Simplified Employee Pension Iras

If you’ve started consulting or added freelance gigs to your plate, you may be able to take advantage of Simplified Employee Pension IRAs. A SEP, like an employer’s retirement plan, is funded with pretax dollars, potentially lowering your taxable income. Under federal rules, you may be able to put away up to 25% of your 2020 net income from those ventures, or up to $57,000 .2

Health Savings Account And Flexible Savings Account Contribution Limits

While the Health Savings Account and Flexible Savings Account are technically not for retirement purposes, people use them to save for retirement anyway. The HSA and FSA should be used for medical-related expenses. Contributions are made pre-tax. However, any money leftover can be saved.

For single people, the HSA contribution limit will increase from $3,650 in 2022, to $3,850 in 2023, and up from $3,600 in 2021. Family coverage is always double the single coverage, so it will increase from $7,300 to 7,700 in 2023.

The HSA is only possible if you have a High Deductible Health Plan . You really have to weigh the pros and cons because sometimes, a HDHP will cost you more than a low deductible health plan with higher premiums.

Personally, Ive decided to get a regular Gold plan, which precludes me from getting a Health Savings Account.

Healthcare FSA contribution limits will increase from $2,850 in 2022 to $3,050 in 2023.

Saving With Your Spouse

Look across the breakfast table. Is your spouse taking advantage of their maximum 401 contribution limit and also an IRA? Making sure your significant other is also saving the max can set up both of you better for the future. Your spouse can contribute to an IRA even if they’re not working outside the home.

Draw up a list of reasons to stay, focusing first on the practical. For example, proximity to school, a good neighborhood, special features that accommodate aging parents, etc. Once that is done, it’s time to consider more emotionally charged reasons, the most common of which include maintaining a sense of continuity for your children. Remaining close to neighbors who are also supportive friends or the garden you cultivate in your “me time” may be other reasons to stay.

Don’t Miss: What Age Can You Start Withdrawing From 401k

Retirement Contribution Limits At A Glance

First, the IRS increased the max contribution for 401s and other plans you may have through your employer. Meaning your 401 can hold more money. IRA contribution limits didnt increase, but you can still make good progress toward retirement.

If youre 50 or older, you can continue to set aside more money in your employers plan to help reach your retirement goal. Learn how these catch-up contributions work.

| Account | Catch-up limit |

|---|---|

| Employer-sponsored plans: |

Not ready to max out your accounts? Learn how to gradually increase your contributions.

Saving In A Personal Annuity

If you want an additional way to save for retirement outside of your employer plan, consider a personal annuityOpens dialog. A personal annuity, also called an after-tax annuity, can help you build additional retirement savings. It offers options that can provide a steady stream of income when you retire.4

