Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes upfront before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary.Tax brackets for 2023 range from 10% to 37%, which are the same as those from 2022.

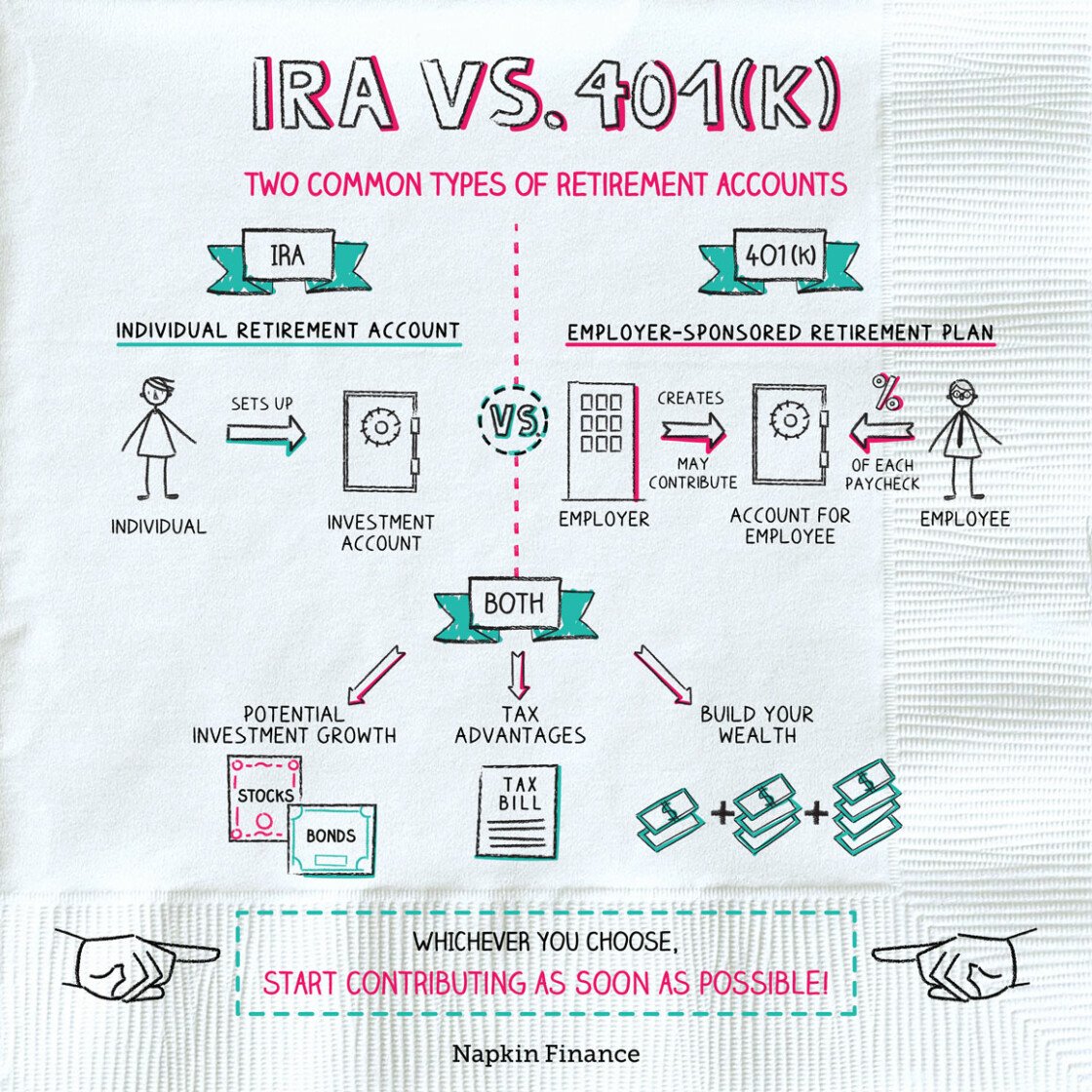

What Is A 401k And Why Should I Consider Rolling It Into A Gold Ira

A 401k is a defined contribution plan that allows employees to set aside money in a retirement account. Employers can implement a 401k plan, and the contributions made by employees are taken directly out of their paychecks before taxes. The money then goes into the employee’s 401k account, usually invested in mutual funds or other stocks.

