Comparing Vanguard And Fidelity

Vanguard and Fidelity are two of the largest employer retirement plan administrators. Both are also popular with individual investors looking to own low-cost index funds.

Vanguard popularized the passive investing craze. But Fidelity has created a portfolio of passively managed index funds to compete.

Fidelity has aggressively lowered minimum investments and expense ratios to attract new customers.

Both companies now have complimentary index funds to satisfy the needs of everyone. But there are notable differences with the funds and platforms.

Moving Money From Vanguard 401k To Transamerica 401k

I worked at a company for the last year where they provided a vanguard 401k savings plan where they would match a static percentage which I guess is pretty typical for most corporate jobs. I just accepted a new job offer though that does not use vanguard for their 401k matching but instead uses transamerica. Now I know since I only worked at this company for a year their minimum vesting year requirement is 3 years, so I think once I am completely done working there they will automatically pull out all the money they matched. My question is what do I do with the vanguard 401k? Im honestly pretty uneducated/ignorant on how 401ks work and the like so Im just looking for advice what to do with it. Is there a way for me to move the money to transamerica without getting taxed? Or should I just leave it and let it do its thing? Thanks.

You May Like: How To Do Your Own 401k

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Don’t Miss: Can I Move My 401k To A Cd

What States Do Not Tax Tsp Withdrawals

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

You May Like: Where Do I Go To Withdraw My 401k

Contact The 403 Plan Provider

Once you know who your 403 provider is and you have a Vanguard account, contact the 403 plan provider to initiate the transfer. The easiest way to contact the 403 plan provider is by phone. Check the account statement for the plan providerâs phone number.

Before you call the 403 plan provider, ensure you have the information they will need. This may include your Vanguard retirement account number, Vanguard mailing address, and check-related instructions. The check should be made to Vanguard FBO .

Find a quiet place and allow about 20 to 30 minutes for the call. You will be asked to provide personal details such as your social security number and physical address to verify your identity. Once you have verified your identity, you should tell the plan provider representative that you want to do a direct rollover. You will be asked to provide your Vanguard account number and the mailing address of the new plan provider. You can also confirm your 403 account information and update your mailing address.

