What Sorts Of Penalties Can 401 Accounts Incur

In general, 401 account holders are not allowed to withdraw funds until they are 59 and a half years old. Should an account holder choose to liquidate their account before they reach that age, the withdrawal is subject to a 10% tax penalty from the IRS. Additionally, the entire withdrawal is subject to income tax.

The 10% early-withdrawal penalty may be waived in the case of certain hardships like medical, natural disaster, foreclosure, eviction, or funeral costs. This penalty may also be waived if the funds are to be used to pay for a first home or college tuition.

Certain workplaces may also enforce a vesting schedule that delays employee ownership of matched funds to incentivize employees to remain with the company. In these cases, employees who withdraw funds early may not have access to their full balance, as their employer may retain ownership of some or all of the funds they contributed to the account. Check with your employer to see if your account vests or belongs to you in full from the outset.

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- If you leave your employer at age 55 or older

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

Q: What Is A 401k Matching Example

A: Suppose an employee earns $50,000 annually and decides to contribute 10% of his pay to his 401k account, or $5,000 per year. Now suppose his employer matches 100% of employee contributions up to 6% of salary. The employer would make a matching contribution of $3,000. If the employer made a 50% match, the match amount would be $2,500.

Don’t Miss: How To Set Up 401k For Self Employed

Are There Different Types Of 401s

401 plans refer to any plan governed by subsection 401 of the Internal Revenue Code. While these plans all have similar requirements and limitations, the IRS code does have flexibility for different types of 401 plans.

Individuals can receive tax savings from several types of these retirement plans, including:

Bonus Tip: Take Advantage Of Savers Credit

Savers Credit is a $1,000 tax credit to encourage lower/middle taxpayers to put money towards a qualified retirement fund. This incentive does have criteria to meet, such as minimum contributions and income caps. If youre within the incentive range, you may qualify for a $1,000 credit towards your annual tax obligations.

Additionally, money that you put into your 401K is not considered take-home pay and does not count towards your yearly taxes. Your taxable income will be lessened based on your level of contribution.

Don’t Miss: Can You Borrow Against Your 401k

Choosing Investments In Your 401

You will usually have several investment options in your 401 plan. The plan administrator provides participants with a selection of different mutual funds, index funds and sometimes even exchange traded funds to choose from.

You get to decide how much of your 401 balance to invest in different funds. You could opt to invest 70 percent of your contributions in an equity index fund, 20 percent in a bond index fund and 10 percent in a money market mutual fund, for example.

Plans that automatically enroll workers almost always invest their contributions in what is known as a target-date fund. Thats a fund that holds a mix of stocks and bonds, with the mix determined by your current age and your target date for retirement. Generally, the younger you are, the higher the percentage of stocks. Even if you are automatically enrolled in a target-date fund, you are always free to change your investments.

Investing options available in 401 plans vary widely. You should consider consulting with a financial adviser to help you figure out the best investing strategy for you, based on your risk tolerance and long-term goals.

Related:Find A Financial Advisor In 3 minutes

Rolling Over Your 401k Into An Ira

You wont have to pay taxes on the money until you withdraw it, and you can keep growing your retirement savings tax-deferred. However, there are some drawbacks to rolling over your 401k. For example, you may have to pay fees to the financial institution to set up an IRA account. And if you withdraw the money before age 59 1/2, youll still be subject to taxes and early withdrawal penalties.

Also Check: Can I Open A Roth Ira And A 401k

Roth 401 Withdrawal Rules

Withdrawals of any contributions and earnings are not taxed as long as the withdrawal is a qualified distribution, which means certain criteria must be met:

- The Roth 401 account must have been held for at least five years.

- The withdrawal must have occurred because of a disability, on or after the death of an account owner, or when an account holder reaches at least age 59½.

Distributions are required for people who are at least 72 years old unless the individual is still employed at the company that holds the 401 and is not a 5% owner of the business sponsoring the plan. The first required minimum distribution must be taken on April 1 after the account holder turns 72. Keep in mind that individuals can withdraw more than the RMD.

Roth 401s are not available in all company-sponsored retirement schemes. When they are, 43% of savers opt for the Roth over a traditional 401. Millennials are more likely to contribute to a Roth 401 than Gen Xers or baby boomers.

