When Your Desired Asset Allocation Gets Out Of Whack Here’s What To Do About It

When you first opened your 401 account, you probably gave some thought to your asset allocation, opting to put a certain percentage of your money into relatively aggressive investments like stock funds and some other percentage into less aggressive ones like bond funds in order to diversify.

Over time, however, those percentages may have gotten out of whack, as some investments may have outperformed others. To get those percentages back in line, you may need to rebalance your portfolio periodically. Here is how to go about it.

How To Position Your Bond Allocations

While many advisors built portfolios to withstand volatility, do-it-yourself investors may still have room for improvement, said CFP Anthony Watson, founder and president of Thrive Retirement Specialists in Dearborn, Michigan.

For example, you’ll want to consider your bonds’ so-called duration, which measures sensitivity to interest rate changes. Expressed in years, duration factors in the coupon, time to maturity and yield paid through the term.

Best For Low Fees: Charles Schwab

Charles Schwab

The Individual 401 Plan from Charles Schwab is our top choice for low fees. The account has no opening or maintenance fees as well as no commission trades for stocks or ETFs and over 4,000 no-load, no-transaction-fee mutual funds. Customers can also use its robo-advisor, Schwab Intelligent Portfolios, with no extra fees.

-

Accounts are free to open and charge no recurring fees

-

Access to trade stocks, ETFs, and thousands of mutual funds for free

-

Option for a no-cost robo-advisor

-

No solo 401 loans

-

High fees for some mutual fund trades and broker-assisted trades

Charles Schwab is our top choice for low fees in a solo 401 plan. Schwabs version charges no recurring fees and no setup fees. It offers commission-free trades for all stocks and ETFs as well as over 4,200 no-transaction-fee funds on the Schwab OneSource funds list. While Schwab offers excellent customer service, be aware that automated phone trades cost $5 and broker-assisted trades cost $25 each. However, many customers could use this account without paying any fees.

Schwabs Solo 401 doesnt offer 401 loans. Its active investment platform may not satiate all expert investors, and its active charting and analysis tools lag behind some other brokerage platforms for active traders. However, the pending integration of TD Ameritrade will bring the coveted thinkorswim platform under the Schwab umbrella, which is something active traders at Schwab can look forward to.

Dont Miss: What Percent To Put In 401k

You May Like: How Much Do I Put In My 401k

Use Model Portfolios To Allocate Your 401 Like The Pros

Many 401 providers offer model portfolios that are based on a mathematically constructed asset allocation approach. The portfolios have names with terms like conservative, moderate, or aggressive growth in them. These portfolios are crafted by skilled investment advisors so that each model portfolio has the right mix of assets for its stated level of risk.

Risk is measured by the amount the portfolio might drop in a single year during an economic downturn.

Most self-directed investors who arent using one of the above two best 401 allocation approaches or working with a financial advisor will be better served by putting their 401 money in a model portfolio than trying to pick from available 401 investments on a hunch. Allocating your 401 money in a model portfolio tends to result in a more balanced portfolio and a more disciplined approach than most people can accomplish on their own.

You May Like: How To Lower 401k Contribution Fidelity

Changing Your Asset Allocation As You Age

Remember, too, that your asset allocation isn’t forever. Many financial experts suggest adjusting it as you grow older, opting for a more conservative mix as you get closer to retirement age. For 30-something Kendra in our example above, 75%/25% may be about right. When she reaches age 60, however, an allocation closer to 50%/50% could make more sense.

Also Check: How Do Companies Match 401k

Is Fidelity Go Right For You

Fidelity Go is Fidelity Investments automated investment advisor. It uses computer algorithms to create portfolios of custom domains for you with no minimum number of accounts. Fidelity Go was launched in 2016 with the Spend app to help investors who prefer to have their investments managed for them from above. h2> To withdraw funds from your Fidelity 401k Fidelity Voluntary Brokerage Account after taxes to your own Roth IRA retirement account with Fidelity, complete the Fidelity form titled One-Time Withdrawal for Retirement Account Only. CLICK HERE to view the form.

Work With An Advisor For A Tailored Allocation Strategy

In addition to the above options, you can opt to have a financial advisor recommend a portfolio that is tailored to your needs. The advisor may or may not recommend any of the above 401 allocation strategies. If they pick an alternate approach, they will usually attempt to pick funds for you in a way that coordinates with your goals, risk tolerance, and your current investments in other accounts.

If you are married and you each have investments in different accounts, an advisor can be of great help in coordinating your choices across your household. But the outcome wont necessarily be betterand your nest egg wont necessarily be biggerthan what you can achieve through the first four 401 allocation approaches.

