More Information For 401 And Ira Contributors

The Secure 2.0 Act of 2022 will introduce several broad changes for retirement in America in general. One of the biggest will be a mandate for the Department of Labor to create a national, searchable database of retirement plans to help people find lost or misplaced accounts. The agency will be required to launch the database within two years.

The Employee Retirement Income Security Act of 1974 will also get an update. ERISA establishes minimum standards for administrators of private retirement plans, including communication with participants.

The ERISA rule change will require private retirement plans to provide participants with at least one paper statement a year unless the participant opts out. The rule won’t take effect until 2026, however, and won’t impact the other three quarterly statements required by ERISA.

What Is The Tax Penalty For Withdrawing Money From A 401

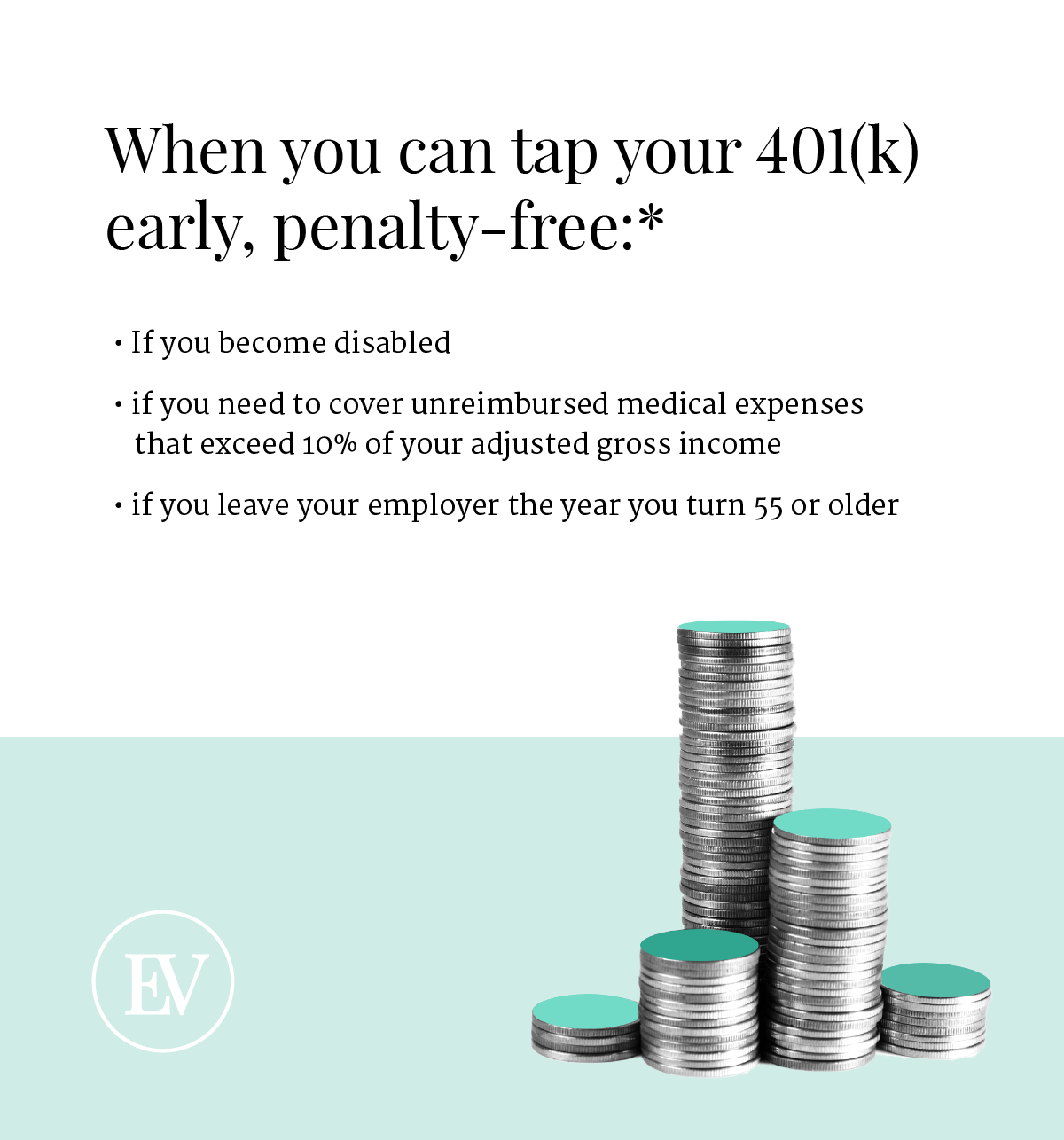

It depends on when you make the withdrawal. If you are age 59 1/2 or older, then there is no tax penalty. However, if you make a withdrawal before reaching this age, you will be charged an extra 10% penalty on top of your regular income taxes that you pay on the funds. In some cases, you might be able to take a withdrawal without being required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your financial planner to discuss your specific situation to see if you can qualify for a penalty-free withdrawal.

Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

You May Like: How To Draw Out Your 401k

New Rules For Early Withdrawal

The Secure 2.0 Act of 2022 includes several rule changes that will benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress added a basic exception for emergencies. Account holders who are younger than 59 and a half can withdraw up to $1,000 per year for emergencies and have three years to repay the distribution if they want. No further emergency withdrawals can be made within that three-year period unless repayment occurs.

The new law also specifies that employees will be allowed to self-certify their emergencies that is, no documentation is required beyond personal testimony. The law will also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters will also get some relief with the changes. The new rules will allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals wont be penalized and will be treated as gross income over three years. The rule will apply to all Americans affected by natural disasters after Jan. 26, 2021.

What Is The Penalty For An Early 401 Withdrawal

Taking money out of your 401 retirement plan early might sound like a good idea compared to borrowing money or putting a large expense on a credit card. But if you cash out your 401 or access your funds before you reach the age of 59 1/2, you will likely face a 10% early withdrawal penalty on the sum you took out. What that means is if you take out $5,000 at age 48, youll lose $500 as a penalty, and youll pay personal income tax on the whole $5,000.