Unlike a Roth 401, a Roth IRA is not subject to required minimum distributions.

Studies Based On The Cps And Other Surveys Of Individuals

Andrews used the May 1988 CPS to estimate three equations: the probability of an employee’s being covered by a 401 plan, the probability of a covered employee’s participating in the plan, and the percentage of the employee’s salary contributed. She relied on workplace characteristics to explain coverage and found that the probability of coverage increases with firm size, unionization, wage level, and so on. But coverage is only part of the story. In 1988, roughly 43 percent of workers who were offered 401 plans did not participate. To explain participation, Andrews used both individual and plan characteristics and found that participation rises with age, income, education, job tenure, and the presence of an employer match. Regarding contributions, she found that increasing age, family income, and participation in an individual retirement account are important positive determinants but that the presence of an employer match is negatively related to contributions.

Read Also: Can I Move My 401k To A Different Company

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is choosing between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that, since there is no tax on withdrawals, all the money that the contributions earn over decades of being in the account is tax free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

How Is A 401 Different From An Ira

The primary difference between a 401 and an IRA is that an employer offers a participant a 401, whereas an individual opens an individual retirement account on their own. While IRAs dont offer benefits like the employer match or a higher contribution limit, they may provide participants with more flexibility and investment choices than a 401 can.

You may be able to contribute to both your employer plan and a traditional or Roth IRA, depending on your income. Learn more about IRA contribution limits and eligibility.

Also Check: Can You Max Out 401k And Ira

How Are 401 Funds Invested

The funds in an employees 401 are invested via its service provider into a variety of securities, including ETFs and mutual funds that may contain stocks, bonds, and, in some cases, even commodities like gold and crude oil.

In many cases, 401 accounts automatically invest an employees contributions in a pre-set array of securities optimized for diversification and a moderate balance of risk and potential upside. In most cases, however, employees can also choose to customize how their contributions are allocated across any number of financial instruments offered by their 401 provider to optimize their portfolio for growth, dividend income, or other financial goals.

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

Read Also: How Do I Know I Have A 401k

A Short History Of 401s

Until the 1980s, pensions were the go-to retirement plan offered by most employers. Pensions were a vehicle through which employers would contribute to an employees retirement account each pay period from the companys earnings. The amount added to an employees account each pay period was determined by a formula that took into account the employees age, years of service with the company, pay rate, and how long they were likely to survive after retirement.

Because this system was funded entirely by employers and involved quite a bit of liability management on the employers part, pensions were quickly ditched by many companies once 401swhich shift much of the burden of saving for retirement onto the employeebecame an option.

This occurred when Congress passed the Revenue Act of 1978. Section 40, subsection k of this actthe new breed of retirement plans namesakestipulated that employees could skip paying income tax on compensation that was deferred until they actually received that income.

In 1980, an employee-benefits consultant named Ted Benna proposed the idea of using this clause to create a tax-deferred retirement account. The company he was consulting for did not end up adopting this idea, so Benna ended up implementing it at the Johnson Companies, where he worked at the time. This was the first time employer-sponsored 401 accounts with contribution matching existed in the United States.