Also Check: How To Check How Much Is In Your 401k

Read Also: Can I Move My 401k To A Self Directed Ira

Keep Cool And Review Your Asset Allocation For Diversification

Now is the perfect time to consider your risk tolerance.

Asset allocation, diversification and periodic rebalancing are just about the most certain protection strategies for your investments, Rob Williams, managing director of financial planning, retirement income and wealth management at Charles Schwab, told Yahoo Money. Of course, developing a long-term strategic asset allocation plan is key to your ability to retire. But sticking to that plan regardless of market swings or recession periods is even more important.

Your age is a factor here.

If you have 10 years or more before youre ready to start taking distributions, youre probably in a position to ride out the recession and allow time for your stocks to rebound, Lazetta Braxton, a Certified Financial Planner and co-founder of 2050 Wealth Partners, a fee-only financial planning and wealth management firm, told Yahoo Money.

One simple equation many financial planners recommend is the percentage of retirement money you have invested in equities should be 110 minus your age.

Investing in the stock market does come with a dollop of risk. That said, over time youre generally paid back with higher returns than if you had parked the retirement savings in plain vanilla certificates of deposit, money market accounts, and bonds.

Keep Your Hands Out Of The Cookie Jar

Taking out loans on a 401 or cashing it out altogether is generally a terrible idea, for a number of reasons. Loans from a 401 not only require you to repay yourself with interest, but in many cases, youll also have to halt any contributions until the loan is repaid. That reduces your retirement savings in two ways. Even worse is cashing out a 401, which will incur taxes, plus a 10% early withdrawal penalty.

These mistakes not only bring hefty fees, but raid the very retirement savings that are your precious safety net in your golden years. Dont think of your 401 as a piggy bank thats what savings and brokerage accounts are for. If you switch jobs, dont cash out your 401 instead, roll it over into your new plan or into an individual retirement account.

Recommended Reading: How Do I Cash Out My 401k With Fidelity

How Often Should I Rebalance My 401

How often you should rebalance your 401 will depend on how quickly and how dramatically it has deviated from your desired asset allocation. You might, for example, want to check on your 401’s actual asset allocation every year or so and rebalance it if necessary. In addition to rebalancing periodically based on how your investments have performed, you might choose to rebalance if your previous asset allocation is no longer appropriate. Many people adjust their asset allocations periodically so that their portfolios become less risky as they get closer to retirement age.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: Can You Open A Personal 401k

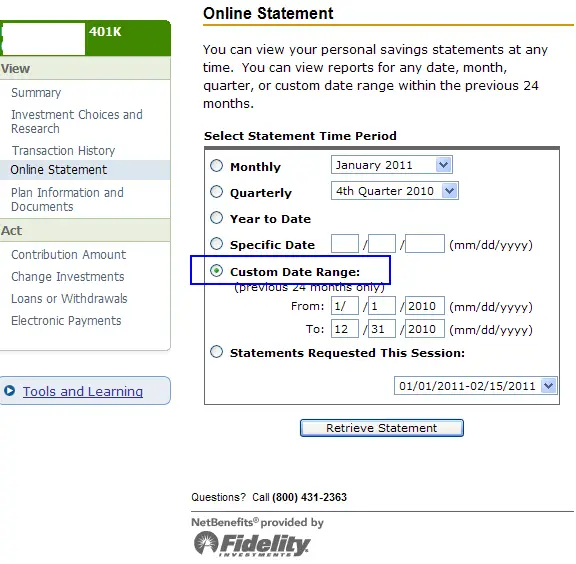

How Do I Change My 401k Contribution Fidelity

Step 2: To change where your future contributions are invested, click on Future Investments. Step 3: To change your current investment mix, click on the appropriate box. Step 4: Follow the prompts. If you prefer, you can make these changes by phone call Fidelity at 1-800-343-0860/V and 1-800-259-9734/TTY.

You May Like: How Do You Find Out About Your 401k

How To Change Plan Providers: Fidelity To Self

Process:

- New Solo 401k Plan Documents

- List the original plan effective date

Additional Considerations:

- Have you been filing Form 5500-EZ?

- If not, need to file under the IRS Correction Program

Planning & Guidance Center

Model and plan your retirement strategy with interactive tools and calculators.

- Complete the Investor Profile Questionnaire for a comprehensive asset mix review. Learn about your risk tolerance and asset allocation.

- Model different savings scenarios using the Take Home Pay Calculator or Contribution Calculator

- See how changes in your savings habits could change your estimated monthly retirement income with Income Simulator

- Try hypothetical scenarios using the Roth Modeler to see differences between pre-tax and Roth after-tax deferrals

- Use the Fidelity Income Strategy Evaluator® to help build a portfolio for your retirement income.

