How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

Theres Little Reason Not To Offer Roth

Honestly, theres little reason not to offer this contribution feature. It requires a little extra work when setting up your payroll for contributions, but this isnt terribly time-consuming or complex. If youve yet to set up your plan or are thinking of changing it, this is an excellent box to check.

To Maximize Savings For Business Owners Or Key Employees

Sheltering money from income taxes and allowing it to grow over time is a very powerful way of building wealth. And for some small businesses, its especially important that their owners and key employees are able to contribute as much of their income as they can to the retirement plan. In order to reach the annual contribution limit of $56,000 – and potentially push the companys retirement tax benefits even higher – youll need to be clear on this objective so you can choose the right partners and optimize your plan design accordingly.

Recommended Reading: How To Find Old 401k Funds

Reasons To Add A Discretionary Match Feature

- Employees must contribute salary deferrals themselves to receive an employer match. Because few employees tend to leave this free money on the table, an employer match usually increases the salary deferrals made to a 401 plan.

- The ADP test is used to test the salary deferrals made to a traditional 401 plan for nondiscrimination. A discretionary match can help a plan pass the ADP test by increasing salary deferrals. A stretch match can increase salary deferrals even further.

- If your business is a startup, has erratic profitability, or frequently acquires other companies, you may not be in a position to make an employer contribution every year. This isnt a problem with a discretionary match. At the end of each year, you have control over whether to contribute, and if so, how much.

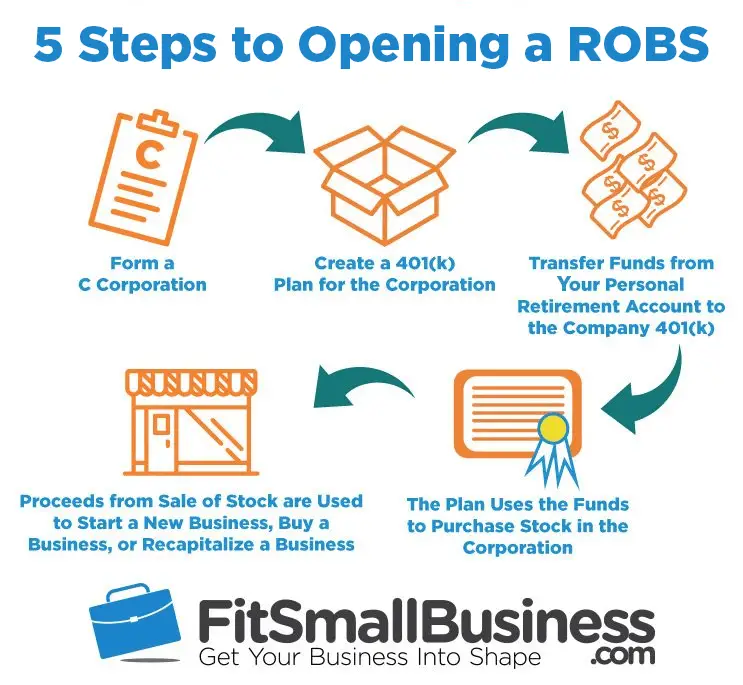

Is A Robs A Good Idea

Utilizing the ROBS options for financing a new business has several advantages. Remember, this is like buying any other stock in your retirement plan. Its not like taking a loan out of your 401 account. If you go through the hoops, youll have access to your retirement funds tax free and without the requirement to pay interest.

A ROBS can be a great way to fund your business without having to take on debt or give up equity in your company, says Linda Chavez, Founder & CEO at Seniors Life Insurance Finder in Los Angeles. Essentially, a ROBS allows you to use your retirement savings to start or grow your business. There are a few requirements for using a ROBS. First, you must have a 401 or other eligible retirement plan. Second, your business must be a C-Corporation. Finally, you must use the funds from your retirement account to purchase stock in your company. Once youve met these requirements, you can roll over your retirement savings into your companys 401 plan. This will allow you to take advantage of the tax benefits of a retirement account, while also using the funds to grow your business.

You May Like: How Long Does It Take To Get 401k Inheritance

Appoint A 401 Trustee/recordkeeper

All 401 plans get funding from a trust. This trust is established to hold and invest the assets in the plan. The trust requires an appointed trustee to handle investment management. In most cases, the business owner, a trusted employee, or a financial institution will manage the fund’s assets.

It’s incredibly important that the trustee is selected with careful consideration. They are trusted with managing all of the 401 assets, which is an important responsibility. Plus, trustees can face legal repercussions for mismanaging money. If there has been any negligence, the trustee can’t plead ignorance. For this reason, it’s vital that the trustee is fully qualified to handle the responsibilities.

