Rolling Out To Iras After An In

After completing a Roth conversion within your workplace retirement plan, rolling out to IRAs should be relatively straightforward if you choose to do that. If youre planning to roll the money out to a Roth IRA at some point and dont already contribute to a Roth IRA, it may make sense to open an account and make at least one contribution now, if possible, so the 5-year clock starts ticking on this account. Roth IRAs have a 5-year aging requirement as wellif youve never contributed to a Roth IRA and roll in money from a Roth 401 another 5-year clock starts in January of the year in which the rollover was done.

If you earn too much to contribute to a Roth IRA, you do have options. Read Viewpoints on Fidelity.com: Do you earn too much for a Roth IRA?

Convert Existing Fidelity Solo 401k And Take A 401k Participant Loan Question:

I was looking for a 401k alternative to Fidelity and stumbled on your site and wanted to send an email with a few questions. I am in the process of buying a new house and was hoping to take a loan out from my solo / self employed 401k plan at fidelity however to my surprise they said that my 401k plan doesnt have the loan feature because it is a self employed / small business type. Needless to say I am looking for a new 401k provider where I can transfer my and my wifes 401k monies from fidelity and shortly after take a loan for the down payment. Does this sound like something you folks would be able to help me with? If this sounds doable, please give me a call when you have some time to go over next steps.

Use Model Portfolios To Allocate Your 401 Like The Pros

Many 401 providers offer model portfolios that are based on a mathematically constructed asset allocation approach. The portfolios have names with terms like conservative, moderate, or aggressive growth in them. These portfolios are crafted by skilled investment advisors so that each model portfolio has the right mix of assets for its stated level of risk.

Risk is measured by the amount the portfolio might drop in a single year during an economic downturn.

Most self-directed investors who aren’t using one of the above two best 401 allocation approaches or working with a financial advisor will be better served by putting their 401 money in a model portfolio than trying to pick from available 401 investments on a hunch. Allocating your 401 money in a model portfolio tends to result in a more balanced portfolio and a more disciplined approach than most people can accomplish on their own.

You May Like: How To Lower 401k Contribution Fidelity

How To Make Changes To Your 401 Contributions

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Whether you just set up your 401 plan or you established one long ago, you may want to change the amount of your contributions or even how theyre invested. Fortunately, changing your 401 contributions is usually straightforward, and you may be able to change your 401 contributions at any time .

After all, the point of a 401 plan is to help you save a substantial amount for your retirement. So its important to keep an eye on your account and your investments within the account, to insure that youre saving and investing according to your goals.

To understand how to maximize this investment opportunity and grow your nest egg, its important to start with the basics.

Benefits Of The Mit 401 Plan

When you enroll in and contribute to your 401 account, you are 100% vested that is you fully own your contributions, MITs matching contributions, and all interest earned on the investments you choose through the Plan.

In addition, you receive tax benefits when you contribute to your MIT Supplemental 401 account. You can choose when you receive your tax benefits right away, with pre-tax contributions, or later on, with Roth post-tax contributions.

Save on a pre-tax basis and receive tax benefits now

- Your 401 contributions are deducted from your paycheck before taxes are applied, reducing your current taxable income and therefore your taxes.

- In retirement, you will pay federal and state income taxes on any amount you withdraw from the plan.

Save on a post-tax basis and receive tax benefits later

- Your 401 contributions are taken out of your paycheck after federal and state income taxes have been applied, so they will not reduce your current taxable income or your taxes.

- In retirement, you will pay no taxes on any amount you withdraw as long as you take the distribution after age 59½ and at least 5 years after the first Roth contribution was made.

Recommended Reading: How Do I Open A Roth 401k

Fidelitys 401 Account Balances Contributions Reach Record Levels

Despite the Great Resignation, saving for retirement is still very much a priority, as Fidelitys IRA and DC plan savers set new records in 2021.

Assisted by strong market gains and employers helping to keep workers on track, Fidelity Investments 2021 year-end analysis of more than 35 million IRA, 401 and 403 accounts finds that the average 401 balance climbed to a record $130,700 in the fourth quarter, up 4% from the third quarter and 8% from a year ago.

Similarly, the average 403 account balance increased to a record $115,100, an increase of 4% from last quarter and an 8% increase from the fourth quarter of 2020.