This is an advantage to employees as it lets them manage their portfolios as they see fit, but it also has some drawbacks. The money taken from their paychecks is taxed as income, and the money in their accounts isn’t. When they retire, the value of their 401k can dwindle significantly due to investment fees and taxes on the assets inside the accounts.

This can leave the employee with a lackluster retirement and become frustrating when it interferes with their ability to live comfortably during retirement.

Like many people, you may wonder if there is another way to do your 401k work for you. One alternative is to roll your 401k into a gold IRA. This option can be beneficial because it allows you to avoid the taxes on your money that would have been taken out of your paychecks, which can be a significant amount throughout your career.

Investing in a gold IRA also gives you an alternative investment vehicle if a company that was once part of your 401k plan goes out of business.

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward. Your first step is to contact your companys plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use the forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Also Check: What Happens To Your 401k When You Quit A Job

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA.

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Dont Miss: How To Roll Over 401k To New Job

Your Employer Retirement Account Options

It can be reassuring to know that you still have access to your contributions and those vested employer-matching contributions. Whenever you terminate employment after participating in a workplace retirement plan, you will have several options for what to do with the vested amount in that account. In fact, there are four options you should consider:

Cashing out of your former employerâs retirement plan is almost never advisable. It is one of the top retirement planning mistakes to avoid. Though leaving your money in your former employerâs plan or rolling it over to a new employer plan are both fine options, donât disregard the opportunity to roll your funds into a rollover IRA. A rollover IRA comes with its own set of strategic benefits, and when executed properly, it ensures that you wonât trigger any negative tax consequences.

You May Like: Can I Use My 401k To Buy A Second Home

Avoiding The 70 1/2 Rmd Rule

If you’re 70 1/2 and have money in a traditional IRA, SEP IRA, or SIMPLE IRA, you’re required to take “Required Minimum Distributions” from your account. If you’re no longer working, and have a 401k, you’re also required to start taking required minimum distributions by April 1 of the year after you turn 70 1/2. However, there is an exception to this rule.

With a 401k, if you’re still working at the employer who sponsored your plan, you don’t have to take the RMD until after you retire. Employees who own more than 5 percent of the company sponsoring the plan can’t use this tactic and they must start distributions from their 401k accounts after age 70 1/2, regardless of whether they continue to work.

Since traditional and SEP IRAs require you to take an RMD at 70 1/2 regardless of whether you’re working, it can make sense to do a reverse rollover into your 401k if you want to delay taking the RMD.

Exceptions To Additional Taxes

You dont have to pay additional taxes if you are age 59½ or older when you withdraw the money from your SIMPLE IRA. You also dont have to pay additional taxes if, for example:

- Your withdrawal is not more than:

- Your unreimbursed medical expenses that exceed 10% of your adjusted gross income ,

- Your cost for your medical insurance while unemployed,

- Your qualified higher education expenses, or

- The amount to buy, build or rebuild a first home

Recommended Reading: How Do I Use My 401k To Start A Business

Best Practices And Strategies For Rolling Existing Retirement Funds Into An Annuity

Determining how much of your retirement savings should be in an annuity should start with an analysis of your routine expenses. Ideally, you should make sure you have a guaranteed income stream to fund at least 80% of your budget. This income stream can come from Social Security, a pension or annuities.

When you consider rolling your retirement savings into an annuity, you should be familiar with the types of annuities and the benefits and drawbacks of each. Some investment advisors say that variable annuities are not a good option because they can be expensive, complicated and unpredictable. Fixed annuities, however, are less costly to the purchaser and more reliable as far as an income stream.

You should consult a financial advisor to chart out your budget moving forward and determine how much of your retirement savings should be used to purchase an annuity. You should determine what type of annuity works best for you and whether you should purchase specific riders to modify the contract to meet your needs.

You could also use various strategies, such as annuity laddering, which takes advantage of different types of annuities to construct the income stream you need, or a split-funded annuity, which enables you to get the best of different types of annuities.