Library

Search the Library for a variety of multi-media financial resources

Life Events

Refer to Life Events to help with timely financial and benefits decisions.

- New Hire Checklist

Don’t Miss: Can I Pull My 401k To Buy A House

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Dont Miss: How To Borrow From 401k To Buy A House

How To Make Changes To Your 401 Contributions

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Whether you just set up your 401 plan or you established one long ago, you may want to change the amount of your contributions or even how theyre invested. Fortunately, changing your 401 contributions is usually straightforward, and you may be able to change your 401 contributions at any time .

After all, the point of a 401 plan is to help you save a substantial amount for your retirement. So its important to keep an eye on your account and your investments within the account, to insure that youre saving and investing according to your goals.

To understand how to maximize this investment opportunity and grow your nest egg, its important to start with the basics.

Recommended Reading: How To Rollover A 401k Without Penalty

How To Change Investments In Fidelity Ira

Step 1: After you dive into the process, click on the dropdown to the right of the Quick Links and select Edit Investments. If you are logged in, check the Investments box and then Edit Investments. Step one. To change where your future investments are safe to invest, click Future Investments.

Advantages And Disadvantages Of Index Funds

Index funds are ideal for new investors, but they have their fair share of advantages and disadvantages.

Advantages of index funds

- Low fees. Index funds simply track an index they are not typically actively managed. This allows fees to stay on the low side. Some index funds today even have no fees at all.

- Built-in diversification. Because index funds track an index, they are inherently diverse. For instance, an S& P 500 fund allows you to own a small piece of about 500 of the largest companies in the U.S. Thus, these funds provide instant diversification.

- Minimal maintenance. When you buy index funds, rebalancing your portfolio may be less needed. If you were to put all of your money in a single index fund , the fund itself handles all of the shifting allocations for the constituents in the index.

- Tax efficiency. Because index funds are not actively managed, they buy and sell stocks infrequently. This helps reduce capital gains taxes you might otherwise incur.

Disadvantages of index funds

- No ability to select stocks in the index. For beginners, it can be nice having everything done for you. But more advanced investors often prefer to hand-select their stocks something that isnt possible with index funds.

- Can be less diverse than expected. Index funds are market-cap-weighted, meaning they invest more of their money in companies with higher market caps. So larger companies make up a bigger share of a given index.

Also Check: Should I Transfer My 401k To My New Employer

Regulators Skeptical Of Bitcoin For Retirement Legal Risks For Employers

The U.S. Labor Department, which regulates company sponsored retirement plans, said that Fidelitys could threaten the retirement security of Americans.

We have grave concerns with what Fidelity has done, Ali Khawar, acting assistant secretary of the Employee Benefits Security Administration, told The Wall Street Journal. The regulator is discussing its concerns with Fidelity, especially the 20% threshold.

Charles Field, managing partner of the San Diego office of Sanford Heisler Sharp and chair of the firms financial services group, says the SEC and Labor Departments warnings could provide support to any claimants in potential future litigation against companies and their fiduciaries.

Bitcoin still is experiencing growing pains, and with the next market upheaval will come claims that fiduciaries who approved Bitcoin breached their fiduciary duty of prudence, Field says. At this stage, there may not be enough disclosure out there that would protect employers from such claims. Employers who offer Bitcoin in their 401k plans do so at their own peril.

In addition to the potential legal risks to employers, its unclear just how appropriate of a retirement investment Bitcoin is. Bitcoin has been a tremendous investing success story up to this point, but many retirement investors are hoping to build wealth over several decades.

Educational Resources Trading Platforms And Market Research

Fidelity also has an extensive offering of trading platforms, research materials, and educational content. Its learning center gives you access to blogs and live webinars on relevant financial topics. And with Fidelitys news and research tab, you can read up on stock market trends and real-time investment prices.

In addition to its online platform and mobile apps, Fidelity offers a trading platform specifically for its active traders: Active Trader Pro. Active Trader Pro is a downloadable platform that offers real-time trading alerts, investing insights, portfolio monitoring, customizable dashboard layouts, and option trading assistance. Though it doesnt have a mobile version, this platform could be great for you if you want to stay on top of market movements and determine when to buy or sell securities. It also lets you place up to 50 orders at a time.

According to Fidelitys website, the brokerage utilizes investment analysis and stock research from more than 20 independent providers, including Thomson Reuters StarMine. Fidelity also provides market insights and commentary through Fidelity Viewpoints, and it offers several retirement and investing tools.

Recommended Reading: How To Invest 401k Fidelity