Despite facing a variety of financial hurdles in 2021, including ongoing market uncertainty and a shifting employment landscape, investors did not let the events derail their efforts and continued to stay focused on the key fundamentals of retirement savings, Kevin Barry, President of Workplace Investing at Fidelity Investments, said in a statement. By making regular contributions to retirement accounts, not cashing out savings when they change jobs and taking advantage of their employer’s contributions, individuals were able to keep their savings on track as we head into 2022.

|

Average Retirement Account Balances |

|

$53,700 |

Contribution Increases

Among Gen Z workers, 53% increased their contribution rate in 2021, as well as more than a third of women investors on Fidelitys 401 platform. Whats more, 34% of 403 savers increased their contribution rate in 2021.

Work With An Advisor For A Tailored Allocation Strategy

In addition to the above options, you can opt to have a financial advisor recommend a portfolio that is tailored to your needs. The advisor may or may not recommend any of the above 401 allocation strategies. If they pick an alternate approach, they will usually attempt to pick funds for you in a way that coordinates with your goals, risk tolerance, and your current investments in other accounts.

If you are married and you each have investments in different accounts, an advisor can be of great help in coordinating your choices across your household. But the outcome wont necessarily be betterand your nest egg wont necessarily be biggerthan what you can achieve through the first four 401 allocation approaches.

Also Check: How To Check How Much Is In Your 401k

Also Check: What To Do With 401k

Need Help Call Fidelity

Most questions related to your Nazarene 403 Retirement Savings Plan account can be answered by phoning a Fidelity retirement services specialist at 866-NAZARENE . If you still have questions after doing this, phone Pensions and Benefits USA at 888-888-4656.

Also, Fidelity has a broad array of valuable tools, such as calculators and informational videos to assist in managing your financial life. We encourage you to explore their many resources.

Unless otherwise noted, transaction requests confirmed after the close of the market, normally 4 p.m. Eastern time, or on weekends or holidays, will receive the next available closing prices.

The investment options available through the plan reserve the right to modify or withdraw the exchange privilege.

Read Also: How Much In 401k To Retire

Master The Employer Match

Are you missing out on your employer match because you’re not contributing enough? A recent study from personal finance website MagnifyMoney shows that roughly 20% of Americans are failing to receive their full 401 employer match by not contributing enough.

With the average employer match now reaching an all-time high of 4.7% of a worker’s salary, according to Fidelity Investments, that could result in a cost of tens of thousands of dollars over the typical worker’s career and much more, when compound interest is considered.

Remember, a match is free money you’re leaving on the table if you don’t take advantage of it. By not contributing enough to secure the match, your overall compensation is lower. Think of it as giving yourself an unintentional pay cut. Cut back on whatever you need to in order to contribute enough to get that full match. You’re opting for lower total compensation, otherwise.

Read Also: How To Find Fidelity 401k Fees

How Can I Protect My 401 From A Stock Market Crash

Although there is no way to perfectly protect your investments from a financial downturn, there are solid strategies you can take to hedge against a major crash. These include keeping a diverse portfolio, not panicking about a stock market crash when dips happen in the market, and consistently funding your 401 over time.

Don’t Let Plan Costs Derail Your Profits

Are your 401 fees too high? Recent data show that the average person pays about 0.45% on their balance annually in plan administration fees and costs. And as the average 401 balance now exceeds $103,000, the costs and fees associated with retirement plans become an even more significant consideration. Even a fraction of a percent more in fees can eat away at your investments and mean thousands less in retirement.

Speak with your plan administrator or human resources department to understand your plan and investment selection fees. Choose quality mutual funds or exchange-traded funds with low fees. The average equity mutual fund fee in 2018 was 0.55% and for bond funds, it was 0.48%, according to the Investment Company Institute. Index mutual funds should be even lower. The average fee for a target date fund the popular 401 option that uses a variety of individual mutual funds matched to your risk profile and expected retirement age was 0.40% in 2018.

If you’re considering switching employers, consider the difference in fees between your existing plan and new one. You might do better by keeping your existing 401 with your old employer if it offers significantly lower-fee choices.

Read Also: How To Sell 401k Plans

Placing Real Estate Investment Question:

That is good news, and it sounds like the Fidelity brokerage account set up up process went smoothly and now you can start placing investments in alternative investments such as real estate. You can either place the investments by writing a check or by filling out the Fidelity outgoing wire directive, which we can fill out for you. for more information regarding investing in real estate.

And 457 Savings Plans

COVID-19 Communications:

Effective March 16, 2020, all in-person retirement planning sessions with TIAA, Fidelity, ICMA and VRS that were scheduled for UVA offices have been canceled or rescheduled to a virtual meeting. You will be contacted by the appropriate vendor retirement consultant with more information. Future appointments are still available through the signup links below and will be held virtually until further notice.