You May Like: Can You Roll A 401k Into A 403b

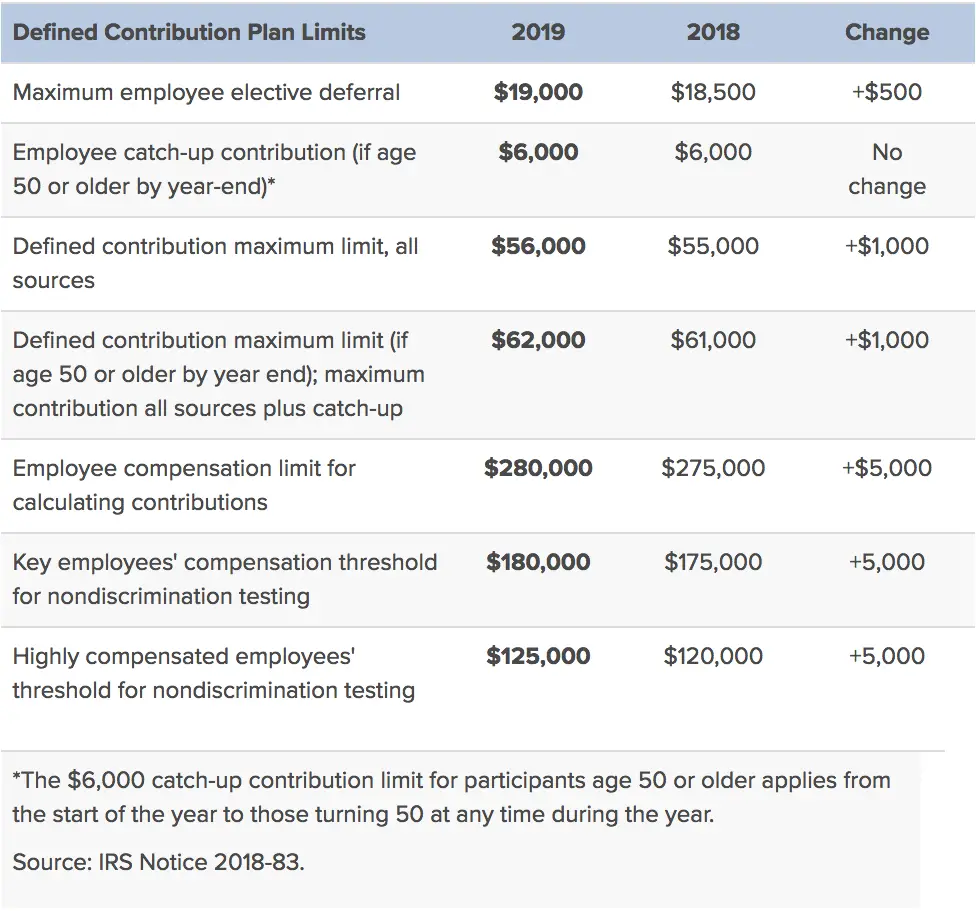

Maximum 401 Company Match Limits

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

Therefore, in 2022, an employee can contribute up to $20,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $61,000 employer-employee matching limit.

Since matching $20,500 in full would only total $41,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2021 and 2022.

The key employees compensation threshold increased from 2021 to 2022, from $185,000 to $200,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Recommended Reading: How Do I Find Out My 401k Balance

/403/401 Employer And Total Contribution Limit For 2023

What some people do not realize is that the employee contribution limit is only one part of the 401 and 403 plan contribution limit. There is also the employer portion of the contribution limit, which is actually much more. Therefore, strategically, you want to work for an employer who also contributies to your 401 or 403 in terms of profit-sharing and company matching.

For 2023, the employer maximum contribution limit is $43,500. Therefore, the total contribution limit is $66,000 for those under 50. If you are over 50, then the total contribution limit is $6,500 more, or $73,500.

