When Must I Receive My Required Minimum Distribution From My Ira

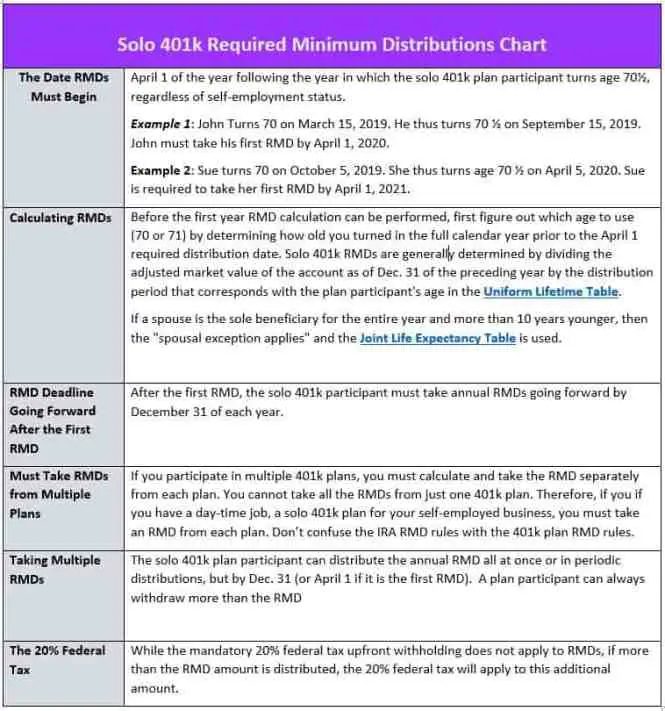

You must take your first required minimum distribution for the year in which you turn age 72 . However, the first payment can be delayed until April 1 of 2020 if you turn 70½ in 2019. If you reach 70½ in 2020, you have to take your first RMD by April 1 of the year after you reach the age of 72. For all subsequent years, including the year in which you were paid the first RMD by April 1, you must take the RMD by December 31 of the year.

A different deadline may apply to RMDs from pre-1987 contributions to a 403 plan .

Inheriting A 401 From A Non

If you inherit a 401 from someone who was not your spouse, you must rollover the funds into an inherited IRA. And, owing to a rule change in the SECURE Act, you would be required to withdraw the money within five or 10 years, depending on when the account holder died.

The five-year rule comes into play if the person died in 2020 or before the 10-year rule applies if they died in 2021 or later.

Retirement Savers Who Are 72 Must Start Withdrawing Funds From Tax

After decades of squirreling away money in tax-advantaged retirement accounts, investors entering their 70s have to flip the script. Starting at age 72, Uncle Sam requires taxpayers to draw down their retirement account savings through annual required minimum distributions. Not only do you need to calculate how much must be withdrawn each year, you must pay the tax on the distributions.

Theres no time like the present to get up to speed on the RMD rules. Once you know the basic rules, you can use smart strategies to minimize taxable distributions and make the most of the money that you must withdraw.

Here are 12 things you should consider regarding required minimum withdrawals.

You May Like: Can I Transfer My Ira To My 401k

Recommended Reading: How To Locate Old 401k

Simple Ira Definition And Rules

SIMPLE IRA stands for Savings Incentive Match Plan for Employees Individual Retirement Account. A SIMPLE IRA is similar to a traditional IRA, but it has higher contribution limits.

Heres how it works: A small business owner with fewer than 100 employees, along with the sole proprietor or partner in a business, can set up a SIMPLE IRA for herself and her employees. Per IRS rules, all employees who, in the previous two calendar years, received at least $5,000 in compensation from the employer and who are expected to receive at least as much during the present calendar year are eligible.

Eligible employees can decide to make elective deferrals, just like with a 401. That means that employees can choose to save a certain percentage of their pre-tax income. The employer then contributes to the SIMPLE IRA on behalf of each eligible employee.

Employer contributions can be either matching or non-elective. Non-elective means that the employer makes a unilateral decision to contribute to an employees savings plan, regardless of whether the employee contributes in a given year. Non-elective matches have a lower limit of 2%.

IRS rules prohibit employees from opting out of a SIMPLE IRA. They can choose not to make elective deferrals , but they cannot opt out of receiving non-elective contributions from their employers. This shouldnt ever be an issue however, because it would be against the employees interest to turn down more money from their employer.

Make Withdrawals From Your Retirement Accounts Strategically

For example, if you have multiple IRAs, you can determine the total amount of RMDs that must be withdrawn from all of them and make distributions from each account in whatever amounts you like. But the rules are different if you have more than one 401. Here, you have to take the correct amount of RMDs from each account separately.

Recommended Reading: Can I Convert My 401k To A Roth

What Is An Ira Rollover

An IRA rollover is a transfer of funds from one retirement account to a traditional IRA or Roth IRA. IRA rollovers are common when people switch jobs and want to move money from their previous companys retirement plan, like a 401 or 403, into an IRA. Rollovers also occur when someone just wants to switch from one IRA to another with better benefits or different investing options. An IRA rollover does not count toward your IRAs annual contribution limit.

