Choose A Recordkeeping System

Employers must develop a recordkeeping system to help track participants and properly attribute contributions, earnings and losses, plan investments, expenses, and benefit distributions. Most employers do not try to build a recordkeeping system of their own and instead hire a service provider who is responsible for these taks. A service provider will assist in preparing the plans annual Form 5500.

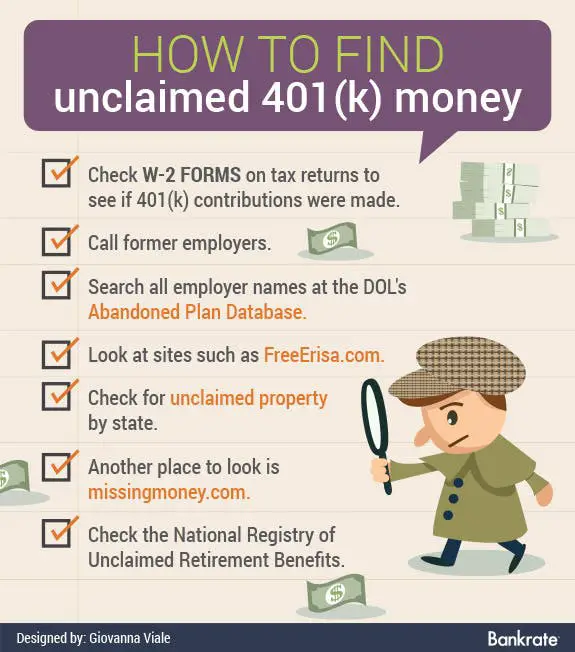

How To Find Previous 401k Accounts

Many employers automatically deduct 401 plan contributions directly from their employees paychecks. This makes it easy for an employee to forget about his 401 plan when he changes jobs or moves to another location. If you stop contributing to a 401 plan because you changed employers, the money stays in your account until you cash out the plan or transfer the money to a new 401 plan. Finding all of your old 401 plans will help to give you a clearer idea of how much money you have for your retirement nest egg.

Contact the human resources or benefits manager at all of your previous places of employment. The administrator of the 401 plan will have access to your account information. Give the administrator the required information to find your account, such as your social security number. The administrator will give you your 401 account information and all relevant contact and transfer information.

Check your personal financial files if they are available. Statements from 401 plans and old pay stubs are examples of financial files that will contain information about your old 401 accounts. Use the contact numbers on the statements to inquire about the status of your 401 accounts.