Pros And Cons Of 401 Business Loans

Consider the following advantages and risks when deciding if a 401 business loan is right for you.

-

Borrowers don’t have to pay taxes and penalties if they pay back the loan

-

Interest paid goes back into the retirement account

-

Easy eligibility

-

Dependent on consistent employment

-

Drains a tax-advantaged retirement account

-

Borrowers younger than 59 ½ will owe back taxes and a 10% penalty if they default

-

Most plans charge fees, often a one-time loan origination fee of $50 or $75

-

Double-taxation occurs: Loan interest is paid with after-tax dollars, which will be taxed again when you retire

Don’t Miss: How Can I Get Money Out Of My 401k

The Basics Of A Small Business 401

First, lets discuss what a 401 plan is and why a small business might want to set one up. A 401 effectively is a retirement plan where employees can hold back a portion of their salary each paycheck and then that money is invested on a pre-tax basis in an investment plan. Many companies also offer to match the contributions employees make as an incentive for employees to use the 401.

One of the biggest reasons to add a 401 offering is to attract and retain talent. Retirement security is such an important concept for all employees, Ben Thomason, executive vice president of revenue at Vestwell, told CO last year. To me, that is the why of offering 401s to attract the right talent so your business can grow the right way. The right people make all the difference.

One other reason for companies to add one is that it can provide tax benefits for both employers and employees. The Setting Every Community Up for Retirement Enhancement Act of 2019, which was signed into law in the U.S. in December 2019, offers small businesses a tax credit up to $5,000 for three years for setting up a new retirement plan like a 401. On the employee side, 401 contributions are pre-tax, so their taxable income decreases and they pay less tax overall while saving for the future.

Companies have a fiduciary responsibility to make sure the selected 401 program is run appropriately. This means you should not offer a 401 without doing the proper planning and research.

How To Streamline And Automate Your Businesss 401 Process

Small businesses can use third-party services like Betterment at Work to streamline and automate their 401 setup, enrollment, and management processes.

For instance, automated platform simplifies and fully manages employee retirement planning including payroll integration, client services, dashboards, custodial services, ERISA consulting, compliance, and Form 5500 preparation, said Carlisle.

Automating these processes through a third-party service ensures your employees receive the proper guidance while taking the burden off your shoulders, so you can focus on growing your business.

To set up your businesss 401, all you need to do is select the type of plan you want to offer your employees, decide whether you plan to match their contributions , communicate your offerings to your employees, then allow a third-party service to enroll, onboard, and manage the rest of the process.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

Also Check: How To Access My 401k Money

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

Tax Breaks And Other Factors Make Launching A Startup 401 Plan For Employees A More Viable Option For Small Businesses

- A 401 is an employer-sponsored savings plan that companies can offer to help employees save money for retirement.

- Small businesses have always been permitted to set up a 401 plan for their employees, but tax incentives and other changes make a startup 401 plan more attainable.

- Small business owners should look at a variety of factors, including fees, transparency and account-holder services, when shopping around for a startup 401 plan provider.

- This article is for small business owners who want to understand the basics of startup 401 plans.

Until recently, many small businesses shied away from offering a 401 plan to their employees based on financial constraints and other concerns. Fortunately, startup 401 plans now lie within easier reach, thanks in large part to legislative changes and the increased availability of small business 401 plans. If youre considering offering a 401 retirement savings plan to your employees, its essential to understand what they are, how they work and how to go about starting one.

Editors note: Looking for the right employee retirement plan provider for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Recommended Reading: Can I Use My 401k To Purchase A House

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

How Do I Set Up A Small Business 401

If youre ready to set up your small business 401, these are the four steps youll need to take.

For small businesses that are ready to help their employees save for retirement, the IRS website covers the actions you need to set up a 401 plan. In case you dont speak in tax code, heres a more approachable step-by-step guide.

Read Also: Can You Convert 401k To Roth 401k

How To Start A 401k For My Small Business In 7 Steps

Employers do not have to offer retirement plans to their employees. However, retirement plans are an added benefit for many companies. Most employees look forward to what types of benefits their employers offer. In return, employees are more likely to stay with a company longer and increase their productivity for businesses that have a great benefits package.

The reason why many companies choose to offer their employees a 401K plan is that not only does it benefit them but also the business. A 401K plan is popular with many companies as employees contribute to their plans with pre-tax dollars. Because of this, an employee’s tax liability is decreased and they are able to save for retirement. Therefore, many companies, especially small businesses, should determine what reasons they have for wanting to offer a 401K plan. For many owners, once they know why, they can begin to determine how to start a 401K for my small business.