Please visit the HR COVID-19 webpages for additional HR information related to the coronavirus, health, and retirement.

Read Also: What Is The Minimum Withdrawal From 401k At Age 70.5

Read Also: Can You Transfer Money From 401k To Roth Ira

A Small Change Can Make A Big Difference

Sometimes the little things in life make the biggest difference. That’s true when it comes to saving for retirement too.

When you start saving for retirement, aim for an amount that’s manageable Then, challenge yourself to save 1% or more each year toward retirement. While 1% is a small percentage of your annual earnings, after 20 or 30 years it can make a big difference in your total savings.

Remember, a key to growing your savings is to increase your contributions each year. If your plan lets you set automatic increases every year, definitely take advantage of it. Overall, Fidelity recommends building up to saving 15% of your income toward retirement annually . But remember, you don’t have to get there overnight, and you can change your contribution amount if you need to.

Go ahead, challenge yourself to save a little more. Whether it’s a 1%, 3%, or even 5% increase, the extra money you save today could make a big difference in helping you achieve the retirement you envision.

Use Balanced Funds For A Middle

A balanced fund allocates your 401 contributions across both stocks and bonds, usually in a proportion of about 60% stocks and 40% bonds. The fund is said to be “balanced” because the more conservative bonds minimize the risk of the stocks. This means that when the stock market is quickly rising, a balanced fund usually will not rise as quickly as a fund with a higher portion of stock. When the stock market is falling, expect that a balanced fund will not fall as far as funds with a higher portion of bonds.

If you dont know when you might retire, and you want a solid approach that is not too conservative and not too aggressive, choosing a fund with balanced in its name is a good choice . This type of fund, like a target-date fund, does the work for you. You can put your entire 401 plan in a balanced fund, as it automatically maintains diversification and rebalances your money over time to maintain the original stock-bond mix.

Also Check: How To Move 401k Into Ira

Cut Off Date For Making Contributions To 401

The less painful it is to save for retirement, the better. When you contribute part of your paycheck to your 401, youre making an important investment in your future. You also receive tax benefits, so it benefits you in the present. As your circumstances change, you may want to make changes to how much you contribute to your 401. If you get a raise, for example, you may want to increase your contribution. If youre experiencing a financial crunch, you may want to temporarily lower your contribution. In most cases, in order to change your 401 contribution, you will need to contact the companys 401 plan provider.