Recommended Reading: Is 401k A Good Investment

Read Also: How To Open A 401k With An Employer

What Qualifies As A 401 Hardship Withdrawal

Different 401 plans may have different rules, so again, check with your plan administrator about whether you qualify for a hardship withdrawal. But the IRS defines it as an immediate and heavy financial need. Here are some examples:

- COVID-19-related expenses, as defined under the CARES Act

- Funds to avoid foreclosure or eviction from a primary residence

- Funeral expenses

Rollover To A Roth Account To Avoid Rmds

For those who own Roth 401s, theres a no-brainer RMD solution: Roll the money into a Roth IRA, which has no RMDs for the original owner. Assuming you are 59½ or older and have owned at least one Roth IRA for at least five years, the money rolled to the Roth IRA can be tapped tax-free.

Another solution to avoid RMDs would be to convert traditional IRA money to a Roth IRA. You will owe tax on the conversion at your ordinary income tax rate. But lowering your traditional IRA balance reduces its future RMDs, and the money in the Roth IRA can stay put as long as you like.

Converting IRA money to a Roth is a great strategy to start early, but you can do conversions even after you turn 72, though you must take your RMD first. Then you can convert all or part of the remaining balance to a Roth IRA. You can smooth out the conversion tax bill by converting smaller amounts over a number of years.

This can help you prevent paying more in taxes in the future. For instance, while traditional IRA distributions count when calculating taxation of Social Security benefits and Medicare premium surcharges for high-income taxpayers, Roth IRA distributions do not. And if you need extra income unexpectedly, tapping your Roth wont increase your taxable income.

You May Like: Where Can I Cash A 401k Check

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer.

You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal, but you can only do this from a current 401 account that’s held by your employer. You can’t take loans out on older 401 accounts.

You can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

Determine Whether You Qualify For A Hardship Withdrawal

The IRS defines a hardship as an immediate and heavy financial need. This is the type of withdrawal you should take if you qualify youll still have to pay income tax on the money, but you wont be charged the 10% early withdrawal penalty in many cases. Examples of financial hardship include the following:

Keep in mind that the IRS limits hardship withdrawals to the amount thats necessary to satisfy the need.

