Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

How Much Can You Withdraw From 401k Each Year

Most retirees wonder what a good percentage to withdraw from 401k. In recent years, financial experts have debunked the 4% withdrawal rate. Instead, they now estimate that retirees can safely withdraw the amount equal to around 2.8% annually and then adjust for inflation each subsequent year for 30 years.

An annuity with a guaranteed lifetime withdrawal benefit will guarantee up to 6% annually for the rest of a retirees lifetime and never run out of money.

Will I Have To Pay Taxes On Assets I Transfer

Great question. You do not need to pay taxes on assets that are transferred to Schwab. If an asset cannot be transferred and you decide to sell it, then you may have a tax liability on that sale.

Most assets, such as publicly traded stocks and ETFs, mutual funds, and bonds, can be transferred to your Schwab account. Assets that may not be transferable are proprietary investments sold exclusively by your old firm, bankrupt securities, penny stocks, or restricted stocks, which can be highly volatile or carry high loads and fees.

Also Check: Can You Use 401k To Buy A House

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

Also Check: How To Recover 401k From Old Job

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

How Much Does It Cost To Roll Over A 401 To An Ira

If you do the process correctly, there should be few or no costs associated with rolling over a 401 to an IRA. Some 401 administrators may charge a transfer fee or an account closure fee, which is usually under $100.

Because moving your money from a 401 to an IRA allows you to avoid the 10% early withdrawal penalty that results if you withdraw money from a 401 before 59 1/2, its a far better option if you cant keep your money invested in an old employers plan or move it to a 401 at your new company.

You should consider whether rolling over a 401 to an IRA is a better option than either leaving it invested when you leave your job or moving the money to your new employers retirement plan. If you can avoid 401 management fees and gain access to investments with lower expense ratios, an IRA may be a cheaper account option.

Also Check: When Leaving A Company What To Do With 401k

Enter The Transaction Details

The next step is entering transaction details. The basic transaction details are the date when you want the funds to be transferred and the amount to be transferred.

Sometimes, you may need the money to arrive in the other banks account as soon as possible. In other cases, you may want to schedule the transfer on a specific date.

At this step, youll also enter the amount you wish to transfer. Ensure that the account youre transferring from has enough funds remaining to cover any upcoming withdrawals or automatic payments.

Finally, some banks allow you to make a recurring transfer. A recurring transfer is an automated deposit from one account to another.

Many people choose recurring transfers from a checking account into a savings account.

How Do I Avoid Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Also Check: What Is The Safest 401k Investment

Can I Transfer My 401k To My Checking Account

Once you have attained 59 ½, you can transfer funds from a 401 to your bank account without paying the 10% penalty. However, you must still pay income on the withdrawn amount. If you have already retired, you can elect to receive monthly or periodic transfers to your bank account to help pay your living costs.

