Ways To Dig Up An Old 401 Account

Before we play “lost and found” with your old 401 plan, know that even though you can’t find your 401 account , your plan money is federally protected.

That’s right. By law, nobody can access, steal or otherwise make off with your 401 funds while they’ve gone missing.

With Uncle Sam at your back, use these tips and strategies to find a lost 401 account.

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

Recommended Reading: How Much Should You Contribute To 401k

Keep Tabs On The Old 401

If you decide to leave an account with a former employer, keep up with both the account and the company. People change jobs a lot more than they used to, says Peggy Cabaniss, retired co-founder of HC Financial Advisors in Lafayette, California. So its easy to have this string of accounts out there in never-never land.

Cabaniss recalls one client who left an account behind after a job change. Fifteen years later, the company had gone bankrupt. While the account was protected and the money still intact, getting the required company officials and fund custodians to sign off on moving it was a protracted paperwork nightmare, she says.

When people leave this stuff behind, the biggest problem is that its not consolidated or watched, says Cabaniss.

If you do leave an account with a former employer, keep reading your statements, keep up with the paperwork related to your account, keep an eye on the companys performance and be sure to keep your address current with the 401 plan sponsor.

Keeping on top of how the plan is performing is very important as you may later decide to do something different with your hard-earned money.

You May Like: How To Rollover My Fidelity 401k

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

You May Like: Can A Sole Proprietor Have A Solo 401k

You Have Four Main Options For An Old 401 Thats Tied To A Former Employer

At Capitalize we help our users move their legacy 401 account into an IRA. Dont worry if you dont already have one our online rollover process guides you through your different IRA options and helps you pick one thats right for you.

If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employer’s plan, you do have the option to leave the money and the account there — just note you can no longer contribute money to it.

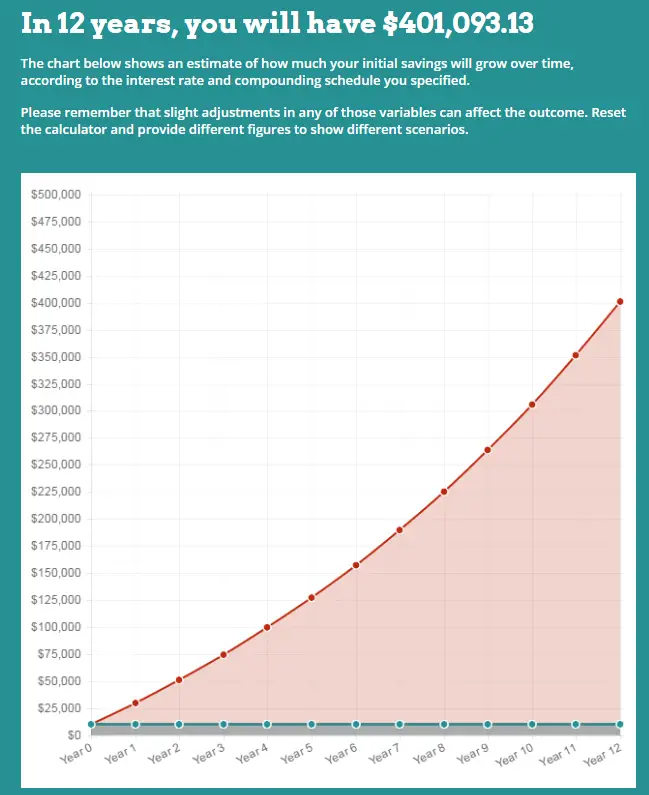

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employer’s 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

Recommended Reading: How To Transfer 401k From Old Job To New Job

Lost And Abandoned Pension Resources

The Pension Benefit Guaranty Corporation is a U.S. government agency. It provides information on pension-related topics to help people understand and find their pensions. A few resources that you can use to find a lost or abandoned pension include:

- The National Registry of Unclaimed Retirement Benefits: This website can help former government and non-government employees find their retirement plan account balances that are left unclaimed.

- Abandoned Plan Program: The Abandoned Plan Program helps terminate and distribute the benefits from pension plan accounts that have been terminated by their employers. You can search this database to help you find your abandoned plan.

- Department of Labor: The Department of Labor can help you find your lost or abandoned pension through its Form 5500 search.