Employee And Employer Combined

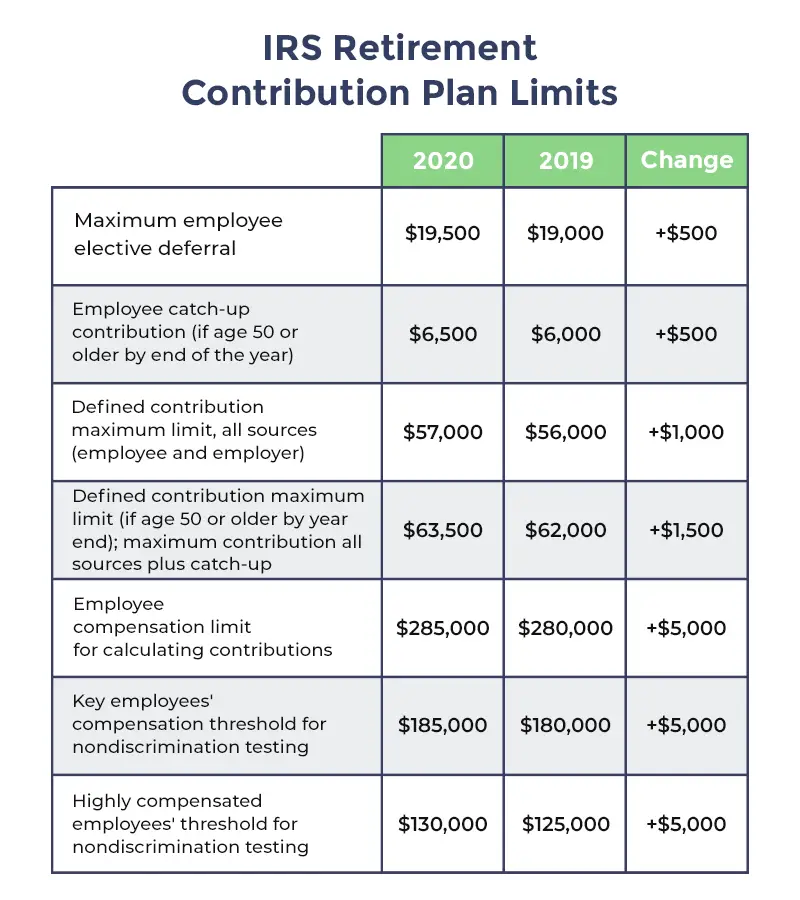

Regardless of whether contributions to your 401 come from you and/or from employer matching, all deferrals are subject to an annual contribution limit dictated by the Internal Revenue Service . For 2022, the total contribution amount allowed for all 401 accounts held by the same employee is $61,000, or 100% of compensation, whichever is less. For 2023, this limit rises to $66,000.

Read Also: How To Transfer My 401k To Vanguard

How Does A 401 Work

401 accounts can only be sponsored by an employer. In most organizations, the 401 plan is offered as an optional retirement benefit.

A 401 is a defined contribution account. If an eligible employee participates in a 401, they will decide an amount of their salary that will be deducted from their paycheck into a separate account.

Employer matching. Employers may or may not match the employees contributions, up to a limit. Employers who decided to match employee contributions do so according to a determined formula. Employer contributions might be on the basis of $0.50 or $1.00 for every $1.00 contributed by the employee.

Investments. Companies typically offer employees several investment options for their 401 accounts. These can include mutual funds, index funds, large- and small-cap funds, real estate funds, bond funds and foreign funds. These options are managed by financial service groups.

For traditional 401 accounts, contributions from employee paychecks are made with pre-tax dollars and taxed as ordinary income upon withdrawal. Contributions to Roth 401s are made with post-tax paycheck deductions but are not taxed upon withdrawal.

Withdrawals. Usually, once the money is deposited into a 401, employees must meet certain criteria in order to make an unpenalized withdrawal from their 401 account . These criteria are known as triggering events:

Early withdrawals that do not satisfy these criteria are typically subject to income taxes and an additional 10% in penalties.

What Is The Maximum Contribution To A 401

For most people, the maximum contribution to a 401 plan is $20,500 in 2022 and $22,500 in 2023. If you are more than 50 years old, you can make an additional 2022 catch-up contribution of $6,500 for a total of $27,000 . There are also limitations on the employer’s matching contribution: The combined employer-employee contributions cannot exceed $61,000 in 2022 and $66,000 in 2023 .