References

You May Like: Should I Roll Over My 401k To A Roth Ira

If You Find The Money

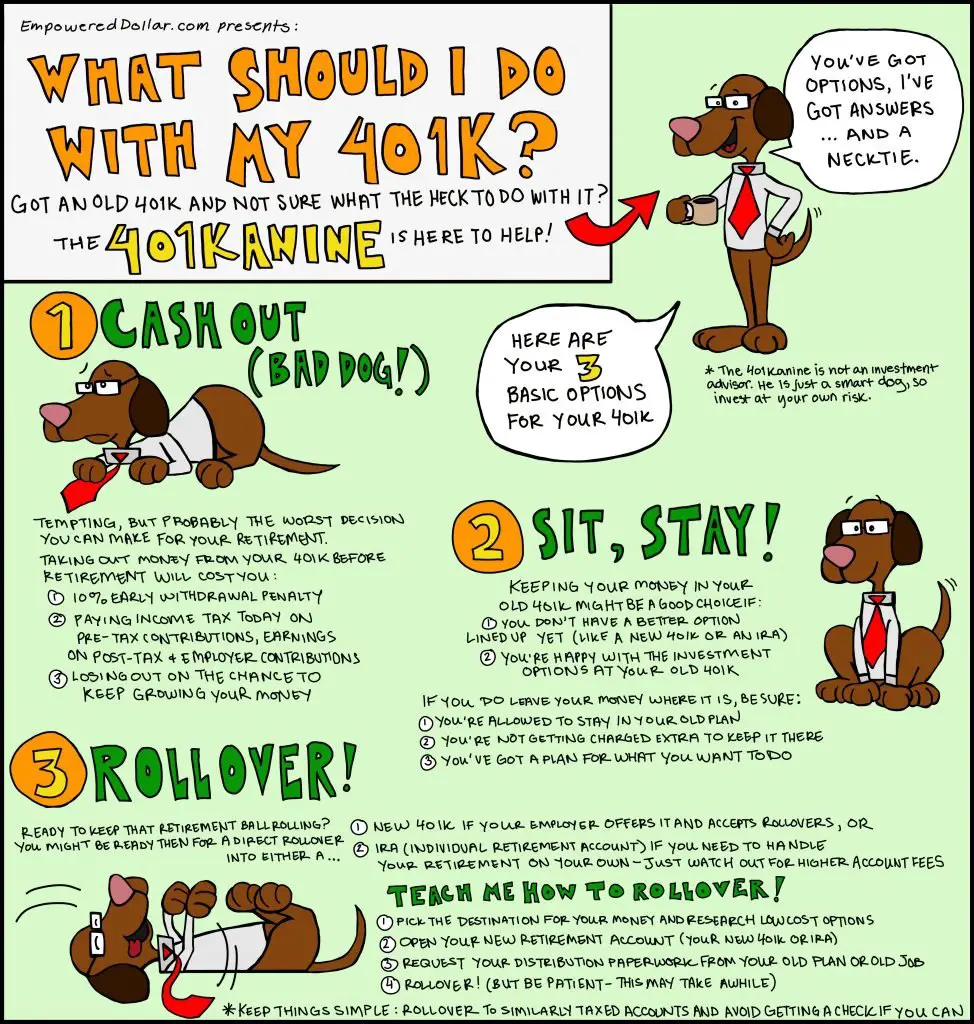

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employers plan, you do have the option to leave the money and the account there just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employers 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

Read Also: Are Part Time Employees Eligible For 401k

Don’t Miss: How Do I Get Money Out Of My 401k

Complete Your Plan Enrollment Form

This is the form youve been waiting for! Its the one youll use to officially commit a percentage of your paycheck for retirement. But there are a couple of other things about this form you dont want to miss:

- Pre-tax or Roth: Whats the difference between a traditional pre-tax 401 and a Roth 401? A pre-tax 401 allows you to make contributions from your pay before taxes are taken out. But when you contribute to a Roth 401, your contributions are made after taxes are taken out. We always recommend the Rothoption since you wont have to pay taxes on the money you withdraw from your Roth 401 in retirement. Pre-tax contributions will lower your taxable income now, but youll pay taxes on withdrawals in retirement.

Your Action Step: Contact your 401 plan manager to find out if you have the option to choose pre-tax or after-tax contributions. If you can, take advantage of the Roth option with your next paycheck!

Your Action Step: Again, your 401 plan manager can tell you if your plan offers an automatic rebalancing feature for your investment selections. Tip: call the plan manager and speak with an actual person.

Read Also: How Much Can We Contribute To 401k

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employers 401.

Its usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isnt back in a retirement account within 60 days will become taxable. So if you dont want that 20% to be considered a taxable distribution, youll have to use other assets to make up the difference.

Don’t Miss: When Can I Start My 401k

What Is Employer Matching

With an employer match, a company matches what an individual employee contributes to their 401 up to a certain amount. Most companies that offer an employer match determine how much it contributes based on a percentage of what an employee contributes.

For instance, a company may contribute 50% of the first 6% that an employee contributes. So, if your annual salary is $60,000 and you choose to contribute 6% to your 401 each year, you will contribute $3,600 and your company will contribute 50% of that, or $1,800. You can choose to contribute more of your salary, but your companys match will be capped at $1,800.

Find Your Retirement Accounts

In order to corral all your accounts, you first must locate all your retirement plans.

If you know you had a plan with certain employers but dont know how to access it, reach out to your former company. They should provide you with the information you need to access the account.

What happens if the company is no longer in business? Well, your retirement account should still be held somewhere. Its your money, after all. You can go to the Abandoned Plan database Opens in new window, hosted by the Department of Labor. There you can search the company, and you will be provided with information on how to locate the lost plan.

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

Dont Miss: When Can I Rollover 401k To Ira

You May Like: What’s The Most I Can Contribute To My 401k

Mom And Brothers Participation Question:

Yes provided they are all owner-employees in the S-corp with not other full-time W-2 common-law employees. The S-corp would sponsor the solo 401k plan and all 5 would participate in the same solo 401k plan. Each participant would separately hold their retirement funds in participant accounts. Lastly, when it comes time to determine if a Form 5500-EZ will need to be filed for the plan, all of the participants balances will need to be added up and if the combined value exceeds $250,000, a Form 5500-ez will need to be filed each year by 07/31.

