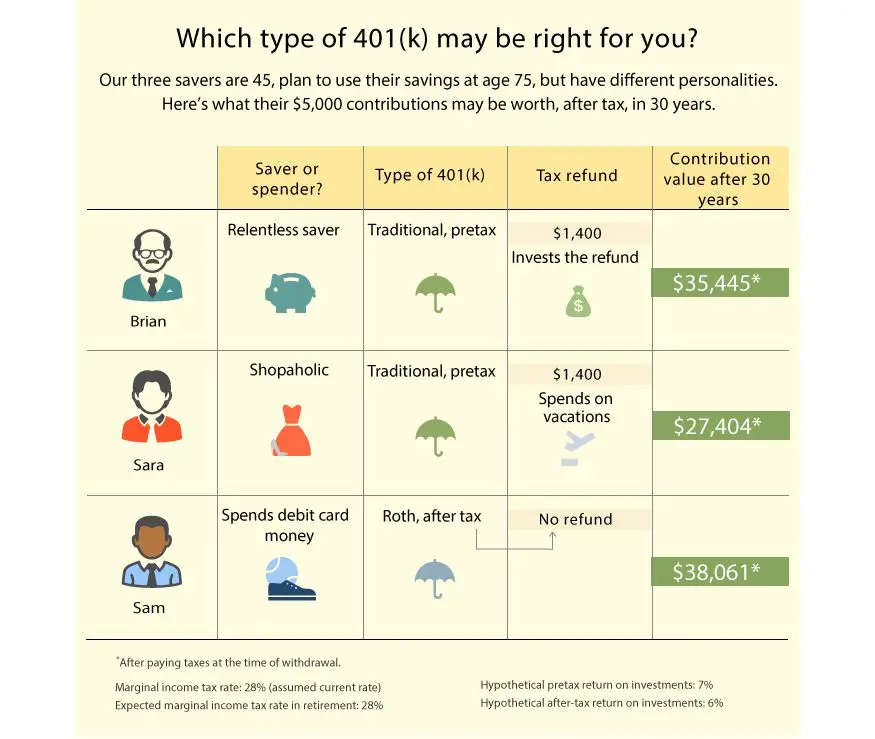

Converting A Traditional 401k Into A Roth Ira

You also have the option to convert a traditional 401k into a Roth IRA transfer. The process is a bit more complicated than a straight rollover, because you will be required to pay income tax on the amount in your 401k. The savings overall will be worth it, but you need to be prepared to pay the taxes before you begin the process.

How Old Are You

If your client is 59½ or younger, theres typically a 10% early withdrawal penalty for both IRAs and 401s . Fortunately, CRA allows the 10% penalty to be claimed as a FTC on the Canadian return in addition to the 15% withholding. On a $100,000 plan, thats $75,000 net the client would also need to owe at least $25,000 in Canadian tax for the transfer to be tax-neutral.

If your client is 70½ or older, she must start withdrawing from the U.S. plan by April 1 of the year following the year the client reached that age. If youre comfortable with where the money is and how its being invested, its probably better to leave it tax-deferred as long as you can, says Altro. You can even withdraw the IRA at a slower pace than a RRIF the minimums are lower than they are in Canada.

If your client is 71 or older, she must convert her RRSP to a RRIF, and its no longer possible to contribute to the RRIF.

What Is A Rollover Ira

A rollover IRA is an account used to move money from old employer-sponsored retirement plans such as 401s into an IRA. A benefit of an IRA rollover is that when done correctly, the money keeps its tax-deferred status and doesnât trigger taxes or early withdrawal penalties.

Rollover IRAs can also provide a wider range of investment options and low fees, particularly compared with a 401, which can have a short list of investment options and higher administrative fees.

Don’t Miss: What Is A Simple 401k

How Do You Find Your Expense Ratios

There are lots of companies that sponsor 401ks , and the steps to find the expense ratio are different for each of them. Generally you can find it by signing into your account online, and find the fund youve selected. Once you find the fund, you will see the expense ratio in the details of the fund.

Account -> Fund -> Expense Ratio

It took me about 15 minutes to find the funds and corresponding expense ratios in two different accounts. Remember that the 15 minutes it took to find the expense ratios, then plug them into the calculator above is how I found out I could save 6 figures in fees.