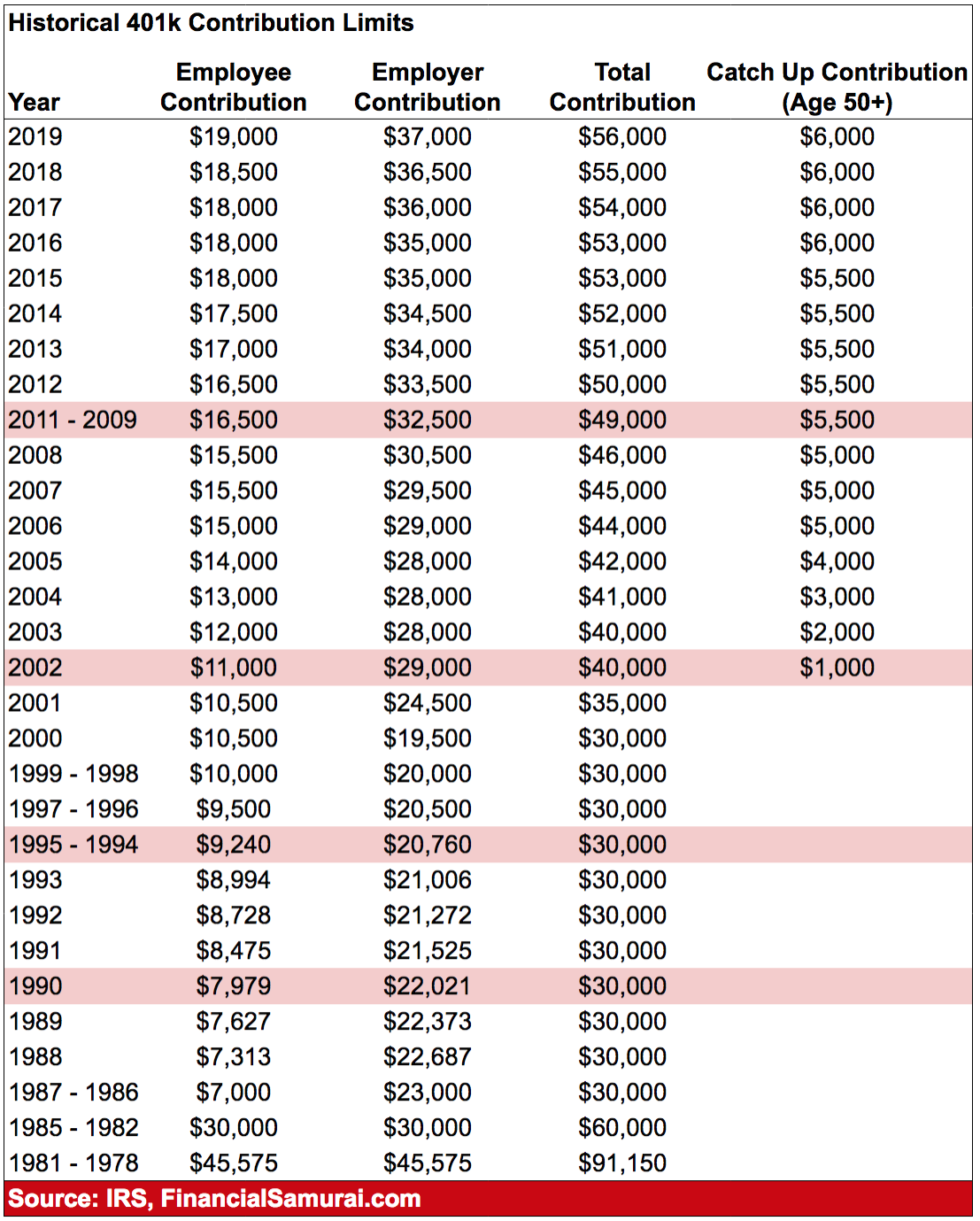

Take a look at this chart I put together on the historical 401 contribution limits.

What Is The Maximum An Employer Can Contribute To Your 401 In 2021 And 2022

Well, maybe there is one thing better than tax-free growthand thats free money! One of the best things about a 401 is that most employers offer some kind of match on your contributions, usually up to a certain percentage of your salary. In fact, about 86% of companies with a 401 plan provide a match on employee contributions.4 And the average employer 401 match is around 4.5% of your salary.5 For an employee who makes $50,000 a year, thats an additional $2,250 dedicated to their retirement savings each year. Thats free money to help you build wealth!

But there is a limit on how much you and your employer can put in together. Between you and your employer, the maximum that can be put into your 401 in 2021 is $58,000 . For 2022, that number jumps up to $61,000.6

Don’t Miss: When Can You Start To Withdraw From 401k

Work With A Financial Advisor

Whether you have questions about your 401 investment options or want to open up a Roth IRA, working with a trusted and qualified financial advisor can go a long way. They can help answer all your investing questions and give you the guidance you need to start investing for retirement and building wealth.

Dont have an advisor? We can help with that! Our SmartVestor program can connect you with up to five financial advisors who are ready to help you take the next step toward the retirement youve always dreamed about.

Ready to get started? Find your SmartVestor Pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

Don’t Miss: How To Transfer 401k To Bank Account

The Cap Isn’t The Problem

Despite concerns that some have about the failure to raise limits, for most workers the contribution cap isn’t the real problem. The problems that arise for most retirement programs are simply that enough employees don’t contribute.

It’s surprising how many staff don’t contribute to 401 plans that are offered. In fact, only 50 percent of employees exceed the median value of $18,433 in their 401. This means that despite the fact that the cap hasn’t risen, half of all employees don’t approach the cap anyway.

If You Have Multiple Roth Accounts

The question for those who also want to have a Roth IRA: Do you meet the income limits for being permitted to contribute to one? In 2021, the income phaseout for Roth IRA contributions started at $125,000 for single filers and eligibility ended at $140,000. For those who were married filing jointly in 2021, that income threshold started at $198,000 and ended at $208,000.

In 2022, these figures went up. Income phaseout for Roth IRA contributions starts at $129,000 and ends at $144,000 for single filers. For those married filing jointly, plus qualifying widows, the income phaseout starts at $204,000 and ends at $214,000.