Read Also: How Do You Check How Much Is In Your 401k

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

You May Like: How Do I Access My Wells Fargo 401k

How To Fill Out The Vanguard Brokerage Ira Distribution Form

Recommended Reading: Can I Move Money From 401k To Roth Ira

How To Transfer Your Plan To Vanguard

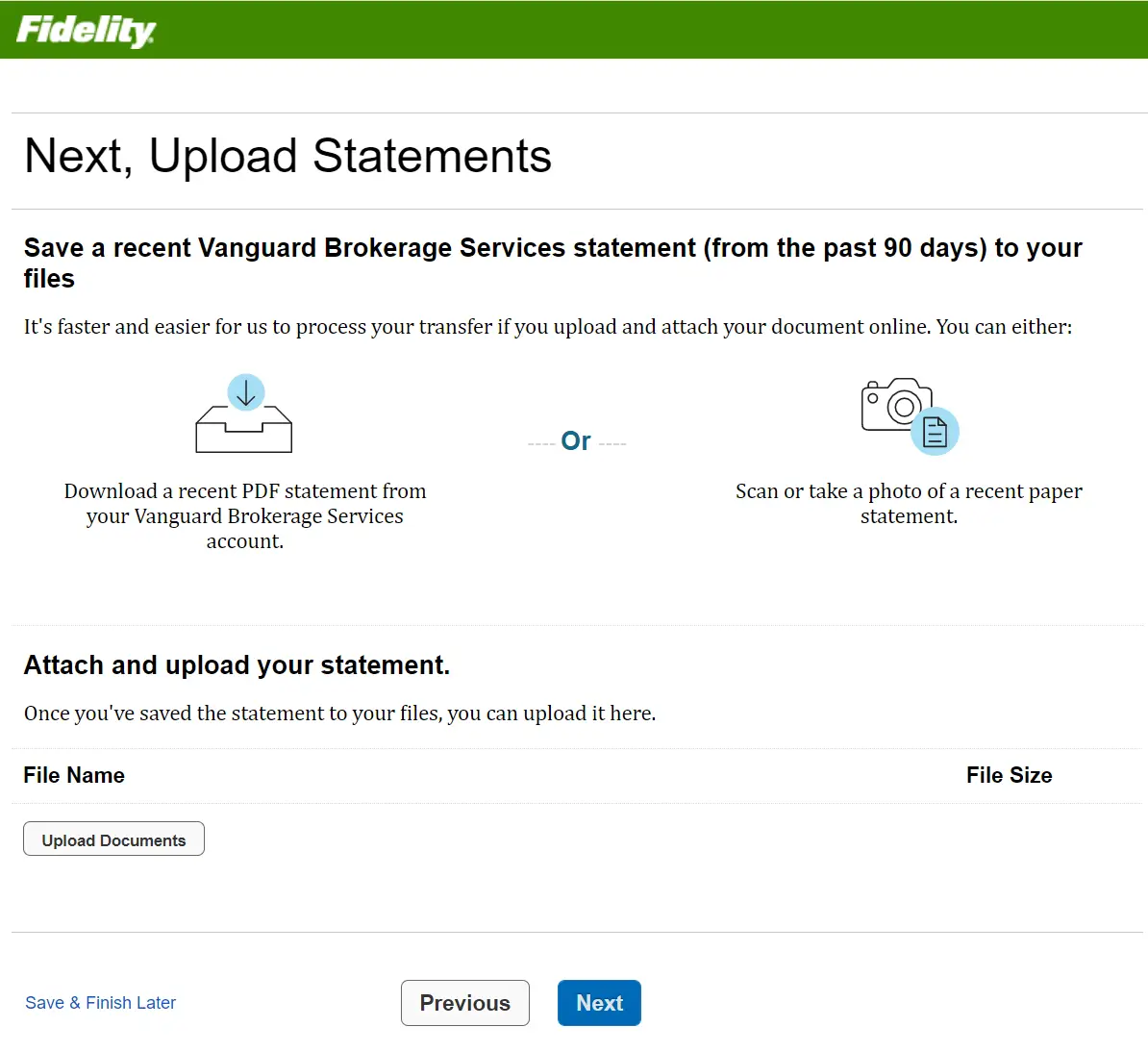

You can follow these steps to get started.

Step 1

Gather your information

Hereâs what youâll need to prepare for your transfer:

- A plan statement dated within the past 90 days from the company that currently holds your account.

- The plan number and dollar amount currently invested in the plan.

- The type of plan you want to transfer ).

- Your Vanguard account number .

When youre ready to get started, give us a call at 800-992-7188.

- Well guide you through the process to ensure its as seamless as possible.

- A qualified representative will let you know which documents are required to complete the transfer and answer any questions you have.

Step 3

Track your transfer

- Once we receive your request, well initiate the transfer and send you an email that explains how you can track the status of your transfer online.

- Once your transfer is complete, well send you an email confirmation.

Look Out For Your Check In The Mail And Deposit Into Your New Account

In many cases, Vanguard will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Also Check: How To Choose Fidelity 401k Investments

Rolling Over Your 401 Is Annoying

Modified date: Dec. 2, 2022

Rolling over your 401 when you leave your job is essential. Some employers wont allow former employees to keep money stashed in their plans, and, after a certain amount of time, may just cash out your investments, sending you a check with taxes and the 10% early withdrawal fee taken out. And, even if they dont, you may be able to get lower fees and better fund options elsewhere.

Now, the benefits of rolling your 401 are obvious and undeniable. The actual process of rolling over your 401 into a new plan, Im sorry to tell you, is exceptionally tedious.

Ive recently gone through the excruciating experience of rolling over not one, not two, but three different accounts into a single IRA at Vanguard. I dont wish the process on my worst enemy.

Every broker and plan is different, but here are some guidelines to make rolling over your 401 a little easier. And we should warn you, its a very manual process that almost always involves phone calls and snail mail.

Whats Ahead:

Rolling Over To A New 401

The first step in transferring an old 401 to a new employers qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

You May Like: Can I Check My 401k Online

Should You Roll Over Your 401 Into Another 401

There are some situations that might make an IRA rollover the wrong move for you. Heres what to consider before completing a 401 rollover.