There are two types of IRA rollover direct and indirect. A direct rollover is a transfer of funds directly from one retirement account to another. You dont have to pay any taxes with a direct rollover. This is the simplest and best option if you just want to move an entire account. Indirect rollovers are more involved and have more tax implications. With an indirect rollover you get a check for the rollover amount and then deposit the check into your IRA account on your own.

How To Calculate Your Mandatory Withdrawal Amount

Once you turn 72, you are required to withdraw a specific amount from your 401 each year. You must take out this amount by December 31 of each year to avoid penalties. Take out too little, and the remaining amount will still be penalized.

To make sure you are withdrawing the correct amount from your 401, the IRS provides a calculation so you can zero in on the exact amount you need to withdraw.

To get your annual amount, divide your 401 balance as of December 31 of the previous year by your life expectancy factor.

An exception to this requirement is if your spouse is the only primary beneficiary and they are 10 years younger than you, use the IRS Joint Life Expectancy Table instead.

Also Check: How To Cash In Your 401k

What Is A Required Minimum Distribution

The government imposes penalties for making early withdrawals from retirement accounts. After a certain age, however, youre required to take some money out every year. A mandatory 401k withdrawal is called a required minimum distribution.

In general, 401k withdrawal rules from the IRS require you to start withdrawing money from your 401k by April 1 of the year following the year that you turn 70.5, and your age and account value determine the amount you must withdraw. If youre 70.5 or older and still working, you might be able to delay taking RMDs if your plan is sponsored by the company for which youre still working. Known as the still working exception, you can apply if you:

- Are employed throughout the entire year

- Own no more than 5 percent of the company

- Participate in a plan that allows you to delay RMDs

Related: How to Master Your 401k in Your 60s

What Are The Penalties For Not Taking Mandatory Withdrawals

Failing to withdrawal the required amount each year could cost you a pretty penny. Although the IRS has been waiting patiently to get their share of your retirement via income tax, they arenât too patient once you reach 72.

Any mandatory amount that hasnât been withdrawn from a 401 by December 31 of the applicable year will be subject to a 50 percent penalty.

If your calculated mandatory amount is $10,000 and you fail to withdraw it, you could lose $5,000 automatically.

Itâs best to review your mandatory withdrawal amount at the beginning of each year and make a plan to withdraw that amount before the end of the year.

You May Like: Can An Individual Open A 401k

What If I Inherit An Ira

If you inherit a traditional IRA and the original owner had started taking RMDs at the time of death, you must continue to receive the distributions as previously calculated during the year of the original owners death. After this, the amount of your RMD will depend on your status as a beneficiary .

One rule change in 2022 for inherited IRAs is that the IRS included a transition rule for non-spouse beneficiaries who inherited an IRA prior to January 1, 2022 after RMDs have begun, and are using the Single Life Table. The transition rule has the life expectancies reset using the new tables.

This reset will look like this: The beneficiary will go back to the year after the owners death and find their single life expectancy as of their age in that year using the new table. Then, one year will be deducted from the new life expectancy for each year since the first distribution year to get the divisor for the relevant post-2021 year.

This can be complex as there are different rules for different years. Talk to your financial advisor and tax planning professional about your RMDs.

Do I Need To Withdraw From My Traditional Ira

You’re required to start taking an annual distributions from traditional IRAs no later than April 1 of the year following the year you turn 72, regardless of employment status .

Minimum distribution rules don’t apply to ROTH IRAs during the owner’s lifetime, though they may apply to the beneficiary that inherits the ROTH IRA. Note: this exception to taking lifetime RMDs does not apply to Roth-source amounts in a retirement plan. Designated Roth accounts are subject to RMD in the same manner as accounts funded by before-tax contributions.

Also Check: How To Check If You Have A 401k

What Is The Deadline For Taking The Rmd Each Year

RMDs are due by December 31 of each year however, for the year a participant first turns age 72, the initial RMD deadline is not until April 1st of the following year. For example, a participant who reaches age 72 in 2022 has until April 1, 2023 to take his or her first RMD, with each subsequent RMD paid by December 31 of each year.

It is important to note that that same participant is also required to take an RMD for 2023 no later than December 31, 2023. That means he or she ends up taking two RMDs in the same year and then a single RMD in each year thereafter.

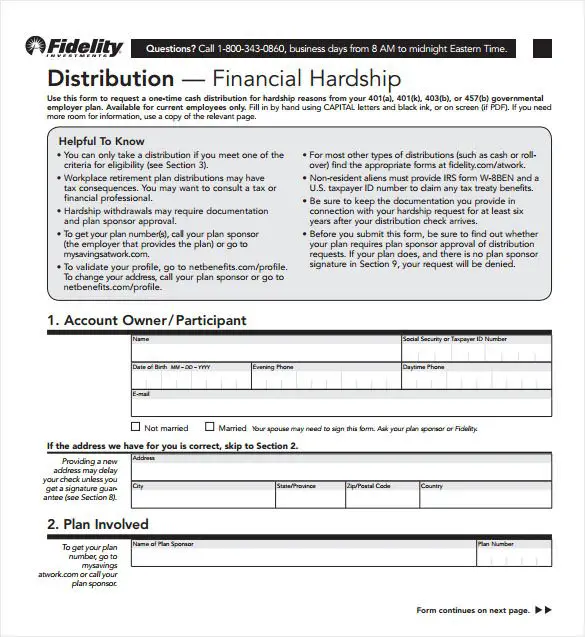

Important Note: Work with your recordkeeping service provider or platform provider to process distributions timely, as most platforms will have a deadline of mid-December to ensure the checks can be processed and delivered before the end of the plan year. Your recordkeeping service provider, platform, TPA, or investment advisor is not authorized to approve or process an RMD without a distribution form.