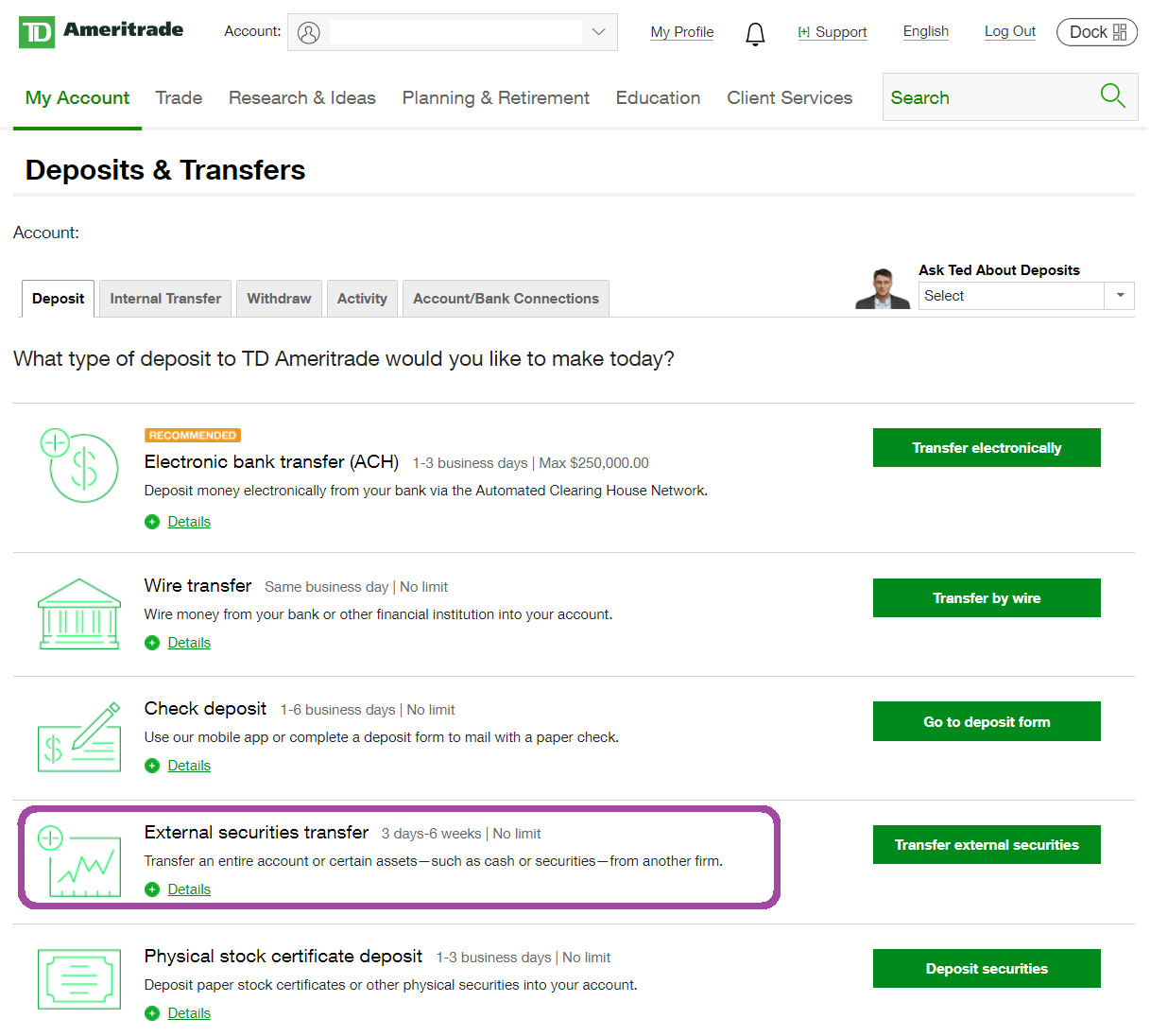

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

I often help clients prepare these requests and do a three-way call with them , making it quick and easy to get things done. But if you prefer, you can probably figure this out on your own.

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

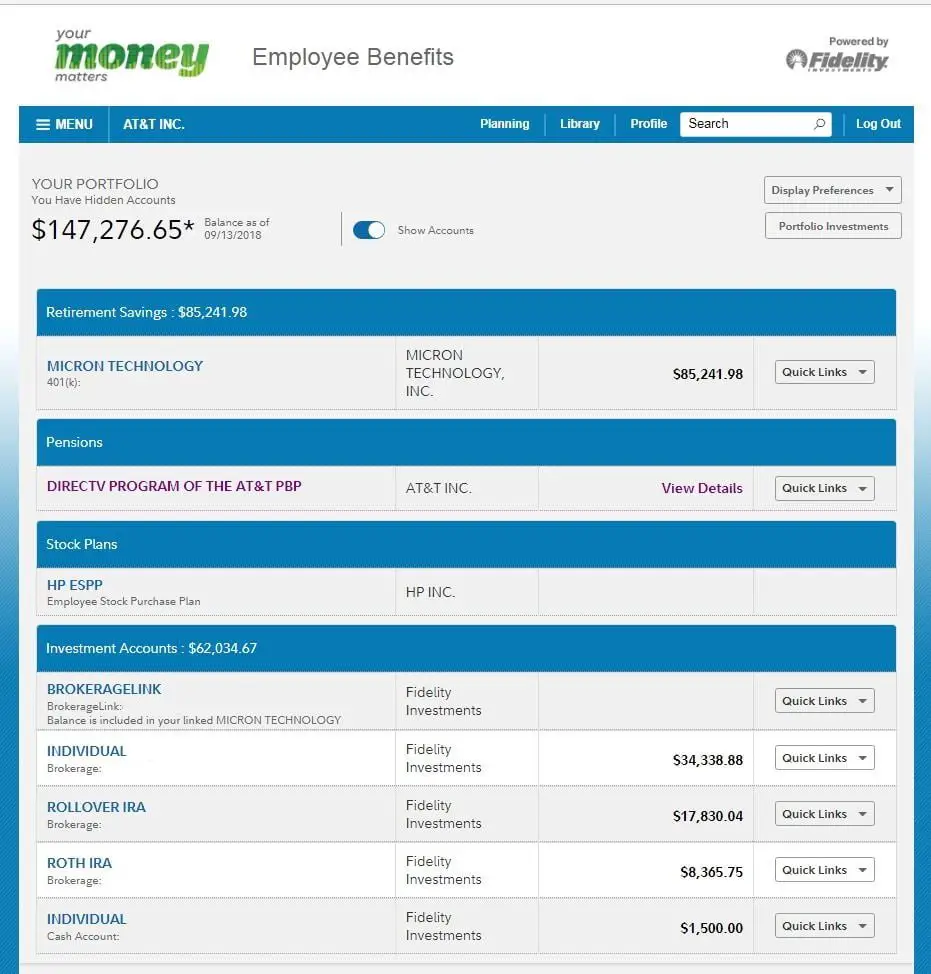

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

What to Say

You May Like: How To Open 401k Solo

What To Do With An Old 401 Account

When you leave a job, you often face a decision about what to do with your 401 or other workplace-based retirement accounts. You could leave it in place or cash it out. But unless youre retiring or you need the funds immediately, the smartest course is usually to roll over the account.

