Other Ways To Avoid The 401 Withdrawal Penalty

The rule of 55 isnt the only way to avoid the 401 early withdrawal penalty. Other circumstances that allow you to avoid that additional 10% penalty include:

Total and permanent disability.

Medical expenses that exceed 7.5% of your adjusted gross income.

Withdrawals made because of an IRS levy plan.

Qualified disaster distributions.

Status as active duty and qualified reservist.

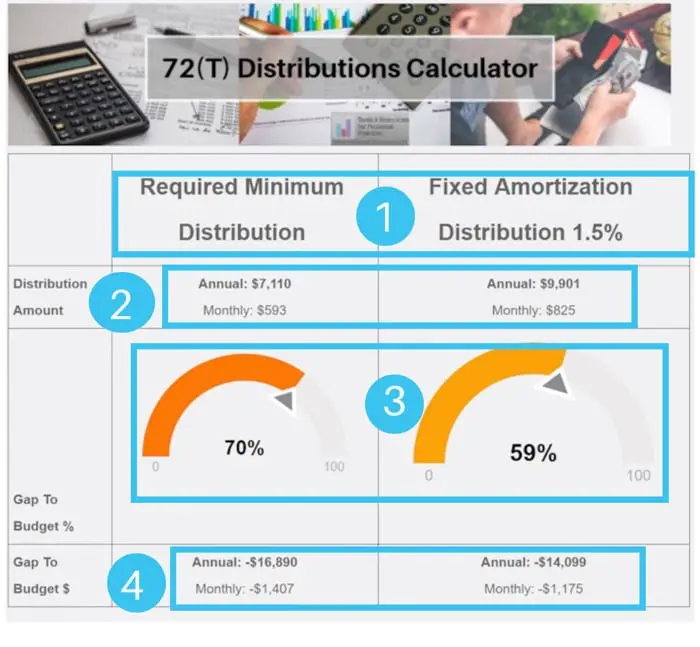

Additionally, Whitney points out, its possible to set up a situation where you take substantially equal periodic payments. This is sometimes called the 72t rule.

With 72t, you use IRS tables to decide how much to take each year if youre under age 59 ½, he says. You wont be stuck with the penalty, but you wont have flexibility. You have to commit to taking those withdrawals for at least five years or until youre 59 ½, whichever is greater.

With the rule of 55, you have more flexibility, Whitney says. As long as you meet the requirements, you can take as much or as little as you want from the 401 without committing to a set schedule.

You Agree To Substantially Equal Periodic Payments

Some people choose to retire early once they reach 50. By agreeing to substantially equal periodic payments under Internal Revenue Code Section 72, you can withdraw money from your 401 once a year for a minimum of five years or until you reach age 59.5 whichever period is longer.

You may use one of three methods to calculate your payments:

Where Can I Hide My Savings

Effective Places to Hide Money

- In an envelope taped to the bottom of a kitchen shelf.

- In a watertight plastic bottle or jar in the tank on the back of your toilet.

- In an envelope at the bottom of your child’s toybox.

- In a plastic baggie in the freezer.

- Inside of an old sock in the bottom of your sock drawer.

Read Also: What Age Can You Start Withdrawing From 401k

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Retirement Funds Dont Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Also Check: How To Roll Over 403b To 401k

You May Like: How To Take A Loan Out On Your 401k

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Don’t Miss: Should I Convert My 401k To A Roth 401 K

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Recommended Reading: How To Move 401k To Safer Investments

The Devil In The Details

Normally, if you were to take money from your retirement plan, you would be subject to a 10% penalty if you’re under age 59½, along with income taxes on the amount you’re withdrawing.

The relief bill gives you the opportunity to pay the taxes over the course of three years. You can also replenish the amount that you pulled from your retirement account over that time.

These distributions may be taken by people who themselves are diagnosed with coronavirus, or whose spouse or dependent has been diagnosed with COVID-19, or who experience adverse financial consequences from being quarantined, laid off or furloughed.

How Does This Affect Your Retirement If Youre A Canadian Living In The Us

If you live in the US and would love to retire in Canada, you can contribute to a 401k plan but then transfer the funds to the Canadian RRSP once you retire and want to get back to Canada. The tax rules will apply here and might have negative results for you.

Thats why you need to ensure you consult a cross-border finance expert to help you with the transfer.

Dont Miss: How Do I Find My 401k Money

Don’t Miss: How To Take Money Out From 401k

Exceptions To The Penalty: Hardship Withdrawal

The IRS permits withdrawals without a penalty for immediate and heavy financial needs. Dont guess. Check the current IRS rules to see whether your reason for withdrawing money is likely to be deemed a hardship withdrawal.