How To Roll Your 401 Into An Ira

Rolling your 401 into an IRA is not as complicated as it seems.

Choose the financial institution you want to roll over your savings into, such as a bank, online investing platform, or brokerage.

Once you have selected the institution, contact your previous employer’s 401 administrator and request a direct rollover of your savings into your new IRA account.

Hence, in making rollovers, there are two types that either could be your option.

- Direct Rollovers

Direct rollovers occur when your money is transferred from one account to another electronically.

- Indirect Rollovers

The funds come to you to re-deposit in an indirect rollover.

You have only sixty days to deposit the funds in a new plan if you get the money in cash rather than transferring it directly to the new account. Missing the deadlines means that you opt to withhold taxes and penalties.

Recommended Reading: How To Find Out If I Have Old 401k

Open Your Rollover Ira In 3 Easy Steps Were Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Also Check: How To Withdraw Money From My Fidelity 401k

The Penalty If You Deposit To The Wrong Account

You have 60 days to deposit the funds into the appropriate account when you receive a rollover check. Your rollover wont count as a rollover if you miss the 60-day deadline. It will become taxable.

Exceptions to the 60-day rollover time frame are hard to come by unless your financial services company makes a gross error. Its important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

You May Like: Can You Transfer 401k To Ira While Still Employed

Open An Account With A Brokerage In Your Name

Open an account in your primary residence, as this is more convenient. You can use this account to purchase gold online or at a local store. The brokerage you use can determine the type of account you will have , but it is not advisable to roll your 401k into a regular brokerage account.

These accounts have lower contribution limits, and you will have to pay taxes on your investment. The money in your rollover account should be treated as if it were your own, as you can choose which investments you want on your own.

Warnings About Doing A Reverse Rollover

Before you jump into doing a reverse IRA to 401k Rollover, here are a few warnings that you need to consider.

First, only 69% of employer-sponsored 401ks currently allow reverse rollovers into them, according to the Plan Sponsor Council of America. So, before you go an cash out your IRA, make sure that your employer is willing and able to receive the deposit. Otherwise, you could be in for some trouble.

Second, make sure that you consult with your accountant or tax advisor. These types of distributions and transfers are complex. Not every accountant has seen them before, and it could raise red flags on your tax return. To protect yourself, you really should consult with an advisor who is knowledgeable in retirement plans and the taxability of these types of situations.

Check out this IRA rollover chart to double-check yourself.

Don’t Miss: How To Transfer Rollover Ira To 401k

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Recommended Reading: How Young Can You Start A 401k

Reasons To Avoid A 401 Rollover

There are some cases when it doesnât make sense to roll your 401 into another account:

⢠IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

⢠Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

⢠Limited investment choices. A new employerâs 401 might have more limited investment choices. If thatâs the case, you might want to stick with your existing 401 because the assets work better for your situation.

⢠A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs donât have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Don’t Miss: Where To Find Fidelity 401k Account Number

What Happens If I Cash Out My 401

If you simply cash out your 401 account, youll owe income tax on the money. In addition, youll generally owe a 10% early withdrawal penalty if youre under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Should I Rollover To An Ira Or A 401k

Generally, the money from the old 401 has to be deposited into the new IRA within 60 days in order to roll it over to an IRA.

Heres how to start and finish a 401 IRA rollover in 4 steps:

- Compared to your old 401, an IRA may offer you more investment choices and lower fees.

- Rollovers to Roth IRAs are taxed on the rolled amount.

- Taxes are deferred when you roll over to a traditional IRA.

- You wont have to pay a rollover tax if you move from a Roth 401 to a Roth IRA.

There are generally two options for getting an IRA: online brokers or Robo-advisors.

- A Robo-advisor can do all the work for you if you dont want to pick individual investments.

- An online broker lets you buy and sell investments yourself to build and manage your portfolio. Providers should offer low-cost investments, offer no account fees, and have an excellent reputation for customer service.

401 plans may offer direct rollovers, or you can use the 60-day rule.

Don’t Miss: Can I Rollover Multiple 401k To Ira