What Is The Maximum Amount I Can Contribute To My 401 Each Year

Known as the 402 limit in the Internal Revenue Code , individuals can contribute up to $20,500 between their traditional and Roth 401 accounts in 2022. If youre 50 or older, you can contribute an additional $6,500 thanks to whats known as a catch-up contribution.¹

While these limits may stay the same some years, they are re-evaluated by the IRS every year to consider cost-of-living adjustments and are subject to change annually. In October 2022, the IRS announced that annual limits for 2023 would be increasing to $22,500. Additionally, the catch-up contribution limit will be increasing to $7,500, bringing the limit for those 50 or older to $30,000.

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Don’t Miss: How Do You Take Out 401k Money

The Contribution Limit For 2022

Pretty much all retirement accounts s, IRAs, 403s, etc.) have specific contribution limits that change almost every year due to cost of living adjustments. A lower contribution limit can feel like theres a little less leg work to be done to max out the account.

According to the IRS, you can contribute up to $20,500 to your 401 for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only accounts for the amount you defer from your paycheck your employer matching contributions dont count toward this limit.

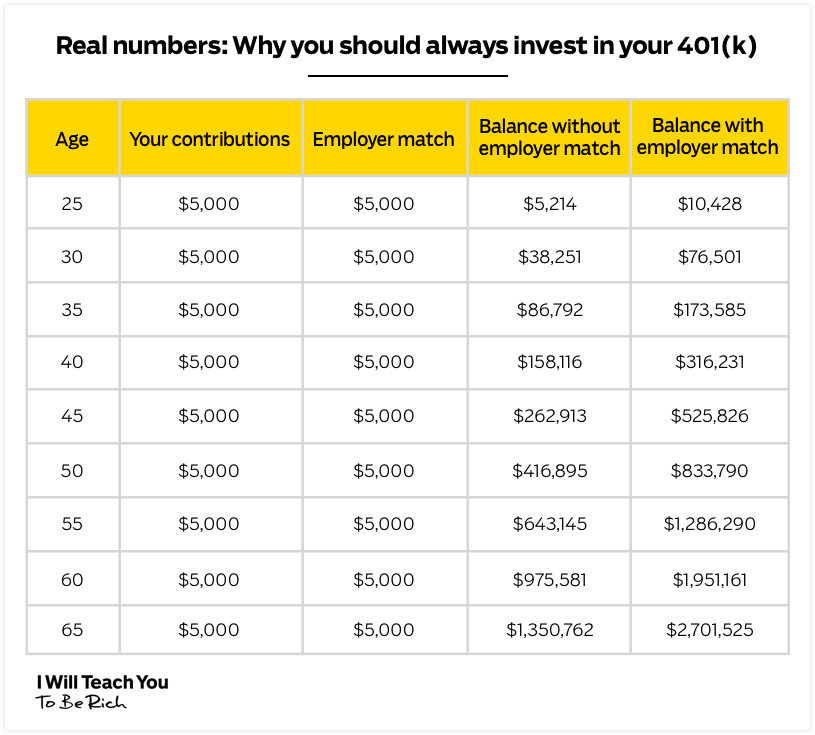

Some companies provide a dollar-for-dollar match on your 401 contributions, up to a certain percentage of your total salary, usually between 3% and 7% . So lets say you contribute 7% of every paycheck to your 401, which works out to be $200 per paycheck. If your company matches your contributions dollar-for-dollar up to 7%, that means your employer is giving you an additional $200 per paycheck into your 401. If you get paid twice per month, that works out to be a total 401 contribution of $800 per month, or $9,600 per year.

In this scenario, you can still contribute beyond 7% of your paycheck, but anything beyond 7% will not be matched by your employer. Youll need to double check with your HR department if you arent sure how much of a match your company provides.

Start Earning More For A Better Financial Future

The answer to How much should I have in my 401k? is an important one but its not the only way to ensure your financial future.

We are going to let you in on a little secret. It is one that has helped thousands of people live their Rich Life:

Theres a limit to how much you can save, but theres no limit to how much money you can earn.

Bonus:

Many people dont understand this and because of that, theyre content with contributing very little to their retirement accounts. When they actually retire, theyre surprised when their nest egg is a lot smaller than they thought and they have to get a job as a Walmart greeter to pay for their condo.

If you realize that your earning potential is LIMITLESS, you can truly get started working toward living a Rich Life today.

We recommend three ways to start earning more money:

1. Negotiate a salary raise. 99% of people are content with not asking for a salary raise. So if you are willing to negotiate, that puts you in the 1% and showcases to your boss that youre a Top Performer willing to work hard for more money.

2. Start a side hustle. One of my favorite money-making tactics is starting your own side hustle. We all have skills. Why not leverage those skills to start earning more money in your free time?

We want to help you get started on one of these tactics today: Starting a side hustle.

Thats why we want to offer you my Ultimate Guide to Making Money.

Stuff like:

UGH.

Don’t Miss: Can I Rollover Multiple 401k To Ira

Tips To Save For Retirement

Enrolling in your 401 is one of the easiest ways to begin building retirement savings. Your employer may have enrolled you automatically when you were hired. If youre not sure, contact your HR department. You can also check your default contribution rate to see how much youre contributing to the plan.

Its a good idea to contribute at least enough to get the full company match if one is offered. Otherwise, youre leaving free money on the table.