Also Check: Can You Cash Out 401k Early

Don’t Leave Free Money On The Table

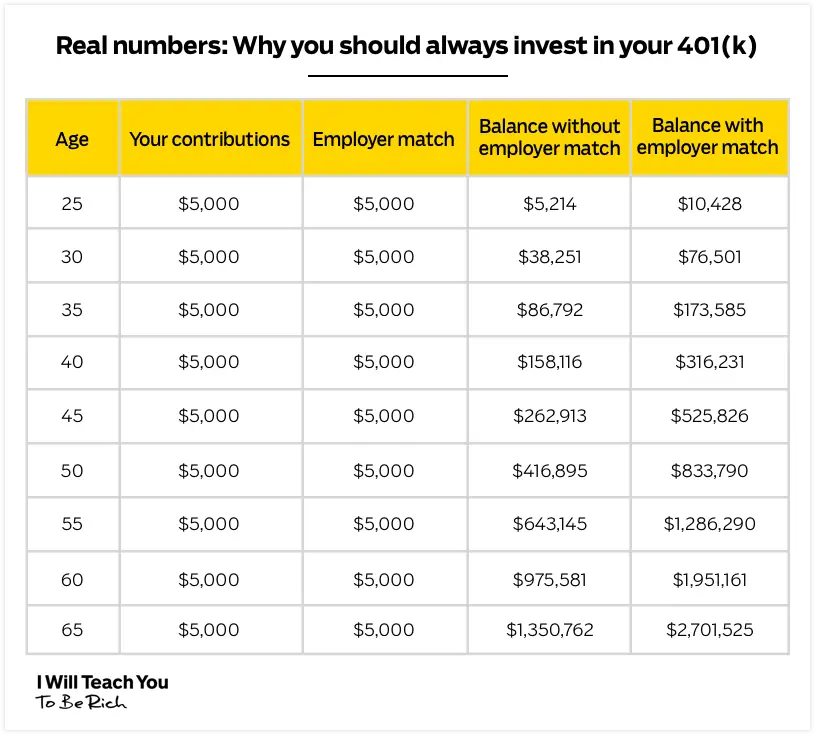

Employer matching of your 401 contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Depending on the terms of your employer’s 401 plan, your contributions to your retirement savings may be matched by employer contributions in several ways. Typically, employers match a percentage of employee contributions up to a specific portion of the total salary. Occasionally, employers may elect to match employee contributions up to a certain dollar amount, regardless of employee compensation.

Plans For Certain Small Businesses Or Sole Proprietorships

The Economic Growth and Tax Relief Reconciliation Act of 2001 made 401 plans more beneficial to the self-employed. The two key changes enacted related to the allowable “Employer” deductible contribution, and the “Individual” IRC-415 contribution limit.

Prior to EGTRRA, the maximum tax-deductible contribution to a 401 plan was 15% of eligible pay . Without EGTRRA, an incorporated business person taking $100,000 in salary would have been limited in Y2004 to a maximum contribution of $15,000. EGTRRA raised the deductible limit to 25% of eligible pay without reduction for salary deferrals. Therefore, that same businessperson in Y2008 can make an “elective deferral” of $15,500 plus a profit sharing contribution of $25,000 , andâif this person is over age 50âmake a catch-up contribution of $5,000 for a total of $45,500. For those eligible to make “catch-up” contribution, and with salary of $122,000 or higher, the maximum possible total contribution in 2008 would be $51,000. To take advantage of these higher contributions, many vendors now offer Solo 401 plans or Individual plans, which can be administered as a Self-Directed 401, permitting investment in real estate, mortgage notes, tax liens, private companies, and virtually any other investment.

Don’t Miss: Can I Set Up A 401k For My Child

What Is A 401 Plan And How Does It Work

A 401 plan is a great, tax-advantaged way to build a solid retirement nest egg.

A 401 plan is a good way for U.S. workers to save for retirement on a tax-advantaged basis.

A 401 plan, named after the IRS tax code section that details 401s, is an employer-sponsored retirement plan that enables career professionals to save money for their post-working years in a tax-deferred manner. Once a worker retires, any withdrawals from a 401 plan are taxed by the IRS.

401 plans were designed to be an option, if not take over for, company pension plans. Known as “defined contribution” plans, 401s were considered less expensive for companies to run, and that paved the way for 401s to generally supplant defined benefit-based pension plans.

Matching Roth 401k Contributions

Some employers offer what is referred to as a Roth 401k in addition to a traditional 401k. Contributions to a Roth 401k are made with after-tax money, or in other words, money that youve already paid taxes on. Traditional 401k contributions are made with pre-tax money, or money that you havent paid taxes on yet.

What this means from a practical standpoint is that you can withdraw money from a Roth 401k tax-free after you retire. With a traditional 401k, youll have to pay income tax on withdrawals in retirement. However, traditional 401k contributions reduce your current taxable income, which reduces your current taxes Roth 401k contributions dont do this.

The contribution limits for Roth 401ks are the same as for traditional 401ks: up to $20,500 in 2022, or $27,000 if youre 50 years of age or over. Unlike Roth IRAs, there is not an income limit for participating in a Roth 401k. Note that employer matches to Roth 401k accounts are made into a traditional 401k.

You May Like: Can I Move My 401k To A Self Directed Ira