Read Also: How To Rollover A 401k From One Company To Another

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Exception To 10% Additional Tax

| Exception | The distribution will NOT be subject to the 10% additional early distribution tax in the following circumstances: | Qualified Plans | IRA, SEP, SIMPLE IRA* and SARSEP Plans | Internal Revenue Code Section |

|---|---|---|---|---|

| after participant/IRA owner reaches age 59½ | yes | |||

| permissive withdrawals from a plan with auto enrollment features | yes | yes for SIMPLE IRAs and SARSEPs | 414 | |

| Corrective Distributions | corrective distributions of excess contributions, excess aggregate contributions and excess deferrals, made timely | yes | ||

| after death of the participant/IRA owner | yes | |||

| total and permanent disability of the participant/IRA owner | yes | |||

| to an alternate payee under a Qualified Domestic Relations Order | yes | |||

| series of substantially equal payments | yes | |||

| dividend pass through from an ESOP | yes | |||

| qualified first-time homebuyers, up to $10,000 | no | |||

| because of an IRS levy of the plan | yes | |||

| amount of unreimbursed medical expenses | yes | |||

| health insurance premiums paid while unemployed | no | |||

| certain distributions to qualified military reservists called to active duty | yes | |||

| if withdrawn by extended due date of return | n/a | |||

| earnings on these returned contributions | n/a | 408 | ||

| Rollovers | in-plan Roth rollovers or eligible distributions contributed to another retirement plan or IRA within 60 days | yes | 402, 402A, 403, 403, 408, 408A | |

| the employee separates from service during or after the year the employee reaches age 55 ** | yes | 72,72 |

Don’t Miss: Can I Rollover 401k While Still Employed

Possible Exceptions To The 10% Penalty

In most instances, you have to wait until you’re 59 ½ years old to avoid paying the IRS’s early withdrawal fee. There are some exceptions to this rule, however.

For example, if you’re between the ages of 55 and 59 ½ and lose your job for any reason, including voluntarily resigning, you can begin withdrawing from your 401 early without incurring a penalty fee.

The IRS also allows for penalty-free hardship withdrawals in some instances, such as preventing foreclosure on a primary home or burial expenses after a death. Each plan has slightly different rules regarding hardship withdrawals and what qualifies as an emergency situation, so you’ll need to speak to your employer to find out if your circumstances qualify.

There are several other key exceptions for early withdrawal from a 401:

Can I Transfer My 401k To My Checking Account

Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay income on the withdrawn amount. If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs.

Recommended Reading: Are Employer 401k Contributions Taxable

At What Age Should I Start 401 Withdrawals

There are plenty of best practices for growing your money in a 401, but in this article, we tackle the rules related to the age at which you can withdraw from 401 plans.

During retirement, intentionally or not, youll begin a decumulation strategy . Think of this as a game that aims to minimize taxes and get the maximum after-tax income from your nest egg. By knowing the age-related rules, you can create a better withdrawal strategy and decide when to begin taking money out of your 401 plan.

Can I Withdraw My 401k Now

Individuals affected by COVID-19 can withdraw up to $100,000 from employee-sponsored retirement accounts like 401s and 403s, as well as personal retirement accounts, such as traditional individual retirement accounts, or a combination of these. The 10% penalty will be waived for distributions made in 2020.

Also Check: Can I Get My Own 401k Plan

How Much Social Security Will I Get If I Retire At 63

Monthly Social Security payments are reduced if you sign up at age 63, but by less than if you claim payments at age 62. A worker eligible for $1,000 monthly at age 66 would get $800 per month at age 63, a 20% pay cut. If your full retirement age is 67, you will get 25% less by signing up at age 63.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

You May Like: How Do I Withdraw Money From My Fidelity 401k

Learn Whether You Can Qualify To Supplement Your Income

For many Americans, the balance of their 401 account is one of the biggest financial assets they own — but the money in these accounts isn’t always available since there are restrictions on when it can be accessed.

401 plans are meant to help you save for retirement, so if you take 401 withdrawals before age 59 1/2, you’ll generally owe a 10% early withdrawal penalty on top of ordinary income taxes.

However, there are limited exceptions. For instance, if you incur unreimbursed medical expenses that exceed 10% of your adjusted gross income, you can withdraw money from a 401 penalty-free to pay them. Similarly, you can take a penalty-free distribution if you’re a military reservist called to active duty.

Because the exceptions are narrow, most people must leave their money invested until 59 1/2 to avoid incurring substantial taxes. However, there is one big exception that could apply if you’re an older American who needs earlier access to your 401 funds. It’s called the “rule of 55,” and here’s how it could work for you.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

Recommended Reading: How Much Should I Have In My 401k At 60

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Recommended Reading: How To Pull 401k Early