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

You may also withdraw up to $5,000 without penalty to pay expenses related to the birth or adoption of a child under the terms of the Setting Every Community Up for Retirement Enhancement Act of 2019. Keep in mind that youll still owe income taxes on that money. If it is a traditional individual retirement account , youll owe taxes on the entire withdrawal. If it is a Roth IRA, youll owe taxes only on the profits that accumulate in the account because youve paid in after-tax money.

With a hardship withdrawal, you will still owe the income taxes on that money, but you wont owe a penalty.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Don’t Miss: How Can I Get My 401k Money Without Paying Taxes

What Is An Early Withdrawal From A 401

An early withdrawal from a 401 happens when you take distributions from your account before the age of 59 ½.

The accounts are designed to provide you with an additional source of income during retirement, hence, the age requirement on distributions. If you decide to make an early withdrawal from your 401, the IRS will charge you a penalty.

If Youre Still Working For The Company

Most 401 plans dont allow regular withdrawals at age 55 while youre still working for the company. A regular withdrawal is defined as one thats not subject to penalties and doesnt require you to qualify based on special circumstances.

You might be able to take a 401 loan or qualify for a hardship withdrawal rather than take a regular withdrawal if your 401 plan allows these options. Not all 401 plans are required to offer loans or hardship withdrawals, however.

You can check with your plan administrator to see if they have a special provision that allows for something called an in-service distribution.

Read Also: Can You Buy A House With 401k

Does 401k Count As Income Against Social Security

401k Income. … The amount of money you’ve saved in your 401k won’t impact your monthly Social Security benefits, since this is considered non-wage income. However, since your Social Security benefits increase if you delay retirement, it may be beneficial to rely on 401k distributions in the early years of retirement.

Tips For Retirement Planning

- Meet with your financial advisor to discuss the pros and cons of retiring early. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering leaving the workforce ahead of your normal retirement age, learn how it changes your retirement income plan. Use a retirement calculator to estimate how much youll need to retire. A 401 calculator can give you an idea of how much youll be able to grow your savings. This is important to know ahead of your target retirement date.

You May Like: Where To Put 401k After Retirement

Tax Benefits Potential Earnings & Control

In other words, gold IRAs offer excellent tax benefits, have a massive upside profit potential, and put you in full control of your retirement money. And, even if you don’t want to transfer the entire amount in a 401, it’s still possible to achieve a high amount of portfolio diversification by putting a portion of the funds into a gold retirement account.

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. Thats from 10% to 37%, depending on your total taxable income. In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Recommended Reading: How Can I Check My 401k Online

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Do I Pay Taxes On 401k Withdrawal After Age 60

The IRS defines early retirement as taking money from your retirement plan before the age of 59 years. In most cases, you will have to pay an additional 10 percent tax on early retirements, unless you qualify for an exception. It is above your normal tax rate.

Can I cash out my 401k at age 60?

As soon as you turn 59 1/2, you are allowed to access the funds in your 401 plan whenever you want, even if you have always worked for the company. So, if youre 60, your company cant stop you from withdrawing your money. You dont have to start taking money until youre 70 1/2 years old.

Prev Post

You May Like: How Do I Cash Out My Fidelity 401k

What Are The Penalty

The Internal Revenue Service permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these exceptions, but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal: for costs directly related to the COVID-19 pandemic.

Youll still owe regular income taxes on the money withdrawn, but you wont get slapped with the 10% early withdrawal penalty.

Circumstances Where Both Iras And 401s Permit Penalty

- If a military reservist is called to active duty. Both IRA and 401 account owners can take certain qualified distributions from their retirement accounts if they are a military reservist who is called to active duty for 180 days or more.

- To cover qualified medical expenses. If unreimbursed medical expenses total more than 10% of the account ownerâs adjusted gross income for that year, early distributions are allowed from both a 401 or IRA without penalty.

- Disability. Early withdrawals can be taken without penalty in the case of a total and permanent disability of the participant/account owner. This applies to both IRAs and 401 plans.

- Adoption or birth of a child. Under the SECURE Act, up to $5,000 in qualified distributions can be taken from an IRA if the account owner adopts or gives birth to a child. â

- Inherited accounts. If an IRA or 401 account owner dies and passes the plan to a beneficiary, that beneficiary can withdraw funds from the account without penalty. As of 2020, inherited IRA distributions must be taken entirely by the end of the tenth year following the original account ownerâs death.

Read Also: How To Invest 401k Fidelity

What Is The Covid

Youll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if theyre younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent mustve been diagnosed with Covid-19.

Alternatively, you must have experienced adverse financial consequences due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.