What Is A Required Minimum Distribution And Why Should I Care About It

An RMD is the smallest amount you must withdraw from your tax-deferred retirement accounts every year after a certain age. At some point in your life, you may have put money into tax-deferred retirement accounts, such as Individual Retirement Accounts and 401 workplace retirement accounts. The key words here are tax-deferred. You postponed taxes on your contributions and earnings you didnt eliminate them. Eventually, you must pay tax on your contributions and earnings. RMDs make sure that you do that.

Don’t Miss: Should You Roll Your 401k Into An Ira

Beneficiary Required Minimum Distributions

This calculator has been updated for the ‘SECURE Act of 2019 and CARES Act of 2020’.

The American Institute of Certified Public Accountants

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Be Aware Of Rmd Exceptions

Theres at least one important RMD exception with 401s. If youre still employed after reaching age 72, you generally wont have to make withdrawals from your current employers 401 if you participate in it. But if you have 401 accounts from former employers, youll have to take RMDs from them on schedule.

You May Like: How Do I Set Up A 401k For My Employees

Required Minimum Distributions What You Need To Know

Were fast approaching the end of another calendar year, and for many older Americans, that means its time to take a Required Minimum Distribution from their 401 account. If you participate in a 401 plan, you want to understand the RMD rules. Failing to take a RMD can mean stiff tax penalties from the IRS. Understanding the RMD rules can also help you avoid required distributions altogether.

The RMD rules for 401 plans can get complicated, but below are some of the basics. If you need more specific information, refer to your plans Summary Plan Description . If you have RMD questions after that, talk to your accountant or 401 provider.

Why Required Minimum Distributions Exist

The government provides a tax break for retirement savings by allowing workers to contribute to a 401 with pre-tax funds and enjoy tax-free growth on investments within a 401.

Uncle Sam wants to collect its piece of the money eventually, though, so RMD rules exist to make sure those who have invested in a 401 begin taking the money out during retirement.

RMDs ensure workers take out a set minimum amount of money each year based on their life expectancy. Withdrawals that follow RMD rules are taxed as ordinary income.

You May Like: Can I Rollover My 401k Into My Spouse’s Ira

How To Avoid Rmds

If you fail to take an RMD on time, you will have to pay a 50% tax on the amount you should have withdrawn. However, one easy and perfectly legal way to avoid RMDs is to roll over your IRA or 401 assets into a Roth IRA or Roth 401. Youll have a bigger tax bill the year you do it, but the IRS will not require you to take RMDs from these accounts. Theoretically, you can leave money in a Roth IRA or Roth 401 until your death, and it can continue growing tax-free. But as long as your assets have been in these accounts for at least five years, you can make tax-free and penalty-free distributions after reaching age 59.5. And at any time, you can withdraw your own contributions penalty and tax-free.

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

Read Also: How Can I Get My 401k

Other Considerations For Required Minimum Distributions

Your 401k administrator might calculate your RMD, but its your ultimate responsibility to make sure the calculation is accurate. Note that you can withdraw more than your required minimum, but you cant apply the excess funds to your following years RMD.

If you own more than one 401k, you must calculate the RMD amount for each account. You can, however, withdraw your RMD amount from a single account. If you own different types of accounts, such as one IRA and one 401k, you must take RMDs from each one.

You might consider opting for a systematic withdrawal plan. SWPs provide income in the form of monthly, quarterly or annual withdrawals from 401k plans, which you can schedule to meet your RMD obligations.

Required Minimum Distribution Planner

When you reach the age of 72, you must begin annual withdrawals from most retirement accounts in accordance with IRS regulations. These withdrawals are known as required minimum distributions, or RMDs.

Except for your first year taking RMDs, each RMD must be taken by December 31 to avoid a hefty penalty.

Need to take an RMD but dont need the funds for retirement? Learn how your RMD can be a great way to contribute to a 529.

Use this RMD calculator to determine your projected required minimum distributions for multiple years based on a hypothetical rate of return.

Also Check: How To Pull Funds From 401k

Consider A Roth Ira Conversion

You do not have to take RMDs from Roth IRAs because these funds have already been taxed. Therefore, converting a traditional IRA to a Roth IRA eliminates the issue of RMDs altogether.

Keep in mind there are other tax consequences involved with Roth IRA conversions. The biggest is the fact that income taxes are due on the value of the IRA when the conversion is done. This can result in a large tax bill thats due in full all at once.

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Don’t Miss: Can You Rollover A Roth 401k To A Traditional Ira