there are no income limits for participating in a Roth 401. So if your income is too high for a Roth IRA, you may still be able to have the 401 version. The contribution limits on a Roth 401 are the same as those for a traditional 401: $20,500 in 2022, with the $6,500 catch-up amount, and $22,500 in 2023, with the $7,500 catch-up contribution depending on your age.

Recommended Reading: How Do You Roll A 401k Into Another

Read Also: How Do I Pull Money From My 401k

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.