Organize And Rebalance Your Accounts

After years of neglect, your forgotten retirement accounts may not be properly balanced. This means there may be too much emphasis on one type of investment, or not enough on another.

If you plan to keep the IRA or company plan open, you may want to consider diversification, so theres the right amount in stocks, bonds, U.S. investments or international exposure thats appropriate for your investment goals and risk tolerance.

Youll need to check each account individually at first. However, if you can list them all in one place, youll see how your combined investment diversification stands up. An online tracking service can continue to monitor your accounts, possibly flagging you if you need to consider rebalancing again.

Online tracking services cant do the rebalancing for you, however youll have to go to each individual account to manage the rebalancing. And if the diversification seems off but its not time for you to rebalance, youll have to look at each individual account to determine which one may be out of balance the most.

Read Also: How Much Can I Convert From 401k To Roth Ira

How Long Can A Company Hold Your 401k After You Leave

60 daysFor amounts below $5000, the employer can hold the funds for up to 60 days, after which the funds will be automatically rolled over to a new retirement account or cashed out. If you have accumulated a large amount of savings above $5000, your employer can hold the 401 for as long as you want.

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Read Also: Can You Pull Money Out Of 401k

Eventually You Must Withdraw Money From A 401

Uncle Sam wont let you keep money in the 401 tax shelter forever. As with IRAs, 401s have required minimum distributions. You must take your first RMD by April 1 in the year after you turn 72. You will have to calculate an RMD for each old 401 you own. Once youve determined the RMD, the money must then be withdrawn separately from each 401. Note that unlike Roth IRAs, Roth 401s do have mandatory distributions starting at age 72.

If you hit that magic age, you are still working, and you dont own 5% or more of the company, you dont have to take an RMD from your current employers 401. And if you want to hold off on RMDs from old 401s and IRAs, you could consider rolling all those assets into your current employers 401 plan.

Prevent Losing Your 401s In The Future

Having a plan is the best way to prevent you from losing your 401s in the future. You should actively manage a 401 plan to ensure youre on pace to meet your retirement goals.

Yearly or semi-yearly checkups are best. Itll prevent you from analyzing your accounts performance and help you keep tabs on your account.

Having your 401 in the back of your mind, you more likely to remember to bring it with you when you leave your job.

Tags

You May Like: How To Calculate Mandatory 401k Withdrawal

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. Its a free service, and it only requires your Social Security number.

What Is A 401 How Does A 401 Work

A 401 is an employer-sponsored retirement savings plan that offers significant tax benefits while helping you plan for the future.

With a 401, an employee sets a percentage of their income to be automatically taken out of each paycheck and invested in their account. Participants can choose how to allocate their funds among the investment choices offered by the plan, which usually include a variety of mutual funds.

Also Check: What Happens To 401k When You Change Jobs

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

I Still Have A 401k From My Last Job What Do I Do About That

As you move ahead from job to job, dont make the mistake of leaving a trail of old savings accounts behind you. Put your hard-earned savings to work for you by looking at all the options. If youve left a job and a 401k, here are the options available to you for those funds.

- Leave your balance

- Rollover to new 401 plan.

- Rollover to an IRA.

- Cash out your 401.

Recommended Reading: Can You Use 401k For Investment Property

Federal Insurance For Private Pensions

If your company runs into financial problems, youre likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Can My Financial Advisor Manage My 401k

Hsa Withdrawals In Retirement

You can always withdraw money from your HSA tax-free and penalty-free for qualified medical expenses. In retirement, you can withdraw HSA money for things other than healthcare without incurring a tax penalty. Once you turn 65, you can use HSA funds for any reason. You just pay ordinary income tax on the distributions.

Best Places For Employee Benefits

SmartAssets interactive map highlights the counties across the country that are best for employee benefits. Zoom between states and the national map to see data points for each region, or look specifically at one of four factors driving our analysis: unemployment rate, percentage of residents contributing to retirement accounts, cost of living and percentage of the population with health insurance.

Recommended Reading: Can You Roll 401k Into Another 401k

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

You May Like: Should I Keep My 401k Or Rollover To Ira