The 401 contribution deadline is at the end of the calendar year, whereas the deadline on IRAs is April 15 or thereabouts. In other words, for the 2021 tax year, you can contribute to your Roth IRA until April 15, 2022.

If you have both a Roth 401 plan and a Roth IRA, your total annual contribution for all accounts in 2022 has a combined limit of $26,500 contribution + $6,000 Roth IRA contribution) or $34,000 if you are 50 or older contribution + $6,500 catch-up contribution + $6,000 Roth IRA contribution + $1,000 catch-up contribution).

Roth IRA accounts have a separate annual contribution limit of $6,000, with an additional $1,000 limit for catch-up contributions if you are age 50 or over . This limit has been in place since 2019.

Read Also: How To Open A Personal 401k

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracket in retirement compared with the one they’re in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if you’re at least age 59 1/2 and have owned the account for five years or more. You’ll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which has no required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts can’t exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Contribution Limits Rules And More

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

Your 401 contribution limits are made up of three factors:

- Salary-deferral contributions are the funds you elect to invest out of your paycheck.

- Catch-up contributions are additional money you may pay into the plan if you are age 50 or older by the end of the calendar year.

- Employer contributions consist of funds your company contributes to the plan also known as the “company match” or “matching contribution,” they may be subject to a vesting schedule.

There are two types of limits. One is a limit on the maximum amount you can contribute as a salary deferral. The other limit is on the amount of total contributions, which includes both your and your employer’s contributions.

Recommended Reading: Can I Roll My 401k Into A Brokerage Account

Why Is There A Maximum Contribution To A 401

The IRS limits the amount that individuals can contribute to a 401 plan as well as other tax-advantaged retirement accounts because of their tax benefits. Depending on the type of contributions you make , a 401 allows you to either defer taxes on your contributions until retirement or pay taxes now.

Having these limits allows people with lower income to have potential access to savings vehicles and greater market share return while limiting the amount that higher-income earners can deduct, said Mindy Yu, the Director of Investing at Betterment at Work.

Without limits on tax-advantaged contributions, high earners could easily shelter large portions of their income in a 401, helping them to avoid much of their tax burden. Contribution limits help to prevent that.

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

| Type of Contribution |

|---|

Recommended Reading: Can I Borrow From My 401k

Saving In An Ira After You Max Out Your 401 Or 403

First, make sure you’re really on track to max out your 401 or other workplace plan contribution limit. For 401 or similar workplace retirement plans, you can contribute up to $19,500 in 2020 . Plus, if you’re age 50 or older in 2020, the retirement catch-up contribution is $6,500 , allowing you to contribute up to $26,000 .

If you have maxed out your 401 or 403, next look into an individual retirement account . Wherever you are in life, an IRA can help complement your workplace plan. The pretax savings guidelines for IRAs look pretty straightforward at first glance:

- If you’re younger than age 50, you may sock away up to $6,000 pretax in an IRA if you meet certain IRS guidelines.

- If you’re 50 or older, the IRS lets you contribute an additional $1,000, totaling $7,000, to an IRA.1

It’s a good idea to see if you are eligible for a Roth IRA, which has income limits. If you are eligible, you make contributions with after-tax dollarsbut retirement withdrawals in many cases are tax-free.

Dont Leave Your 401 Match On The Table

You should always begin saving in your 401 if your company offers you a matching contribution. This is additional money your employer gives to you to help you pay for your retirement, but you only get it if you put money into your 401 first.

Check with your companys HR department if youre unsure how its matching system works. Find out how much you have to contribute in order to get the full match. Then figure out how many pay periods it will take you to set aside enough money based on your monthly savings goal.

The Daily Money:Get our latest personal finance stories in your inbox

If you have to contribute $3,000 of your own money to get the full match and youre setting aside $150 per pay period, it will take you 20 pay periods to claim your employer 401 match. Thats where your retirement savings should go, for the first part of the year at least.

The exception to this rule is if you arent fully vested in your 401 plan and you plan to leave your job soon. Quitting before youre fully vested could cost you your 401 match, so you may not gain anything by putting your money here versus another retirement account. Check with your HR department to learn more about its vesting schedule.

Don’t Miss: How Much Tax On 401k Distribution