National Registry Of Unclaimed Retirement Benefits

You may be able to locate your retirement account funds on the National Registry of Unclaimed Retirement Benefits. This registry is a secure search website designed to help both employers and former employees. Employees can perform a free database search to determine if they may be entitled to any unpaid retirement account money. Employers can register names of former employees who left money with them. Youll need to provide your Social Security number, but no additional information is required.

Don’t Miss: How To Get Money From 401k Before Retirement

Can I Resign Immediately

How to Immediately Resign from a JobCall employer promptly. Time is of the essence, so communicate as soon as it becomes clear that a departure is imminent. State reasons for sudden leave. Since short notice goes against the grain and can sour professional relationships, it often helps to share some background information about the change.Try to give 2-weeks notice. More items

How To Search For Unclaimed 401 Retirement Assets

You can take a few steps to search for your unclaimed 401 retirement benefits. The first step is to gather as much information as you can about your former employers. If your employer is still in regular operation, theres a chance that your 401 is still in the account that you had when you were with the company.

If you need to do a bit more digging, here are some further steps you can take:

Don’t Miss: Can A Small Business Set Up A 401k

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

Read Also: How Do You Open A 401k Account

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Roll Over The Old 401 Account Into An Ira

This will likely be the best option for most people because the IRA is attached to you instead of your employer, making it less likely that youll lose track of the account again. An IRA also comes with a much wider selection of investments than most 401 plans. Youll be able to choose from individual stocks as well as mutual funds, ETFs and more.

If you dont already have an IRA, youll need to set up an account before you roll over your 401. The process is fairly straightforward and you can open an IRA through most online brokers.

Recommended Reading: Where To Open A 401k

Follow These 2 Tips To Prevent This Issue

Are You Missing A 401 Plan How To Find And Convert Old Retirement Accounts

If you’ve changed jobs and left a 401 behind, learn how to get your money back.

Peter Butler

Writer

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Changing employment can be an exciting and stressful time. With everything you need to do when you switch jobs, it’s possible to forget about dealing with a 401 plan from your soon-to-be former employer. A study by the fintech company Capitalize found that there were 24.3 million forgotten 401 accounts holding $1.35 trillion as of May 2021, with another 2.8 million lost accounts added each year.

That money isn’t gone, however. Most of it is still sitting in those accounts, waiting for someone to claim it. Depending on your former employer and the size of your account, you can likely find your old retirement account and roll it over into a new 401 or an individual retirement account.

Learn how to locate your old 401 account, and what to do after you find it. For more, discover the easiest way to save for retirement and how to figure out the best time to start receiving Social Security.

Recommended Reading: How To Pick Investments For 401k 2020

Eventually You Must Withdraw Money From A 401

Uncle Sam wont let you keep money in the 401 tax shelter forever. As with IRAs, 401s have required minimum distributions. You must take your first RMD by April 1 in the year after you turn 72. You will have to calculate an RMD for each old 401 you own. Once youve determined the RMD, the money must then be withdrawn separately from each 401. Note that unlike Roth IRAs, Roth 401s do have mandatory distributions starting at age 72.

If you hit that magic age, you are still working, and you dont own 5% or more of the company, you dont have to take an RMD from your current employers 401. And if you want to hold off on RMDs from old 401s and IRAs, you could consider rolling all those assets into your current employers 401 plan.

You May Like: How To Move Money From One 401k To Another

Dont Be Forced Out Of A 401 From Your Former Job

When you change jobs and abandon vested amounts in your 401, your former employer has to follow IRS rules and plan provisions for dealing with your account balance. Pursuant to these guidelines, the 401 plan may have a force-out provision. That means when your vested balance is less than $5,000, you can be forced to take your money out of the plan.

Your former employer is required to give you advance notice of this rule so you can decide what to do with the money. Your choices are to cash out your account and receive a check, or roll your account balance into an IRA or your new employers plan.

What happens if you fail to respond to the notice? If your vested balance is more than $1,000, your former employer must transfer the money to an IRA. For balances under $1,000, you will either get a check or your former employee will open an IRA on your behalf.

Neither outcome is optimal, according to a report by the U.S. Government Accountability Office. If you receive the money, youll owe federal income tax. When the balance is transferred to an IRA, account fees may outpace investment returns and your balance will be eroded over time.

Protecting assets you worked for and earned is always a smart move. Consult your tax professional for assistance.

Recommended Reading: Can I Convert My 401k To A Roth Ira

Don’t Miss: How To Close 401k Without Penalty

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.