If youre worried youre not saving enough, consider supplementing your 401 with an Individual Retirement Account .

An IRA is another tax-advantaged savings option. You can open a traditional IRA, which offers the benefit of tax-deductible contributions, or a Roth IRA. With a Roth IRA, you cant deduct contributions, but qualified withdrawals are 100% tax-free.

Not sure how to start a retirement fund? Its actually easy to do through an online brokerage. You can create an account, choose which type of IRA you want to open, and set up automatic contributions to start building wealth.

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

Don’t Miss: How Much Will My 401k Grow If I Stop Contributing

What Percentage Should I Be Putting In My 401 Per Week

A 401 is an easy, accessible plan that many take advantage of to save for retirement. Your employer deducts your contributions from your pay and very often matches them up to a certain percentage. If the amount you contribute is small enough, you probably wont even miss the money. But if thats your only method of saving for retirement, youll need to consider whether you are adding enough money to your retirement savings account. According to Fidelity, the rule of thumb is that youll need about eight times your annual salary to ensure you dont run out of money in 25 years of retirement.

How Much Should I Put In My 401k

The maximum allowable employee contribution you can make to a 401k is $19,500 in 2021. This doesnt include any employer matches though, so any amount the company adds on your behalf is extra. I know putting $20k towards a 401k sounds like too much, but do it consistently and you wont have to worry about retirement savings.

Those who start young can consider a slightly less aggressive approach. With time on your side for compound interest to work its magic, a good starting point is to contribute 10% to 20% of your salary. And if you can swing it, I highly recommend turning on the automatic escalation. With this feature toggled, you can tell your employer to increase your employee contributions by 1% every year. By slowly increasing your contributions and timing it with promotions and inflation adjustments, you wont see as much of a reduction in take home pay and before you know it, you would have a large nest egg.

Read Also: Can You Open An Individual 401k

Are You Maxing Out On Your 401 Contributions

First things first if you have a match, maxing out too early in the year can lead to missing out on a portion of your employers match. Once you max out and are no longer able to contribute for that tax year, your employers match will stop as well. In your Guideline accounts contribution setting page, well alert you if the amount youve elected to contribute will push you into this territory so you can adjust your deferral amount and get the most value from your Guideline 401 each year.

Now, if you are already contributing the maximum allowable amount to your 401 and looking to save more with a dedicated retirement account, consider contributing to an IRA.¹ IRAs offer similar advantages to a 401 and allow you to contribute an additional $6,000 in 2022. The limit on IRAs increased to $6,500 for 2023 . In addition to this uppermost limit, there are contribution limits and considerations based on your income, which are covered here.

Takeaways:

¹ Subject to IRS cost-of-living adjustments

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax advice that considers all relevant facts and circumstances. Guideline makes no representations or guarantees with regard to investment performance as investing involves risk and investments may lose value. Clients should consult a qualified investment or tax professional to determine the appropriate strategy for them.

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

Read Also: How To Roll My 401k Into An Ira

Are You Meeting Your Match

Weve said it before, and well say it again. At the very least, do what you can to contribute the minimum amount required to earn your employers match. Not doing so is equivalent to not earning your full salary. While this may reduce your take-home pay, consider the growth potential of your retirement account from compound interest over the long run.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investing involves risk, including risk of loss.

Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How Do I Roll My 401k Into Another 401k

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

Recommended Reading: Can I Roll Over A 403b To A 401k

Assume A Realistic Return For Your 401k Contributions

Its common to assume that you will be able to see returns of 10% or even 12% annually. However, even though investing can be a good way to build wealth over time, basing your retirement planning on those types of returns is foolhardy. Stock and bond valuations are very high and its likely that we wont see historical returns in the next 10 or maybe more years. The longer term returns past the next decade is even harder to predict, but shoot for 7% annualized or less over time.

Its better to plan for lower returns and save more than to assume that you will see big returns. Make sure that you have realistic expectations for your returns, and set aside more than you might think you need.

Give Your 401 A Raise With Your Salary Raise This Year Your Future Self Will Thank You

Each year, many of us receive a salary bump with our annual review. Of course, itâs awesome to have more money so you can manage your budget or have some extra fun, but what if you used some of it for something your future self will thank you?

Most everyone struggles with how much to put away for retirement. On average, Americans with access to a 401 are putting 7.7% of their salary into their account. Not bad. However, most experts recommend saving 10% to 15% over the course of your career to retire at your current standard of living. That may not be doable for everyone, but even a little bit more can go a long way when it comes to amassing a bigger nest egg.

One way to do it is to add just 1 or 2% more towards your 401 every time you get a raise. Even saving 1% more than you are today can really add up over the course of your career. After all, thereâs always a lingering concern about what Social Security will look like when we reach retirement age, so how much we can save on our own with our retirement accounts is increasingly important. calculator will automatically show you what it adds up toâand with an added click of your mouse, you can see how long your 401 nest egg might last you in retirement.)

To give you a quick idea of the power of saving just a little more, check out these three savers. Each of these three hypothetical people has a salary of $60,000 today, receives a 3% merit raise each year, and will reach retirement age in 25 years:*

You May Like: Which Investments Should I Choose For My 401k

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $22,500, your taxable earnings for the 2022 tax year would be $57,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $22,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $66,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.