How To Start A 401 For My Business: 4 Steps

Once youve decided that a 401 plan is the right option for your business, its time to get it set up. There are a lot of details that go into starting and managing a 401 plan, but to get started there are four main steps youll need to take:

1. Find a Plan Provider

You can administer a 401 plan yourself, but its much easier to outsource this task to a plan provider. There are a lot of administrative tasks that can be handled by a plan provider who has more experience.

But youll want to take your time to find the right plan provider. When shopping around for a plan provider youll want to consider a few things:

Once youve picked a plan provider, youll need to spend time documenting your decision. You have a fiduciary responsibility to your employees to select and maintain the best provider on their behalf.

Even after youve hired the provider, youll need to monitor your selection to make sure its still the best choice. You should:

- Regularly review their performance

- Review updates to their contract and policies and procedures

- Follow up on participant complaints

2. Decide on Your Employer Contribution

One way you can entice employees to save in the 401 plan you set up is to offer employer contributions. With an employer contribution, youre depositing money into your employees retirement accounts. Employer contributions are a valuable benefit for employees.

With a traditional 401 plan, you have options for offering your contribution.

3. Create Your Vesting Schedule

Don’t Miss: How To Find Out If I Have Any 401k

Reason : Youre Investing In Your Own Business

Youve probably been pumping every last dollar back in your own business in an effort to get yourself on a solid foundation. Many self-employed people do the same. Its a mistake. Youre prioritizing your present over your future. Balance is the key here.

Reality: Is that still necessary? Its great to pump every last nickel into your business when youre a startup, but is it really necessary now? Cant you take some money off the top and sink it into a retirement account each month? Your future self will thank you when youre living the good life in your golden years.

Recommended Reading: How Much Should I Contribute To My 401k

How Long Does It Take To Set Up A 401

Theres no set timeframe for establishing a 401. It really depends on how long it takes you to complete the steps we just discussed. For many businesses, it typically takes less than 60 days.

One way you can speed and streamline the process is to partner with a 401 third party administrator to handle a lot of the tasks for you and take some of the responsibility off your plate. As you evaluate potential partners, youll want to ask how easy it is to get your plan up and running and whats required of you during the process.

For example, all providers will ask you to fill out some documents but find out if you will get a dedicated point of contact to help you navigate the tasks involved and ensure you correctly complete the forms.

Youll also want to ask if they offer automatic enrollment for a hassle-free onboarding process that also increases participation. To make it even easier on your employees, find out whether the interface theyll be using is simple and intuitive for tasks like monitoring their account or making changes to their salary deferrals.

Also Check: Why Rollover 401k To Ira

How Do You Choose The Best Funds To Offer To Your Employees

The contributions you make to your 401 are invested in a portfolio made up of mutual funds, stocks, bonds, money market funds, savings accounts, and other investment options, as permitted by the plan.

Beneficial funds allow your employees to choose the types of investments they make. The fund choices are transparent, have a low fee, and follow well-researched investment approaches. Again, speak with a finance professional while you are researching options.

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

Don’t Miss: Can I Have A 401k And An Ira

What Are Some Things To Remember When Opening A 401

When it comes to small business retirement planning, 401s are one of the most popular options. However, there are a few things to keep in mind when opening a 401. First, business owners will need to choose a 401 provider like Penelope. Penelope is leading the way with competitive pricing and fees when it comes to small business retirement.

Second, businesses will need to decide how much they’re willing to match employee contributions. This will usually be a percentage of salary, up to a maximum amount. Lastly, businesses will need to ensure that they comply with all the relevant regulations. Fortunately, plenty of resources are available to help small businesses navigate the world of 401s. By keeping these things in mind, small businesses can set up a 401 that’s right for them.

Why A Retirement Plan Is A Smart Move

A 401 plan can be a very powerful benefit for your company and your employees. But offering a 401 plan is a big commitment. How do you know if its right for your company?

Here are some reasons starting a 401 plan is a smart move.

- Attract and retain employees: It can be difficult to find and keep the right people for your business. A 401 might help. According to a Glassdoor study, 401 plans are one of the top five benefits employees care about.

- Deferred tax growth: A traditional 401 plan offers deferred tax growth to help fuel retirement. If you participate in your plan that means both you and your employees are reaping that benefit.

- Tax deductions: Not only can a 401 plan be good for your financial health, it can be good for your business health. Any contributions that you make to your employees plan are tax-deductible. And your business may even be eligible for a $500 tax credit for the first three years after setting up your plan.

- Offer solutions:48% of people 55 and over have nothing set aside in a retirement plan. This isnt good for anyone. Offering a retirement plan can help your employees protect their financial future and show that you care about their wellbeing.

Read Also: How To Properly Invest In 401k