Contributing To Your Mit 401 Account

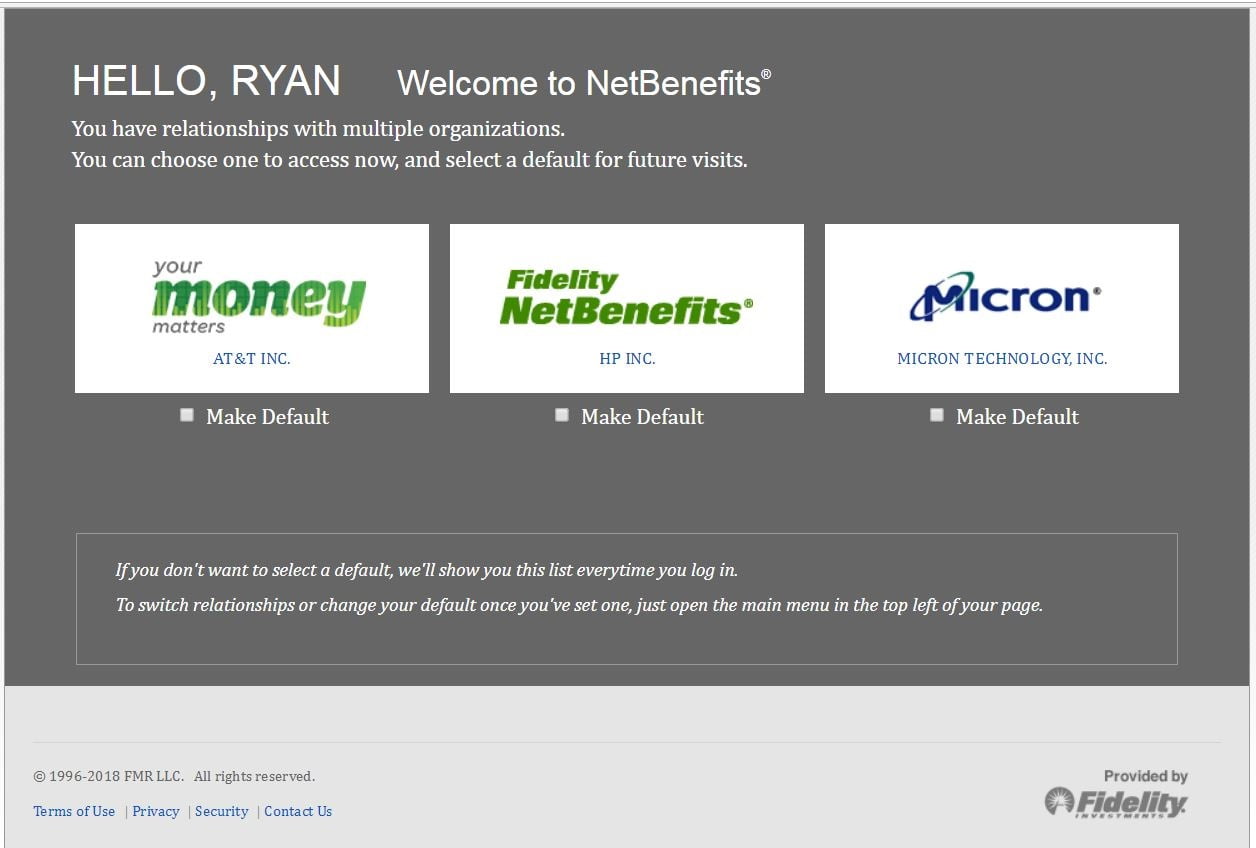

You contribute to your 401 account through deductions from your MIT paycheck. You can contribute pre-tax dollars, Roth post-tax dollars, or a combination of both. You may change your contribution preferences any time through Fidelity NetBenefits.

Your contributions are sent to Fidelity Investments at the end of each pay period. You may contribute as little as 1% and as much as 95% of your salary after amounts for Social Security and Medicare taxes and health and dental insurance have been subtracted. You may start, stop, or change your deferral or investment elections at any time.

Federal law limits the amount of your pay each year that may be recognized for determining your allowable contribution. In 2021, MIT can consider only the first $290,000 of pay for calculating your allowable contributions. This means that if your annual compensation exceeds $290,000, MIT Payroll will take 401 deductions from your pay until your pay for the year reaches $290,000, or one of the other 401 program limits has been reached .

Contribution limits

What MIT contributes to your 401 Plan

- MIT matches your 401 contributions dollar-for-dollar up to the first 5% of your MIT pay .

- MIT only contributes a match during months in which you have made a contribution

- The MIT match is provided pre-tax, and therefore is fully taxable when you withdraw your matching contributions from the plan, along with associated investment earnings.

When contributions are invested in your 401 account

Don’t Miss: How Soon Can I Get My 401k After I Quit

Sysco 401 Plan Enhancement

When you need to take a loan or withdrawal from your 401 plan, it can take days or even weeks to access your funds due to waiting periods. In an effort to support our associates impacted by coronavirus, weâve partnered with Fidelity to make Electronic Funds Transfer and eCertified Hardships available, so you can access your funds quickly.

Electronic Funds Transfer â Starting today, we have eliminated the 10-day waiting period for EFTs. Now, when a participant enters their banking information in NetBenefits, they no longer have a 10-day waiting period to receive funds. EFTs are immediately available for any loans or withdrawals that are $50,000 or less. In addition to eliminating wait times, this will also reduce cost to the participant.

eCertified Hardships â If you need to make a hardship withdrawal, you may be able to initiate a withdrawal in as little at 48 hours through eCertification. You can speak with a representative or initiate a qualifying hardship withdrawal anytime on NetBenefits.

To learn more about accessing your retirement funds for coronavirus-related relief, call Fidelity at 1-800-635-4015 or visit the Fidelity website. Review the rest of the content on this page to learn more about the Sysco 401 Plan.

Review And Make Changes To Contribution Amounts

Contribution amount changes can be made at any time during the year. Northwestern utilizes NetBenefits, administered by Fidelity, to provide enhanced services for the Retirement Savings Plans offered to faculty and staff. All contribution amount changes, even if you contribute to TIAA, are made using this system.

There are two ways to make this change for those in both TIAA and/or Fidelity:

- Call NetBenefits at 800-343-0860 to speak with a representative

- Update your contribution amount yourself via myHR. Call NetBenefits at 800-343-0860 for assistance with navigating the portal and maximizing your benefit. See this user guide on how to navigate the system or view the video below.

Recommended Reading: How Much Does A 401k Grow Per Year