Heres where I found the expense ratios within my Roth IRA at Vanguard and my 401k at Merrill Lynch. Keep in mind that the funds in my account may be different than yours.

Merrill Lynch was a little more complicated. After signing in and selecting my 401k plan, I had to find the Average annual total returns tab under Investment Choices and Selection.

How Can I Meet The 5

There are two ways to roll over your Roth 401 into a different account and satisfy the five-year rule. The first is to roll the Roth 401 funds over into an existing Roth IRA. The rollover funds will be counted toward the clock that’s been since the opening of the Roth IRA. The second way is to roll your current Roth 401 into a new Roth 401 with your new employer. In this case, the time that your money spent in the first account counts in the total tally.

Also Check: When Can I Start A 401k

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Choose A Rollover Ira Provider

Your choice of rollover IRA provider is not the biggest driver of your portfolios growth that’s where your investments come in. However, selecting a rollover IRA provider is critical for keeping fees low and gaining access to the right investments and resources to manage your savings.

The choice often boils down to two options: an online broker or a robo-advisor.

-

An online brokermay be a good fit for you if you want to manage your investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

-

A robo-advisor may make sense if you want someone to manage your money. A robo-advisor will choose investments and rebalance your portfolio over time for a fraction of the cost of a human advisor. Check out our explainer on robo-advisors to see if its the right choice for you.

Recommended Reading: Can I Transfer My Roth Ira To My 401k

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So lets look at a few of the pros and cons of consolidating them into one IRA with one institution.

Rollover Ira: How It Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Recommended Reading: How Can I Get My 401k Money Without Paying Taxes

Look Out For Your Check In The Mail And Deposit Into Your New Account

Fidelity will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

State Taxes On Retirement Income

Managing your state retirement income taxes can save you thousands of dollars a year in unnecessary costs.

Many retirees are set on fixed incomes and must follow a strict budget, says Ron Tallou, founder and owner of Tallou Financial Services. That means every little bit helps when stretching your retirement savings.

Retirement income tax rules vary widely from state to state. And state taxes on retirement income largely depend on the source of the income. Some states dont tax any income, period, while others may tax your pension but leave income from your 401 or individual retirement account untaxed.

Whats more, state income tax rules can change from year to year. For the most up-to-date information, visit your states tax department website or work with a tax pro.

Read Also: How Can I Get A Loan From My 401k

Preparing For A Backdoor Roth Ira Conversion

If youre considering doing a Backdoor Roth IRA Conversion, one of the first things you need to do is eliminate any money you have in a traditional, SIMPLE, or SEP IRA. The reason for this is that you can run into complexities and potential tax consequences if you have pre-tax money in any of these accounts when you convert.

As we previously discussed in our ultimate guide on how to do a mega backdoor Roth IRA conversion, one of the simplest ways to eliminate money in these pre-tax accounts is to roll it into an employer sponsored 401k. Remember, though, that you can only roll over pretax money into a 401k, so any non-deductible contributions you have made to these accounts dont qualify.

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

Don’t Miss: How Much Should You Put In 401k

Roll It Into A New 401 Plan

The pros: Assuming you like the new plans costs, features, and investment choices, this can be a good option. Your savings have the potential for growth that is tax-deferred, and RMDs may be delayed beyond age 72 if you continue to work at the company sponsoring the plan.

The cons: Youll need to liquidate your current 401 investments and reinvest them in your new 401 plans investment offerings. The money will be subject to your new plans withdrawal rules, so you may not be able to withdraw it until you leave your new employer.

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

Also Check: How Do I Check My 401k From A Previous Employer

Start Your Transfer Online

Youâll get useful tips along the way, but you can call us if you have a question.

Youâll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so weâll ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youâre already a Vanguard client, confirm the information that weâve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roth’s that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

Though this may sound relatively simple, the five-year rule can actually be tricky, and careful consideration of how it applies to your situationand perhaps a good tax advisoris recommended.

Don’t Miss: How Do I Cash Out My Fidelity 401k

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. Now youre in charge and you have more investment flexibility, said Smith. Try not to go it alone, he advises. Once you roll the money over, its you making the decisions, but getting a financial professional should be the first step.

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if youre still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free, said Rain.

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

You May Like: Can I Withdraw Money From My 401k To Pay Taxes