A rollover is when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of them, within 60 days, to another eligible retirement plangenerally, a rollover IRA that you set up. That way, you maintain the tax-deferred status of your retirement account, consolidate all retirement accounts for easier management, andbecause its your own accountbenefit from increased investment flexibility.

Under this option, you would ask your plan administrator to make a direct and tax-free transfer of funds from your former employers plan to an IRA at a financial institution of your choice.

Also Check: How To Transfer 401k From Fidelity To Vanguard

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Also Check: How Do I Find Out What My 401k Balance Is

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fund fees to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broken, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

K Retirement Plan Contributions Explained

Although 401ks are not the only means of saving for retirement, they offer many perks that make them appealing. In addition to your contributions, your employer can contribute to your plan on your behalf as well. Employers can match your contributions dollar for dollar, a percentage of your contributions, or a combination of the two, and might also put a dollar limit on the total match. For example, your company might match the first 3 percent of your salary of your salary dollar for dollar, and the next 3 percent at 50 cents per dollar, up to a maximum of $10,000.

The 401k cap for contributions is substantially higher than the limits for an IRA. For 2018, youre allowed to contribute up to $18,500 of your salary to your 401k. Plus, people age 50 or older can make an additional catch-up contribution of as much as $6,000, for a total of up to $24,000. Note that 401k limits can change from year to year with inflation.

Although you cant write a check or deposit cash straight into your 401k account, there might be options for you to increase your contributions before the end of the year. Check with your 401k plan administrator to learn how often you can make a free change to your contribution limits.

Related: 13 Ways to Increase Your 401k

Don’t Miss: How To Transfer 403b To 401k

How Long Does It Take To Get Retirement Money

The answer depends on a few factors if youre wondering how long it will take to get your retirement money. First, you must ensure that everything is in order and that your paperwork is complete. Once everything is in order, it typically takes up to 30 business days for the money to be disbursed. However, if there are any complications or delays, it could take longer. So, if youre planning on retiring soon, its best to start the process early so that you can have peace of mind knowing that your finances are in order.

How To Complete An Ira To 401 Rollover

The first step is checking whether your employers 401 plan accepts IRA rollovers. Not all plans will allow you to roll over IRA assets. If they do, youll want to request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

If a direct transfer isnt an option, your IRA provider will send you a check for 80% of your accounts value and withhold the remaining 20% for taxes. You must deposit 100% of the value of your IRA into your 401 within 60 days or the transaction will be treated as an early distribution, triggering the 10% penalty and income taxes. The 20% that your IRA provider withheld will serve as a tax credit when you file your tax return.

You May Like: How Do I Add Money To My 401k

Read Also: Can I Withdraw 401k To Buy A House

The Difference Between A Direct Vs An Indirect 401 Rollover

There are two main ways to go about rolling over a 401 into another retirement plan: a direct or indirect rollover.

A direct rollover allows you to transfer the money from a former employers 401 plan into a different retirement account without having to actually withdraw and deposit it yourself. Your 401 administrator simply writes or wires a check to the account you wish to send it to.

You can make a tax-free, direct rollover when moving money from an old employer-sponsored retirement account to a traditional tax-deferred IRA or qualified company plans, including a new 401 or 403. While you can also roll a 401 into a Roth IRA, youll have to pay taxes on the money transferred because Roth IRAs are funded with post-tax contributions.

In the case of an indirect rollover, your previous retirement plan administrator writes you a check, which youre then responsible for depositing into its new location within 60 days. This is a much riskier choice and can often end up costing you thousands of dollars in taxes and penalties, as the money is no longer safely in a pre-tax account.

How Long Does It Take To Receive Funds From Fidelity

The processing time for electronic money transfers made from Fidelity accounts is typically between one and two business days. EFTs that have been sent to Fidelity accounts normally become available within four business days, however the funds can be traded as soon as they have been deposited.

Recommended Reading: How To Calculate 401k Contribution

Does Fidelity Make Funds Available Immediately

YOUR CAPABILITY TO GET MONEY OUT OF THE ACCOUNT The monies from your cash deposits will be made available to you immediately, and the funds from your check deposits will be made available to you either on the same business day or on the first business day after the day we receive your deposit.This is in accordance with our policy.The day we receive the deposit will mark the beginning of the availability of electronic direct deposits.

How To Roll Over A 401 Into A New Retirement Account

Kenadi Silcox15 min read

So youve your old employer-sponsored 401 balance into a new account. Now comes the tricky part: deciding where your savings should go and figuring out how to actually get it from one account provider to another without doing damage to your wallet.

Heres everything you need to know about rolling over a 401, from beginning to end:

Also Check: How Much Can I Invest In My 401k

Can You Transfer Money From Fidelity To Bank Account

The Electronic Funds Transfer or Wire Transfer services offered by Fidelity make it simple to transfer money to and from other financial institutions. Before you can use these functions, you will need to provide information about your bank account, which may be subject to a validation procedure that takes between seven and ten days.