Retirement account protection. In general, 401 accounts offer better protections from creditors than IRAs.

Rule of 55. With a 401, you can actually start withdrawing funds at age 55 penalty-free if you leave your job. You dont have that advantage when you roll your 401 to an IRA, though you can emulate it by taking subsequently equal periodic payments from your IRA

Performance. If you like your current plan, and its performing well, theres no reason to complete a rollover.

You can always choose to roll your old 401 balance into your new employers 401 plan. If you value the simplicity of having everything in one place, you like the features of the plan at your new job or you want to maintain the legal protections of a 401, it may make more sense to roll your old 401 into a new 401.

Also Check: Is It A Good Idea To Borrow From Your 401k

Where To Rollover Your 401

We have a list of the best IRA providers that have proven themselves for years. These companies are solid choices for where to rollover your 401k. They offer many of the same options, so it’s personal preference on where you want to invest.

To start the process, all you have to do is go to one of these companies, select “Open Rollover IRA” and provide your 401k information. The company will handle the rest.

Also Check: Why Transfer 401k To Ira

What’s A Settlement Fund

At Vanguard, settlement fund refers to the sweep program option used to pay for and receive proceeds from trades. VBS’ sweep program automatically transfers any uninvested funds, such as new deposits or the proceeds from securities transactions, into a money market fund or bank product sweep option. Funds are swept out to pay for transactions.

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Recommended Reading: How To Transfer 401k To Another Job

What About M1 Finance

Im a big fan of the online broker M1 Finance. Like Robinhood, M1 Finance charges no fees to buy and sell stocks and ETFs. Investing on M1 Finance is not the same as most online brokers, but I like the intuitiveness of building a dividend portfolio with pies.

Ive created an M1 pie of 10 dividend stocks that I contribute to every month. Its a convenient way to dollar cost average into high-quality dividend growth stocks over time.

Dividends are easily reinvested back into the portfolio, much like DRIPs, but more flexible. I always liked dollar cost averaging with DRIP investing, but now theres a better way to accomplish the same thing. Thats my primary reason for keeping this account active. Someday, I may transfer those assets to Fidelity as well.

I recommend M1 Finance for investors looking to build a long-term dividend growth or index ETF portfolio. RBD is an affiliate partner with M1 Finance and recommends several investing platforms.

You can open individual accounts or IRAs, making it a good choice for many investors. The no-fee model, I do believe, is the future, today.

However, Ive chosen not to use my M1 Finance account for my tax-advantaged investing. Fidelity is a long-established company in the space, and I have built a 20-year relationship with them, and Ive never had a reason to leave. Plus, my employer-sponsored accounts are there, and I expect to remain for a while.

On top of that, the M1 Finance platform does not support mutual funds.

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Recommended Reading: How Can I Take Money Out Of My 401k

You May Like: How To Cash In Your 401k Early

What You Need To Know

- The RCH Auto Portability program allows for an account balance, no matter how small, to automatically be moved into the next jobs retirement plan.

- Workers of color with smaller accounts are most susceptible to leaving behind savings accounts when changing jobs.

- The service also should help younger generations who tend to change jobs frequently.

Vanguard has joined forces with Retirement Clearinghouse to provide an auto-portability service that allows 401 participants to have their defined contribution plans automatically roll over when changing jobs.

The service will be available to 401 sponsor clients and participants in mid-2022, noted the $8.1 trillion investment management company in a statement.

The importance of transferring 401 accounts has increased as more workers are part of a defined contribution plan, Vanguard noted. Its research found that at the end of 2020, 62% of all Vanguard participants were solely invested in an automatic investment program, like a target date or managed fund, compared with 33% at the end of 2011. They also found that participants who have smaller balances often dont roll over their retirement savings.

For employees who have less than $5,000 in their 401, employers can roll those balances into a Safe Harbor IRA, where fees can be higher, Vanguard states, and these accounts are often abandoned.

This type of forfeiture especially affects minorities, said Robert L. Johnson, founder and chairman of the RLJ Cos., parent of RCH.

The Latest